By Chloe Mari A. Hufana, Reporter

THE UNEMPLOYMENT RATE in November dropped to its lowest in five months as businesses ramped up hiring ahead of the holiday season, the statistics agency said on Wednesday.

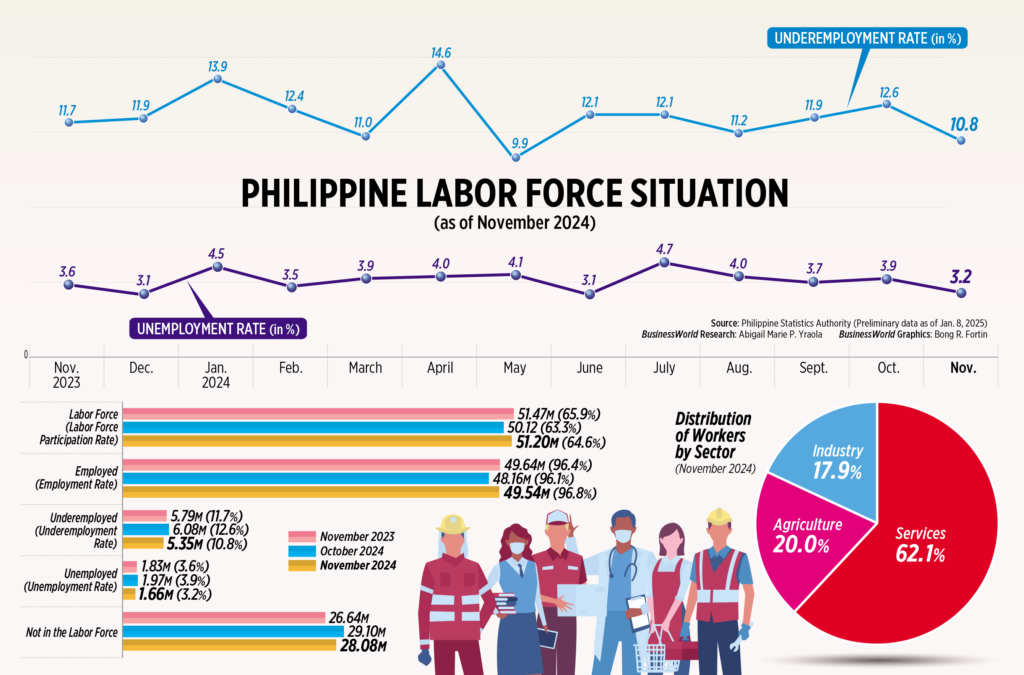

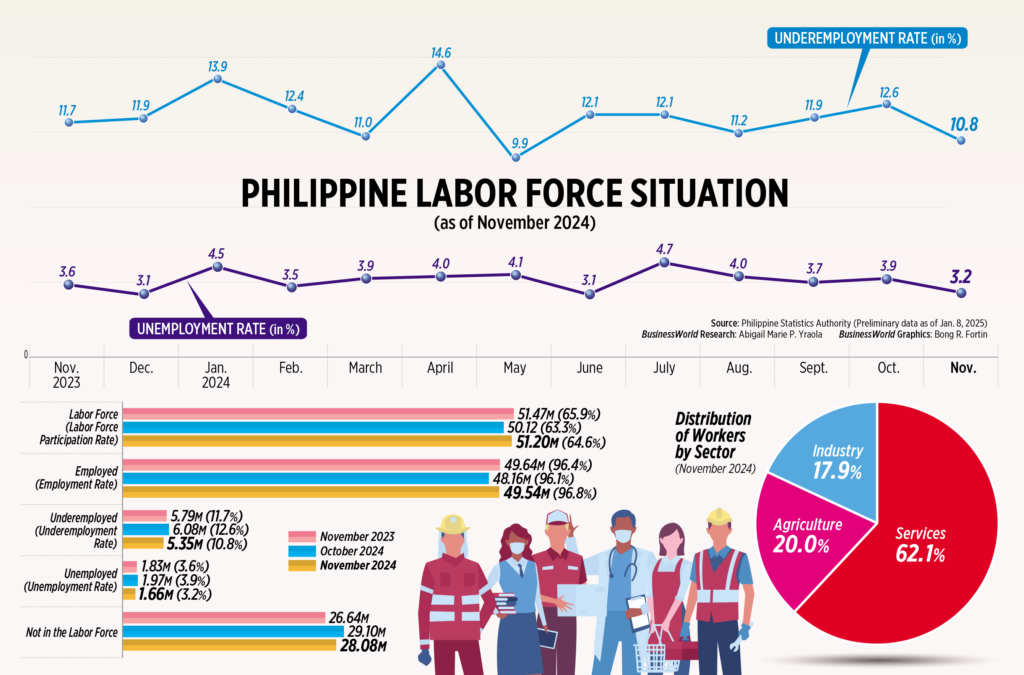

Preliminary data from the Philippine Statistics Authority’s (PSA) Labor Force Survey showed the jobless rate fell to 3.2% in November, lower than the 3.9% in October and the 3.6% in the same month last year.

