Yields on gov’t debt mixed ahead of CPI, Fed meeting

YIELDS on government securities (GS) ended mixed last week amid market anticipation for the release of April consumer price index (CPI) data and the US Federal Reserve’s policy meeting.

YIELDS on government securities (GS) ended mixed last week amid market anticipation for the release of April consumer price index (CPI) data and the US Federal Reserve’s policy meeting.

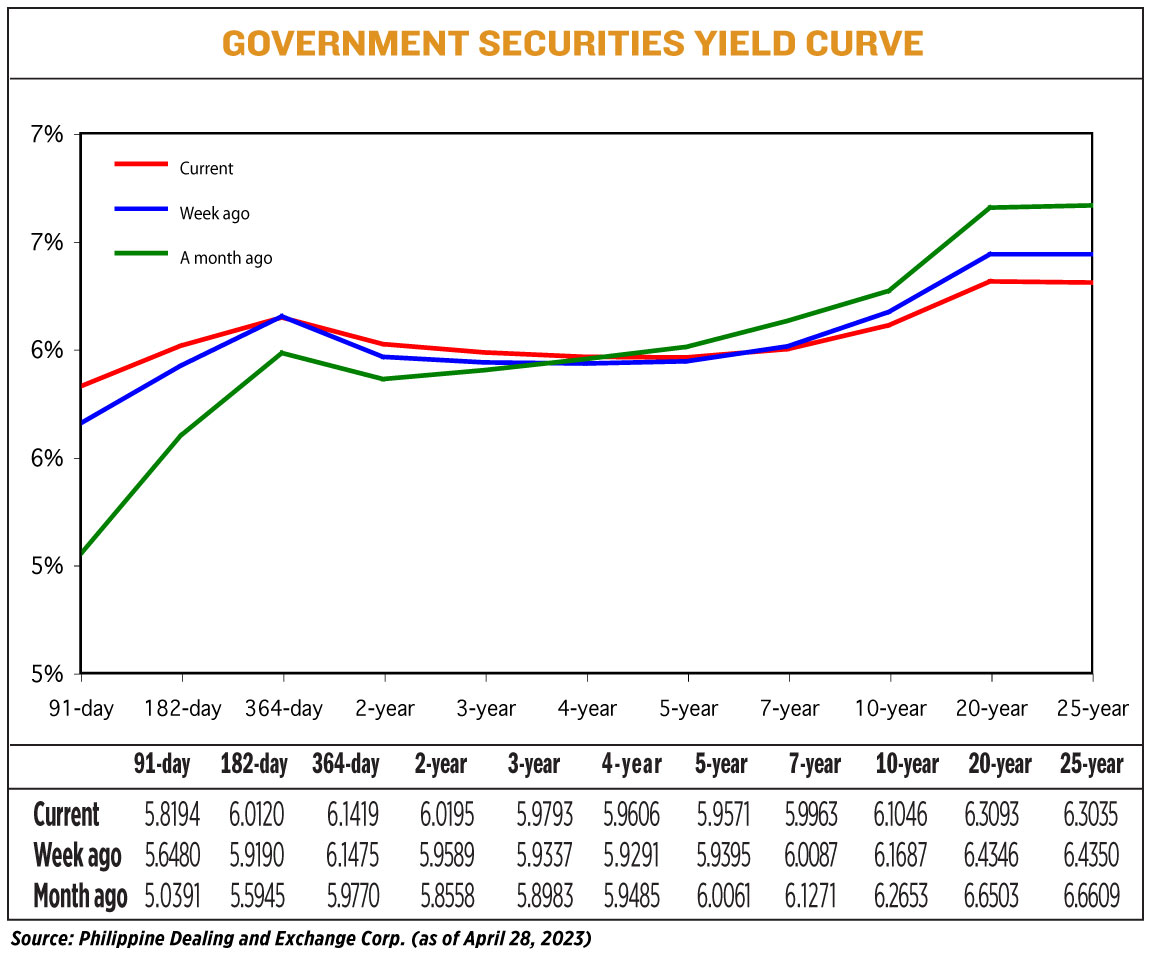

GS yields, which move opposite to prices, went up by an average of 0.73 basis point (bp) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of April 28 published on the Philippine Dealing System’s website.

