Entertainment News (06/25/24)

Western Horizon: An American Saga opens in PHL

AN EPIC visual journey arrives in Philippine cinemas on June 28 in the form of Horizon: An American Saga. Directed by Kevin Costner, the film marks the actor’s comeback to the big screen after the success of his latest Western TV series Yellowstone (for which he received a Golden Globe Award for Best Actor in a TV series). The three-hour film brings together an ensemble of actors that includes Sienna Miller, Sam Worthington, Giovanni Ribisi, Abbey Lee, Will Patton, Jena Malone, Michael Rooker, Danny Huston, Luke Wilson, Jaime Campbell Bower, and many more. It explores the post-Civil War expansion and settlement of the American West. Horizon: An American Saga opens June 28 in local cinemas nationwide.

Robinsons Palawan launches Biodiversity Crisis Escape Room

IN partnership with The Mind Museum and USAID, Robinsons Malls is launching the first-ever Biodiversity Crisis Escape Room at Robinsons Palawan from June 29-30. As part of the celebration of Environment Month, this immersive and educational experience is meant to raise awareness about local biodiversity and conservation efforts, offering an interactive and informative encounter for mallgoers of all ages. To avail themselves of tickets to the escape room, mallgoers must pre-register and present a receipt from any store in Robinsons Palawan worth at least P500 for adults and P250 for children up to 12 years old.

KYLIX releases new single

SINGER-songwriter KYLIX has dropped his latest single, “Another Life,” which draws from personal experiences. The track delves into the feelings of loving someone you cannot be with in this lifetime. “Another Life” is out now on all digital music streaming platforms.

Skarlet Brown, Tots Tolentino bring jazz to Ayala Museum

ON June 29, 8 to 10 p.m., the Ayala Museum presents Skarlet Brown’s Jeepney Jazz Session, featuring tunes from the vintage American songbook, with lyrics translated into Filipino. The repertoire includes traditional Philippine songs arranged to carry today’s sound. She will be joined on the stage by internationally acclaimed saxophonist Tots Tolentino. Mr. Tolentino is famous for joining the Asian Jazz All-Stars Power Quartet. Tickets are now available through the Ayala Museum website.

Despicable Me 4 in PHL cinemas in July

THE fourth Despicable Me animated movie begins a new chapter as Gru (voiced by Steve Carell) and Lucy (Kristen Wiig) and their girls — Margo, Edith, and Agnes — welcome a new member to the Gru family, Gru Jr., who is intent on tormenting his dad. The blockbuster franchise welcomes a new nemesis in Maxime Le Mal (Will Ferrell) and his femme fatale girlfriend Valentina (Sofia Vergara), and the family is forced to go on the run. The movie opens in Philippine cinemas on July 3.

Benj Pangilinan, Angela Ken drop new single

FILIPINO singer-songwriters Benj Pangilinan and Angela Ken have released a collaborative single, “Nandito Na Ako,” out via Sony Music Entertainment. The newly minted duo created a soothing track that balances vintage Pinoy pop songwriting with youthful appeal. It also happens to be Benj Pangilinan’s first foray into writing songs in Filipino. Pangilinan co-wrote the track with his good friend, award-winning singer-songwriter Moira Dela Torre; his cousin, Over October’s Josh Buizon; and his aunt, Felichi Buizon. His brother Donny Pangilinan also recommended Angela Ken for the duet. “Nandito Na Ako” is out now on all digital music streaming platforms.

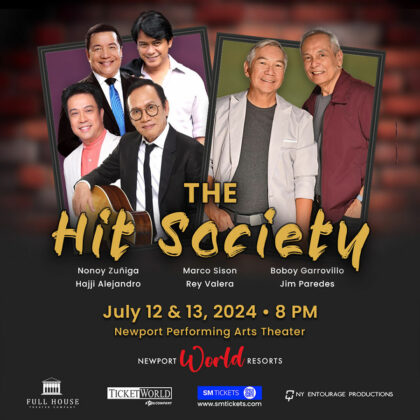

OPM classics at Newport with Hitmakers and APO

SONGS by the Philippines’ Hitmakers and APO will fill the halls of Newport Performing Arts Theater thanks to the two-night concert, The Hit Society, on July 12 and 13. Hajji Alejandro, Marco Sison, Rey Valera, and Nonoy Zuñiga, the crooners known collectively as the Hitmakers, will share the stage with APO’s Jim Paredes and Boboy Garovillo. Tickets, priced from P1,500 to P8,900, are now available at all SM Tickets and TicketWorld outlets.

Indonesian artist AFGAN releases EP

THE INDONESIAN singer AFGAN has dropped his second all-English EP, Sonder, which includes an official music video for “ESCAPE,” featuring Kpop hip-hop singer Jessi, and “Criminal,” a single featuring R&B star thuy. Recorded entirely in London, it is Afgan’s most personal body of work. According to him, he has found a new voice after making music for decades in Indonesia. “I’ve come so far and have grown and experienced so much,” he said in a statement. Sonder is out now on all digital music streaming platforms.

Silent action film Silent Night now on Lionsgate Play

ACCLAIMED action director John Woo has taken on a different challenge: a movie without dialogue. The gritty revenge tale of a tormented father, Silent Night is full of Woo’s signature “bullet ballet” style that redefined the action genre with thrill-a-minute storytelling sans dialogue. It kicks off when a young boy dies from a stray bullet amidst a gang gunfight. Brian Godlock (Joel Kinnaman), the child’s father, immediately hunts down and successfully locates a handful of the culprits. However, his confrontation with the gang leader, Playa (Harold Torres), leaves him severely wounded and on the brink of death. Now unable to speak, he is driven by vengeance. Silent Night is now available to stream on Lionsgate Play.

NIKI drops astrology-inspired single

JAKARTA-born, LA-based singer-songwriter NIKI has released a new single titled “Blue Moon.” It follows the announcement of her upcoming album, Buzz, out Aug. 9, via 88rising. Penned by NIKI during her 2023 Nicole World Tour, the new single comes in the aftermath of a four-year relationship that felt like home but suddenly fell apart. A Blue Moon in astrology is a cosmic rarity, often linked to heightened clarity, which NIKI channels into a song. “Blue Moon” is out now on all digital music streaming platforms.