Debt yields fall on BSP bets after GDP, inflation

By Abigail Marie P. Yraola, Deputy Research Head

YIELDS on government securities (GS) traded in the secondary market fell last week on expectations of more rate cuts by the Bangko Sentral ng Pilipinas (BSP) following data showing weaker economic growth and below-target inflation.

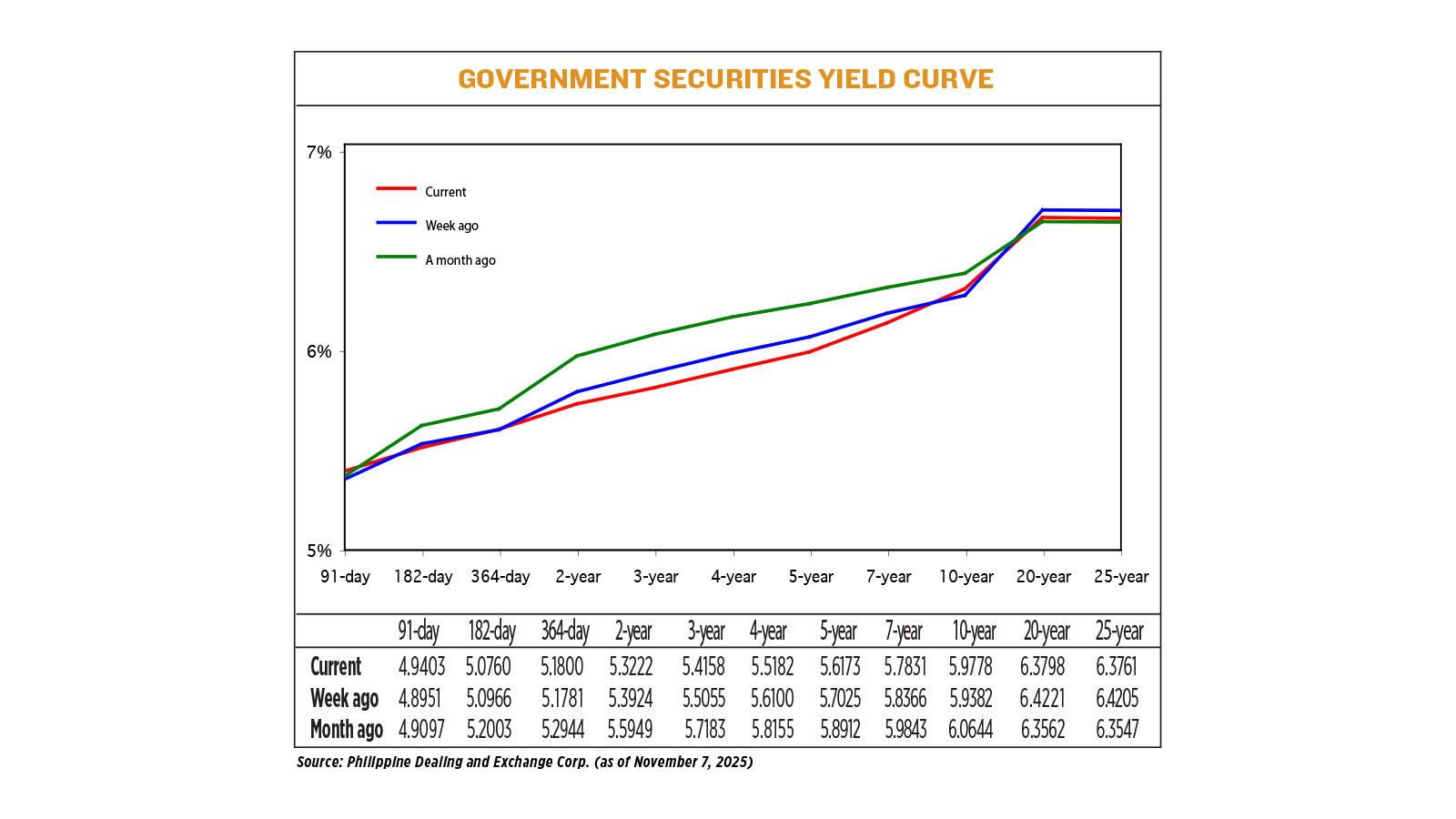

GS yields, which move opposite to prices, declined by 3.74 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates data as of Nov. 7 published on the Philippine Dealing System’s website.

