National Museum unveils marker in Rizal Park

FOR International Museum Day, the National Museum of the Philippines (NMP) unveiled a historical marker at the renovated Sentinel of Freedom Monument in Liwasang Rizal, located at the southern section of the Rizal Park Complex. The event also marked the reopening of the main gates at Maria Orosa St. which had been closed since 2021. It now offers direct access to the National Museum Complex from Maria Orosa St. and Rizal Park – Luneta. The new marker commemorates the revised foundation date of the National Museum, acknowledging the Aug. 12, 1887 royal decree that established the Museo-Biblioteca de Filipinas as the genesis of the first museum-library of national scope, and recognized as the precursor of the NMP.

Walang Sugat staged at Paco Park

ON MAY 23, the National Parks Development Committee, in collaboration with Sound Experience Manila, brings Walang Sugat, the iconic sarswela by Severino Reyes and Fulgencio Tolentino, to the historic Paco Park in Manila. The special one-hour program in celebration of National Heritage Month begins at 6 p.m., and is open and free for everyone. At its core, Walang Sugat is a story of the love and sacrifice of Julia and Tenyong, the push and pull of the heart’s destiny and a daughter’s duty, and importantly, the perseverance of the Filipino spirit through and beyond adversity. The presentation is directed by Dr. Alegria O. Ferrer and features performances by Daniella Silab, Diego Alcudia, Abet Guande, Vianca Yu, Archibald Dalupang, and Bettina Hernandez, with Samuel Silvestre playing the keyboard. Music and additional composition are arranged and provided by Josefino Toledo.

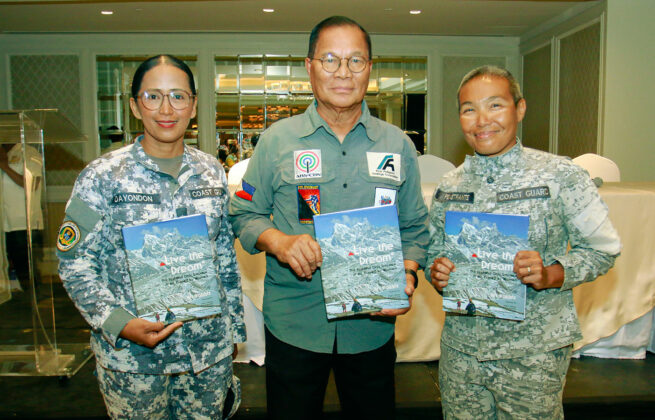

Young artists support World Vision

WORLD VISION has teamed up with Raya Gallerie and DryBrush Gallery for Next Gen: The New Faces of Art, an exhibit and auction that supports the “Bawat Batang Pinoy Malusog” (Every Filipino Child is Healthy) campaign. It aims to rehabilitate 7,700 undernourished children by giving them access to life-saving nutrition and provide more than 919,700 individuals with access to clean drinking water by 2026. Set to happen at Dry Brush Gallery MOA in MOA Square, Mall of Asia, Pasay City, the invitation-only auction will be on May 24, at 2 p.m., with proceeds going to the campaign. An art workshop for kids is scheduled on May 25, 1 to 3 p.m. Public viewing of the exhibit is ongoing until May 30. Featured artists include Junevy Formentera Llosa, Morris Labana, and Katelyn Ann de los Santos Miñoso, among others.

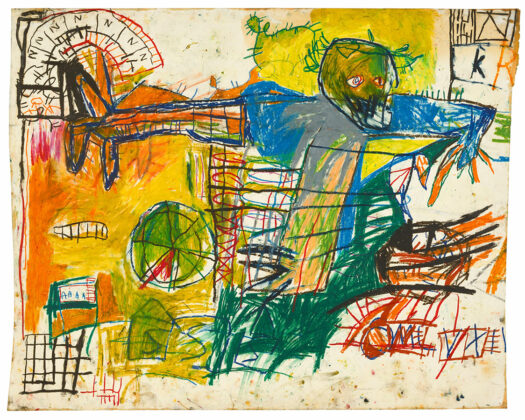

Judy Sibayan at Calle Wright

JUDY FREYA SIBAYAN returns to Calle Wright with the exhibit Early Philippine Contemporary Art (1969-1985), Works and Documents from the Collection of Judy Freya Sibayan. It will run from May 25 to Aug. 31. There will be a “Reframing Art” performance with the audience during the opening reception on May 25. The performance will be at 4:30 p.m., while the reception itself will be from 5-8 p.m. Revolving around the works of Huge Bartolome, Roberto Chabet, Ray Albano, and Johnny Manahan, the exhibit features a collection of gifts from these artists who were critical in Sibayan’s early years of artmaking. Also included are Sibayan’s own works. The five artists were often involved in the same exhibitions and projects at the Cultural Center of the Philippines Art Museum in the 1970s and early ’80s. Materials from her self-archive document these interconnections. Also on view will be works by Nap Jamir II, Fernando Modesto, Bencab, Marciano Galang and Ben Maramag who, together with Albano, Bartolome, Manahan, and Sibayan, were all recipients of the Thirteen Artists Award. Calle Wright is an art house at 1890 Vasquez St., Malate, Manila. It is an initiative of Isa Lorenzo and Rachel Rillo of Silverlens.

