Yields on government debt mixed

By Abigail Marie P. Yraola, Deputy Research Head

YIELDS on government securities (GS) traded in the secondary market edged lower last week following the release of US consumer inflation data and as investors looked ahead to the US Federal Reserve’s policy decision.

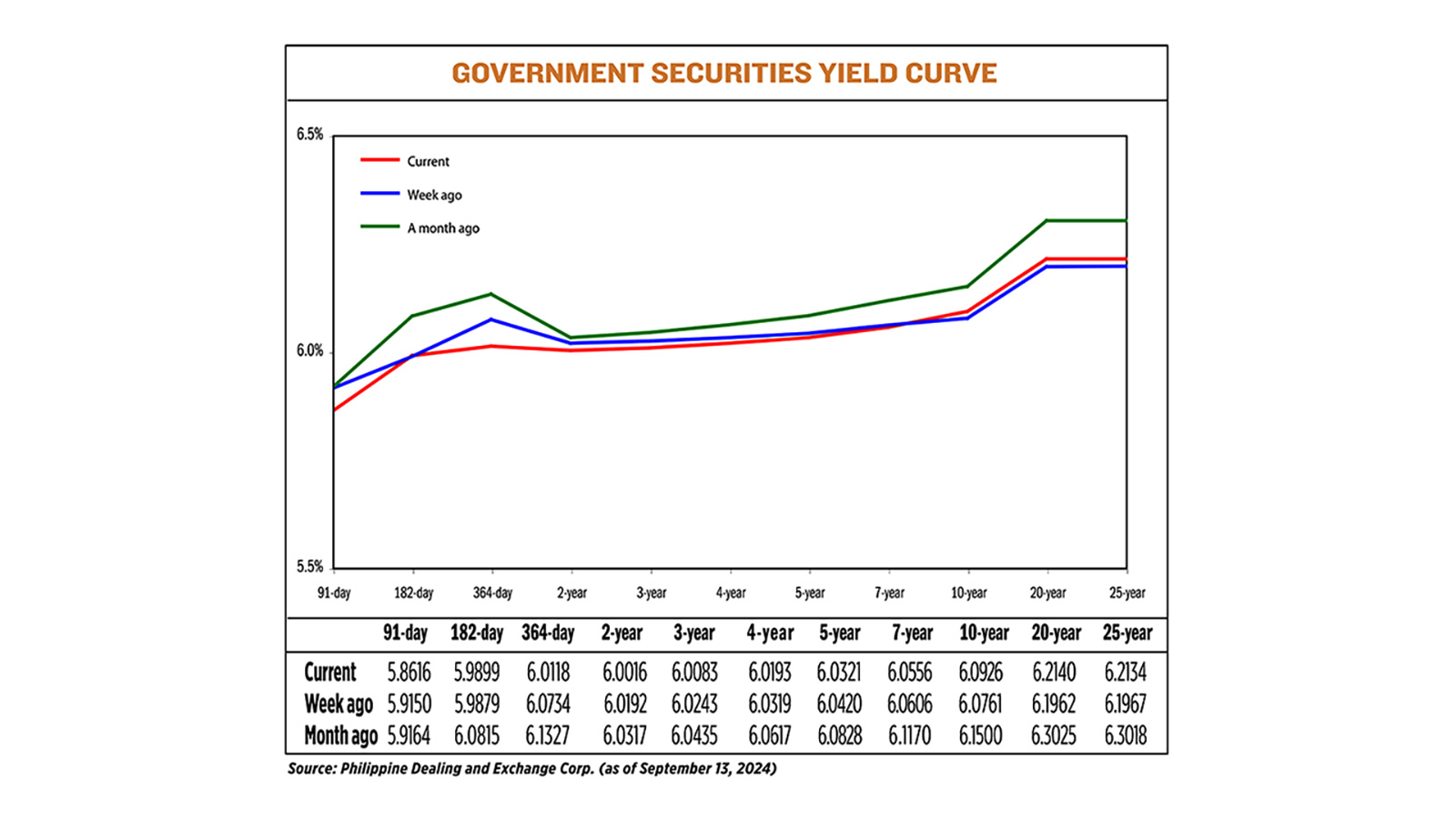

GS yields, which move opposite to prices, went down by an average of 1.12 basis points (bps) week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of Sept. 13 published on the Philippine Dealing System’s website.

Rates at the short end of the curve were mixed, with the 91- and 364-day Treasury bills (T-bills) falling by 5.34 bps and 6.16 bps to fetch 5.8616%, and 6.0118%, respectively. Meanwhile, the 182-day T-bills inched up by 0.20 bp to fetch 5.9899%.

At the belly, yields fell across all tenors. The two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) saw their rates decrease by 1.76 bps (to 6.0016%), 1.60 bps (6.0083%), 1.26 bps (6.0193%), 0.99 bp (6.0321%), and 0.5 bp (6.0556%), respectively.

On the other hand, tenors at the long end saw their rates climb. The 10-, 20-, and 25-year T-bonds rose by 1.65 bps, 1.78 bps and 1.67 bps to fetch 6.0926%, 6.214%, and 6.2134%, respectively.

GS volume traded was at P23.13 billion on Friday, lower than the P31.8 billion recorded a week earlier.

ATRAM Trust Corp. Vice-President and Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said market players started the week cautiously, but risk sentiment shifted after the release of key US data.

“Despite the selloff in US Treasuries following the higher-than-expected inflation figures in the US, bond investors in the local space remained resolute as they extended duration across the curve on expectations of policy easing from the US Federal Reserve and the Bangko Sentral ng Pilipinas (BSP),” Mr. Ulpo said in a Viber message.

A bond trader said the market’s main focus was the US consumer price index data released on Sept. 11, as well as the European Central Bank’s policy decision.

“Although the auctions were reflective of strong support in the market considering the upcoming rate cuts by central banks including the BSP, the main drive of the week was whether the Fed would cut by 25 or 50 bps [this] week, depending on the data released from the US,” the trader added.

For this week, the Fed’s two-day policy meeting will be the main driver of yield movements, both analysts said.

“We could see the market trade lower this week as the Fed begins its cutting cycle by at least 25 bps. There has been some holdover speculation that the Fed will cut more than 50 bps, but this is less likely given recent data,” the trader said.

“Along with the 10-year bond auction, the Federal Open Market Committee meeting is the highly awaited event for this week as the Fed will finally begin its easing cycle,” Mr. Ulpo said. “We expect Philippine bonds to recoup some losses this week as investors optimize fixed-income positioning before any yield correction from policy normalization.”

The Federal Reserve is nearly as likely to deliver an outsized interest-rate cut this week as a more-usual-sized reduction, trading in rate-futures contracts suggested on Friday, as financial markets priced in a bigger chance that the Fed will move more aggressively, Reuters reported. A quarter-point reduction at the Fed’s Sept. 17-18 meeting is still seen as the slightly more likely outcome, but only marginally so. — with Reuters