The Philippines faces an increasingly precarious fiscal situation, one that has been building slowly and should no longer be ignored. Recent decisions, such as the Department of Finance’s order to divert funds from the Philippine Health Insurance Corp. (PhilHealth) to unprogrammed appropriations, are symptomatic of a deeper problem — the government’s eroding fiscal space. This erosion is not merely the result of disconnected actions but is a reflection of a broader trend of fiscal mismanagement, where key reforms are sidelined, and political motivations take precedence over sound economic policy.

The erosion of the fiscal space is underscored by underwhelming fiscal performance and the consequent revision of the Medium-Term Fiscal Framework (MTFF). The administration’s inability to pass crucial fiscal and tax reforms, many of which are now in danger of being undone, further compounds the issue. The politicization of the budget process, rife with the reintroduction of “pork” in infrastructure projects and social assistance programs, has only exacerbated this decline. The appointment of Ralph Recto as Finance Secretary — following the lackluster tenure of Benjamin Diokno — signals a further shift toward a more politically motivated approach. Together, these developments suggest a worrying trajectory for the nation’s fiscal health.

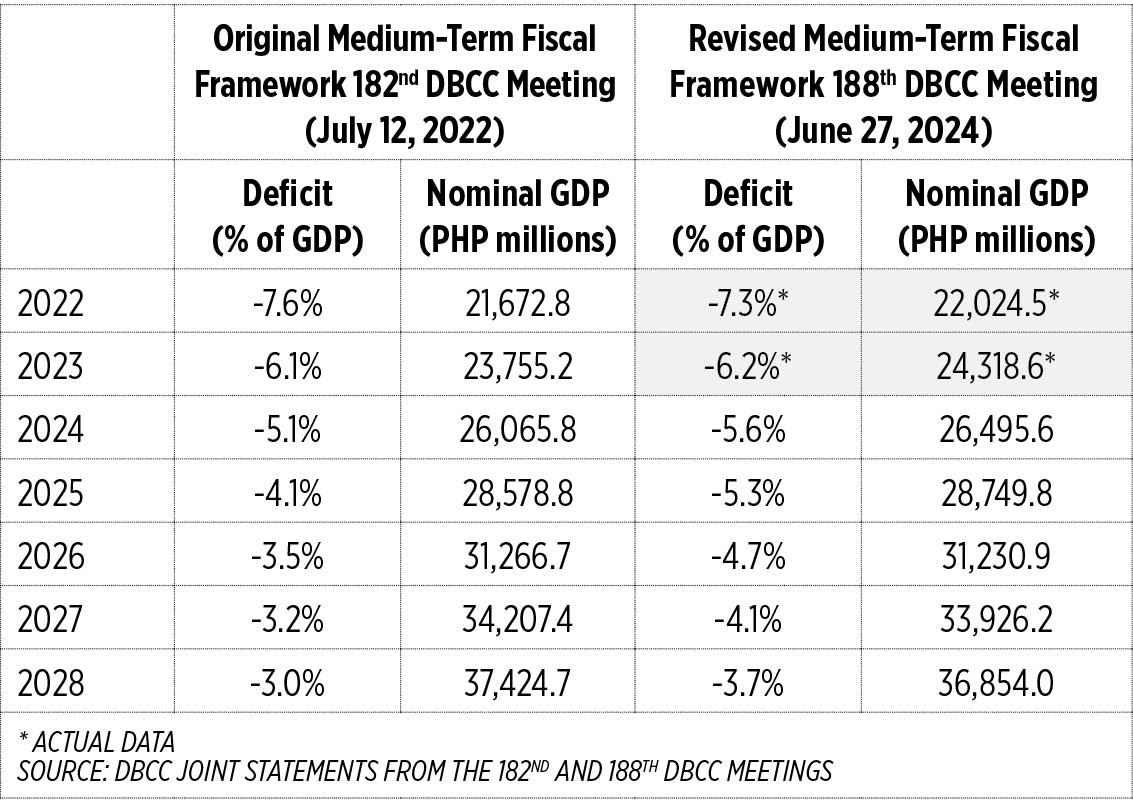

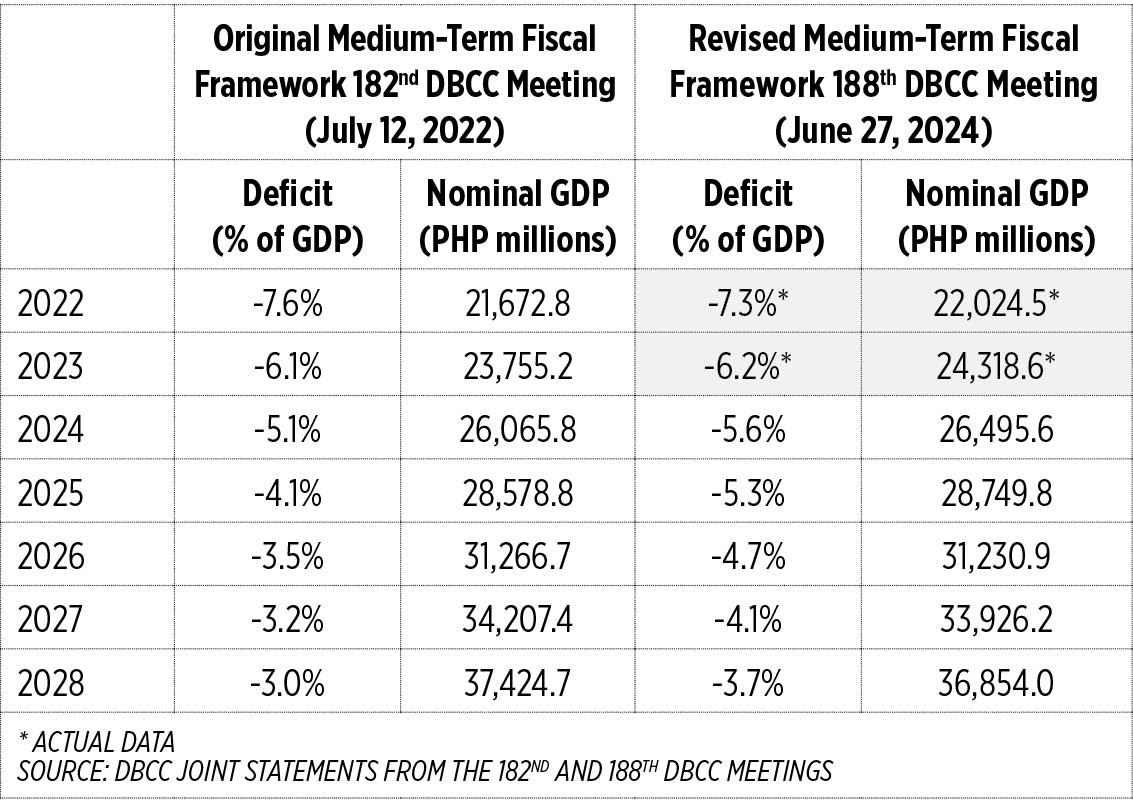

In 2022, the new administration introduced its MTFF covering 2022-2028. Initially praised by the IMF as the administration’s “commitment to fiscal consolidation” and fully supported by Congress, the MTFF set ambitious targets:

(1) 6.50-7.5% real GDP growth in 2022; 6.5-8% real GDP growth annually between 2023 to 2028;

(2) 9% (i.e., single-digit) poverty rate by 2028;

(3) 3% National Government deficit to GDP ratio by 2028;

(4) Less than 60% National Government debt-to-GDP ratio by 2025;

(5) At least $4,256 income (GNI) per capita (attainment of upper middle-income status).

House Speaker Martin Romualdez even made the pronouncement that the “legislative agenda shall be guided by targets set in the MTFF.”

