Debt yields end mostly higher on US elections

YIELDS on government securities (GS) traded in the secondary market ended mostly higher last week amid cautiousness ahead of the US presidential elections.

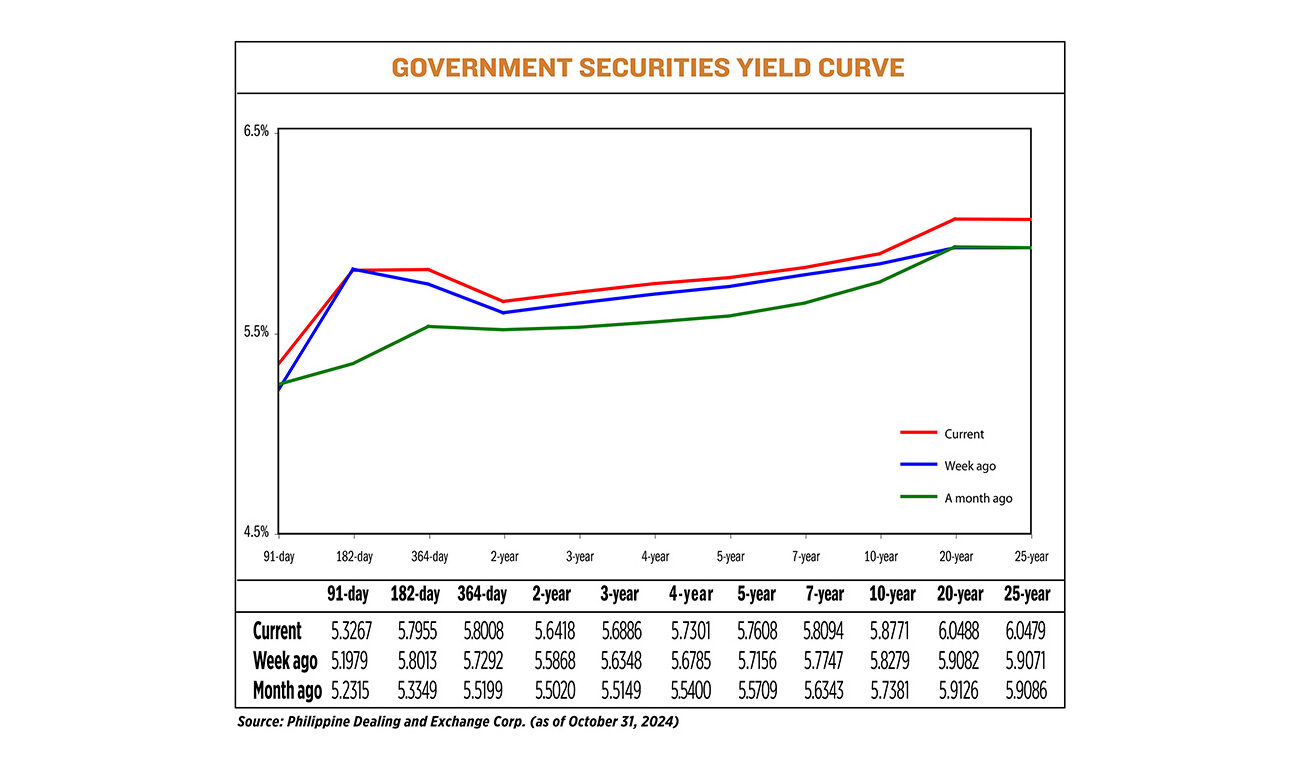

GS yields, which move opposite to prices, went up by an average of 6.96 basis points (bps) week on week, according to PHP Bloomberg Valuation Service Reference Rates data as of Oct. 31 published on the Philippine Dealing System’s website.

Philippine financial markets were closed on Friday (Nov. 1) for All Saints’ Day.

At the short end of the curve, rates of the 91-, and 364-day Treasury bills (T-bills) increased by 12.88 bps (to 5.3267%) and 7.16 bps (5.8008%), respectively. Meanwhile, the 182-day T-bills inched down by 0.58 bp to yield 5.7955%.

At the belly, yields on the two-, three-, four-, five-, six-, and seven-year Treasury bonds (T-bonds) climbed by 5.5 bps (to 5.6418%), 5.38 bps (5.6886%), 5.16 bps (5.7301%), 4.52 bps (5.7608%), and 3.47 bps (5.8094%), respectively.

Lastly, at the long end of the curve, rates of the 10-, 20-, and 25-year debt papers went up by 4.92 bps (to 5.8771%), 14.06 bps (6.0488%), and 14.08 (to 6.0479%), respectively.

GS volume traded stood at P11.95 billion on Oct. 31, lower than the P39.31 billion recorded a week prior.

Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., said the GS market was mostly defensive last week.

“Uncertainty regarding the US Federal Reserve’s rate cut path along with the upcoming US elections dampened the mood locally,” Mr. Aquino said in an e-mail.

A bond trader said GS yields mostly moved sideways with an upward bias as a lack of local catalysts led the market to track US Treasuries’ movements, especially following the release of key US economic data last week.

Benchmark 10-year Treasury yields rose on Friday as investors digested a weak US jobs report, Reuters reported.

Treasury yields initially tumbled after the jobs data, which showed the US economy barely added any jobs in October, though the numbers were heavily disrupted by industrial action and hurricanes. The US unemployment rate, however, held steady at 4.1%, offering assurance that the labor market remained on a solid footing.

Traders are now pricing in 99% odds of a 25-bp cut at the Fed’s Nov. 6-7 meeting, up from 93% before the data, and an 83% probability of a 25-bp reduction at both its November and December meetings, up from 71% earlier on Friday, according to the CME Group’s FedWatch Tool.

The focus will now turn to the US presidential election, with polls pointing to a knife-edge race. Polls, both nationally and in the seven closely divided states, show Republican Donald Trump and Democratic Vice President Kamala Harris in almost a dead heat with days to go before Election Day.

For this week, GS yield movements will likely depend on the US election results and bets before the Fed’s policy meeting, both analysts said.

“We expect some volatility [this] week given the US elections on Nov. 5. The market has already priced in a possible Donald Trump win as US yields jumped 60 bps higher since the Fed reduced rates last month,” Mr. Aquino said.

“Once the election risk subsides, the market may see a relief rally as focus will likely shift back to the macro picture, wherein rate cuts remain the base case for both the Fed and the BSP (Bangko Sentral ng Pilipinas),” he added.

The bond trader said October Philippine inflation data to be released on Tuesday (Nov. 5) could also be a catalyst for the market.

A BusinessWorld poll of 11 analysts yielded a median estimate of 2.4% for the October consumer price index, within the BSP’s 2-2.8% forecast for the month.

If realized, October inflation would be faster than the 1.9% in September but slower than the 4.9% in the same month a year ago. — Charles Worren E. Laureta with Reuters