YIELDS ON government securities (GS) fell last week following the strong result of the seven-year Treasury bond (T-bond) auction.

GS yields, which move opposite to prices, went down by an average of 5.46 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of April 23 published on the Philippine Dealing System’s website.

“Local bond yields ended lower week on week following the turnout of BTr’s (Bureau of the Treasury) very strong seven-year auction,” Robinsons Bank Corp. peso sovereign debt trader Kevin S. Palma said in a Viber message last Friday.

“Strong market liquidity continued to take center stage, with GS benefitting from it given the dearth of investment outlets amid the current risk aversion,” he said.

“Economic growth concerns initially led to buying of government securities pushing yields to intra-week lows,” a bond trader said in a separate Viber message, adding that the prolonged strict lockdown in Metro Manila and surrounding provinces could spell economic losses and further dampen the country’s economic outlook.

“However, lack of further catalyst led to profit taking and as the market assesses BTr’s borrowing plan in the coming months,” the trader said.

The Treasury borrowed P35 billion as planned via its offering of fresh seven-year T-bonds on Tuesday. The papers fetched a coupon rate of 3.625%.

Investors swamped the auction, with tenders reaching P90.386 billion, prompting the BTr to open the tap facility to raise another P25 billion as it took advantage of the low rate quoted for the tenor.

Meanwhile, the government will report first- quarter gross domestic product (GDP) data on May 11. Strict lockdowns implemented to contain the spread of the coronavirus caused the Philippine economy to shrink by 9.6% last year, the steepest fall since the 1940s.

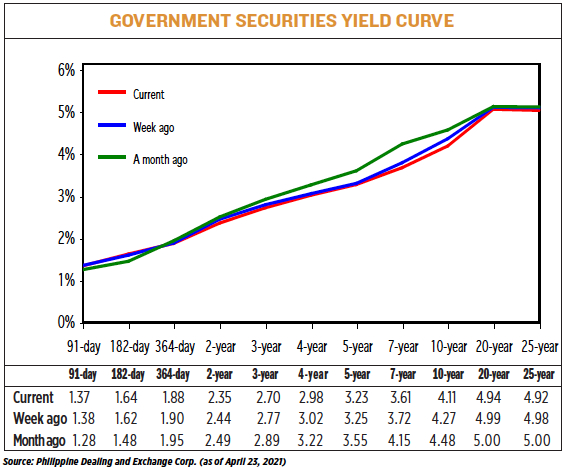

The short end of the yield curve ended mixed on Friday as the rates of the 91- and 364-day Treasury bills dropped by 0.76 bp and 1.26 bps, respectively, to 1.3728% and 1.8835%, while the 182-day paper rose by 2.41 bps to 1.6438%.

At the belly, yields on the two-, three-, four-, five-, and seven-year T-bonds decreased by 9.39 bps (to 2.3456%), 6.84 bps (2.6978%), 3.45 bps (2.9841%), 2.61 bps (3.2268%), and 11.1 bps (3.6123%), respectively.

The long end of the curve declined as rates of the 10-, 20-, and 25-year debt dropped by 16.1 bps (to 4.1127%), 5.11 bps (4.9421%), and 5.85 bps (4.9226%), respectively.

Both analysts expect yield movements this week to be influenced by the Bangko Sentral ng Pilipinas’ April inflation forecast and the Treasury’s May borrowing schedule.

“These are awaited leads and are expected to provide guidance on the direction of the yield curve. Until then, yields may continue to consolidate,” Mr. Palma said.

“Yields will continue to trade sideways as we wait for CPI (consumer price index), BTr’s May borrowing schedule and updated quarantine status for the month of May,” the bond trader said.

The government is looking to borrow P3 trillion this year from local and foreign sources to help plug a budget deficit seen to hit 8.9% of GDP. — Lourdes O. Pilar