Yields edge up as market turns defensive on tariffs

By Lourdes O. Pilar, Researcher

YIELDS on government securities (GS) were mixed last week as players remained defensive due to the global market volatility caused by the Trump administration’s trade policies.

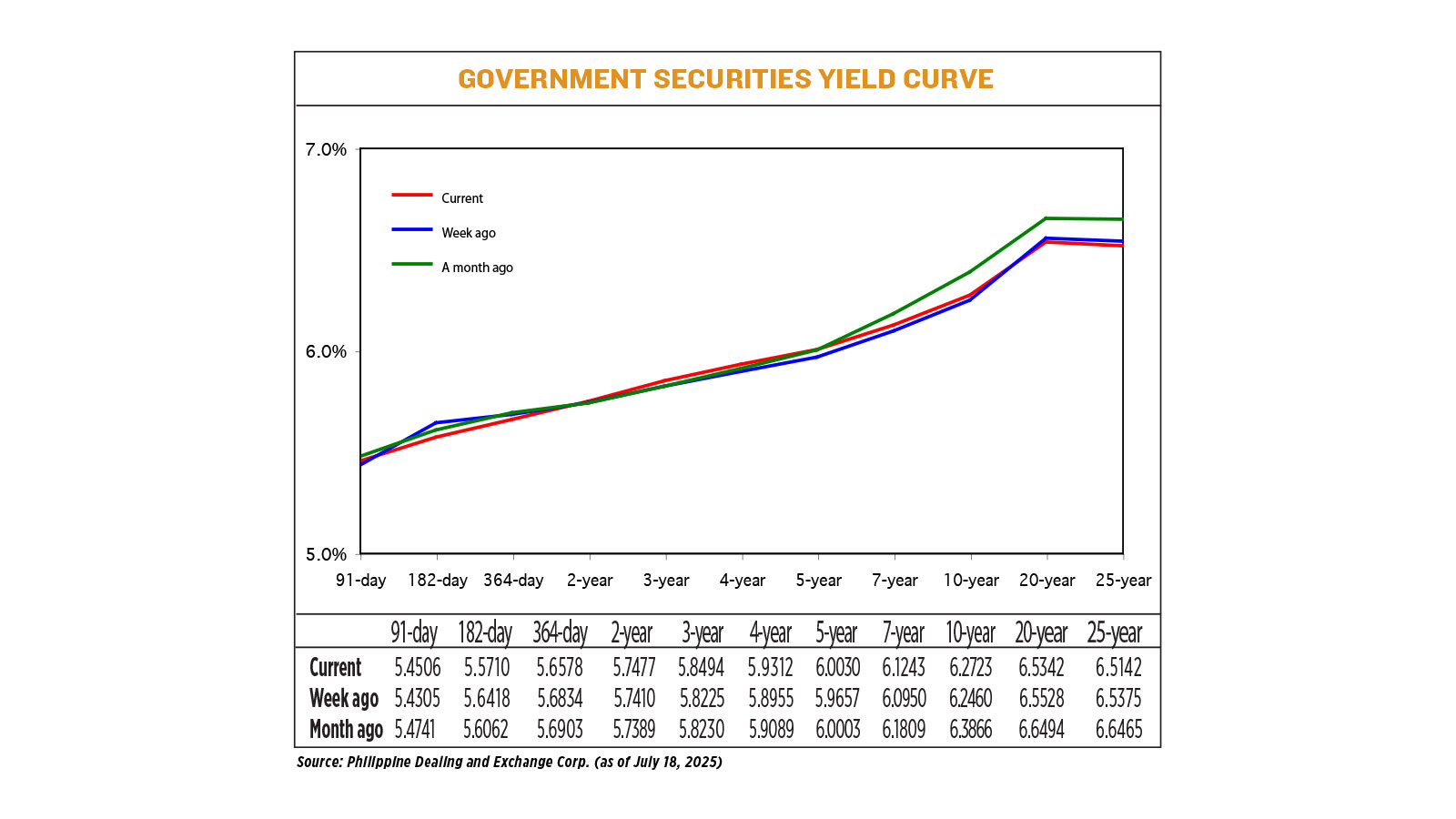

GS yields, which move opposite to prices, edged up by an average of 0.4 basis point (bp) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of Jul. 18 published on the Philippine Dealing System website.

At the short end, yields on the 182- and 364-day Treasury bills (T-bills) went down by 7.08 bps and 2.56 bps week on week to 5.5710% and 5.6578%, respectively. Meanwhile, the 91-day T-bill saw its rate go up by 2.01 bps to end at 5.4506%.

