By Luisa Maria Jacinta C. Jocson, Reporter

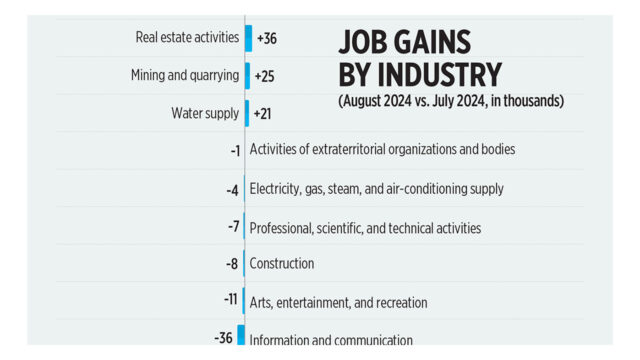

THE EXPOSURE of Philippine banks and trust entities to the property sector declined to 19.92% at end-June, data from the Bangko Sentral ng Pilipinas (BSP) showed.

This was lower than the 20.31% ratio at end-March and the 20.8% logged in the same period a year ago.

This was also the lowest real estate exposure ratio recorded in four and a half years or since the 19.84% seen as of December 2019.

The BSP monitors lenders’ exposure to the real estate industry as part of its mandate to maintain financial stability.

Investments and loans extended by Philippine banks to the real estate sector rose by 3.6% to P3.16 trillion as of June from P3.05 trillion a year ago.

Broken down, real estate loans increased by 7.3% to P2.79 trillion in the period from P2.6 trillion at end-June 2023.

Residential real estate loans jumped by 8.9% year on year to P1.04 trillion from P958.192 billion, while commercial real estate loans edged up by 6.1% to P1.74 trillion from P1.64 trillion.

Past due real estate loans stood at P141.254 billion, higher by 7.1% from P131.843 billion a year prior.

Past due residential real estate loans rose by 3.5% to P97.89 billion from P94.59 billion, while past due commercial real estate loans climbed by 16.4% to P43.37 billion from P37.25 billion.

Meanwhile, gross nonperforming real estate loans went up by 5% to P110.862 billion as of the second quarter from P105.632 billion a year ago.

This brought the gross nonperforming real estate loan ratio to 3.98% at end-June, easing from 4.07% a year earlier.

On the other hand, real estate investments fell by 18.4% to P371.108 billion from P454.856 billion in the same period a year ago.

This, as debt securities declined by 16.7% year on year to P245.313 billion from P294.558 billion. Equity securities likewise dropped by 21.5% to P125.795 billion from P160.298 billion.

Joey Roi H. Bondoc, director and head of research at Colliers Philippines, said the low real estate exposure seen at end-June is in line with the slow recovery of the property market.

“It’s what we’re seeing right now. It’s definitely reflecting the slow take-up that we’re seeing in the market,” he said via phone call.

Mr. Bondoc said this was due to the lengthened remaining inventory life of unsold condominium units.

“We have about 21,000 units right now across Metro Manila and these remain unsold. These are ready for occupancy already. But the problem is, we’re seeing a slow take-up of this ready-for-occupancy (RFO) units, about 21,000 units, and our estimate is that it will take the market five years to fully absorb these unsold RFOs,” he said.

From 2017 to 2019, the annual average period for absorption of unsold RFOs was at 12 months, according to Colliers data.

“But right now, take-up(for the pre-selling sector) is only about 12,000 to 13,000 units and then the amount of time for the unsold RFOs to be absorbed is 60 months,” Mr. Bondoc said.

“So, it’s really a dampened market at this point, especially in Metro Manila. This only reflects the slow exposure of banks to the residential real estate market.”

Mr. Bondoc also noted that real estate developers are not launching new projects, especially in Metro Manila.

“They’re not launching a lot of vertical projects. If you’re seeing less launches right now, after four or five years, these launches will be under bank financing. Definitely, we will see reduced exposure of the Philippine banking system to residential loans in the near to medium term,” he added.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the lower exposure of banks was also due to the “adoption of credit risk management based on global best practices.”

This led to “more prudent management of property exposures in view of prescribed limits set by regulators also partly led to the decrease in the said exposures to the sector,” he said in a Viber message.

In 2020, the central bank raised the real estate loan limit of banks to 25% of their total loan portfolio from 20% previously to help free up additional liquidity as a relief measure during the coronavirus pandemic.

Mr. Ricafort also noted higher vacancies due to the rise in hybrid or remote work arrangements, shuttering of Philippine offshore gaming operators (POGOs) and increase in online businesses.

“Thus, the continued need for banks to diversify their loan portfolio and credit risk exposures, also in view of tighter capitalization standards that may require higher risk weights for riskier loans and investments, including those in the real estate sector,” he added.

Separate data from the central bank showed that the Residential Real Estate Price Index rose by an annual 2.7% in the second quarter, much slower than the 6.1% recorded in the previous quarter.

Mr. Bondoc added that the BSP’s easing cycle will have a lagged impact on real estate loans.

“It will not be immediately felt by the market. We’re estimating, since the cut was just recent, perhaps early 2025 to mid 2025,” he said.

“If there will be additional cuts, perhaps if there are two more rounds this year, those will definitely be felt by mid of next year.”

The central bank began its easing cycle in August, cutting borrowing costs by 25 basis points (bps) to bring the policy rate to 6.25% from an over-17 year high of 6.5% previously.

BSP Governor Eli M. Remolona, Jr. earlier said that the Monetary Board can deliver 25-bp rate cuts at each of its last two meetings of the year.

“Definitely, there is greater room for policy rate easing, but in terms of their effect on mortgage rates, which currently is at 8.3% average, it will take a bit longer for the policy rate cut to have an effect on the actual mortgage rates imposed by banks. There really is a lag effect, so it will not have an immediate impact on the residential take-up,” Mr. Bondoc said.