Elevated inflation, rate hikes, bank collapse fears drag markets in Q1

By Lourdes O. Pilar, Researcher

STUBBORN INFLATION, costlier borrowing costs, and US banking sector collapse contagion dragged domestic financial markets in the first three months of the year.

But analysts still keep their eyes peeled on central banks’ decision as inflation starts to come down.

The barometer Philippine Stock Exchange index (PSEi) closed the first quarter at 6,499.68, down 1% quarter on quarter from 6,566.39 in the fourth quarter. Likewise, on year-on-year basis, the index declined by 9.8% year on year from the 7,203.47 finish in the first quarter of 2022.

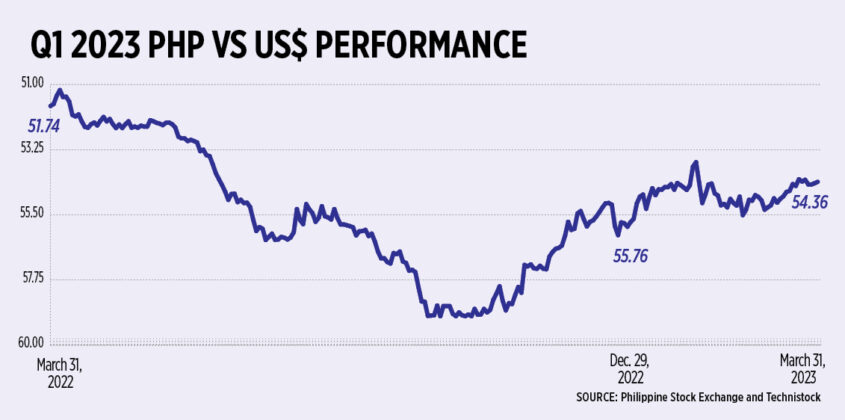

Meanwhile, the peso closed P54.36 against the dollar in the first quarter, appreciating by 2.6% from the previous quarter’s end of P55.76 to a dollar. On an annual basis, the local unit retreated by 5.1% from P51.74 finish in the first quarter last year.

Demand for Treasury bills auctions saw a total subscription amounting to P443.8 billion with P167.8-billion total offered amount in the first quarter.

The oversubscription amount of P266 billion was higher than the P169.4 billion in the fourth quarter.

Meanwhile, demand for Treasury bonds increased to P1.1 trillion, almost double the P572.9 billion in the fourth quarter. The demand was higher than the aggregate offered amount of P511.2 billion in the first three months of 2023.

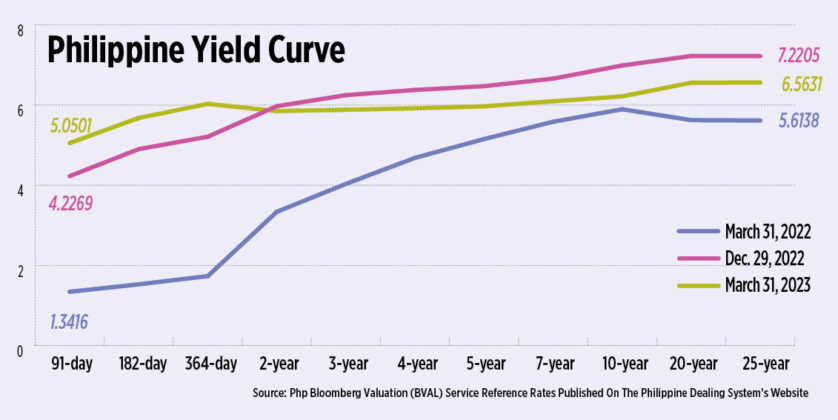

At the secondary bond market, domestic yields plunged by 15.34 basis points (bps) on quarter-on-quarter average, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates published on the Philippine Dealing System’s website.

On a year-on-year basis, yields also grew by 193.46 bps.

The US Federal Reserve has raised borrowing costs by 500 bps since March 2022, bringing the Fed funds rate to 5-5.25%. Market players are expecting the Fed to start keeping rates on hold at its next meeting on June 13-14.

The BSP maintained the key policy interest rate on the overnight reverse repurchase facility at 6.25% at its May 18 meeting, ending nine straight meetings of rate hikes. The corresponding interest rates on the overnight deposit and lending facilities remained at 5.75% and 6.75%, respectively.

Economists attributed financial market developments during the first quarter to stubborn inflation, rising borrowing costs, and sudden sell-off due to the collapse of Silicon Valley Bank and Signature Bank.

“The start of 2023 was quite optimistic, especially for Philippine equities as upbeat corporate earnings were sustained,” Union Bank of the Philippines Chief Economist Ruben Carlo O. Asuncion said in an e-mail.

Local factors such as high interest rates and stubbornly high inflation continued to persist causing investors to sit on the sidelines and opt for attractive fixed-income securities, added Mr. Asuncion.

“An external factor was the looming banking crisis in the West. For some time, fear flooded the markets causing a short sell-off on banking stocks. However, it was swiftly tapered down by news on bailouts and acquisitions,” said Mr. Asuncion.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail that financial markets took their cue from the outlook on US Federal Reserve (US Fed) policy and any development that might impact that outlook moved markets.

“Troubles at banking institutions impacted the markets in so far as it might impact on US Fed policy,” said Mr. Mapa.