At the belly, rates rose across the board, with the two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) climbing by 0.67 bp (to 5.7477%), 2.69 bps (5.8494%), 3.57 bps (5.9312%), 3.73 bps (6.0030%) and 2.93 bps (6.1243%), respectively.

At the long end, yields on the 20- and 25-year papers dropped by 1.86 bps and 2.33 bps week on week to end at 6.5342% and 6.5142%, respectively. Meanwhile, 10-year T-bond rose by 2.63 bps to fetch 6.2723%.

GS volume traded fell to P21.21 billion on Friday from P45.12 billion on July 11.

“Yields went sideways, with sentiment still driven by headlines relating to US tariff policy,” a bond trader said.

“Local bond yields, particularly in the belly of the curve, ended the week marginally higher as investors remained defensive amid global yield volatility due to rising tariff-related inflation concerns. These worries intensified after US President [Donald J.] Trump announced new trade measures with major trading partners and as the US CPI (consumer price index) came in slightly above expectations,” said Amanda Marie L. Arguelles, fixed income fund manager at Security Bank Corp.

US Treasury yields dipped on Friday as investors monitored the latest US tariff threats while they digested a mixed economic picture, Reuters reported.

US consumer sentiment improved in July and inflation expectations declined, but households still saw substantial risk of price pressures increasing, the University of Michigan’s Surveys of Consumers released on Friday showed.

On Wednesday, data showed US producer prices were unexpectedly unchanged in June as an increase in the cost of goods due to tariffs on imports was offset by weakness in services. The unchanged reading in the producer price index for final demand last month followed an upwardly revised 0.3% rise in May. This was after Tuesday’s US consumer price data for June pointed to higher costs for some goods.

On Friday, the mood dimmed after the Financial Times reported that Mr. Trump is pushing for a minimum tariff of 15% to 20% on the European Union (EU). The report said he was unmoved by the latest EU offer to reduce car tariffs and would keep those duties at 25% as planned.

In government bonds, US Treasuries prices rose, dragging their yields lower, after comments from Federal Reserve Governor Christopher Waller pushed for a rate cut later this month.

In contrast, most officials who have spoken publicly have indicated a desire to hold rates steady and traders are betting on a 95.3% probability that rates will stay where they are after the month-end meeting, according to CME Group’s FedWatch tool.

The yield on benchmark US 10-year notes fell 3.9 bps to 4.424% from 4.463% late on Thursday while the 30-year bond yield fell 1.8 bps to 4.9958% from 5.014%.

The 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, fell 4.4 bps to 3.873% from 3.917% late on Thursday.

“Meanwhile, demand for short-dated bonds remained robust, supported by expectations that BSP (Bangko Sentral ng Pilipinas) will still cut policy rates this year,” Ms. Arguelles said.

BSP Governor Eli M. Remolona, Jr. said earlier this month that there is room for two more rate cuts this year amid benign inflation.

In June, the central bank delivered a second straight cut, reducing benchmark borrowing costs by 25 bps to bring the key rate to 5.25%. The Monetary Board has now lowered interest rates by a total of 125 bps since it began its easing cycle in August last year.

Ms. Arguelles added that yields at the long end were partly supported by the result of the Bureau of the Treasury’s (BTr) auction of reissued 10-year bonds last week. The BTr raised P25 billion as planned via the offering of the papers, which have a remaining life of nine years and nine months, at an average rate of 6.285%, with accepted yields ranging from 6.264% to 6.295%.

“Last Tuesday’s 10-year bond auction demonstrated strong demand for the tenor despite the overall defensive tone in the market. Following the auction, yields declined by about 1-2 basis points, likely driven by follow-through buying from participants who were unable to secure allocation,” she said.

“However, yields inched back higher when the peso-dollar exchange rate breached the P57 level due to strong US inflation figures, prompting de-risking activity among market participants.”

The peso last week plunged back to the P57 level as safe-haven demand boosted the greenback amid tariff concerns.

For this week, the market could continue to monitor US yields for leads amid lingering global uncertainties, Ms. Arguelles said.

“However, the scheduled three-year bond auction on Tuesday may offer some reprieve. Despite the prevailing cautious market tone, demand for this issuance is expected to be strong, especially given the limited offer size of P20 billion,” she said.

On Tuesday, the BTr is offering P20 billion in reissued seven-year bonds that have a remaining life of two years and nine months.

“We might see sideways movement with upward bias given supply factors and still-elevated US Treasury yields and as the Federal Open Market Committee (FOMC) looks to keep policy rates unchanged,” the bond trader added.

The FOMC will hold its next policy meeting on July 29-30. — with Reuters