At the short end, yields on the 91- and 364-day Treasury bills (T-bills) went up by 4.52 bps and 0.19 bp week on week to 4.9403% and 5.1800%, respectively. Meanwhile, the 182-day T-bill went down by 2.06 bps to yield 5.0760%.

At the belly, rates declined across all tenors. The two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) saw their yields decrease by 7.02 bps (to 5.3222%), 8.97 bps (5.4158%), 9.18 bps (5.5182%), 8.52 bps (5.6173%), and 5.35 bps (5.7831%), respectively.

At the long end, the rates of the 20- and 25-year debt papers dropped by 4.23 bps (to 6.3798%) and 4.44 bp (6.3761%), respectively, while the 10-year bond climbed by 3.96 bps to yield 5.9778%.

GS volume traded reached P132.81 billion on Friday, significantly higher from the P70.02 billion recorded a week earlier.

Bonds rallied following the weaker-than-expected third quarter gross domestic product (GDP) data, Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a Viber message.

“The slower growth reinforced expectations that the BSP may deliver another 25-bp rate cut at its upcoming meeting,” she said.

“Market sentiment was largely driven by the disappointing 4% GDP print, which solidified expectations for another BSP rate cut in December. Some market participants even floated the possibility of a larger 50 bps “jumbo cut,” though this will depend on the Federal Reserve’s policy direction during the same period.”

Ms. Araullo said the belly of the curve led the rally, with trading activity also picking up on strong buying momentum.

Noel S. Reyes, chief investment officer for Trust and Asset Management Group at Security Bank Corp., likewise said that bond yields moved lower over the past week in anticipation of a slowdown in GDP growth.

“Weak third-quarter GDP was being priced by the market as a result of a number of analysts flagging drastic reduced spending by both government and households as a result of the plunder scandal… Its actual release increased the belief of more cuts and led to further buying that saw above average volume being traded,” he said in a Viber message.

Philippine economic growth slowed to a more than four-year low of 4% in the third quarter, the government reported on Friday, due to slower public spending amid a corruption scandal that highlighted governance issues, and as typhoons also affected household consumption.

This was sharply slower than the 5.5% growth in the second quarter and the 5.2% clip in the same period in 2024. This was also well below the 5.3% median estimate in a BusinessWorld poll of 18 analysts and economists.

The third-quarter clip brought the nine-month average to 5%, slower than 5.9% in the same period last year and putting the government’s 5.5%-6.5% full-year GDP growth goal further out of reach.

Meanwhile, headline inflation stood at 1.7% in October, unchanged from September’s print but easing from 2.3% a year ago.

This was a tad slower than the 1.8% median forecast from a BusinessWorld poll of 17 analysts, but was within the BSP’s 1.4-2.2% forecast for the month.

In the first 10 months, the consumer price index averaged 1.7%, matching the central bank’s full-year forecast and falling below its 2-4% target.

Analysts said benign inflation and weak economic growth would give the BSP space to continue its easing cycle.

In October, the BSP trimmed benchmark rates by 25 bps for fourth straight meeting to bring the policy rate to 4.75%. It has now lowered borrowing costs by a total of 175 bps since its rate-cut cycle began in August 2024.

BSP Governor Eli M. Remolona, Jr. has signaled further easing until next year to help support domestic demand as the corruption mess has hit investor sentiment and economic prospects.

Meanwhile, Ms. Araullo added that market players also monitored global developments, especially in the United States, with the release of key economic data amid a government shutdown there expected to affect global yield movements.

For this week, domestic bond yields may continue to go down as the market digests the economic reports and their potential impact on monetary policy.

“Yields are likely to drift lower next week as investors continue to position ahead of an anticipated BSP rate cut. The softer GDP data supports a constructive view on duration, particularly in the belly to long end of the curve,” Ms. Araullo said.

“The risk though is such a rally could trigger risk-off to take profits ahead of market concerns that the plunder mess is taking a while to be addressed by the government,” Mr. Reyes added, noting this could affect the peso.