PHL likely exited recession in Q2

LOOSER LOCKDOWN restrictions, coupled with base effects likely lifted the Philippine economy out of the recession in the second quarter, economists said, adding that the outlook for sustained recovery remains cloudy due to the reimposition of tighter restrictions this month.

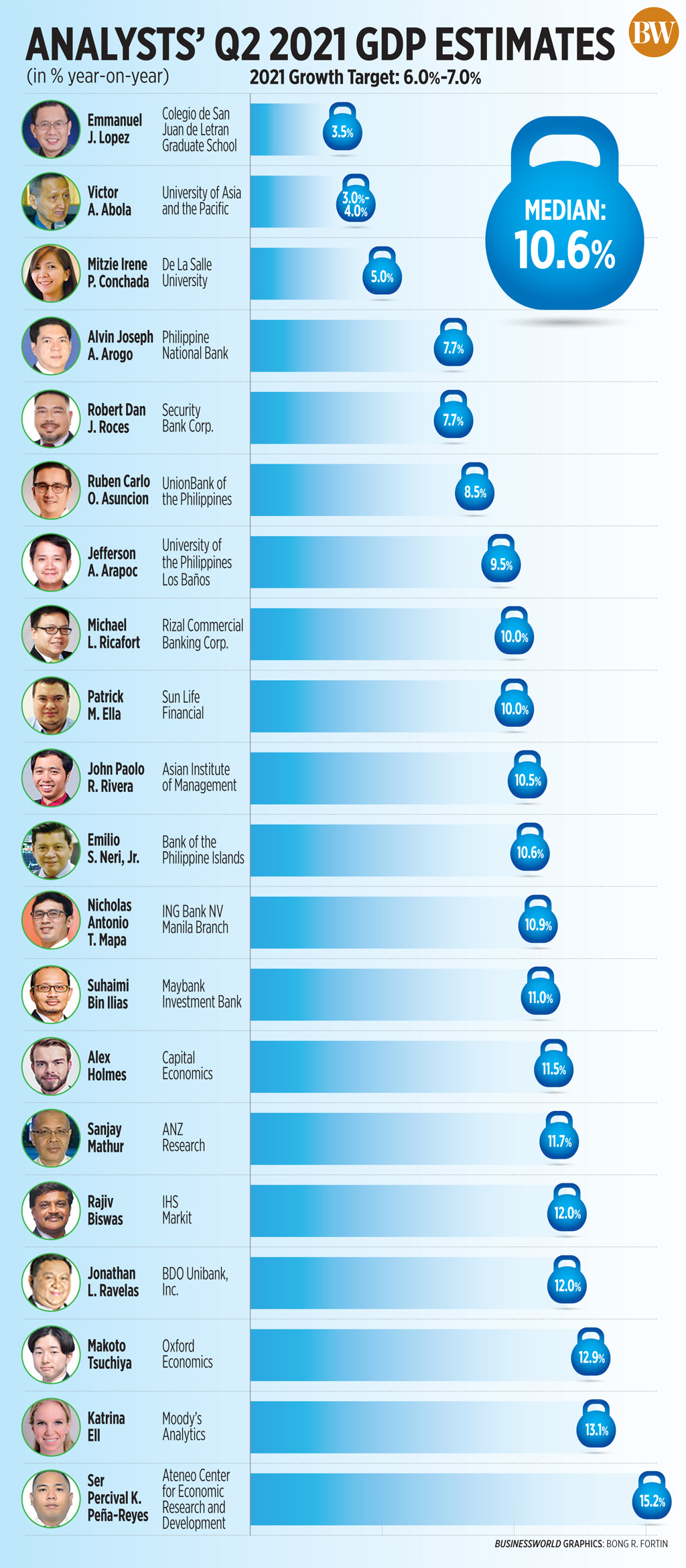

A BusinessWorld poll of 20 analysts yielded a gross domestic product (GDP) growth estimate of 10.6% for the second quarter, a turnaround from the annual contractions of 4.2% and 17% posted in the first quarter of 2021 and the second quarter of 2020, respectively.

If realized, this would be the fastest year-on-year GDP growth rate since the 12% expansion in the fourth quarter of 1988. This would also be the first time the Philippine economy posted growth since the fourth quarter of 2019, right before the coronavirus disease 2019 (COVID-19) brought economic activity to a near standstill.

This would also bring the GDP growth to average 3.2% in the first half, still below the government’s GDP growth target of 6-7% for this year.

The Philippine Statistics Authority is scheduled to release second-quarter economic data on Aug. 10.

