‘Endo’ could scare away socially responsible investors, unions say

By Chloe Mari A. Hufana, Reporter

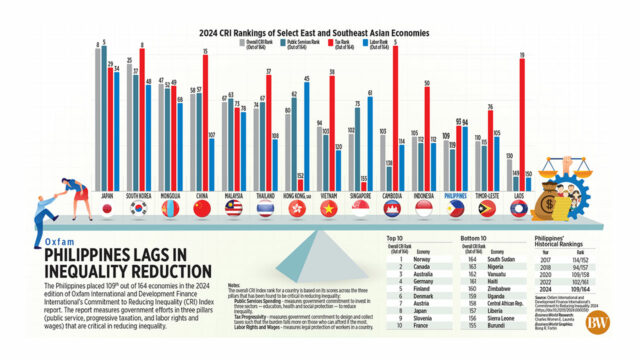

CONTRACTUALIZATION, also known as “endo,” which denies workers a path to regular employment, is damaging the Philippines’ global standing with regard to labor rights, possibly deterring funds that pick investments on the basis of social responsibility criteria, union leaders said.

Endo “can portray the country as having weak labor protections, which may deter socially responsible investors and impact relationships with world global unions, including the International Trade Union Confederation (ITUC) and United Nations agencies such as the International Labor Organization (ILO),” according to Federation of Free Workers President Jose Sonny G. Matula.

Endo schemes terminate employment before a worker’s tenure hits six months, the period which by law triggers regular employee status.

Mr. Matula said endo goes by various names, like labor-only contracting, “555” arrangements (short-term contracts renewed every five months), or frequent changes in manpower agencies. These practices are prevalent in manufacturing, construction, and services.

“All these strategies are aimed at preventing employees from attaining regular status. These practices allow companies to reduce costs and obligations, but they come at the expense of workers’ job security and benefits,” he told BusinessWorld via Viber.

Mr. Matula added that a strong stance against contractualization could improve worker welfare and strengthen the country’s international position in advocating for fair labor standards.

He urged the Department of Labor and Employment (DoLE) to take a proactive role by using its visitorial and enforcement authority to detect and prevent abusive contracting practices.

In addition, he called for an amendment to the 1974 Labor Code, specifically Article 106 on contracting arrangements, to provide stronger job security protections; and Article 303 to impose stricter penalties on violations.

RESTRICTIONS ON RIGHT TO ORGANIZE

The ITUC earlier this year named the Philippines as one of the worst countries for workers, for the eighth time in a row largely due to so-called red-tagging — the association of labor leaders with the Communist movement — and violence against organizers.

Earlier this week, the Philippines’ score on the global Labor Rights Index worsened largely due to an environment that restricts unions, strikes, and collective bargaining deals.

The Philippines scored zero out of 100 in the Freedom of Association indicator due to the lack of protections for unions and the red-tagging.

Trade Union Congress of the Philippines (TUCP) Legislative Officer Carlos Miguel S. Oñate said the TUCP backs legislation strengthening the right to unionize.

“Workers in particular are calling on President Ferdinand R. Marcos, Jr. to certify as urgent long-pending priority labor legislation on freedom of association, which amends our Labor Code to be in full alignment with international labor standards,” he said via Viber.

The Labor Code is not compliant with international standards and ILO Conventions the Philippines is bound to observe an ILO member-state, he said.

The measures the TUCP is proposing include the lowering of the requirements for union registration or House Bill 1518.

Mr. Oñate said the ILO found many provisions of the Labor Code a restraint to the exercise of the freedom of association.

“This measure removes the 20% minimum membership requirement for union registration; reduces from 10 to 5 locals/chapters the requirement for registration of a federation/national union; and that the independent union or a local/chapter only has to give notice of its creation to DoLE,” he added.

Another TUCP initiative is the lowering of penalties for illegal strikes and lockouts via House Bill 7043.

“Dismissal or imprisonment as a penalty for illegal strikes is too harsh and not proportionate to the seriousness of the violation or action. This measure removes imprisonment as a penalty for illegal strikes and lockouts,” he noted.

“Through pro-labor rights reform, workers can have the opportunity to access more and better jobs to be created by international trade instruments and privileges which the Philippines can only access if it upholds core labor standards and no longer enjoys a reputation for being among the worst for workers.”