On April 17, the Fourth Division of the Court of Appeals, among other actions, prohibited all concerned in the Philippines from applying for “contained use, field testing direct use as food or feed, or processing, commercial propagation, and importation of genetically modified organisms.”1

The said provision stopped all activities in the country involving imported genetically modified plants and products. The order covers research, field trials, and commercial propagation of GM plants, unless their seeds or planting materials are locally produced.

The way they penned their decision, the Justices not only acted on the petition with respect to Golden Rice and Bt eggplant, but also prohibited all importation activities of GM products such as corn, soybeans, and soya meal.

In this case, the Justices granted the Petition for a Writ of Kalikasan and Continuing Mandamus filed by Magsasaka at Siyentipiko para sa Pag-unlad Agricultural (Masipag), GreenPeace Southeast Asia – Philippines and several others. The case respondents included the Secretaries of Agriculture, Environment and Natural Resources, and of Health, the Director of the Bureau of Plant Industry, the Philippine Rice Research Institute (PRRI), and the University of the Philippines – Los Baños.

The last two respondents are included because the petition targeted on stopping the use of Golden Rice in the Philippines, which PRRI had developed along with the International Research Institute.

UP Los Baños scientists had developed a novel eggplant which kills the eggplant fruit and shoot borer pest, thus increasing the productivity of eggplant farms, and potentially incomes of eggplant farmers.

The other respondents regulate the use of GM plants and products.

IMPACT ON THE FEED AND LIVESTOCK INDUSTRIES

The importation ban of GMOs has grave adverse effects on the country’s swine and poultry industries. Animal feeds comprise 60% to 70% of the total cost of pork, poultry meat and egg production. Because of the critical role of feed to these industries, feed production has evolved into a multi-billion industry.

Yellow corn and soya meal are the most important feed ingredients in animal feeds. The country imports yellow corn and soya meal, all of which are genetically modified.

