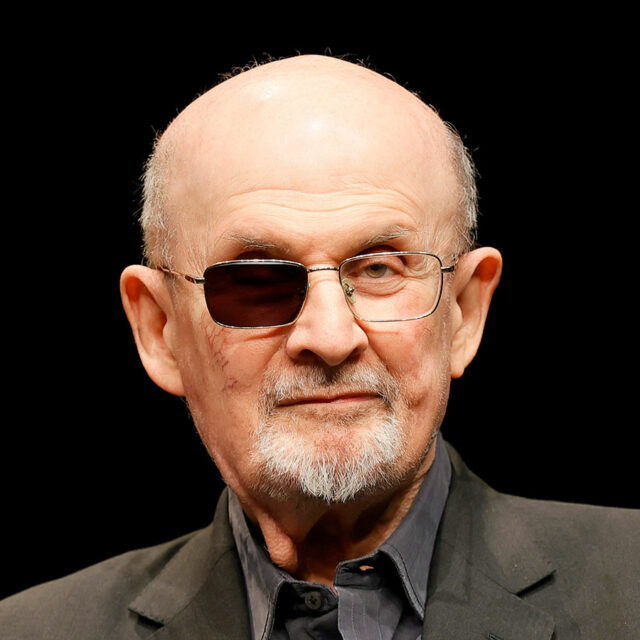

MAYVILLE, New York — Jurors heard on Monday how an attacker stabbed novelist Salman Rushdie more than a dozen times in a matter of seconds at a New York lecture, during the trial of the man accused of trying to murder the author.

A poet introducing the 2022 talk, on the subject of keeping writers safe from harm, was barely into his second sentence when defendant Hadi Matar bounded onto the Chautauqua Institution open-air stage and made about 10 running steps towards a seated Rushdie, Chautauqua District Attorney Jason Schmidt told the jury.

“Without hesitation, upon reaching Mr. Rushdie, he very deliberately and forcefully and efficiently at speed plunged the knife into Mr. Rushdie over and over and over and over and over again,” Mr. Schmidt said. Eyewitnesses who testified on Monday said they heard no words from the assailant, and that Mr. Rushdie was quickly soaked in blood.

The trial ended for the day and is due to continue on Tuesday.

Mr. Rushdie, who spent most of the 1990s in hiding in the UK after receiving death threats over his 1988 novel The Satanic Verses, was stabbed about 15 times: in the head, neck, torso, and left hand, blinding his right eye and damaging his liver and intestines.

Mr. Rushdie, 77, is due to testify about his injuries at the Chautauqua County Court in Mayville, New York, a few miles north of the Chautauqua Institution, a rural arts haven.

Mr. Matar, 26, has pleaded not guilty to a charge of second-degree attempted murder and second-degree assault. The latter charge is for wounding Henry Reese, the co-founder of Pittsburgh’s City of Asylum, a non-profit group that helps exiled writers, who was conducting the talk with Mr. Rushdie that morning. Mr. Reese is also due to testify.

Jurors will see videos of the attack, which some 1,000 audience members witnessed, and Mr. Matar’s arrest, and will hear from the Erie trauma surgeon who treated Mr. Rushdie after he had lost catastrophic volumes of blood, Mr. Schmidt said.

Mr. Matar said “Free Palestine, free Palestine,” as he walked past the public gallery after entering the courtroom, dressed in a blue shirt and dark pants, before the jury was brought in.

His lead defense lawyer, Nathaniel Barone, has been hospitalized with an illness, Mr. Barone’s colleagues told the court, but Judge David Foley denied their request to delay proceedings.

Lynn Schaffer, a public defender representing Mr. Matar, told the jury in her opening statement that the prosecution would fail to prove the necessary element of intent beyond reasonable doubt. She told them that none of the evidence Mr. Schmidt would present would show why Mr. Rushdie was attacked that day.

She referred to some evidence that Mr. Schmidt had cited: the pass Mr. Matar had bought to enter the Chautauqua Institution on Aug. 12, 2022, the morning of Mr. Rushdie’s appearance.

“Those gate passes are reflective of an intent to come in and watch a lecture, to watch a show,” Ms. Schaffer said.

FATWA AGAINST RUSHDIE

Mr. Rushdie was born into a Muslim Kashmiri family in India and is now a US citizen. In 1989, he went into hiding under the protection of British police after Ayatollah Ruhollah Khomeini, then Iran’s supreme leader, pronounced The Satanic Verses to be blasphemous.

Khomeini’s fatwa, or religious edict, called upon Muslims to kill the novelist and anyone involved in the book’s publication, leading to a multi-million-dollar bounty and the 1991 murder of Rushdie’s Japanese translator, Hitoshi Igarashi.

The jury has heard no mention of the fatwa or the threats against Mr. Rushdie. Mr. Schmidt, the district attorney, has said it is irrelevant to proving the crime of attempted murder took place.

The Iranian government said in 1998 it would no longer back the fatwa, and Mr. Rushdie ended his years as a recluse, becoming a fixture of literary gatherings in New York City, where he lives.

After the attack, Matar told the New York Post he had traveled from his home in New Jersey after seeing the Rushdie event advertised because he disliked the novelist, saying Rushdie had attacked Islam. Matar, a dual citizen of his native US and Lebanon, said in the interview he was surprised that Rushdie survived, the Post reported.

On Monday, two employees of the Chautauqua Institution who were at the amphitheater that morning testified about the attack. Deborah Sunya Moore, the institution’s chief program officer, recalled being handed the knife after it had been taken from Mr. Rushdie’s assailant by audience members who rushed on stage.

On Monday, it was inside a cardboard box on the prosecutors’ table.

If convicted of attempted murder, Matar faces a maximum sentence of 25 years in prison.

Matar also faces federal charges brought by prosecutors in the US attorney’s office in western New York, accusing him of attempting to murder Mr. Rushdie as an act of terrorism and of providing material support to the armed group Hezbollah in Lebanon, which the US has designated as a terrorist organization.

Mr. Matar is due to face those charges at a separate trial in Buffalo. — Reuters