Debt yields mixed on easing bets

YIELDS on government securities (GS) ended mixed last week on expectations of rate cuts from the Bangko Sentral ng Pilipinas (BSP) and the US Federal Reserve at their final policy meetings for the year.

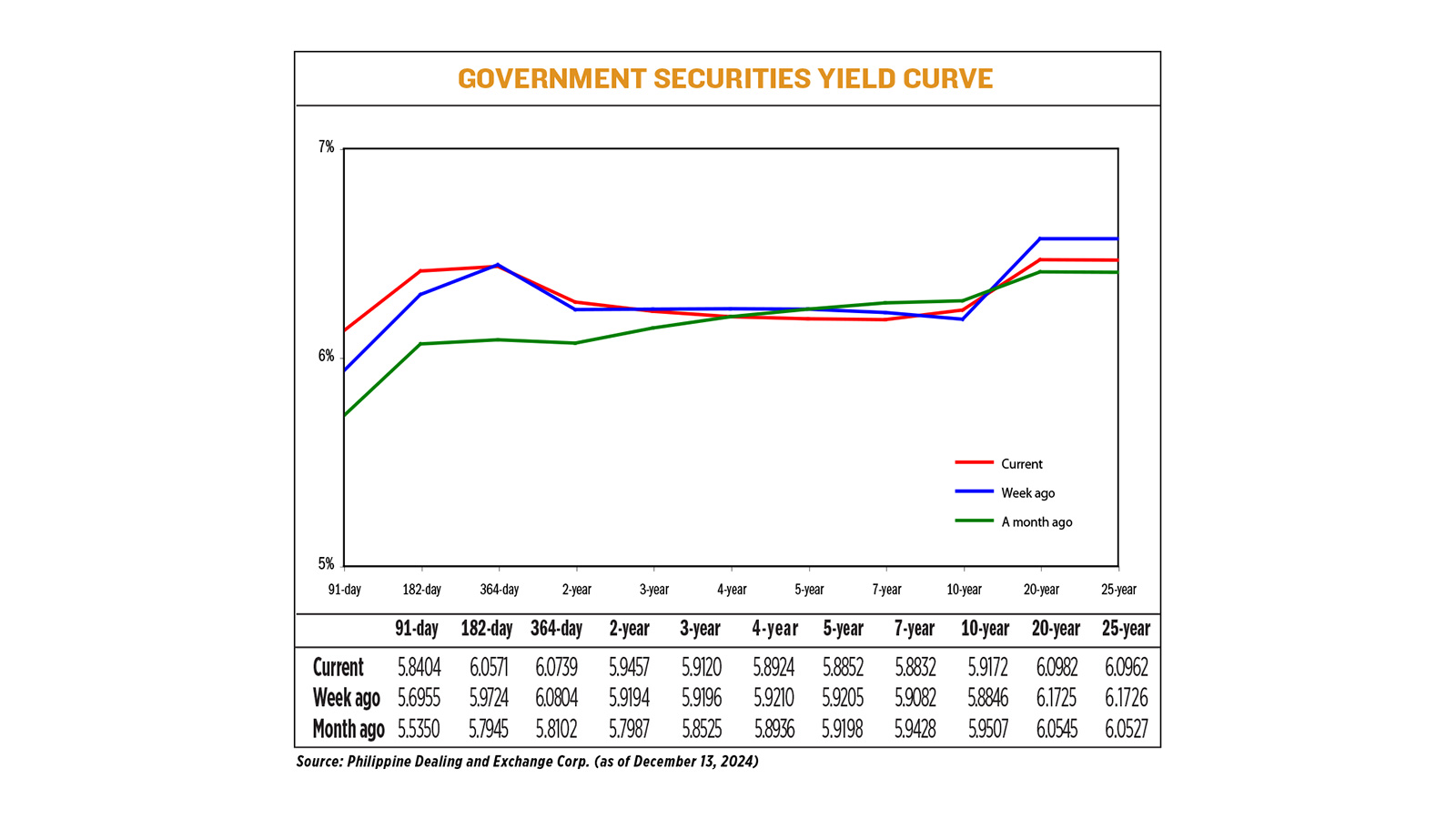

Yields, which move opposite to prices, inched up by an average of 0.32 basis point (bp) week on week, data from the Bloomberg Valuation Service Reference Rates as of Dec. 13 published on the Philippine Dealing System’s website showed.

Rates at the short end of the curve were mostly up, with the 91- and 182-day Treasury bills (T-bills) jumping by 14.49 and 8.47 bps to 5.8404% and 6.0571%, respectively. On the other hand, the yield on the 364-day paper inched down by 0.65 bp to 6.0739%.

Meanwhile, at the belly of the curve, yields mostly went down, as the three-, four-, five-, and seven-year Treasury bonds (T-bonds) saw their rates fall by 0.76 bp (to 5.912%), 2.86 bps (5.8924%), 3.53 bps (5.8852%), and 2.5 bps (5.8832%), respectively. Only the two-year bond climbed, rising by 2.63 bps to end at 5.9457%.

Lastly, at the long end, rates of the 20- and 25-year T-bonds fell 7.43 bps and 7.64 bps to 6.0982% and 6.0962%, respectively. Meanwhile, the 10-year paper went up by 3.26 bps to yield 5.9172%.

GS volume traded increased to P35.73 billion on Dec. 13 from P35.18 billion a week prior.

“Local participants remained cautious ahead of the BSP and Fed policy decisions [this] week, which explains the muted action in the domestic bond market,” a bond trader said in an e-mail.

“Both the Fed and the BSP will have their policy meetings [this] week where most investors are expecting a hawkish 25-bp cut for both,” Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., said in an e-mail.

The Fed is holding its final policy meeting for the year on Dec. 17-18. Markets fully expect a cut at the upcoming meeting, but only price a roughly 24% chance of another one in January, with March the most likely point for another move, according to CME’s FedWatch tool, Reuters reported.

The US central bank kicked off its easing cycle in September with an outsized 50-bp cut and followed it up with a 25-bp reduction at its November review, bringing the fed funds rate to the 4.5%-4.75% range.

The Fed will also give updated economic and interest rate projections at this week’s meeting.

Meanwhile, the BSP’s Monetary Board will meet to discuss policy on Dec. 19 (Thursday). A BusinessWorld poll conducted last week showed that 13 out of 16 analysts expect the Monetary Board to reduce benchmark borrowing costs by 25 bps for a third straight meeting, which would bring the policy rate to 5.75%.

The BSP began its easing cycle in August with a 25-bp cut and slashed rates by another 25 bps in October to bring the target reverse repurchase rate to 6%.

The release of November US inflation data last week also affected GS yields, both analysts said. The US consumer price index data, while within expectations, caused US yields to continue rising amid Fed rate bets, Mr. Aquino noted.

“While this latest US consumer inflation print came in within expectations, views of a Fed rate cut remains intact. However, near-term worries of inflationary risks from the potential impact of tariffs by the incoming Trump administration pushed short-term yields higher,” the bond trader said.

For this week, the Fed and BSP policy meetings will be the main drivers for GS yield movements, both analysts said.

“The bond market will remain anchored on the anticipated policy rate decisions by the BSP and the Federal Reserve. Traders will also take cues from hints by central bankers regarding their projected actions on monetary policy next year,” the bond trader said.

“Depending on the manner of communication specifically by the Fed, yields could see some relief once these event risks are taken out,” Mr. Aquino added. — Karis Kasarinlan Paolo D. Mendoza with Reuters