Securing the digital space amid the new normal

THE RAPID growth in digital transactions has often been cited as the silver lining for economies currently constricted by lockdown restrictions due to the pandemic. Even so, this increase has also exposed businesses and households to an increased threat of cyberattacks.

Addressing consumer complaints in the new normal

JENNIFER L. DACANAY, a 48-year-old housewife wished to upgrade her credit card status. Unfortunately, she faced credit card fraud and lost some money in the process.

Vaccines, inflation, and GDP recovery to drive financial markets this year

THE FOURTH QUARTER of 2020 saw local financial markets rebound somewhat with reports of the COVID-19 (coronavirus disease 2019) vaccine developments and expectations of economic recovery driving performance during the period.

Economic rebound, asset quality to drive bank stocks — analysts

ANALYSTS expect bank stocks to perform better this year as market players look for catalysts that will aid on economic recovery, but noted banks’ provisions for credit losses to continue weighing down on their outlook.

Banking on bancassurance in the new normal

The jury is still out on the net impact of the coronavirus disease 2019 (COVID-19) pandemic on bancassurance firms following a rough year of extended quarantines and economic recession.

Microinsurers cope with losses amid challenged market conditions

REGARDLESS of the nature of the disaster, the poor are usually the ones most affected as any negative impact on their assets and consumption levels threaten their subsistence.

Financial markets see renewed optimism

DOMESTIC FINANCIAL MARKETS rebounded for the most part in the third quarter as the gradual easing of quarantine restrictions, waves of positive news on the development of potential coronavirus disease 2019 (COVID-19) vaccine trials, and slight pickup in the global economic activity lifted investor sentiment at home.

The funds must flow: Capital raising in the time of crisis

THE UNCERTAINTY caused by the coronavirus disease 2019 (COVID-19) pandemic has pushed some big firms and investors into the defense by cutting back on capital-raising activities and retreating towards safe-haven investments. Despite the pandemic, raising funds through capital markets is still possible, analysts said.

Pandemic to keep steering markets in 2nd half

THE CORONAVIRUS disease 2019 (COVID-19) pandemic remained the primary driver of local financial markets in the second quarter of 2020 as market players continue to adjust expectations and digest a slew of economic reports published during the period.

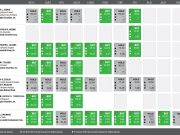

Outlook on bank stocks remains mixed

THE OPINION on whether bank stocks are attractive to buy and hold remain mixed among analysts as uncertainties surrounding the economic recovery from a pandemic-induced slump remain. However, those drawing up their shopping lists on stocks may want to look at listed banks based on analysts’ recommendations.

High-tech, low-touch: Banking under the ‘new normal’

IN THE BUSINESS lexicon, “high-tech, low-touch” refers to the process that involves high levels of automation accompanied by low-level or no personal interaction.

Coronavirus clouds financial outlook

THE SPREAD of the coronavirus disease 2019 (COVID-19) in the first quarter has put a damper on the performance of financial markets for the rest of the year.