This translated to 1.66 million unemployed Filipinos in November, lower than the 1.97 million in October and 1.83 million a year prior.

The 3.2% was the lowest unemployment rate since June 2024 when it slid to 3.1%.

For the first 11 months of the year, the jobless rate averaged 3.9%, easing from 4.5% a year ago.

Meanwhile, job quality also improved as the underemployment rate declined to 10.8% in November, the lowest since the 9.9% seen in May. It was also lower than the 12.6% in October and 11.7% in the same month in 2023.

The number of underemployed Filipinos — those who want longer work hours or an additional job — decreased by 728,000 month on month to 5.35 million in November. Year on year, the number fell by 432,000 from 5.79 million.

The underemployment rate averaged 12% in the January-to-November period, falling from 12.4% a year ago.

“Our labor market remains robust, with consistently high employment rates and reduced underemployment. The next step is to expand business and employment opportunities to enable more Filipinos to actively and productively contribute to the economy,” National Economic and Development (NEDA) Secretary Arsenio M. Balisacan said in a statement.

PSA data also showed the employment rate rose to 96.8% in November from 96.1% in October and 96.4% in November 2023.

This is equivalent to 49.54 million employed Filipinos, higher than October’s 48.16 million but a tad lower than 49.64 million in November 2023.

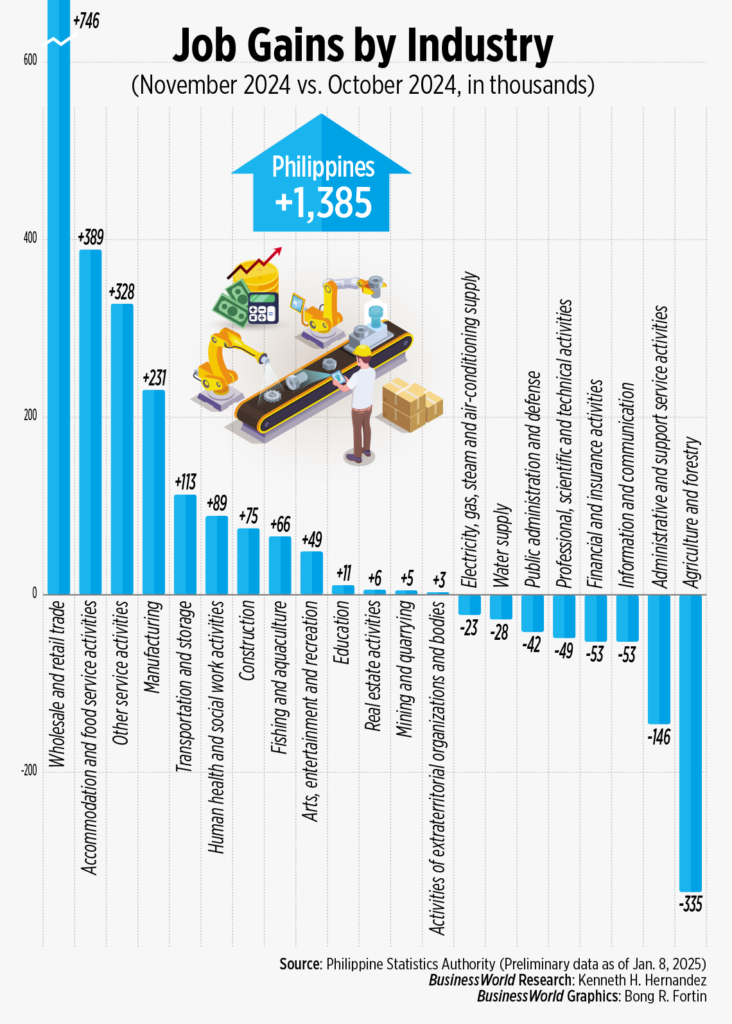

Undersecretary and National Statistician Claire Dennis S. Mapa attributed the job gains in November to the holiday season when businesses hired more workers.

