One of the more wasteful agencies in the government, one that needs an endless subsidy from Philippine taxpayers, is the National Electrification Administration (NEA).

Consider these points:

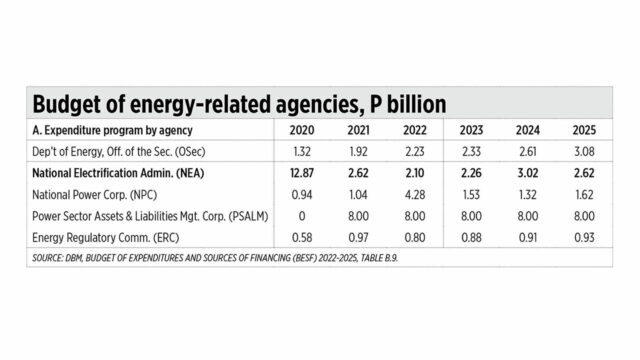

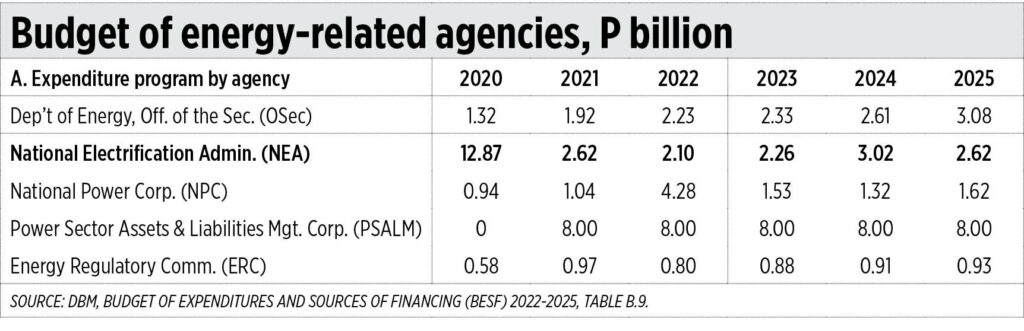

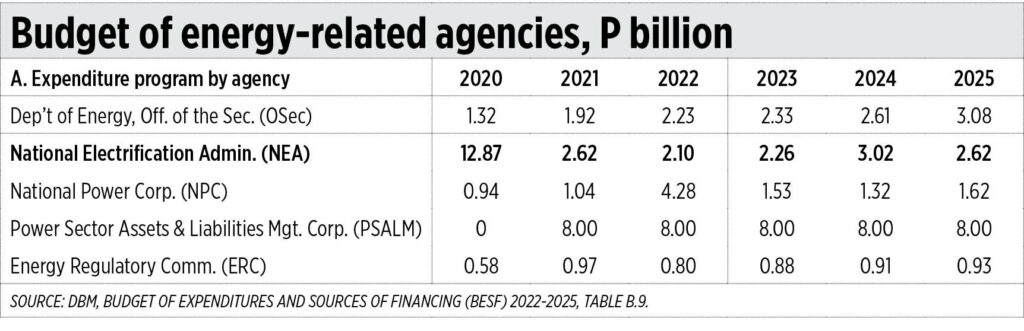

1. In 2020 alone, taxpayers nationwide sent P12.9 billion to NEA, then another P2 to P3 billion/year from 2021 to 2025. The NEA subsidy, on average, is larger than the annual budget of its mother agency, the Department of Energy (DoE), and at least three times the annual budget of the Energy Regulatory Commission (see the table).

2. The NEA is sending billions in taxpayers’ money to inefficient, if not failing, electric cooperatives (ECs) which are in need of capital expenditures (capex) or working capital, short-term (S-T) credit, etc. See these reports from the NEA website itself: “NEA Loans to ECs Reached P1.2 Billion in 2022” (Feb. 18, 2023), “NEA Loans Extended to ECs Exceed P1-Billion for 2023” (Jan. 11, 2024), “27 Electric Cooperatives Access Loans Worth P1.28-Billion — NEA” (Sept. 26, 2024).

In 2022, 35 ECs used up P1.2 billion of the NEA’s subsidy — P561 million for capex loans, P506 million for calamity loans, and P10 million for the S-T credit facility. In 2023, 28 ECs used up P1 billion plus of the subsidy — P475 million for capex loans, P465 million for working capital, and P63 million for S-T credit. And this year, up until August, 27 ECs used up P1.28 billion — P780 million for capex loans, P482 million for working capital, P13 million in calamity loans.

3. The NEA is a political institution that gives political patronage to ECs, which are allowed to incur system losses of up to 12% which are passed on to the consumers while private distribution utilities (DUs) are capped at 6% in system losses. That 6% difference between the two could be hundreds of billions of pesos yearly in additional payments by consumers in the provinces.