Yields at the short end of the curve were mixed as the 91-, and 182-day Treasury bills (T-bills) went up by 17.14 bps and 9.30 bps to fetch 5.8194% and 6.012%, respectively. Meanwhile, the 364-day T-bills went down by 0.56 bp to 6.1419%.

Rates of the two-, three-, four-, and five-year Treasury bonds (T-bonds) increased by 6.06 bps (to 6.0195%), 4.56 bps (5.9793%), 3.15 bps (5.9606%), and 1.76 bps (5.9571%), respectively, while the seven-year papers fell by 1.24 bps to 5.9963%.

At the long end of the curve, rates of the 10-, 20-, and 25-year T-bonds declined by 6.41 bps, 12.53 bps, and 13.15 bps to 6.1046%, 6.3093%, and 6.3035%, respectively.

Total GS volume traded more than doubled to P18.47 billion on Friday from P7.58 billion on April 20.

“Buying interest resumed in [Friday’s] afternoon session as players were emboldened after the BSP (Bangko Sentral ng Pilipinas) stated [on Friday] that it expects April inflation to slow down to 6.3%-7.1% due to a decline in electricity prices and select food items,” Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said in a Viber message.

“Market does take into account the BSP forecast as it gives an indication of where local inflation will be. We see inflation moderating to 6.9%, which could open the door for a pause at the May meeting,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail note.

If April CPI was within the BSP’s estimate, this would be slower than the 7.6% print in March.

The lower end of the forecast range would match the 6.3% print in August 2022. It would also be the slowest inflation rate in 10 months or since June last year, when it stood at 6.1%.

Still, this would surpass the BSP’s 2-4% target for the 13th consecutive month.

The Philippine Statistics Authority will release the April inflation report on Friday.

BSP Governor Felipe M. Medalla on Thursday said the Monetary Board may cut the central bank’s full-year inflation forecast to 5.7% or 5.8% from the current 6% at their next policy meeting on May 18.

This is due to the better-than-expected lower inflation rates in February and March, Mr. Medalla said.

The BSP chief earlier said if inflation eases further in April, the Monetary Board will likely consider pausing its tightening cycle at this month’s review.

The Philippine central bank has increased borrowing costs by 425 bps since May 2022 to tame inflation, bringing its policy rate to 6.25% — the highest in nearly 16 years.

“The benchmark 9.4-year, 12.5-year, and 13-year bonds traded up to 2.5 bps lower, while the 20-year benchmark bond was seen last dealt 7 bps lower at 6.26%,” Mr. Asuncion added.

Local yields are tracking global sentiment as investors expect the Fed to deliver another rate hike at its May 2-3 meeting, Mr. Mapa said.

The Fed has hiked borrowing costs by a total of 475 bps since March 2022, with its target interest rate now at a range between 4.75% and 5%.

Markets expect the US central bank to raise rates by another 25 bps this week.

Though inflation is gradually slowing, it remains elevated. The personal consumption expenditures (PCE) price index gained 0.1% in March, the smallest increase since last July, after rising by 0.3% in February, Reuters reported.

In the 12 months through March, the PCE price index increased by 4.2%. That was the smallest advance since May 2021 and followed a 5.1% rise in February.

Excluding the volatile food and energy components, the PCE price index rose 0.3%, matching February’s gain. The so-called core PCE price index gained 4.6% on a year-on-year basis in March after rising 4.7% in February.

The Fed tracks the PCE price indexes for its 2% inflation target.

For this week, Mr. Asuncion said: “Market… will look out for local headline inflation due to be released on Friday while also keeping tabs with Fed officials’ statements after the FOMC (Federal Open Market Committee) meeting on May 2-3.” —B.T.M. Gadon with Reuters