While less restrictive than the first enhanced community quarantine (ECQ) last year, Metro Manila and its nearby provinces were once again placed under the strictest form of lockdown from late March to May 15 this year to curb a renewed surge in COVID-19 cases. These were gradually relaxed until a Delta-driven spike in infections forced the government to once again put the capital region under ECQ from Aug. 6-20.

Analysts were in agreement that the April-June period marked an economic rebound, although they offer different views on its extent.

Ateneo de Manila University economist Ser Percival K. Peña-Reyes gave a forecast of 15.2% growth for the second quarter based on a reading of other available economic indicators.

“The economy has been much more open in the second quarter this year versus last year, which was the height of the hard lockdown and when the economy bottomed out. Commercial and business establishments have been busier this year. As a result, employment figures have also been much better in the second quarter this year versus last year,” Mr. Peña-Reyes said.

Makoto Tsuchiya, an economist at Oxford Economics Japan, penciled in a 12.9% expansion in the second quarter, citing the “steady growth” in the Philippine manufacturing production.

“Moreover, the manufacturing PMI (purchasing managers’ index) surveys signaled that the business conditions for manufacturers continued to improve toward the end of the quarter and new export orders jumped, pointing to strong foreign demand. The robust recovery in the labor market should also support household spending,” he said.

“However, we expect the recovery in spending to remain relatively subdued given that much of the rise in employment has been part-time work, meaning average monthly earnings are generally lower and the unemployment rate is still elevated,” he added.

The country’s PMI, an indicator of manufacturing activity, sharply fell to 49 in April from 52.2 in March, slipping below the 50 neutral mark that separates deterioration from expansion and ending three straight months of growth. May saw a softer downturn with 49.9 before returning to expansion territory with 50.8 in June.

A separate data by the Philippine Statistics Authority showed manufacturing volume of production posting year-on-year growth rates of 154.3% in April, 263.2% in May, and 453.1% in June. These marked three straight months of growth following a 13-month losing streak.

Besides the gradual lifting of mobility restrictions, economists also pointed to base effects.

“While [GDP growth in the second quarter] is positive, it must be interpreted with caution given that we recorded an all-time high GDP contraction last year at 16.9%. It means that the growth for this quarter is just base effects,” said University of the Philippines Los Baños economist Jefferson A. Arapoc, who gave an estimate of a 9.5% growth in the second quarter.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa gave an annual growth forecast of 10.9% for the second quarter, noting that all sectors are expected to post growth led by capital formation, government spending, and household consumption.

“Despite the headline grabbing year-on-year print, the economy is expected to have slowed relative to [the first quarter] as tighter mobility curbs were implemented for all of April and most of May. The impact of such measures manifested immediately in jobs and manufacturing numbers and we expect quarter-on-quarter GDP to actually contract by 1.5%,” Mr. Mapa said.

UNCERTAINTIES AHEAD

Despite the expected rebound in the second quarter, economic prospects in the next few quarters remain uncertain given the reimposition of tighter lockdowns due to Delta variant driving fresh COVID-19 cases, economists said.

Security Bank Corp. Chief Economist Robert Dan J. Roces said growth is “still expected to improve gradually” driven by better business and consumer confidence on the back of steady vaccination rate and election-related spending.

“The reimposed ECQ this August may complicate the overall growth picture though, and the Philippines will be hard-pressed to hit the 6.0-7.0% GDP growth target… [W]e expect the BSP (Bangko Sentral ng Pilipinas) to keep monetary policy in place for the balance of the year and likely until the first half of 2022 until stable growth is seen,” Mr. Roces said, penciling in a 7.70% annual growth in the second quarter.

ING’s Mr. Mapa is less upbeat on the economy’s future growth.

“With the Philippines (in) yet another lockdown, and one that may be more stringent and protracted than the Alpha variant version, we are expecting the Philippines to post negative quarter-on-quarter GDP growth in the third quarter as well,” he said.

“In a year that started with so much hope for a ‘strong recovery’ and a ‘bounce back,’ 2021 is indeed turning out to be like 2020 with the Philippines likely headed for a lower growth trajectory once base effects fade. Our full-year GDP forecast is now at 3.8% from 4.7% previously, factoring in a four-week community quarantine style lockdown in August,” he added.

For Moody’s Analytics Senior Asia Pacific Economist Katrina Ell: “The Philippines is far from out of the woods when it comes to COVID-19 hurting the economic recovery as evidenced by daily infections once again rising,” she said, forecasting a 13% growth for the second quarter. — Abigail Marie P. Yraola