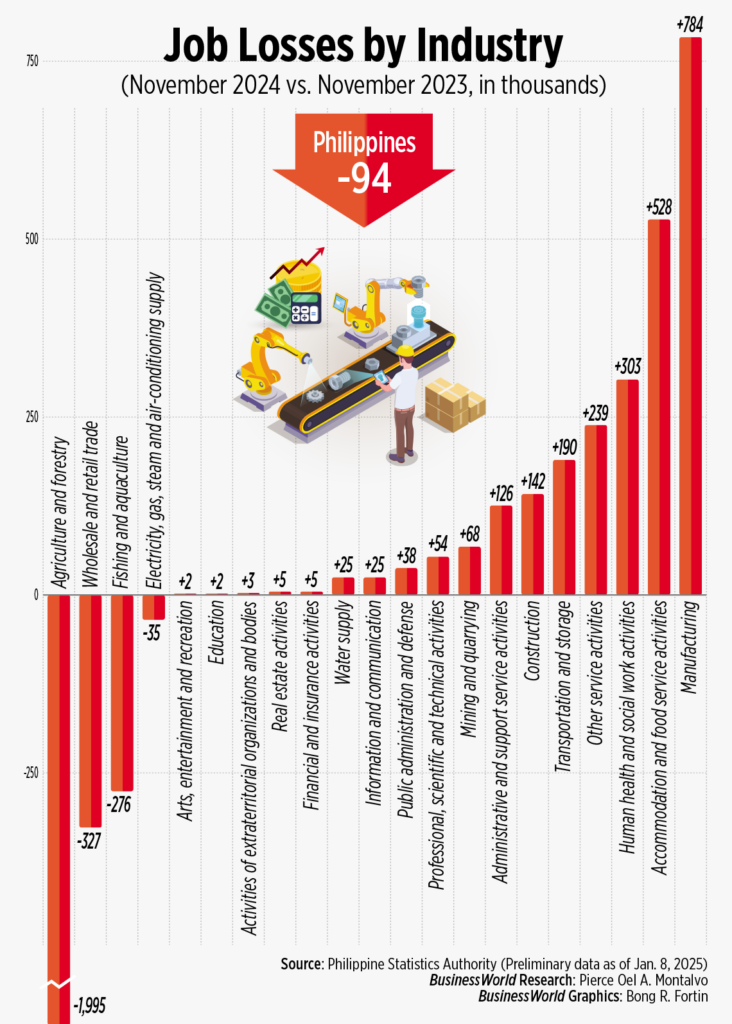

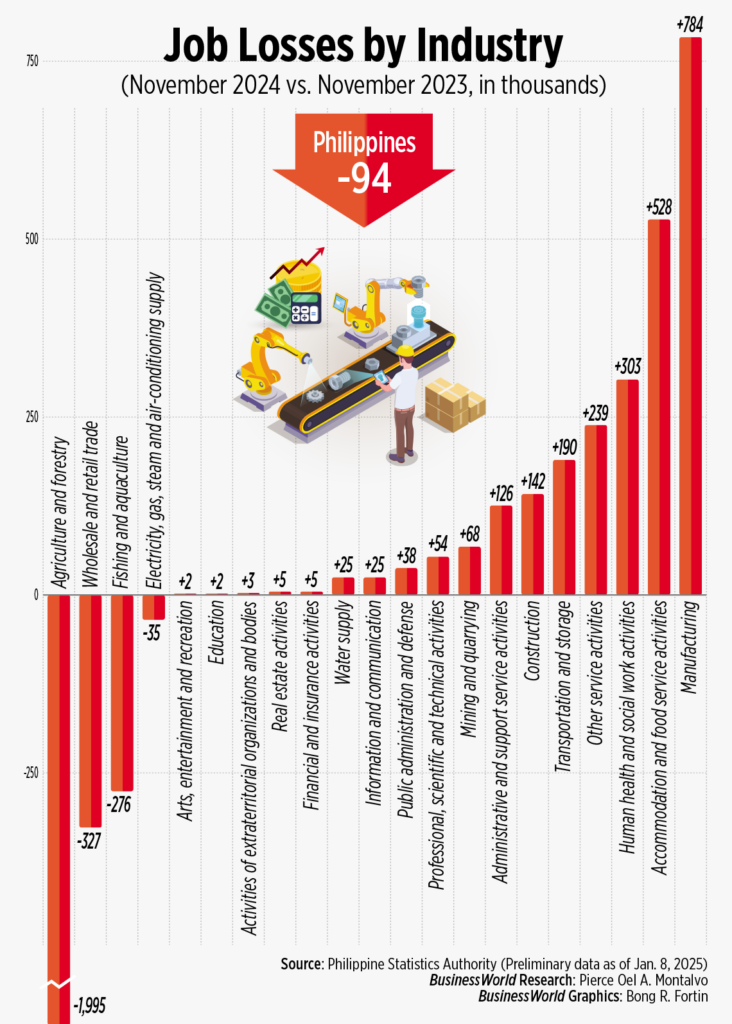

The manufacturing sector saw an annual increase of 784,000 workers to 3.71 million in November, with the majority working on consumer goods, he added.

Of the total, the manufactured bakery products sub-sector added 117,000 workers, while manufacturing of other food products, such as spices and condiments, hired 98,000 more.

Of the total, the manufactured bakery products sub-sector added 117,000 workers, while manufacturing of other food products, such as spices and condiments, hired 98,000 more.

On the other hand, accommodation and food service activities gained 528,000 workers to bring the total to 2.9 million in November. This included restaurants and other mobile service activities, which added 310,000 and short-term accommodation services, which hired 97,000 more.