Galerie Jose marks 1st anniversary

A BROAD coalition of young, mid-career, and seasoned practitioners, with various approaches to art, have contributed works now on display at Galerie Jose, marking the gallery’s first anniversary. Titled COALESCE, the group exhibit highlights a range of critiques on the state of humanity, politics, and social interactions. It features works by Lydia Velasco, Ram Mallari, Jr., Richard Buxani, Hermes Alegre, Jose Tence Ruiz, Cid Reyes, Rico Lascano, Otto Neri, Emmanuel Nim, Marko Bello, Ted Peñaflor, Ambit Mendoza, Nestor Abayon, Jr., Lara Latisa, Meneline Wong, Cezar Arro, Edwin Martinez, Nino Cris Odosis, Govinda Jean, Mary Christie, Nemesis Manahan, Obet Tiaño, Vincent Diñoso, Krishnamurti, Win Castillo, Adrian Trijo, Efren Carpio, and Eduardo Perreras. Galerie Jose is located at 22 Yale St., Brgy E. Rodriguez, Cubao, Quezon City. COALESCE is on view until May 30.

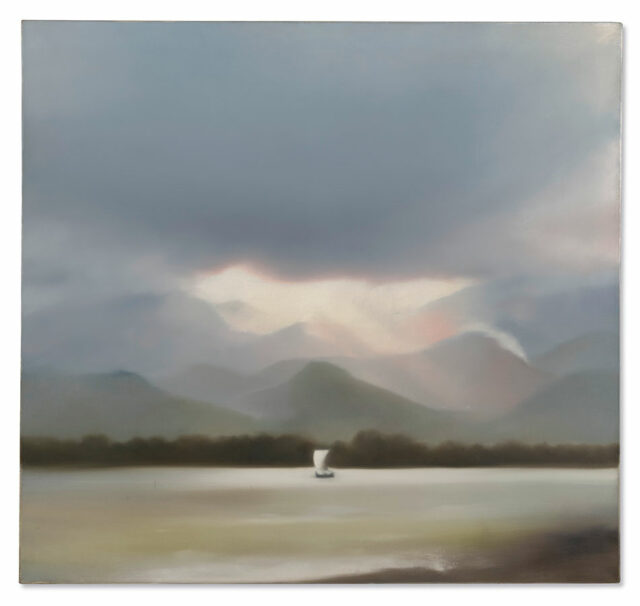

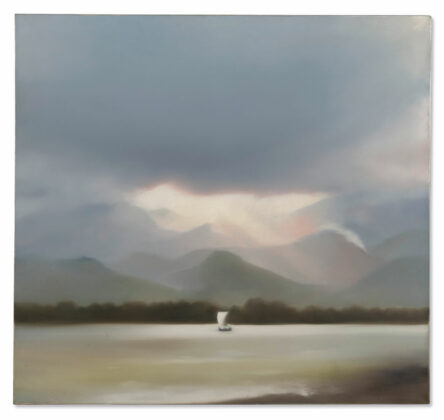

Silverlens opens Collectors Plus

THE 6th edition of Collectors Plus, featuring a selection of works from the 1980s up to the present, is now on view at Silverlens Gallery. Highlights of the exhibit include Pacita Abad’s Baguio Fruit, one of her earliest trapuntos; Corinne de San Jose’s prints from 2013 showing the influence of sound in her artistic practice; a collaboration between Gregory Halili and Nona Garcia that is a dialogue in response to the shared call of the seas; and Ryan Villamael’s works made of paper tackling colonial and contemporary mapmaking. Also on view are paintings by Jonathan Ching, Mariano Ching, Paolo Icasas, Geraldine Javier, Hideaki Kawashima, Yayoi Kusama, Maya Muñoz, Elaine Navas, and Rodel Tapaya; mixed media works by James Clar, Gregory Halili, Bernardo Pacquing, and Luis Antonio Santos; and a lithograph by Yoshitomo Nara. Collectors Plus runs until June 7 at the Silverlens Gallery, Chino Roces Ave. Ext., Makati.

14 artists explore time in MCAD exhibition

MOMENTS OF DELAY, the forthcoming exhibition of the Museum of Contemporary Art and Design (MCAD) of the De La Salle-College of Saint Benilde, brings together the diverse practices of 14 interdisciplinary artists, who navigate the tensions and contradictions in response to the fluidity of time, plural realities, and urgent concerns of the present. Curated by Arianna Mercado and James Tana, the exhibit builds upon the 2015 exhibition The Vexed Contemporary. The participating artists are: Neo Maestro, Christian Tablazon, Allan Balisi, Miguel Lorenzo Uy, Christina Lopez, Corinne de San Jose, Lesley-Anne Cao, artist collective Tambisan ng Sining, Ronyel Compra, Rocky Cajigan, Uri de Ger, Tropikalye (led by Nice Buenaventura), Joar Songcuya, and Celine Lee. Moments of Delay opens on May 27, 5:30 p.m., and runs until Aug. 24. The exhibition and its public programs are free and open to the public at MCAD located at De La Salle-College of Saint Benilde (DLS-CSB) Design + Arts Campus, Dominga Street, Malate, Manila.

