Entertainment News (07/12/24)

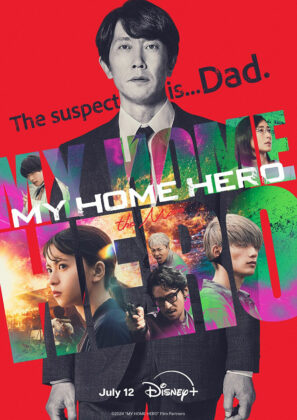

Japanese box office hit comes to Disney+

THE dramatic conclusion to a serialized story about a father who murders his daughter’s abusive partner is set to debut this month on Disney+. After captivating audiences with the series adaptation of the hit manga series, My Home Hero the Movie concludes the acclaimed crime thriller. It briefly topped box offices in Japan. Set seven years after the series, the movie follows businessman Tetsuo Tosu, who evades imprisonment after killing his daughter’s abusive boyfriend by throwing the police off his scent and dealing with gang leader Kyoichi Majima. It stars Kuranosuke Sasaki, Asuka Saito, Tae Kimura, and Kyohei Takahashi. The movie is on Disney+ starting July 12.

Ice Seguerra, Joey G, Noel Cabangon reunite

EARLY this year, Newport World Resorts gathered OPM stars Ice Seguerra, Joey G, and Noel Cabangon for their first collaborative concert. The talented acoustic trio will be back for Strings and Voices: The Repeat on July 20 at the Newport Performing Arts Theater. This time, their solo turns and collaborations will include new surprises. Strings and Voices: The Repeat tickets, ranging in price from P1,500 to P8,500, are now available at all TicketWorld outlets.

Royal Caribbean to be showcased at travel expos

TO cater to a growing demand for cruises, Royal Caribbean will be participating as a key exhibitor at two travel expos in the Philippines this July. From July 12 to 14, it will set up shop at the Travel Madness Expo at the SMX Convention Center, Pasay City. From July 19 to 21, it will have a booth at the Travel Tour Expo VisMin, at the Limketkai Mall, Cagayan de Oro City. Visitors can explore Royal Caribbean’s stalls at the expos to learn about their cruise offerings across the globe.

Felip releases album ahead of July concert

THE newest album of Filipino musician Felip, 7sins, has been released. While not religion-centric, the album is a journey of acknowledging human shortcomings. It is composed of nine songs, with “envy” as the title/focus track and “ache” as the final track. Despite being busy with SB19 engagements, shoots, and projects, Felip spent seven months writing, recording, and mixing the album, with late night sessions with Luke April of PLAYERTWO and Isagani Palabyab. It also features collaborations with artists like Belgian-Filipino Cyra Gwynth on the tracks “greed” and “lust.” Meanwhile, PLAYERTWO collaborated on the song “gluttony.” The album has been released ahead of Felip’s 7sins the Album Concert on July 27, to be held at the Space at One Ayala, Makati City. Tickets are available via felip.helixpay.ph.

Century Tuna awards Superbods 2024 winners

TUNA brand Century Tuna has named Jether Palomo and Justine Felizarta as the Grand Winners for Century Tuna Superbods 2024 #BestYouEver competition. Besting 36 finalists, fitness influencer and Mister Tourism World Philippines Mr. Palomo and the beauty and fitness enthusiast and Miss Tourism World 2022 1st runner-up Ms. Felizarta will each take home P500,000 tax-free.

Drag Race Philippines 3rd season set for August

THE third season of drag queen competition series Drag Race Philippines will be coming to HBO GO on Aug. 7. Paolo Ballesteros, multi-awarded Filipino actor, model, and drag artist, is returning as the series host. Following the success of seasons one and two, the showcase of Pinoy drag excellence returns with 11 more Filipino drag artists: Angel, John Fedellaga, JQuinn, Khianna, Maxie, Myx Channel, Popstar Bench, Tita Baby, Versex, Yudipota, and Zymba Ding.