“As expected, during the last quarter — those three months — we typically see growth in accommodation services, restaurants, and, of course, key inputs like food products,” Mr. Mapa said.

Other sectors that posted the most job gains annually were human health and social work activities (303,000); other service activities (239,000); and transportation and storage (190,000).

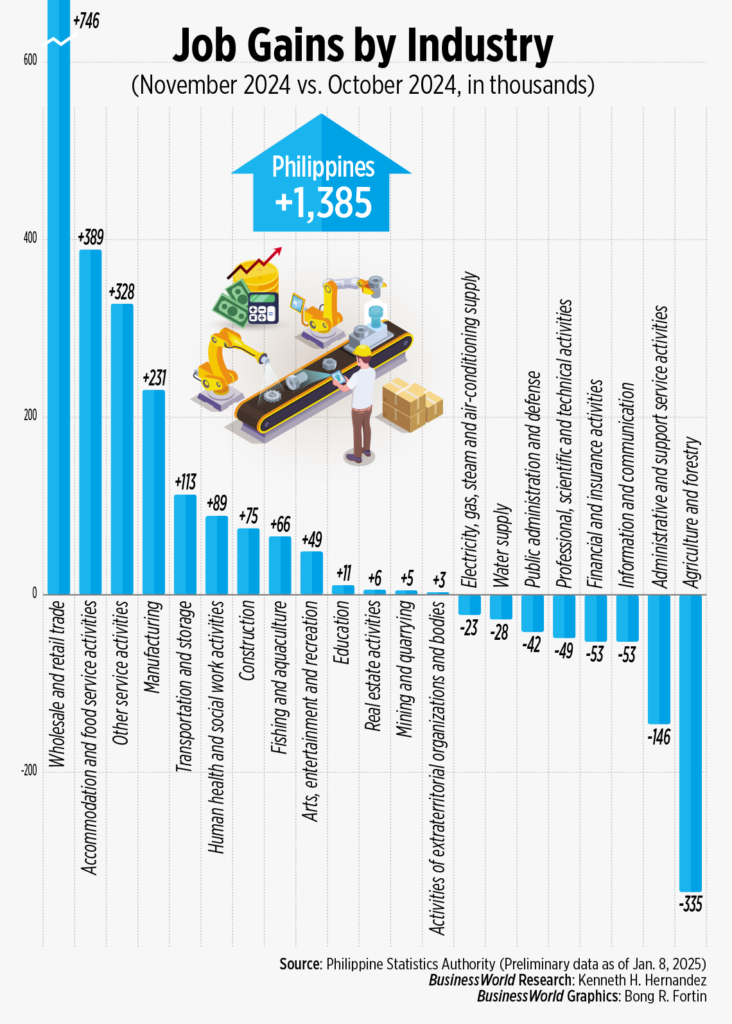

Month on month, the top five sub-sectors with the biggest job increases were wholesale and retail trade; repair of motor vehicles and motorcycles (746,000); accommodation and food service activities (389,000); other service activities (328,000); manufacturing (231,000); and transportation and storage (113,000).