However, not even halfway into the term, the Development Budget Coordination Committee (DBCC) has revised its fiscal targets, and the new projections for 2024 and 2025 do not bode well for the country’s fiscal space. Despite the non-funding or underfunding of priority programs, the deficits are projected to remain alarmingly high at above 5% of GDP. Economic managers can no longer use the pandemic as an excuse for this weak performance.

The administration’s failure to meet its original fiscal and growth targets is apparent. While the country experienced 7.6% GDP growth in 2022 (largely thanks to base effects), post-pandemic recovery has been underwhelming. GDP growth in 2023 stood at just 5.5%, a full percentage point below the target range of 6.5% to 8%. Forecasts for 2024 from the World Bank, ADB, and IMF predict growth of less than 6%, and growth projections for 2025 hover around 5.9%-6.2%.

On the income front, the target of reaching GNI per capita of $4,256 is within reach, with a reported figure of $4,230 in 2023. However, the updated threshold for upper-middle-income status (currently $4,516) is unlikely to be attained before 2026.

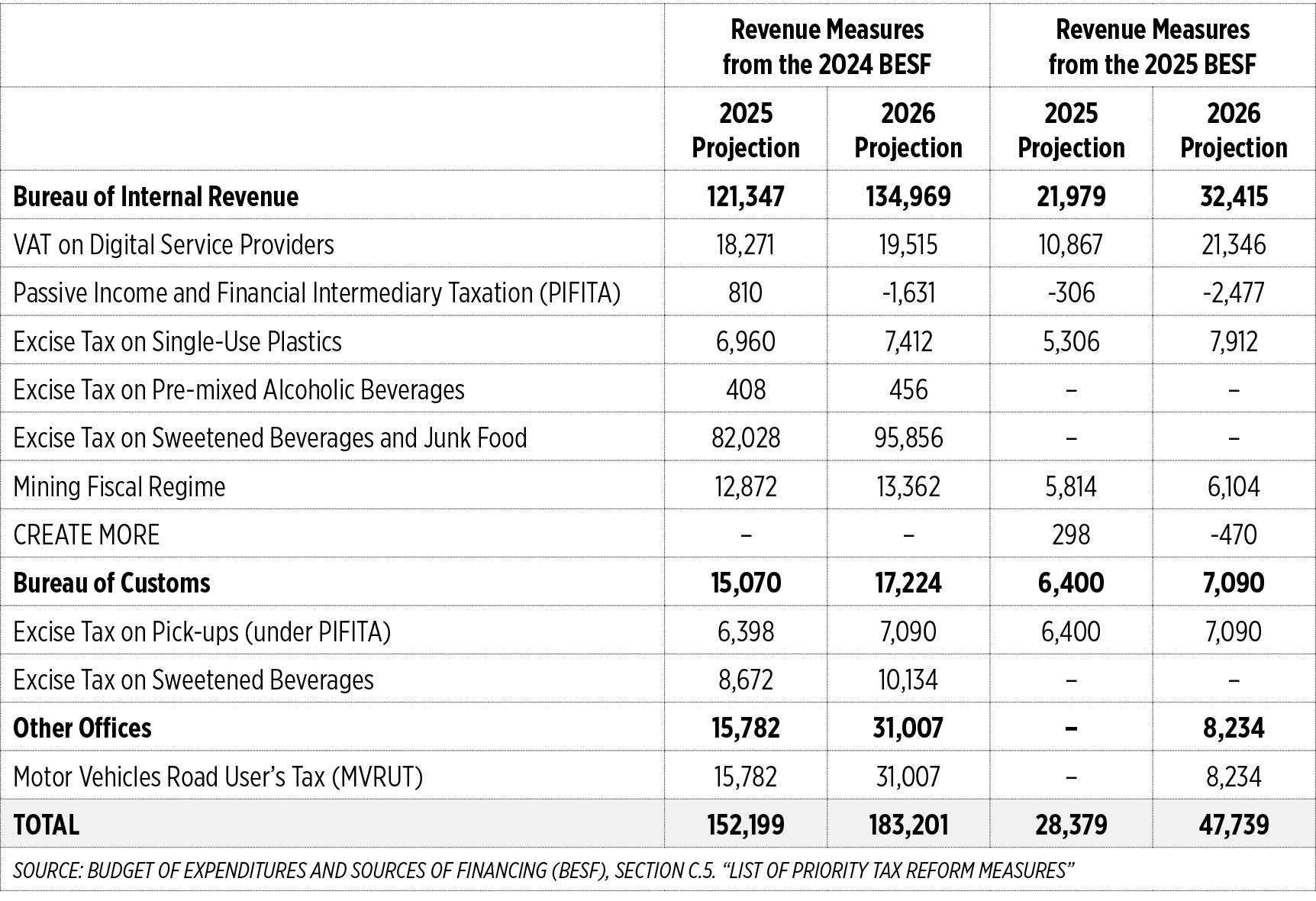

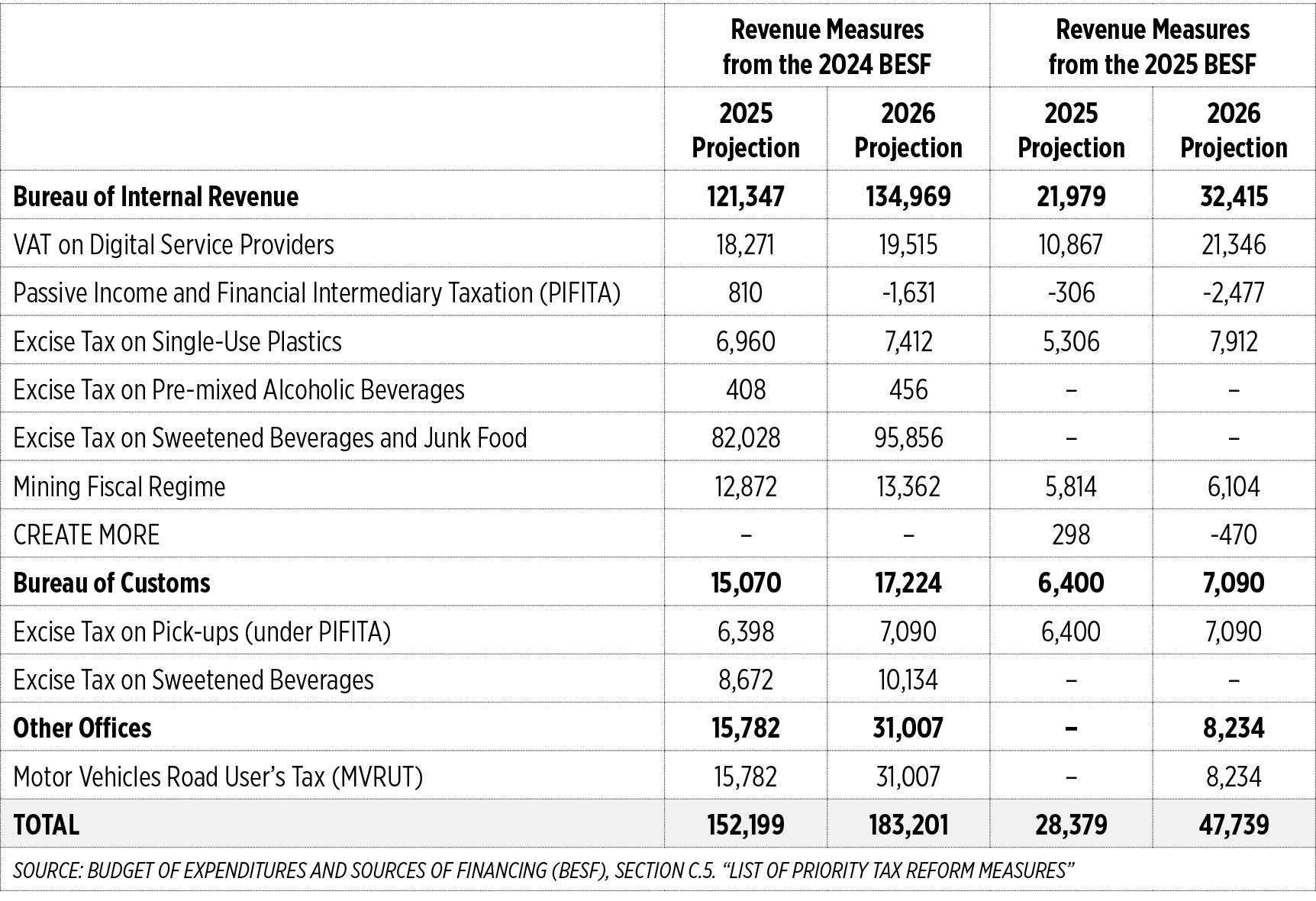

The Budget of Expenditures and Sources of Financing (BESF), which outlines revenue measures, reveals the extent to which the administration’s planned fiscal reforms have been diluted or dropped entirely. For instance, key reforms such as excise taxes on alcohol, sweetened beverages, and junk food have been abandoned, while the mining fiscal regime reform has been scaled back significantly.