There is no “market failure” in electricity distribution to justify this continued patronage. I have argued in the past for the abolition of the NEA someday, and that all ECs should become corporations, monitored by the Securities and Exchange Commission (SEC) and not entitled to any taxpayer subsidy.

TWO CASE STUDIES OF INEFFICIENCIES

Let us look at the Batangas Electric Cooperative, Inc. (Batelec) I and II.

Consider the Ganire sa Batangas Facebook page which listed regular blackouts by Batelec 1 on Oct. 8, 11 p.m. to 3 a.m.; Oct. 9, 6 a.m. to 10 p.m. in Malvar; Oct. 11, 9 a.m. to 5 p.m.; and on Oct. 13, from 7 a.m. to 7 p.m.

I read a statement, “Batangas Mayors issue resolution, officially back Meralco-Batelec I joint venture.” It mentions many mayor-members of The League of Municipalities of the Philippines (LMP) — Batangas Chapter. They passed and issued a resolution supporting a joint venture between Meralco and the EC to help stabilize the power supply in the area. Signatories include the mayors of Agoncillo (Cinderella V. Reyes), Nasugbu (Antonio Jose A. Barcelon), San Luis (Oscarlito M. Hernandez), Calaca (Sofronio Leonardo C. Ona, Jr.), Calatagan (Peter Oliver M. Palacio), Sta. Teresita (Norberto A. Segunial), Taal (Fulgencio I. Mercado), Lian (Joseph V. Peji), and Tuy (Jose Jecerell C. Cerrado). Some 72% of the population of the Batelec I franchise area also support improvement of the power supply and the avoidance of frequent and prolonged blackouts.

The mayors declared that they “urge Batelec I’s management and Board of Directors to actively engage with Meralco executives and representatives to explore potential partnership opportunities, ensuring that such collaboration prioritizes the protection of employment for current Batelec I workers, enhance electric services and commit to providing transparent and regular updates on the progress of partnership.”

Meralco Senior Vice-President and Chief External and Government Affairs Officer, Arnel Casanova, said that “We welcome this development. This is an acknowledgment that we are one with LMP-Batangas in the mission to provide reliable and affordable electricity for the consumers. It is urgent and important that our partnership with Batelec I is equally supported by the stakeholders so we can all move forward with credible solutions. Meralco is positioned to lend technical expertise and infuse capital to Batelec I to jointly provide better service to Batanguenos.”

I also saw a Facebook video post of the chairman of the Batangas Forum and former Tanauan mayor, Francisco Lirio. He lamented that in the 47 years of Batelec presence in the province, there is little and very slow improvement in its services, saying that the problems before are still the problems today, and that he welcomes a joint venture between Meralco and Batelec II.

Rep. Joey Salceda, Chairman of the House Ways and Means Committee, emphasized in a statement that “Meralco provides the most reliable service among all major electric cooperatives and distribution utilities (EC/DUs), with outages suffered by the average consumer totaling to mere minutes in an entire year, versus days’ or weeks’ worth of blackouts for other neighboring EC/DUs.”

Good luck, people and local leaders of Batangas. Your province is rich — it had a provincial GDP of P671 billion in 2022 which is among the top 10 in the Philippines, but it is lower than Laguna’s P1.023 trillion and Cavite’s P780 billion. The whole of Cavite and portions of Laguna are under the Meralco franchise area. A good power supply at competitive prices can spur more growth, and more businesses and jobs, in a province.

Then there is the Northern Davao Electric Cooperative (Nordeco).

Last week at the House of Representatives Committee on Legislative Franchise, legislators questioned Nordeco over its repeated failure in delivering quality and reliable power to consumers within its franchise area, and opposed the planned expansion of the franchise coverage area of Davao Light and Power Co. which includes 16 municipalities and two cities in Davao del Oro and Davao del Norte.

Pwersa ng Bayaning Atleta Rep. Margarita I. Nograles argued that Nordeco’s arguments were just repeated, and that private DU Davao Light, which has a good track record, is willing to improve the reliability of the power supply to the consumers in the area.

Rep. Gustavo Tambunting of Paranaque’s 2nd District, the panel chairman, said that the committee had given enough time to Nordeco: “so much leeway has been given, and it has been a very transparent and open hearing.”

Rep. Cheeno Miguel Almario of Davao Oriental’s 2nd District corroborated the suffering of the consumers from “terrible electricity.”

Many ECs were formed through the forced merger, consolidation, and nationalization of private DUs. A friend told me that one Visayas-based private energy corporation alone lost two utilities in Ormoc and Jolo, and lost Dipolog and Dumaguete franchises.

Franchising was devolved from being a purely legislative prerogative and was granted to the NEA. Construction and development loans to ECs pre-EPIRA or during the 1990s have interest rates of 3% a year, while operating loans, mostly unpaid bills to NPC, are charged 7%. Plus, they pay no taxes and enjoy subsidies. So, it is ironic that some ECs want to be protected from private DUs when they were created at the expense of the private DUs in the past.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com