AGRI JOBS

However, PSA data showed the agriculture sector shed 1.99 million jobs in November, due to several typhoons that hit the country. This brought the number of people employed in the agriculture sector to 8.71 million in November.

“During the month of November, when the labor force survey was conducted, we experienced [several] typhoons entering the country from Nov. 1 to Nov. 18. These significantly impacted our farmers and fisherfolk,” Mr. Mapa said.

“These are the two sectors that experienced a substantial year-on-year decline in the number of jobs or businesses,” he added.

Mr. Mapa noted corn farmers were “significantly affected” with 400,000 in job losses, while banana farmers lost 312,000 jobs.

Year on year, 213,000 paddy rice farmers lost their jobs in November. There were 298,000 jobs lost in planting, transplanting and other related activities, and 122,000 jobs lost in harvesting and other related activities, Mr. Mapa said.

For the fishing and aquaculture sector, marine fishing jobs fell by 286,000.

According to the PSA, the Labor Force Participation Rate (LFPR) — the economically active population, either employed or unemployed — rose to 64.6% in November from 63.3% in October but lower than 65.9% a year prior.

“While statistically, this drop is not significant (year on year), it still reflects a reduction in absolute numbers,” Mr. Mapa said.

The largest drop in the LFPR was in the 15-24 age group, which fell by 409,000, he added. The 35-44 age group saw an increase of 70,000.

When it comes to gender, the decline was more pronounced among females, with a year-on-year reduction of 239,000.

“This indicates mixed trends, with some age groups contributing to increases while others saw declines,” Mr. Mapa said.

Mr. Balisacan said the government must adopt alternative work arrangements to account for workers’ evolving preferences while considering organizations’ demands.

“We will encourage business upgrading and skills training programs to ensure that these jobs offer competitive wages as our workers raise their productivity by developing their human capital,” he said.

Finance Secretary Ralph G. Recto said the Philippine labor market continues to improve and strengthen due to the decline in inflation and faster economic growth.

Finance Secretary Ralph G. Recto said the Philippine labor market continues to improve and strengthen due to the decline in inflation and faster economic growth.

“We can expect even more job opportunities to open up for our fellow Filipinos,” he said.

Labor Secretary Bienvenido E. Laguesma said he expects the jobs data to continue to improve in the coming months.

“We look forward and hope that increase in the employment rate will continue and be sustained, unemployment and underemployment rates to be on the downtrend,” he told BusinessWorld in a Viber chat.

Meanwhile, the passenger land transport sub-sector largely contributed to the decline of underemployment in November 2024 as demand increased during the holiday season.

“There was a reduction of approximately 144,000 in the number of underemployed individuals, with passenger land transport being a major contributor to this decrease. This sector also contributed to the earlier reported increase in employed persons, largely driven by activities related to the holiday season, such as transportation and storage,” he said in Filipino.

Another factor in the drop in underemployment was the “other personal service activities” sector, which added 239,000 jobs year on year.

“Many individuals in this sector appear to have transitioned to full-time employment,” Mr. Mapa noted.

“The decline in underemployment year on year was largely driven by transportation and storage, wholesale and retail trade, and domestic services,” he added.

University of the Philippines School of Labor and Industrial Relations Assistant Professor Benjamin B. Velasco said the drop in unemployment was due to the seasonal increase in economic activity in the run-up to the holidays.

He said the positive trend may continue up to the first few months of 2025 as the midterm elections spur an increase in “project-based” employment for ward leaders, election volunteers and political campaigners.

“The problem of course with such seasonal rise in employment (due to holidays or elections) is that it is temporary and part time. It does not respond to the structural constraints in the labor market which results in 4-5% unemployment and low LFPR, especially for women,” he said in a Facebook Messenger chat.

“One sign of the structural limits is the persistent bleak figures of youth employment, shown in the November LFS,” he added.

Of the total, the manufactured bakery products sub-sector added 117,000 workers, while manufacturing of other food products, such as spices and condiments, hired 98,000 more.

Of the total, the manufactured bakery products sub-sector added 117,000 workers, while manufacturing of other food products, such as spices and condiments, hired 98,000 more. Finance Secretary Ralph G. Recto said the Philippine labor market continues to improve and strengthen due to the decline in inflation and faster economic growth.

Finance Secretary Ralph G. Recto said the Philippine labor market continues to improve and strengthen due to the decline in inflation and faster economic growth.