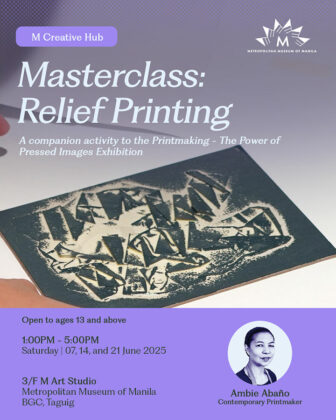

The M holds masterclass in relief printing

THERE will be a three-day workshop on the basics of relief printing at the Metropolitan Museum of Manila. The step-by-step, guided process will see participants create their very own original prints — professionally executed, in both editions and color variations. Facilitated by Ambie Abaño, a multi-awarded Filipino artist and printmaker, the workshop will take place on June 7, 14, and 21, from 1 to 5 p.m., at the 3rd floor art studio of The M. It is open to participants ages 13 and above. The workshop fee is P12,500, inclusive of all materials and tools, snacks during the workshop, and access to all the museum’s exhibits. The M is at the MK Tan Center, 30th St., BGC, Taguig, Metro Manila.

Patis Tesoro to host a special lunch

A LUNCH titled “BLOOM” will be held by cultural icon Patis Tesoro at her garden café in Laguna on June 15. The couturier, who specializes in Filipiniana and is a great supporter of the traditional crafts behind it, will be welcoming visitors to step into her garden of heritage and creativity in an intimate gathering starting at 10 a.m. The day of art and conversation — with sketching and painting inspired by Philippine flora, guided by botanical artist Hazel Scott – includes a traditional Filipino lunch. Guests will also be able to explore her atelier and shop. Materials for the art session will be provided. Limited seats are available. For details, message patisboutique@gmail.com. The Patis Tito Garden Café is located in San Pablo, Laguna.

The Mind Museum launches ‘Cool Learning Adventures’

UNTIL June 29, visitors to The Mind Museum can enjoy all-day access for four persons for a special price of P2,300. This is part of the museum’s new lineup of activities called “Cool Learning Adventures.” Residents and workers of Bonifacio Global City can get an exclusive rate of P500 for all-day access to the museum upon presentation of valid proof of residency or employment. Tickets must be booked via www.themindmuseum.org/buy-tickets or at the onsite Ticket Booth. Mind Moving Studios is also presenting Why does the Philippines have only two seasons?, a show on how weather and atmosphere affect everyday life through lively demonstrations and experiments led by The Mind Museum’s resident scientists, the Mind Movers. This is open on all Fridays, Saturdays, and Sundays of May and June, at 11 a.m., 2 and 5 p.m.

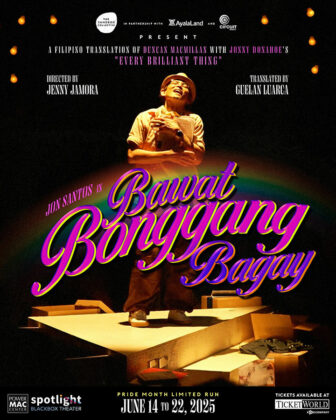

Circuit Makati welcomes back Bawat Bonggang Bagay

FOR Pride Month, The Sandbox Collective is restaging Bawat Bonggang Bagay, which is Palanca awardee Guelan Luarca’s Filipino adaptation of Duncan Macmillan and Johnny Donahoe’s Every Brilliant Thing, starring Jon Santos. The one-man play tackles the unspoken truths about mental health, especially within the LGBTQIA+ community, where struggles remain alarmingly prevalent. The limited run, to take place at the Power Mac Center Spotlight Blackbox Theater in Circuit, Makati, runs from June 14 to 22. Tickets will be available soon at Ticketworld.

Japan presents TOKYO Before/After exhibit

AT Estancia Mall, TOKYO Before/After, a traveling photography exhibit, is enjoying its debut in Manila. Curated by photography critic Kotaro Iizawa, the free exhibit features approximately 80 works that capture life in Tokyo from the 1930s to 1940s, juxtaposed with images taken after 2010. The comparison of these two distinct periods brings Tokyo to life in the past, present, and future lenses. The “Before” section includes shots from photography magazine KOGA, the NIPPON photobook, and Kineo Kuwabara’s snapshots of downtown Tokyo. Featured in the “After” section are works by celebrated Japanese photographers Nobuyoshi Araki, Mika Ninagawa, Natsumi Hayashi, and Shinya Arimoto, among many others. The exhibit is on the third floor East Wing of the Estancia Mall at Capitol Commons, Pasig City, until July 31.