By Aubrey Rose A. Inosante, Reporter

THE NATIONAL GOVERNMENT’S (NG) outstanding debt rose to a record P16.75 trillion in the first four months amid a modest uptick from March that was tempered by a strong peso, according to the Bureau of the Treasury (BTr).

Treasury data showed that outstanding debt inched up 0.41% or P68.69 billion from end-March. Year on year, the debt rose 11.56%.

“The uptick was minimized by the significant appreciation of the peso, which reduced the effect of additional borrowings in line with the fiscal program,” the BTr said in a statement on Tuesday.

“The uptick was minimized by the significant appreciation of the peso, which reduced the effect of additional borrowings in line with the fiscal program,” the BTr said in a statement on Tuesday.

It used a foreign exchange rate of P55.93 a dollar in April, appreciating from P57.28 in March and P57.58 in April 2024.

The bulk or 69.2% of the debt stock came from domestic sources, while external obligations took the rest.

The improved share of external debt at 30.8% is in line with the government’s thrust to cut exposure to external shocks.

As of end-April, outstanding domestic debt inched up 1.85% to P11.59 trillion, mostly made up of government securities.

The BTr attributed the increase to the strong demand for government securities, including P300 billion in benchmark bonds.

In April, the government raised P300 billion worth of new 10-year fixed-rate Treasury notes amid strong demand for longer-dated tenors on expectations of rate cuts by the Bangko Sentral ng Pilipinas.

“With economic fundamentals remaining sound, the country continues to enjoy strong market access at reasonable rates,” it said.

The peso appreciation shrank the peso value of dollar-denominated domestic securities by P3.85 billion. Year on year, domestic debt increased 12.44%.

On the other hand, external debt slipped 2.68% to P5.16 trillion at end-April from March.

“The reduction was primarily due to the P124.74-billion decrease in the peso value of external debt owing to the peso appreciation, combined with net repayments of P58.28 billion,” the Treasury said.

Foreign debt went up 9.63% year on year.

NG-guaranteed obligations dipped 0.68% to P377.54 billion at end-April from March due to P1.75 billion in net repayment of domestic guarantees and P2.14-billion lower valuation arising from the peso appreciation, the BTr said.

Year on year, guaranteed obligations declined 5.2%.

‘FIRMLY ON TRACK’

“Finally, the debt portfolio remains resilient, with 91.7% of obligations carrying fixed interest rates and 82% classified as long term,” the Treasury said. “This structure helps insulate public finances from abrupt changes in interest rates and the market environment.”

It said the Philippine economy is “firmly on track” to cut the debt-to-gross domestic product ratio to below 60% by the end of President Ferdinand R. Marcos, Jr.’s term in 2028.

The debt-to-GDP had risen to 62% by the end-March — the highest in 20 years.

“The fiscal deficit has also been steadily narrowing and is on track to drop to about 3.8% by 2028,” it added.

Reinielle Matt M. Erece, an economist at Oikonomia Advisory and Research, Inc., attributed the rise in government debt to increased demand for government securities.

“In the following months, I expect the country’s debt to rise as spending programs may continue to put a burden on the country’s fiscal space,” he told BusinessWorld in a Viber Message.

The debt would remain “manageable” as long as debt service is consistent and revenue growth is strong, he pointed out.

But the relative strength of the peso, which tempered the rise in domestic debt, is expected to be short-lived, Mr. Erece said.

Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp., said the additional debt in April reflected the P300 billion in Treasury notes issued during the month and the previous month’s budget deficit.

The NG posted a P67.3-billion surplus in April, a turnaround from the P375.73-billion deficit in March.

“For the coming months, the outstanding National Government debt could hit record highs amid new borrowings in the early part of the year, as well as the need to hedge both local and foreign borrowings of the National Government in view of the Trump factor,” Mr. Ricafort said in a Viber Message.

US President Donald J. Trump’s protectionist policies, including higher tariffs, have caused volatility in global financial markets since October, he pointed out.

The NG’s outstanding debt is projected to hit P17.35 trillion by yearend.

In a related development, Finance Secretary Ralph G. Recto said the Bureau of Internal Revenue (BIR) is on track to hit its P3.232-trillion collection goal this year.

“So far, they are on track to meet their target,” he told BusinessWorld in a text message on Monday.

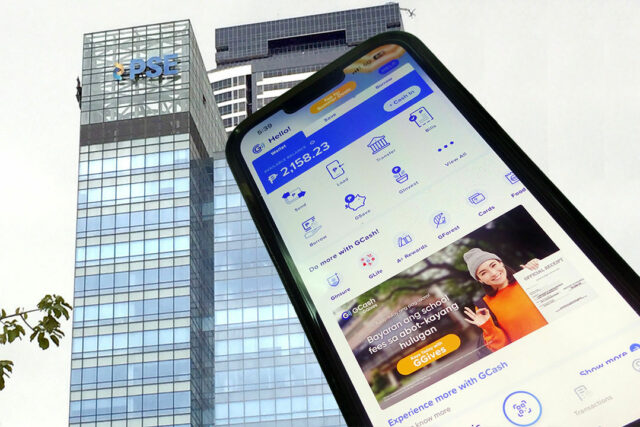

The BIR, which seeks to increase revenue by 13.36% or P380.87 billion this year from 2024, on Friday said it exceeded its goal for the first four months by 14.5%, collecting P1.11 trillion.

“Cumulative collection as of April 2025 represents more than 35% collection of the Bureau’s calendar year 2025 collection target of P3.232 trillion,” it said in a statement.

John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies said the this is a “promising sign.”

“The rollout of new tax measures such as digital taxation and improvements in tax administration can further support collections, especially if enforcement is sustained,” he said in a Viber message.

But an economic slowdown brought by global uncertainties or domestic spending constraints pose risks to the BIR target, he said.

“Volatile inflation and weaker business profits could also dampen collection growth,” he said. “Sustained efficiency reforms, broadening the tax base and minimizing leakages will be key to meeting the target.”

Mr. Ricafort said he expects digital taxes to help the BIR meet its goal this year. He also cited the Philippines’ “good track record of growth in recent years.”

Hitting the BIR target rests not just on new taxes but also on enforcement, said Eleanor L. Roque, tax principal at P&A Grant Thornton.

“The bulk of the tax take will still come from voluntary compliance with regular taxes like income tax and value-added tax,” she said in a Viber message. “To be able to achieve this year’s high target, the BIR needs to exert extra effort widening their tax net.”

“The BIR needs to make the cost of evading taxes higher than the cost of compliance,” she added.