Even more concerning is the prioritization of the Corporate Recovery and Tax Incentives for Enterprises Maximize Opportunities for Reinvigorating the Economy bill (CREATE MORE), a measure that will effectively reduce the powers of the Fiscal Incentives Review Board (FIRB). In fact, the administration’s envisioned version of CREATE MORE will undo the good that CREATE has done in rationalizing fiscal incentives and would result in the further erosion of revenues.

The difference in the 2024 BESF and the 2025 BESF figures is stark: the government’s projected fiscal reform yields for 2025 have been reduced from P152.2 billion to P28.4 billion. This sharp decline signals the administration’s failure to uphold its commitment to fiscal consolidation.

Another key factor in the country’s fiscal instability is the failure to reform the expenditure side, particularly the military and uniformed personnel (MUP) pension system, which former Finance Secretary Diokno previously warned could trigger a fiscal crisis. The government’s inability to rein in the unsustainable pension system, where retirees contribute nothing and pensions are automatically indexed to the salaries of active personnel, has long posed a threat to fiscal health. Diokno pointed out that pensions for MUPs are far higher than those for Social Security System (SSS) or Government Service Insurance System (GSIS) retirees, and the system is on a path toward fiscal collapse if left unaddressed.

Yet, instead of pursuing these much-needed reforms, the government has compounded the issue by increasing the salaries of government workers under Executive Order No. 64, signed by President Ferdinand Marcos, Jr. this month. While the move is aimed at adjusting salaries in response to inflation and improving public sector productivity, it also adds further pressure on the budget. This increase, alongside the pension obligations that balloon with every salary hike, further diminishes the fiscal space. Without meaningful reform to the MUP pension system, the government will continue to struggle with balancing essential expenditures while managing the growing demands of public sector compensation.

