First Asia K-Banker School empowers global leaders in digital finance

Filipino student among participants, talks about PHL’s financial landscape

By Miccel Mendoza

Korea University, Computer Science and Engineering

Yeouido, Seoul — 30 international students from over 20 countries gathered at Kookmin Bank’s new building to participate in Asia K-Banker School, a workshop focused on digital finance and its transformative potential.

The two-day program, held last Nov. 15-16, featured a blend of team-building activities, expert lectures, in-depth discussions, article writing, and networking opportunities. The selection process was rigorous, involving an initial document screening followed by interviews to ensure that the most qualified candidates were chosen to represent their nations.

Among the participants, a Filipino student was selected to showcase the Philippines’ financial landscape and its progress in digital finance.

The workshop commenced with a foundational lecture on the state of Korea’s and the global financial landscape, equipping participants with the context needed for subsequent discussions. A follow-up session delved into the public value and sustainability of finance, exploring how financial systems can drive long-term societal benefits.

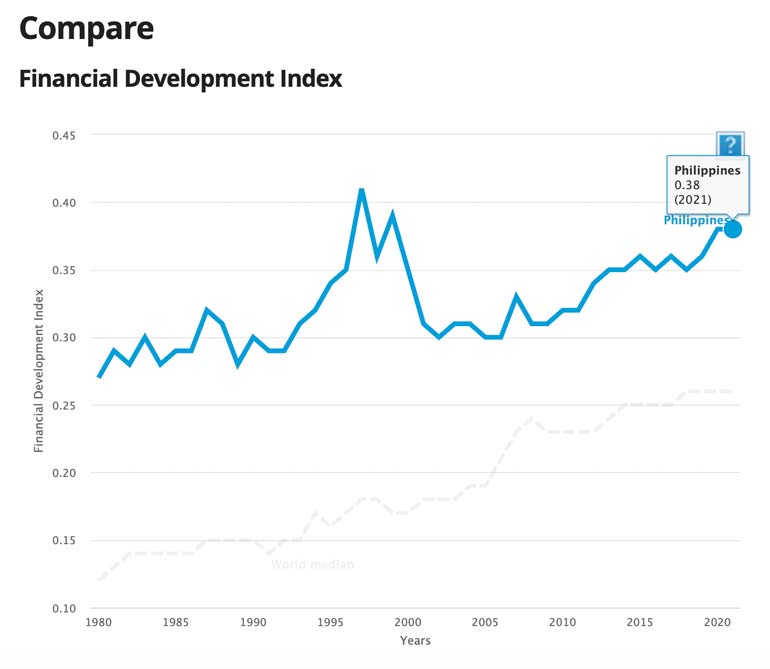

The Financial Development Index represents a country’s relative ranking in terms of the depth, accessibility, and efficiency of its financial institutions and markets. In the case of the Philippines, which is considered a developing country and often assessed as lagging behind advanced economies in terms of economic development, the index reveals notable trends. According to the International Monetary Fund (IMF), the Philippines’ Financial Development Index rose sharply from 0.29 in 1991 to 0.41 in 1997. It then declined to 0.3 by 2002 before showing a generally steady upward trend, reaching 0.38 again in 2021. While the Philippines has consistently remained above global and regional medians, its scores in recent years suggest room for improvement relative to neighboring countries.

The workshop also included an engaging lecture about the advancement of digital technology and finance. In this talk, the participants acquired knowledge about fintech’s latest cutting-edge technology. Fintech is driven by four key technologies: AI, blockchain, cloud computing, and big data. The world is shifting towards digital finance, and its importance cannot be understated.

Just a few years ago, living without cash in the Philippines was nearly impossible due to the heavy reliance on cash transactions. However, in recent years, cashless transactions have gradually become more common, particularly among the younger generation. Internet banking and mobile banking platforms like BDO Online Banking and the BPI Mobile App have significantly improved access to financial services by offering 24/7 access, transaction tracking, and a variety of comprehensive financial services.

Moreover, the real-time payment system known as the Unified Payments Interface (UPI) is gaining attention in the Philippines. Platforms supporting UPI now enable instant fund transfers between various banks and financial institutions. Digital wallets such as GCash and Maya, which offer similar functionalities to UPI, have become leading platforms in the country. These platforms provide a wide range of financial services, including P2P payments, merchant transactions, QR code-based payments, loans, investments, and cryptocurrency services. They go beyond simple payment platforms, serving as one-stop solutions for users seeking a convenient, cashless way to manage their finances. The ability to offer diverse services within a single app appears to be highly appealing to users.

Additionally, neobanks (digital-only banks) are introducing innovative financial products such as quick onboarding, fee-free accounts, high-yield savings accounts, and instant loans, offering a simplified, user-centric experience. Their fully digital operations allow users to open accounts and access services within minutes. In the Philippines, Tonic Bank has gained significant popularity, especially among younger users who value convenience and accessibility.

The Philippines has made significant progress but still has a long way to go in the digital finance sector. Digital payment options such as GCash and Maya have to become even more accessible for everyone. Internet connectivity issues and security concerns have to be addressed. Most importantly, support for Filipino citizens who are unable to adjust with the rapid transition to the digital world must be made available. If concerted efforts are made, we could see the Philippines joining the developed countries in leading the digital finance landscape.

This event was sponsored by Kookmin Bank, providing support and additional scholarships for outstanding participants. The initiative aligns with Kookmin group’s goal to deliver services that bring happiness and well-being to their customers and to the society.

This milestone event reflects Korea’s commitment in cultivating global leaders all over the world and eagerness in fostering a collaborative approach to shaping the future of digital finance.

Disney Store is the official home to shop the stories you love from Disney, Pixar, Marvel and

Disney Store is the official home to shop the stories you love from Disney, Pixar, Marvel and

Follow @DisneyStorebySM on Facebook, Instagram, Twitter, and TikTok, for updates and join us in spreading the excitement using #DisneyStorePH and #DisneyStorebySM.

Follow @DisneyStorebySM on Facebook, Instagram, Twitter, and TikTok, for updates and join us in spreading the excitement using #DisneyStorePH and #DisneyStorebySM.