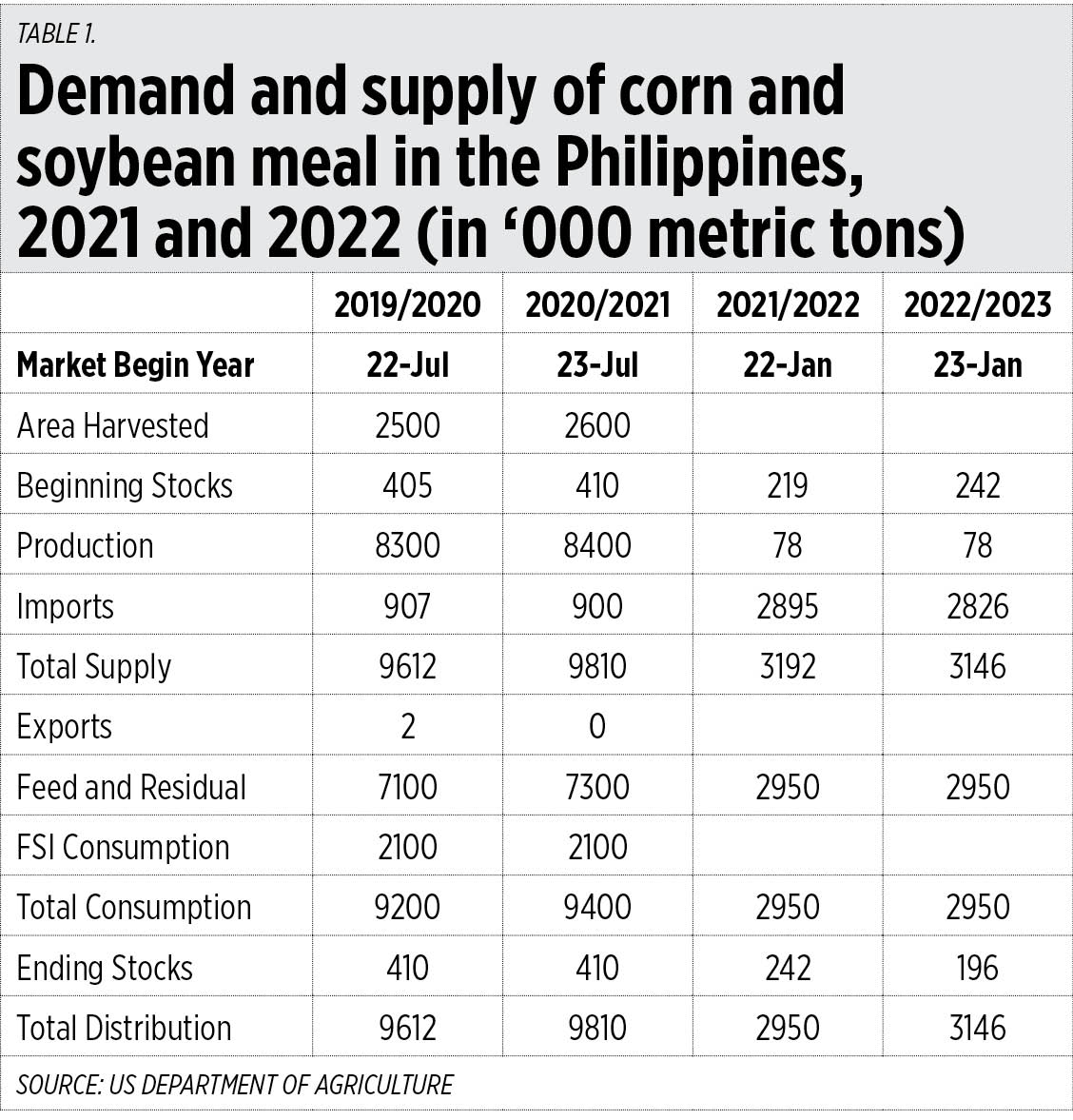

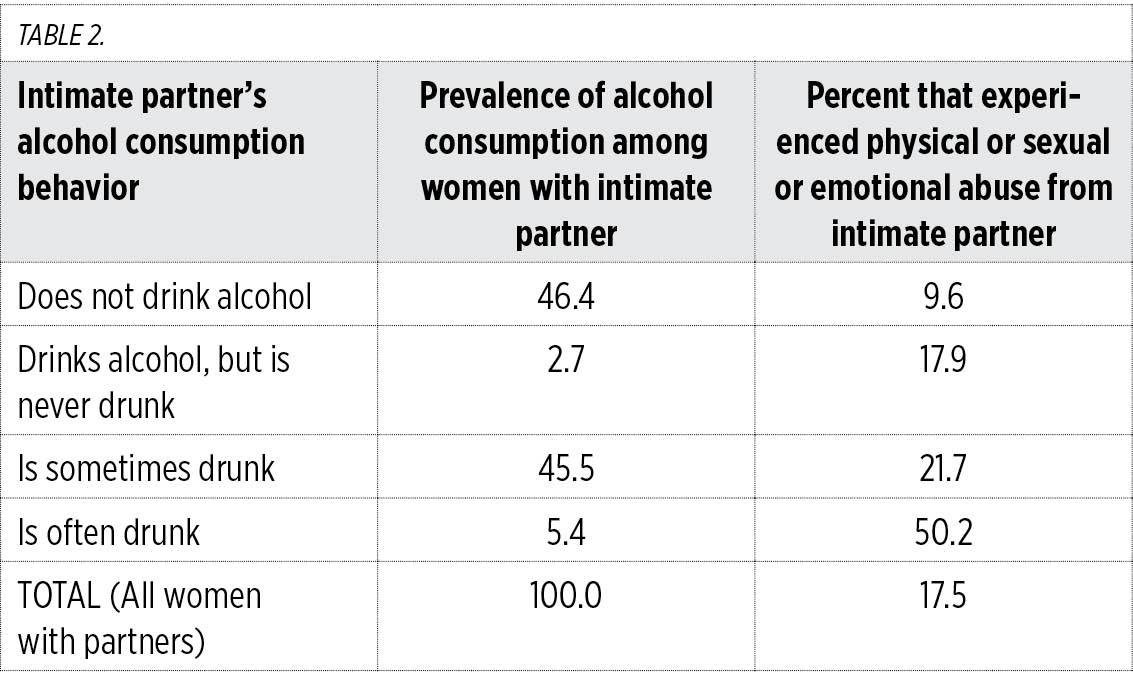

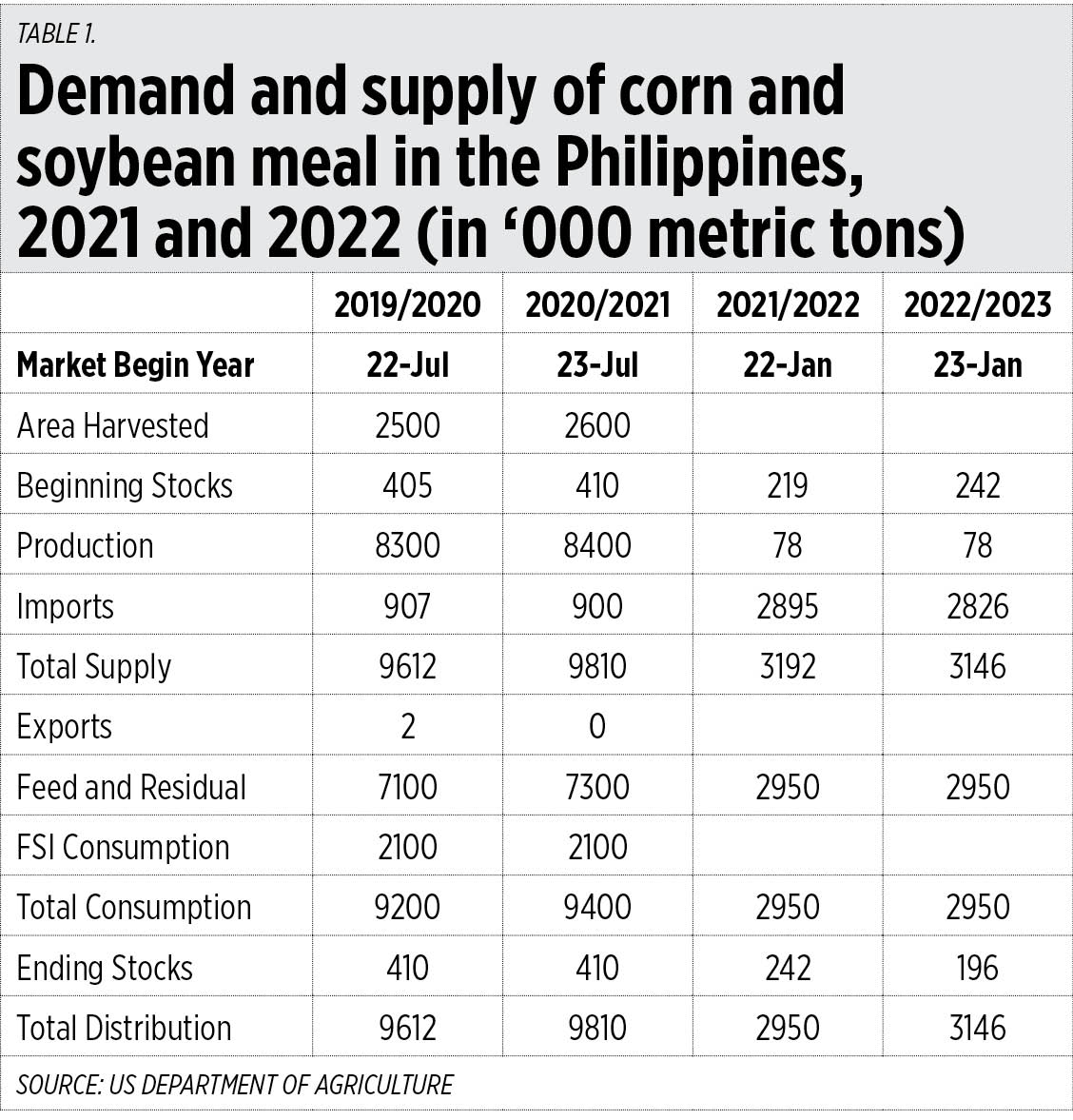

The corn and livestock industries of the country are expected to be severely hit by the CA decision. Table 1 shows the demand and supply of corn and soybean meal in the country.