Speaker Romualdez was disingenuous when he said that the MTFF targets would guide the legislative agenda. Politics, not development or fiscal consolidation, has been the motivation behind the budget, as made evident in the General Appropriations Act (GAA).

One very obvious example is the fact that the legislated budget for the Commission on Elections (Comelec) has ballooned to a record-high P40.1 billion in 2024. There are no elections this year so it is highly peculiar that the agency’s budget in 2024 would be 50% higher than its budget during the last national election in 2022. Reports have surfaced linking this inflated budget to the Speaker’s push for Charter Change, raising further concerns about the politicization of public funds — including reports of ayuda (aid or assistance) being exchanged for signatures for Cha-cha surfaced earlier this year.

Social assistance programs (a.k.a. ayuda) such as Medical Assistance for Indigenous Patients (MAIP), Assistance to Individuals in Crisis Situation (AICS), and Tulong Panghanapbuhay sa Ating Disadvantaged/Displaced Workers (TUPAD), in conjunction with insertions into the Department of Public Works and Highways (DPWH) budget, have become the new and less transparent forms of pork barrel within the budget. The combined budget for these three ayuda programs has risen from P59.6 billion in 2021 to P121.9 billion in 2024. The proposed allocation for these programs may seem reduced at P77 billion in the National Expenditure Program (NEP) for 2025, but this is expected to rise. The final budget for these programs was increased by 117% compared to the original proposals in the NEP for 2024.

