Powell says Fed needs to manage against risk that tariff inflation proves persistent

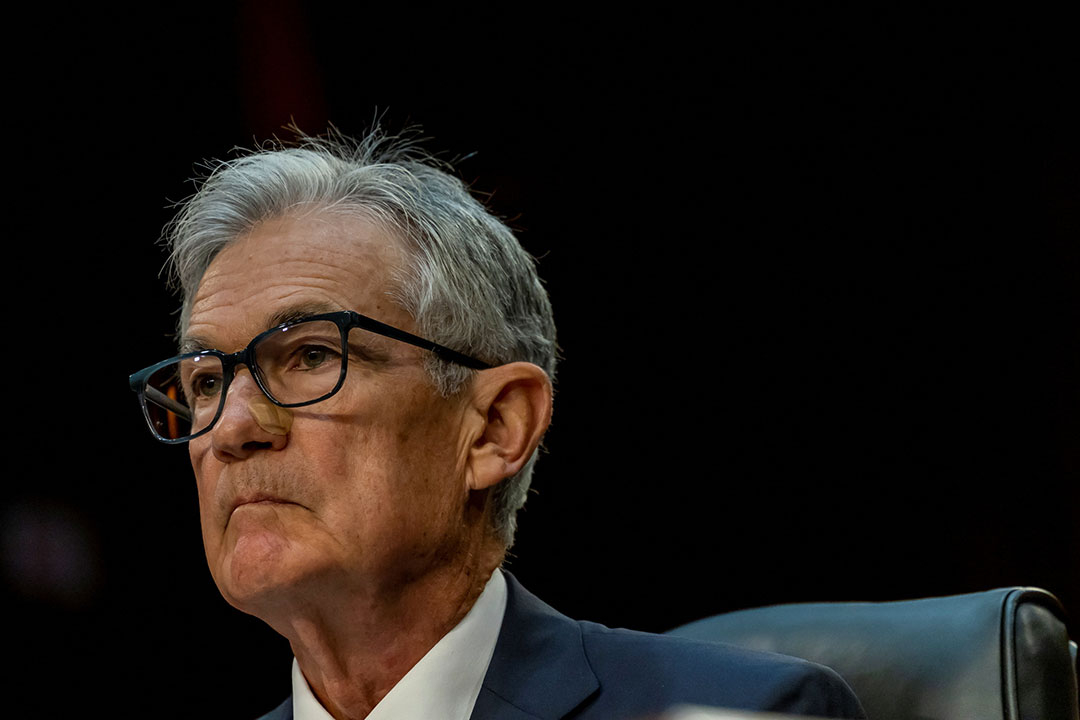

WASHINGTON — The Trump administration’s tariff plans may well just cause a one-time jump in prices, but the risk it could cause more persistent inflation is large enough for the central bank to be careful in considering further rate cuts, US Federal Reserve Chair Jerome H. Powell told a US Senate panel on Wednesday.

Though economic theory may point to tariffs as a one-off shock to prices, “that is not a law of nature,” said Mr. Powell, detailing why the central bank wants more information about the ultimate level of tariffs and the way they impact pricing and public expectations about inflation.

“If it comes in quickly and it is over and done then yes, very likely it is a one-time thing,” that won’t lead to more persistent inflation, Mr. Powell said. But “it is a risk we feel. As the people who are supposed to keep stable prices, we need to manage that risk. That’s all we’re doing,” through holding rates steady for now.

The effects of tariffs “could be large or small. It is just something you want to approach carefully. If we make a mistake people will pay the cost for a long time.”

Fed officials still expect to cut interest rates this year, but the timing is uncertain as officials wait on coming trade deadlines and hope for more certainty about the scope of the tariffs that will be imposed and the ways that rising import levies influence prices and economic growth.

President Donald J. Trump wants the Fed to cut rates immediately, and Republican lawmakers in the House on Tuesday and in the Senate Banking Committee on Wednesday pressed the Fed chair on why officials are so cautious about lowering borrowing costs.

In the Senate on Wednesday, Ohio Republican Senator Bernie Moreno, echoing Mr. Trump’s frequent criticism of Mr. Powell, accused him of shaping monetary policy through “a political lens, because you just don’t like tariffs.”

“We got elected by millions of voters. You got elected by one person who doesn’t want you to be in that job,” Mr. Moreno said of Mr. Powell, who was promoted to Fed chair during Mr. Trump’s first term.

Mr. Powell, in response to other questions, noted the Fed has no modern example of tariff increases of the size Mr. Trump is considering, and even the tariffs Mr. Trump imposed in his first term were far smaller than what seems likely now, and were enacted at a time when inflation was low.

The fact that inflation has been above the Fed’s 2% target for roughly four years, Fed officials worry, may make a new surge in prices more likely to become a more persistent round of price increases.

“This is different,” Mr. Powell said. “There is not a modern precedent, and we have to be humble around our estimates.”

Even with recent inflation more moderate than expected, the central bank expects rising import taxes will lead to higher inflation beginning this summer, Mr. Powell told House lawmakers during a Tuesday hearing, and the Fed won’t be comfortable cutting interest rates until officials see if prices do begin to rise and whether that process shows signs of becoming more persistent.

“We should start to see this over the summer, in the June number and the July number… If we don’t, we are perfectly open to the idea that the pass-through (to consumers) will be less than we think, and if we do that will matter for policy,” Mr. Powell said.

“I think if it turns out that inflation pressures remain contained we will get to a place where we cut rates sooner than later… I do not want to point to a particular meeting. I don’t think we need to be in any rush,” particularly given a still-strong labor market and so much uncertainty about the impact of the still-unresolved tariff debate.

Tariffs have already risen on some goods, but there is a coming July 9 deadline for higher levies on a broad set of countries — with no certainty about whether the Trump administration will back down to a 10% baseline tariff that analysts are using as a minimum, or impose something more aggressive.

The Fed has held its benchmark interest rate steady in the 4.25% to 4.5% range since December.

Economic projections released by the Fed last week showed policymakers at the median do anticipate reducing the benchmark overnight rate half a percentage point by the end of the year. But within those projections is a clear divide between officials who take the inflation risk more seriously — seven of 19 policymakers see no rate cuts at all this year — and those who feel any tariff price shock will be less severe or quickly fade. Ten of the 19 see two or more rate reductions.

Investors currently expect the Fed to cut rates at its September and December meetings, but hold rates steady at its next meeting on July 29-30. — Reuters