The country’s leading healthcare company sets its sights on innovation, local growth, and broader impact in the years ahead

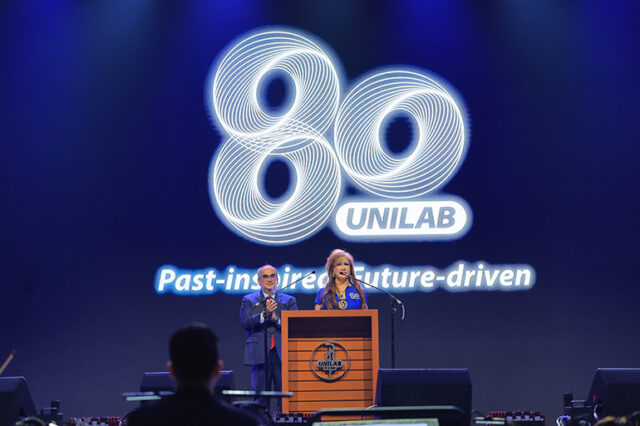

Unilab Group, the country’s most-trusted pharmaceutical and healthcare conglomerate, marked its 80th year with a bold signal to the market: it is accelerating its transformation from a humble corner drugstore into a future-ready, innovation-driven healthcare leader.

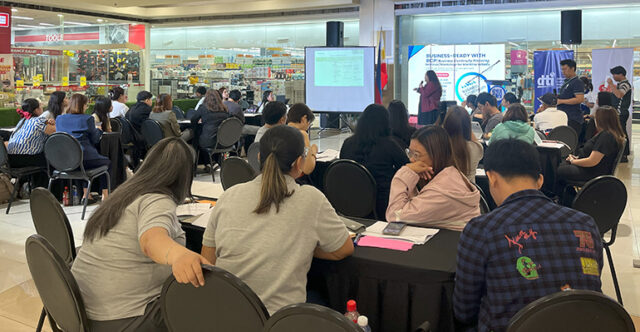

Celebrating its founding anniversary at the PhilSports Arena, the milestone event gathered over 4,000 employees and partners across the Philippines and Southeast Asia. While the program featured a retrospective of Unilab’s growth and milestones, its main message focused squarely on accelerating momentum for the next 20 years as the company approaches its 100th year.

Founded in 1945 during the post-war recovery period, Unilab began as a small drugstore along Sto. Cristo Street in Binondo. Its founder, Jose Y. Campos, and his business partner, Mariano K. Tan, operated with limited capital, a borrowed corner space, and a single shelf for inventory. From those early days, the company grew steadily through hard work, resourcefulness, and a deep understanding of community needs.

That same entrepreneurial mindset continues to guide the organization today. From its origins in pharmaceutical distribution, Unilab Group invested strategically in building robust manufacturing capabilities to ensure quality, accessibility, and self-reliance in its product supply. Unilab has since evolved into a healthcare conglomerate with capabilities in branded and generic pharmaceuticals, personal care, health services, and animal health.

Clinton Campos Hess, who formally assumed the role of Group Chairman, outlined the company’s strategic vision for the next decade. This includes deepening its role as a key healthcare player in the region. He emphasized the need to align business growth with social responsibility, particularly in reaching underserved communities.

“We must ensure that in pursuing our mission, no one gets left behind,” Campos Hess said during his speech.

Campos Hess also outlined Unilab’s three key strategic pillars: Product Solutions, Health Services, and Education, which are expected to drive new business models, enhance consumer access to healthcare, and hold up broader societal goals.

Infrastructure investments have played a critical role in sustaining Unilab’s competitive edge. Over the past decade, the company established several advanced facilities such as the Amherst and Belmont plants, Beaute Et Sante Laboratories, Inc. (BESLI), South-Unilab Material Management Office (SUMMO), and First Pioneer Distribution, Inc. II (FPDI). These facilities enable high-volume production, quality assurance and control, and industry-compliant storage for specialized therapies including vaccines, oncology, and central nervous system treatments, a testament to Unilab’s commitment to deliver no less than high-quality medicines for the Filipinos.

In addition to business expansion, Unilab has pursued programs that reflect its community-oriented culture. Its 8,000 Hours of Bayanihan campaign encourages employees to collectively log volunteer hours that support health and wellness initiatives nationwide. The campaign reinforces a long-standing principle within the organization: that success is measured not only by financial performance, but by the lives touched along the way.

The group also reaffirmed its role in policy advocacy through the Unilab Center for Health Policy (UCHP). Formally launched last year, UCHP serves as a platform for research, dialogue, and multi-sectoral collaboration aimed at addressing systemic gaps in Philippine healthcare.

Much of Unilab’s progress over the past decades was credited to the leadership of Jocelyn Campos Hess, who formally stepped down and assumed the title of Chairman Emeritus. During her tenure, Unilab expanded its business lines, broadened manufacturing capabilities, and launched initiatives under the Unilab Foundation to support health education, inclusive employment, and therapeutic care for children.

Despite rising competition in both local and regional markets, Unilab has expressed confidence in the company’s direction. The challenge now, it said, is to scale operations while retaining the core values of husay, malasakit, and bayanihan that have long shaped its culture.

As Unilab looks ahead to its 100th year, the company is determined to balance growth with purpose. With its foundations firmly in place and leadership looking outward, Unilab is poised to reinforce its standing not only as an industry leader, but as a partner in working towards healthier Filipinos, one health solution at a time.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.