Roughly 70% of the corn supply, including imported corn, goes into animal feeds. Although imported corn used in feeds made up about 8% of supply in the last two years of production, more than 50% of locally produced corn is yellow and genetically modified.

Soybean meal is another important feed ingredient, most of which is imported. The country has hardly any local production of soybeans. In the last two years ending 2023, the country’s imports of soybean meal were 90% of total supply.

ECONOMIC IMPACTS

Using an economy-wide model of the Philippine economy, a study — “Selecting Locally Optimal Low Low-Level Presence (LLP) Threshold of Unapproved GM Events in the Philippines”2 — simulated the possible economic impacts of the import ban involving feed ingredients. With 50 industries, the model is used to simulate policy impacts. In doing this, equilibrium solution is forced such that there are no imports of corn and soybeans.

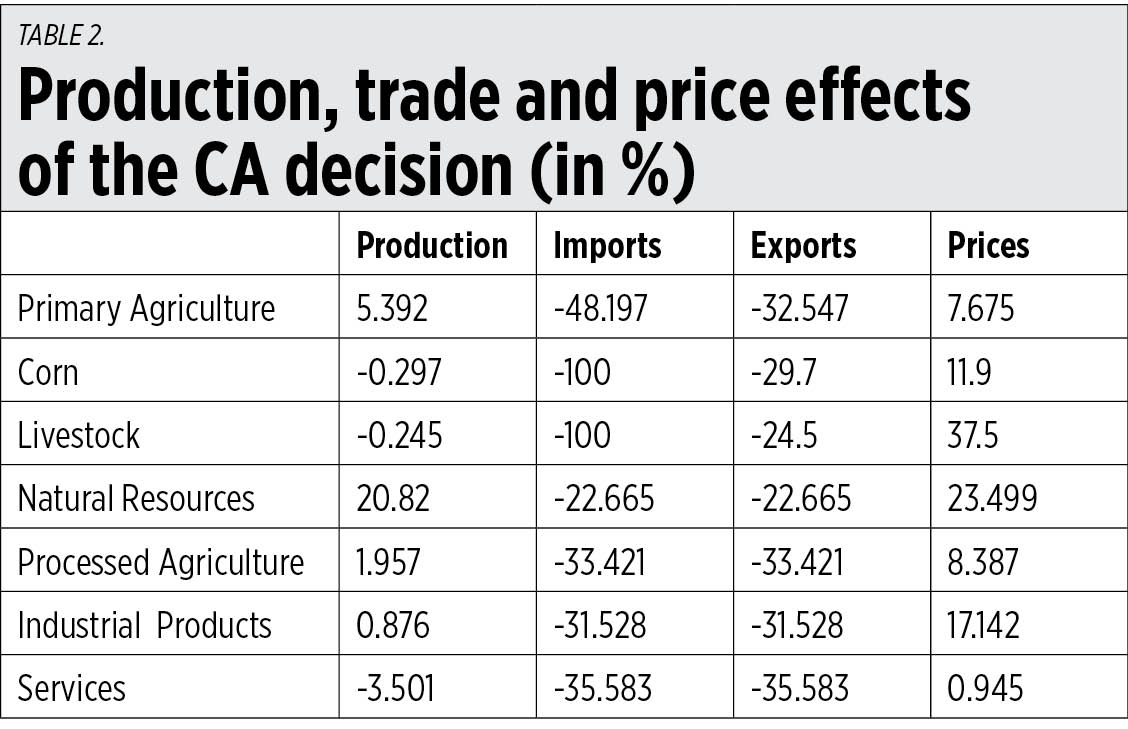

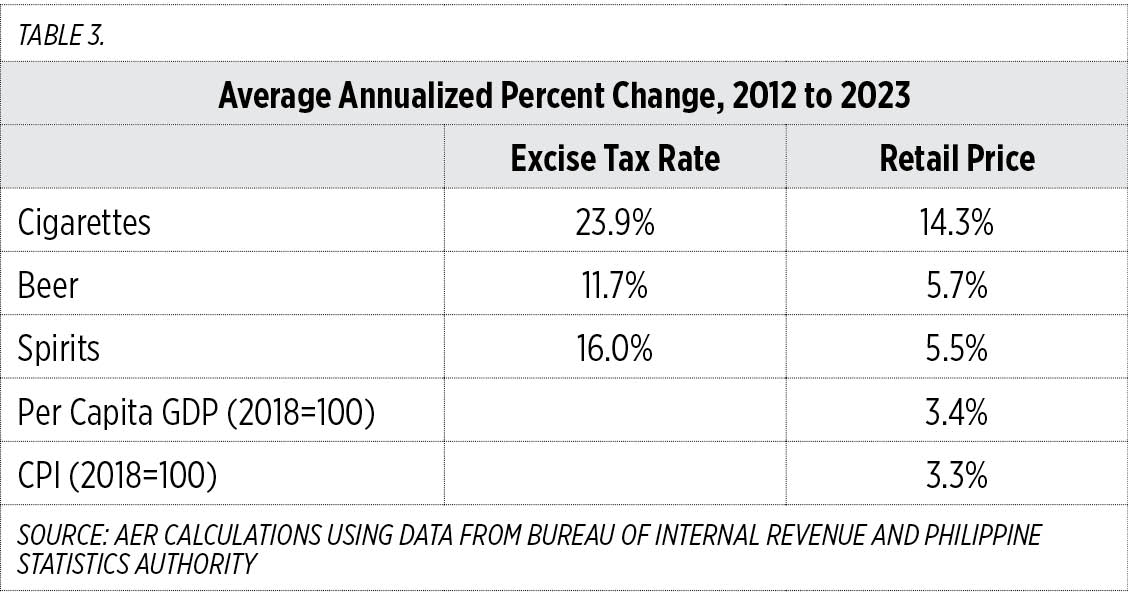

Table 2 shows the average economic effects of the decision on local production, imports, exports, and prices. The various industries are grouped into primary agriculture (with highlights on corn and livestock as two stand-alone industries) natural resources, processed agriculture, industrial products and services.

Local production of corn and livestock take a dive. Corn declines by 29.7% while livestock production falls by 24.5%. Primary agricultural production, however, increases its production as resources are reallocated from corn and livestock towards other primary agricultural industries. Natural resources output expands by 20.82%, Economic resources appear to flow away from industrial products and services.

As expected, imports of corn and feed ingredients decline. Feed ingredients are subsumed in livestock production, noting that nearly 70% of these products are comprised of feed ingredients. In the simulation exercise, the computation of the equilibrium is stopped at near zero for imported corn and livestock.

Interestingly, there appears to be a significant decrease in trade. On average, the product groups are importing and exporting lower imports. Corn and livestock exports decrease by 29.7% and 24.5%, respectively.

Prices comprise a major concern, particularly as authorities monitor food price inflation. Corn prices increase by 11.9% while prices of livestock products by 37.5%. The prices of processed and other primary agricultural products increase as well, but not as much as those of corn and livestock.