“To the extent that it had an impact on global yields and in turn currencies. But after the dust settled and local banks were able to effectively demonstrate that they were not in any way like those banking institutions, markets steadied,” Mr. Mapa said.

He also noted that the China’s reopening also affected markets as this could affect US Fed’s policy outlook via faster inflation induced by China’s resurgent demand.

Domini S. Velasquez, chief economist at China Banking Corp., said in an e-mail that bank woes happened abroad had spurred fears of contagion which caused risk off sentiment to emerge in financial markets.

Rachelleen A. Rodriguez, research analyst at Maybank Investment Banking Group–Philippines, said in an e-mail that the PSE financial sector index slid by 2.04% the day following the news of the collapse of Silicon Valley Bank.

“We think the sell-off was overdone considering Philippine banks’ strong capital positions, reinforced credit policies, high NPL (nonperforming loan) cover buffers and predominantly local government investment exposures,” said Ms. Rodriguez, adding that the local banks have no exposure to the failed banks in the US.

WHAT INDICATORS TO WATCH OUT FOR

Investors should continue to watch out for inflation and gross domestic product data this year as these could sway the central bank’s monetary policy decisions, said Ms. Velasquez.

“A continued downward trend may open the doors for a rate cut as soon as the fourth quarter, especially given expectations of slower economic growth this year. The current account balance is also a key indicator as it provides a picture of the country’s external position. A narrower current account deficit will provide support to the local currency,” Ms. Velasquez added.

Mr. Asuncion said that investors should observe the rate of disinflation, whether it’s increasing or decreasing and how fast.

“If inflation remains stubbornly high (although decreasing), the BSP may hold rates high for longer. Meanwhile, if the optimistic case holds, the BSP could now consider cutting rates which could provide a better outlook for debt-driven sectors such as property,” Mr. Asuncion added.

“For now it is still all about inflation. To some extent investors should also monitor real sector variables as movements for these could also influence central bank policy direction,” said Mr. Mapa

Consumer price slowed to an eight-month low of 6.6% annually in April from 7.6% in March, preliminary data from the Philippine Statistics Authority showed.

But this was still faster than 4.9% in April a year ago and marked the 13th straight month that inflation breached the central bank’s 2-4% target.

This brought the four-month inflation print to 7.9%, still far from the downward-revised 5.5% forecast given by the BSP.

“Easing inflation will provide some relief, however, the recent numbers we are seeing 7-8%, are still far from the BSP’s target of 2-4%,” Mr. Asuncion said.

“This signals the market that the BSP will not be cutting rates anytime soon, hence, the cost of borrowing will remain high in the medium term. A high interest rate environment coupled with lower demand may soften corporate earnings in the second quarter of 2023,” added Mr. Asuncion.

He expects inflation to be at the 6-7% range in the next quarter, while full-year 2023 forecast is at 6.2%.

Security Bank Corp. Chief Economist and Assistant Vice-President Robert Dan J. Roces said in an e-mail that domestic inflation is expected to temper, mostly on base effects and improving food supply.

“However, upside risks are emerging including El Niño which may affect food supply once more and jack up utility costs,” said Mr. Roces.

FIXED-INCOME MARKET

Ms. Velasquez: Market interest rates have likely peaked in the first quarter and are already on a downward path. However, central banks will remain hawkish even as they end their monetary tightening cycles due to sticky inflation. Hence, we expect the yield curve to remain relatively flat in the second quarter.

Mr. Mapa: We could see yields track inflation trends and also take their cue from the BSP policy stance.

Mr. Roces: Yields may continue to go down as inflation tempers.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort: Continued easing trend in long-term peso yields, fundamentally amid the easing trend in global and local inflation largely due to higher base effects.

Mr. Asuncion: With the current rate of disinflation, we expect the BSP to raise 25 bps and pause in 2Q23 and for the rest of 2023. Thus, short-term bonds will continue to be an attractive place to park capital.

EQUITIES MARKET

Mr. Asuncion: With most investors staying on the sidelines, we expect the PSEi to trade between the 6,500-6,800 range in second quarter of 2023 before picking up momentum towards the end of the year.

Mr. Roces: Rangebound to upwards on improving sentiment.

Ms. Rodriguez: We expect the PSEi to reach 7,800 by yearend 2023.

Mr. Ricafort: Important support levels at 6,250-6,400 levels, where there could still be some bargain hunting/bottom fishing activities for some long-term investors. Important resistance at 6,800-7,000 levels where there were some healthy profit taking activities.

FOREIGN EXCHANGE MARKET

Ms. Velasquez: The peso will likely remain weak in the second quarter as easing domestic inflation fuels expectation of a BSP rate pause soon. A narrower interest rate differential between the US Fed and the BSP will lead to a weaker peso.

We expect the peso to depreciate in the third quarter when businesses usually fulfill the bulk of their imports before gaining strength in the fourth quarter as remittances come in ahead of the holidays.

Mr. Roces: Volatile.

Mr. Mapa: Peso should remain pressured on current account dynamics (deficit). That being said, should the strong dollar theme fade towards the end of the year, we could see the peso recover, albeit lagging regional peers.

Mr. Asuncion: Dollar to peso is expected to hover between P54.50-P56.00 in the second quarter of 2023. Forecast range may break to the upside, given rising geopolitical tensions increase within the region the demand for safe-haven assets which benefits the dollar rise. Nevertheless, downside risks remain from the US potential recession overhang.