Crossroads for Philippine monetary policy

The broadsheets said it all: July inflation overshot target, surged to 4.4% in July. From various angles, the July inflation rate of 4.4% sent jitters to most of the financial markets. Market analysts have been betting on an early cut in the Bangko Sentral ng Pilipinas (BSP) policy rate by at least 25 basis points (bps) in the next monetary policy meeting. Such a view is anchored on the average inflation of 3.5% for the first six months of 2024 against the whole-year target of 2-4%. BSP’s baseline inflation forecasts of 3.3% for this year and 3.2% and 3.3% for 2025 and 2026, respectively, further strengthened the increasingly dovish sentiment about the direction of monetary policy.

And dovish sentiment it was that galvanized this broadsheet’s median estimate of only 4% for the July inflation print. Of the 15 analysts, only five submitted estimates that exceeded the 4% upper inflation target this year with a low of 4.2% and a high of 4.6%. Only one hit the mark.

True, the July inflation rate was the fastest in nine months since it leaped to 4.9% in October 2023. Stripped of any seasonality, however, month-on-month inflation sprinted to 0.6%, the highest since September 2023’s 1.2% except during February 2024 when it hit 0.9%. Annualized, July 2024 inflation easily converts to 7.2%.

No wonder, if the previous weeks’ headlines bannered the confidence of the monetary authorities in cutting the policy rates even ahead of the US Fed, there has been some retreat in the messaging this week. While a rate cut remains on the table for next week, the BSP is “a little bit less likely” to do it. Keeping the rate steady seems to be gaining more ground given the “evolving inflation conditions.” July inflation to the BSP was “slightly worse than expected.”

In case the assessment goes awry, the BSP declared, an off-cycle adjustment is possible. Of course, this is not good for optics because it will show the patience of the BSP was rather too prolonged. Neither is it good for keeping inflation expectations firmly moored.

But we continue to maintain our high regard for both the BSP and monetary policy, especially since July 2022. For monetary policy has succeeded in catching up with the curve, reducing core and headline inflation to within the 2- 4% target starting December 2023 and elevating market confidence in the fight against inflation.

As we indicated in our column in another broadsheet two weeks ago, “it is not correct to suggest that today, the BSP should have eased monetary policy.” And the BSP was right in holding the line despite the preponderance of downside risks to inflation during its June 2024 policy meeting. The Monetary Board was particularly prudent in resisting the sirens’ song to ease early despite the decelerating trend in actual inflation, within-target forecasts and downside risks.

The likelihood of an out-of-target June and July inflation which could eventually dislodge short-term inflation expectations must be within the radar of the BSP. Inflation continues to be driven by the prospects of a lower tariff rate on imported rice, but that took ages to be established. Supply constraints, food in particular, are just too unpredictable while the global dynamics remained too erratic for the BSP to be sanguine about the sustained disinflationary path.

If they eased monetary policy two months ago, that stance would have been proven wrong by the 4.4% July inflation. Yes, the inflation blip of one month does not make a long-term trend but that single point might be enough to affect inflation expectations, disrupt capital inflows and drive the weakness of the peso. They are bad for controlling inflation.

The policy choices of the BSP are quite different from those of the US Fed.

There is an emerging view that the US Fed is behind the curve; it should have started on an easing cycle many months back. Second quarter 2024 real GDP in the US is projected to tip at 2.8% compared to the first quarter’s 1.4%, or double. The US economy expects strong support from higher consumer spending, inventory management, and business investment. But unemployment is now at its highest since 2021 due to the corporate cost-cutting cycle, and it is expected to peak at 5.5%. With declining recruitment, jobless claims are spiking. Net profit margins of S&P 500 firms plummeted to their lowest levels at the end of last year. These labor market indicators convince many that a recession is likely in the US.

With a long lag, a monetary policy reversal of the US Fed is not only urgent, but it should have been done some way back. Instead of a baby step of 25 bps increase, market pulse shows a greater probability for a 50 bps.