The politicization of these programs, despite their significant roles in providing essential aid, highlights the persistent issues of political patronage and the potential misuse of public funds to advance political interests.

There is no such thing as a free lunch however, and the budget variance in favor of these programs for pork has to be made up for, resulting in a crowding out effect on the rest of the budget. Because the differences between the GAA and NEP figures for these three ayuda programs were large (to the tune of P66 billion combined), Congress had to either take funds away from other programs, or relegate some items into the Unprogrammed Appropriations. Ayuda is just the tip of the iceberg as many more pork items are hidden as insertions in the budget for the DPWH’s infrastructure projects.

Combining the impact of an inefficient and politicized budget process with the shrinking fiscal space, we now see why Finance Secretary Ralph Recto has resorted to wringing out PhilHealth for additional funds to send to the National Government.

When Ralph Recto was appointed as Secretary of Finance at the beginning of this year, two narratives emerged. The first was that Recto was a highly competent technocrat who would serve the country well. The second was that Recto would be able to make up the fiscal gap by prioritizing tax administration measures. With the benefit of hindsight now, we can say that neither is true.

Just a month into his appointment, Mr. Recto was already hedging his bets by stating that the Development Budget Coordination Committee (DBCC) had to come up with more “realistic” (read: lower) growth and fiscal targets. Rather than finding a path to succeed where his predecessor had failed, Mr. Recto has essentially lowered the standards of performance. By the end of his term, he would like to project himself as a good performer, but this would be achieved by significantly lowering the metrics or standards of performance. It seems that Secretary Recto is still misguided in thinking that the best policy is “no new taxes,” despite recent surveys showing that a majority of Filipinos support increasing excise taxes on tobacco, alcohol, and soft drinks.

Because of his lack of moral fortitude and political resourcefulness, Finance Secretary Recto is weakening PhilHealth’s fiscal position in order to fund projects under the Unprogrammed Appropriations. Mr. Recto seems to have abandoned his mandate as the chief fiscal manager of the country and has instead chosen to be complicit in funding Congress’ pork insertions in the budget.

When questioned about the PhilHealth reallocation, Mr. Recto said that he is just following Congress’ provisions in the 2024 GAA. Mr. Recto conveniently left out the fact that prior to his appointment as DoF Secretary, he was the sitting Representative of the 6th District of Batangas, and was also a member of the Bicameral Conference Committee that passed the final version of the 2024 GAA. He also forgot to mention that the provision allowing the transfer of funds from government-owned- or -controlled corporations (GOCCs) to the Unprogrammed Appropriations has only ever appeared in the 2024 GAA, after the Bicam Conference had made its amendments.

Secretary Recto has positioned himself as a willing enabler of the deception and illegal transfer of funds from GOCCs, including PhilHealth. In his latest justification, he claims that the reallocation of PhilHealth funds is necessary to pay for health workers’ allowances — a manipulative tactic designed to pit patients and PhilHealth members against health workers. This narrative distracts from the real issue: the failure of Congress and Mr. Recto himself to fully fund health workers’ allowances in the Programmed Appropriations. If there had been a genuine intent to address the compensation of health workers, it should have been allocated up front rather than being relegated to the uncertain Unprogrammed Appropriations.

Unprogrammed Appropriations represent items that will be funded only if new revenues or taxes are raised, new foreign loans or grants are secured, or if excess revenues are collected. The National Budget reflects the administration’s priorities, and items under the Unprogrammed Appropriations cannot be considered priority projects since their funding depends on these uncertain sources.

As the Philippines grapples with the consequences of these fiscal decisions, it is crucial to take a step back and examine the broader implications. Only by doing so can we begin to address the root causes of this fiscal decline and chart a course toward genuine fiscal recovery.

AJ Montesa heads the tax policy team of Action for Economic Reforms.