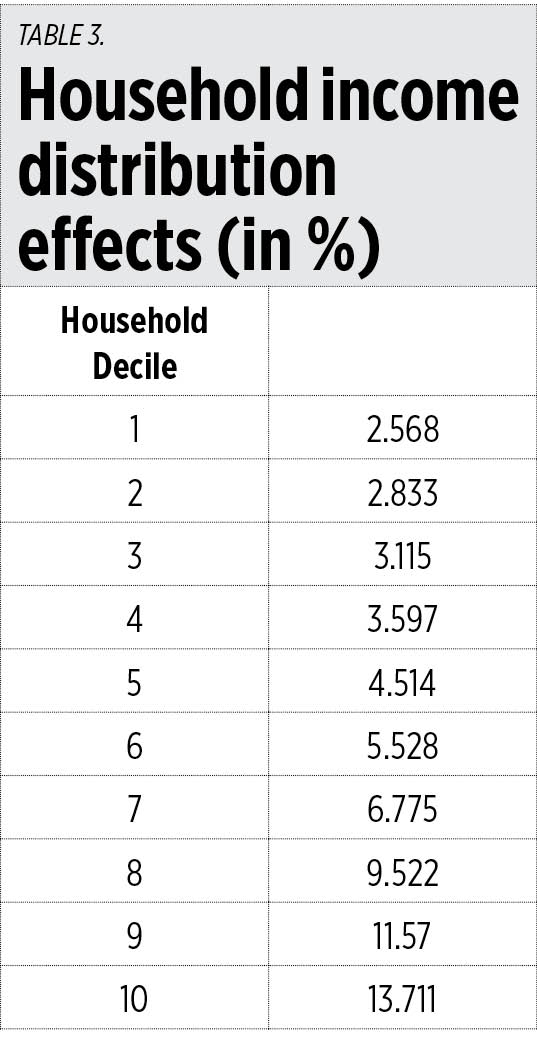

INCOME DISTRIBUTION EFFECTS

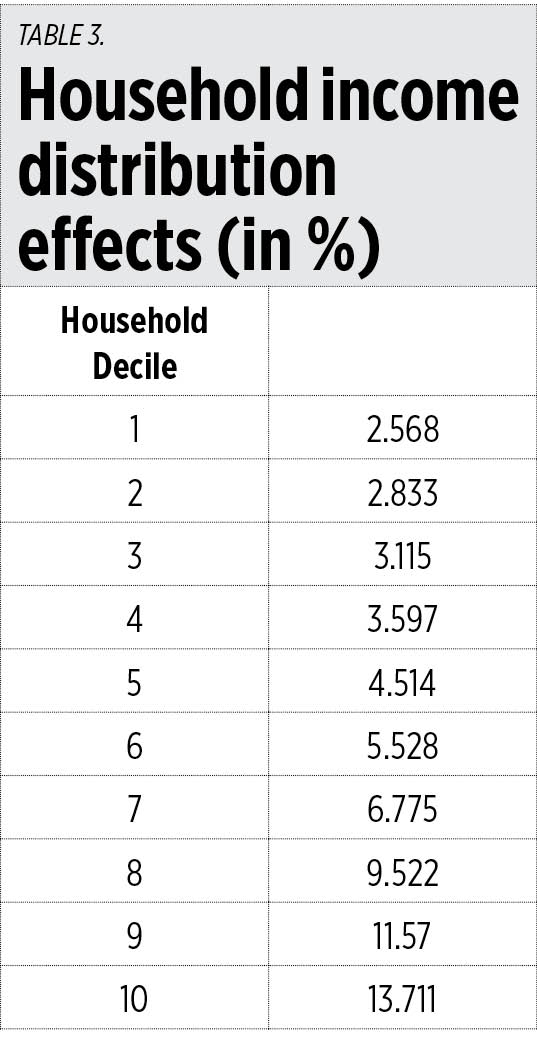

Table 3 portrays how incomes are distributed among the 10 households of the model. The CA decision appears to favor richer households. The richest household, for example, see their incomes increase by 13.7%, while the poorest, by 2.5%.

OVERALL ECONOMIC EFFECTS

Gross domestic product (GDP) in current prices increases by 2.71%. Headline inflation is 7.026%. The decision apparently aggravates the food price inflation problem of the country. Economists use this indicator to see how well off the population is with this decision. Each year, since this is an annualized model, the economy loses P66.1 billion. The loss is not large, but the country is worse off still. This model remains to be a full employment model, meaning all resources are allocated. However, in real situations, there may be delays in the movement of resources from one industry to another, and thus in the short run, the decision provides authorities with another problem to solve to offset the transitory unemployment due to the movement of resources.

1 See par. 8, page 142, CA-G.R. SP No. 00038

2 The simulations conducted in this model comes from a study done by Manalo, A., Ramon, G., and Clarete, R. (2024), “Selecting Locally Optimal Low Low-Level Presence (LLP) Threshold of Unapproved GM Events in the Philippines.”

Ramon L. Clarete is a professor at the University of the Philippines School of Economics.