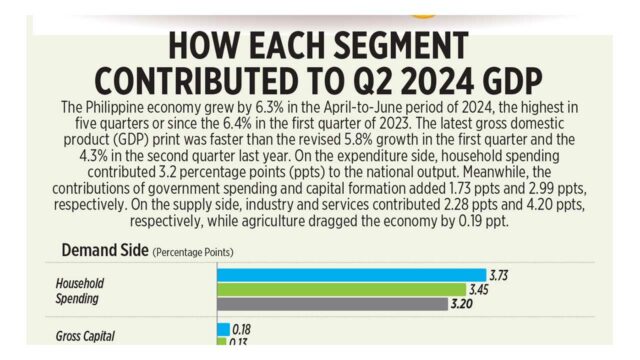

The Philippine case is very different, perhaps the US economy’s antonym. We don’t see the urgency in pulling back the tight monetary lever at this point when the economy expanded by 6.3% for the second quarter of 2024. Unlike in the US with rising unemployment, the latest unemployment rate for June 2024 stood at 3.1%, down from May’s 4.1% and 4.5% a year ago.

Most important, headline inflation has just blipped. There are no indications that the uncertainties on the supply side could recede except for the favorable impact of a reduced rice tariff.

As we stressed in our earlier pieces, part of the reason why the credit market seems weak is the lending banks’ own decision to be procyclical. They were tightening their loan standards at a time when interest rates had been driven up by the BSP’s leading interest rates. Any weakness in the financial markets cannot be entirely attributed to strict money policy because weak capital flows also derive from inflation concerns in the country. The BSP should continue to do its job of promoting price stability and in the process also inspiring confidence among investors and consumers alike.

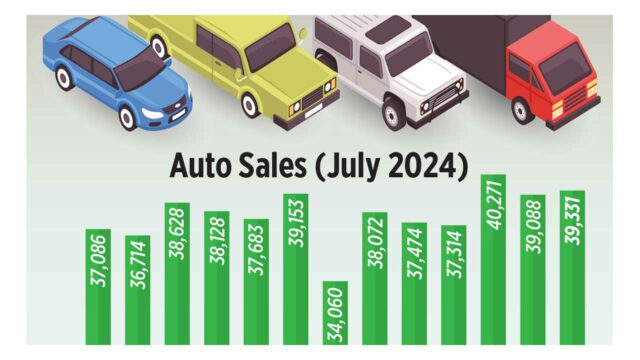

Given the high output growth, positive developments in the labor market as well as the reported expansion in manufacturing, higher capacity utilization, and sustained improvements in the country’s purchasing managers’ index, the country’s output gap must have remained positive. A vigilant BSP is crucial in safeguarding macroeconomic stability.

It is also wise for the BSP to be mindful of the remaining upside risks coming from higher food prices, transport charges, higher power rates and global fuel prices. In particular, Philippine Statistics Authority data illustrated that the production value of agriculture and fisheries actually dropped by 3.3% in the second quarter due to El Niño. Extending to the third quarter, El Niño could also upset food production during the same period.

If there is anything that could undermine the integrity of inflation targeting and pull back the BSP’s achievement in promoting price stability without causing a recession in the Philippines, it is to adjust monetary policy for reasons other than prices and sustainable growth, in that order. Monetary policy is not about reducing the cost of borrowing to allow governments to borrow cheaply. Monetary policy is not about enabling consumers to borrow from lending institutions to spend on travel and other personal effects, even if that is their own decision to make. Monetary policy is all about ensuring inflation is at appropriate level that both business and households, and even governments, can ignore it because price stability has produced the right costs for goods, services and money for business, households, and governments alike.

All up, we expect the BSP to be more patient in keeping its policy rate steady. We recall Raghuram Rajan, formerly of the IMF and the Reserve Bank of India likening the task of central banks to juggling six balls. For the US Fed, as for the BSP, it is not just interest rates going up or down, it has to monitor and weigh the impact of the exchange rate, long-term yields, short-term yields, and credit growth. And the central bank has to respond to all these and more potential disturbances in the economy. Very few would envy the BSP when it decides on the future path of monetary policy next week.

Diwa C. Guinigundo is the former deputy governor for the Monetary and Economics Sector, the Bangko Sentral ng Pilipinas (BSP). He served the BSP for 41 years. In 2001-2003, he was alternate executive director at the International Monetary Fund in Washington, DC. He is the senior pastor of the Fullness of Christ International Ministries in Mandaluyong.