(Part 2)

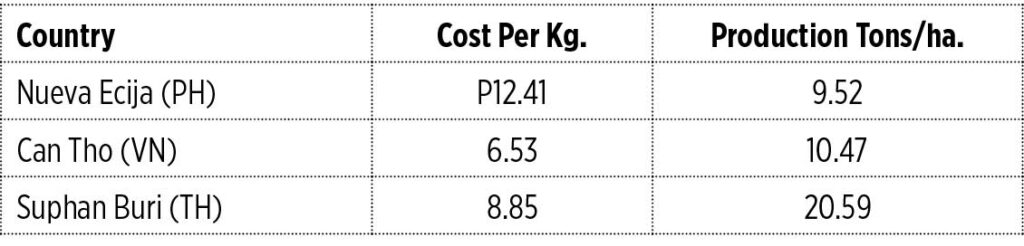

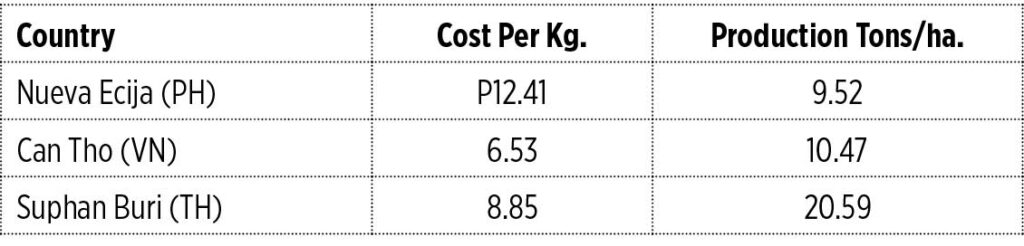

“The Philippine Rice Industry Road Map – 2030,” published by the Department of Agriculture in 2018, includes a comparative analysis of rice farming productivity in the Philippines, Vietnam, and Thailand. The comparison was made on the basis of the relevant data from the more productive provinces in each country, as shown in the accompanying table.

The comparison clearly shows that the Philippine production cost per kilo of rice is higher. But at the same time, the rice produced expressed in tons per hectare is lower, particularly compared with Thailand where the rice production per hectare is double that of the Philippines. It is a double whammy for the Philippines: incurring higher cost but producing lower output.

The roadmap does not provide more details from which we can determine the factors of production causing the large comparison differences. These details are necessary when formulating Philippine public policy choices to improve the current dismal situation. However, it is safe to assume that one of the factors, if not the single one that makes the greatest impact, is the comparative average rice farm size.

THE SIZE OF FARMS

The average Philippine rice farm size at 1.4 hectares in 2018 — and which is probably even smaller today — is so small that it is more likely that the average farm size in the two other countries mentioned is larger than that of the Philippines. Size is a major factor in production. When scaled up, size or capacity produces higher productivity per unit of measure. Therefore, smaller farm size is a major factor in the much lower productivity that the Philippines derive from its rice farms.

There are two things that stand out from the information and analyses made in Parts 1 and 2 of this essay. One is the very small average size of our rice farms which, in my view, is a major factor that causes the very low productivity of our rice farms. And the other is the current miserable economic condition of most of our rice farmers, both the landowning farmers and non-landowning farmers, but especially the latter.

No matter what we do in trying to increase rice farming productivity, it will not result in a significant improvement if we do not endeavor to substantially increase the size of our farms. Try to picture it yourself — there is nothing much one can do to raise productivity in a piece of farmland measuring 1.4 hectares or less, whether farming is mechanized or not. In fact, by just increasing the farm size itself, and using the same method of production as before, it will already produce higher productivity. Such is a natural result of scaling up.

We can only increase the average rice farm size by removing the present legal limit in the ownership of farmland, which is presently five hectares per person. By removing this limit — or increasing it substantially — the marketplace will do the rest in increasing farm size. There will be buyers who see good profits in large-scale agriculture production because of economies of scale and its suitability to full mechanization, two factors which will certainly lead to much higher productivity. And there will be sellers when they see an attractive price, which increased demand usually produces. To make these buying and selling activities more vigorous, it is necessary that we also remove any present restrictions in the disposal of farmland acquired by the beneficiaries of the past land reform program.

There is nothing that prevents us from removing the present farm size limit or increasing it to a much larger size. Having gone through a land reform program, however imperfectly it was executed, we have duly performed our social obligation to our landless countrymen. I believe then that there is no longer any impediment in removing or increasing the farm size limit. We must absolutely do so if we want to improve our rice farming productivity to a high degree.

A BASIC INCOME

Let me now turn to the rice farmers, both landowners and non-landowners. As mentioned before, most of them have an annual income that is below the poverty threshold. They need help to escape from this pitiful condition.

This observation recalls my earlier commentary suggesting that the government adopt a program of providing poor Filipinos with a basic income. This program will cover all poor families whose annual income is within the poverty threshold. To be clear, the program coverage will include, in addition to the rice farmers, all other farmers, owning the farmland or not, and the urban poor. This program will replace the present 4Ps, the amount of which given per family is miniscule.

I realize that such a program is very controversial because some believe that the beneficiaries would tend to become lazy and would just spend part of the money in consuming alcohol and engaging in other vices. However, I recall from my readings that the reviews of similar programs adopted by some countries did not indicate a significant occurrence of such results. Moreover, the adoption of public policy must be dictated by the benefits it brings to the great majority and must not be deterred by the consideration of the anticipated bad behavior of the few.

The current poverty threshold for a family of five people has increased to P166,000 per year (rounded off this comes to P13,873 per month) as determined by the Philippine Statistics Authority (PSA) in 2023. For purposes of illustration, let’s get a fraction of that amount to be given as basic income to poor families. Say, P4,000 per month or P48,000 per year for each poor family. That translates to P144 billion per year based on the reported 3 million poor families in 2023 as similarly determined by the PSA. I believe that this total amount per year of P144 billion is affordable and therefore doable. Moreover, this total amount should decline as we move towards the future.

Nowadays, it should not be difficult to manage such a program as cash transfers can be done electronically and therefore quickly with minimum human intervention, reducing substantially the probable occurrence of corruption.

An important matter to consider is that such a total amount will be spent by the beneficiaries for basic consumption, such as food and clothing, which are locally produced using substantially local materials and employing local labor. Such consumption, taken alone by itself, will certainly add to economic growth.

In sum, removing or increasing substantially the present legal limit in the ownership of farmland will significantly increase productivity in the production of rice and other agricultural crops and produce.

Giving the Filipino poor a meaningful basic income does not result in a wasteful use of money. On the contrary, doing so helps the poor, especially the farmers, in improving their living conditions which, in turn, provides a contribution, in no small measure, to economic growth.

(See Part 1 here: https://tinyurl.com/2c7zn9dd)

Benjamin R. Punongbayan is the founder of Punongbayan & Araullo. Contact him at (ben.punongbayan@ph.gt.com).