By Katherine K. Chan and Adrian H. Halili, Reporter

THE MINES and Geosciences Bureau (MGB) on Thursday urged communities and local governments in Luzon and Mindanao to stay on high alert for rain-induced landslides and flash floods as a low-pressure area (LPA) strengthens the southwest monsoon.

In an advisory posted on Facebook, the bureau under the Environment department warned at least eight cities in Metro Manila and 24 provinces of landslides, floods or flash floods, and debris flows starting Thursday until Sunday.

Some provinces not on the MGB list and mentioned in the weather bureau’s separate advisories should activate the appropriate preparedness measures and monitor for future geohazard advisories, should there be any sudden changes in the rainfall forecast or weather conditions, it added.

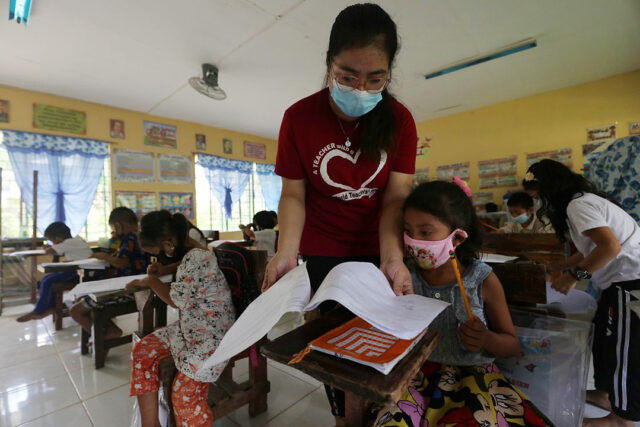

Several local government units suspended classes on July 3 due to heavy rains.

The MGB said moderate to very high flooding and moderate landslides might hit 412 villages in Manila, Marikina, Pasig, Quezon City, Caloocan, Malabon, Navotas and Valenzuela in the National Capital Region.

Meanwhile, at least 3,358 other villages in Calabarzon, Mimaropa, Cagayan Valley, Central Luzon, Cordillera Administrative Region, the Ilocos Region, Caraga Region, and Northern Mindanao might encounter moderate to very high flooding, moderate to very high landslides and debris flow.

Moderate floods are 0.5 to one meter high that could last for as long as three days. High floods reach one to two meters, while very high floods are more than two meters, both lasting over three days.

“The threshold values were lowered in Metro Manila due to the nature of flooding in highly urbanized areas, wherein the rains are not readily absorbed by the land,” the MGB said.

“This leads to increased surface runoff that overwhelms the drainage system and causes flooding in low-lying areas, as well as those proximal to waterways,” it added.

The MGB urged local governments, local disaster risk reduction and management councils and communities to be vigilant.

The bureau also asked mining companies, particularly those in hazard areas, to have their emergency response and preparedness teams on standby and coordinate with local government units (LGU).

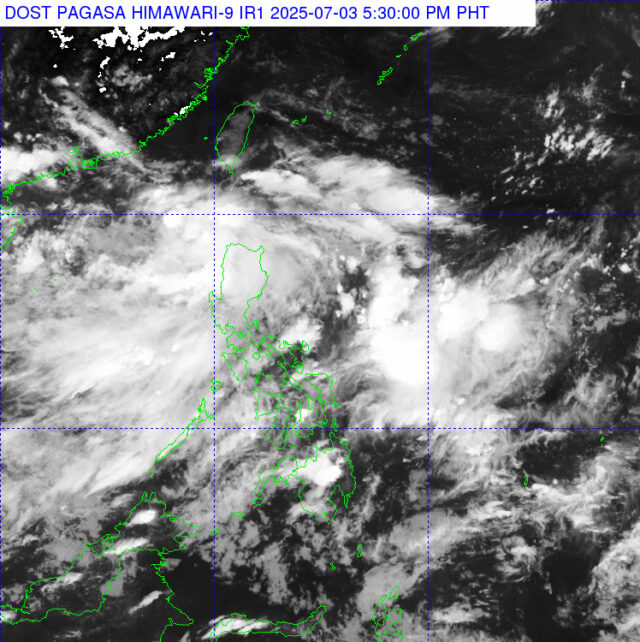

Meanwhile, the state weather bureau said the low-pressure areas had a “medium potential” to develop into a tropical depression in the next 24 hours.

If it intensifies, it will be the second tropical depression in the country this year and will be named Bising, the Philippine Atmospheric, Geophysical, and Astronomical Services Administration (PAGASA) said in a separate weather bulletin.

As of 3 p.m. on Thursday, the low-pressure area, which entered the Philippine Area of Responsibility (PAR) on Sunday evening, was spotted over the coastal waters of Sabtang, Batanes in northern Philippines.

It was expected to bring cloudy skies with scattered rains and thunderstorms in the Ilocos Region, Cordillera Administrative Region, Cagayan Valley and Aurora.

Meanwhile, the southwest monsoon could cause occasional rains over Metro Manila, Pangasinan, Zambales, Bataan, Cavite, Batangas, and Occidental Mindoro, and cloudy skies with scattered rains and thunderstorms in Western Visayas and the rest of Luzon.

The rest of the country might see partly cloudy to cloudy skies with isolated rain showers or thunderstorms, it added.

PAGASA was also monitoring another tropical storm outside the Philippine area of responsibility.

FLOOD MITIGATION

The Philippines lies along the typhoon belt in the Pacific and experiences about 20 storms each year. It also lies in the so-called Pacific Ring of Fire, a belt of volcanoes around the Pacific Ocean where most of the world’s earthquakes strike.

The country often experiences unavoidable losses and damage equivalent to 0.5% of its annual economic output mainly due to an increasingly unpredictable climate, according to the Finance department.

Also on Thursday, the palace said President Ferdinand R. Marcos, Jr. would study the Interior and Local Government department’s request to give it the authority to suspend classes during typhoons.

The present system, where mayors decide whether to suspend classes, would remain in place, Palace Press Officer Clarissa A. Castro told a news briefing.

She said the President had ordered agencies to step up flood mitigation efforts during the typhoon season.

“The President has ordered the immediate cleaning of drainages because this will help prevent rapid flooding, especially here in Metro Manila,” she said.

Last month, the state weather bureau declared the onset of the southwest monsoon, which could increase the chances of tropical cyclone activity in the next few months.

Ms. Castro said the Metropolitan Manila Development Authority (MMDA) has identified 23 priority estuaries in Metro Manila for clean-up. Displaced workers would be tapped in the clean-up drive, she added.

The Department of Interior and Local Government was also ordered to strengthen the disaster preparedness measures of LGUs.

The agency is also intensifying the activation of emergency operation centers, evacuation preparedness, updated contingency plans, community drills and exercises and the enforcement of no-build zones, she added.

“Local disaster offices need to be prepared as first responders in these types of situations,” she said.