It might have been death by coronavirus as the COVID-19 pandemic choked the economy and strangled many businesses to bankruptcy. But more than the abstraction that is the economy, or the corporate fiction that a business could be, the flesh and blood individual struggling with his threatened physical health even while anxious over dwindling material wealth is COVID’s ultimate victim.

The Bayanihan to Recover as One Act or Bayanihan II was passed by both houses of Congress and signed into law by President Rodrigo Duterte on Sept. 11. For the main aspects of Bayanihan II under his implementation, Bangko Sentral ng Pilipinas (BSP) Governor Benjamin Diokno said at a press conference, “the 60-day loan payment moratorium provides much-needed relief to consumers and businesses as they rebuild their way out of this crisis. The BSP supports bold measures meant to steer the country towards inclusive economic recovery.”

The BSP has ordered all supervised financial institutions — universal and commercial banks, thrift banks, rural banks, cooperative banks, savings and loan associations, and pawnshops, including credit card companies — “to implement this mandatory, one-time, 60-day grace period to all loans of individuals and entities that are existing, current and outstanding, falling due, or any part thereof, on or before Dec. 31, 2020.”

These institutions shall not charge or apply interest on interest, penalties, fees or other charges during the mandatory grace period to future payments or amortizations of the borrowers, and are likewise prohibited from requiring their clients to waive the application of the provisions of the Bayanihan II law, which aims to provide relief to various sectors of the economy reeling from the coronavirus pandemic. Loans that are considered past due as of Sept. 15, 2020 are not eligible for the mandatory grace period.

Regular interest will be charged per installment period, based on the outstanding principal balance of the loan, and shall continue to accrue during the grace period, payable on the new due date following the 60-day grace period, unless the borrower may voluntarily want to pay the accrued interest on a staggered basis until the end of this year.

The mandatory 60-day grace period, in effect, moves the payment due dates of the entire loan, thereby extending the loan maturity. This reprieve is certainly a blessing for borrowers, in this time when cash inflows have been drying up, and priorities are for health and survival. But what happens after Dec. 19, when payments mature and amortizations resume?

After tensions have been eased, and borrowings pushed back in memory, will there be the wherewithal to step up to fulfill financial obligations that then insinuate back into tight (or negative) budgets? Beneficiaries of the moratorium will have spent the money elsewhere that should have paid for loans in the reprieve. Will some dramatically improved economic scenario have presented itself in the 60 days of grace, to override the restraints of the coronavirus on productive activities? Will businesses have revived? Will the unemployed have found jobs?

The original proposed bill in the House of Representatives was for a year-long moratorium on loan payments but this was opposed by banks and government regulators, citing the potential risks to the banking system and the Philippine economy of a prolonged delay in loan payments. The Senate wanted a 45-day moratorium, until the 60-day compromise was reached during the bicameral conference committee meetings. Can the optimal duration of the loan moratorium as a reprieve for the suffering people ever be determined when it is not even known when a vaccine for COVID-19 will be found to ease anxieties and fears for health and survival, such opacity haranguing hopes for economic recovery in the foreseeable future?

Yet the BSP’s Diokno urges banks to lend to medium, small and micro-enterprises or MSMEs, which he said account for 63% of all employment and 99% of all firms in the country. A boost to the economy. But a check with an account officer in one of the biggest commercial/universal banks in the country said the interest rates for loans have not changed — the rates before the declaration of the COVID-19 pandemic in March are the same interest rates now, in the prevailing general community quarantine (GCQ).

Banks can lend to SMEs and MSMEs at 6% to 7% p.a., usually amortized over 10-15 years, at 80% of appraised collateral value, and based on projected income capacity. Personal loans (clean) are at 1.2% down to 0.98% per month, auto debited from deposit accounts. Unpaid credit card payables are to be charged 2% per month or 24% per annum all-in, now the maximum allowed effective Nov. 3. Auto loans are for five years effectively at 26.98% total interest paid for the five years. Housing loans are like business loans at 6%-7% at 0.8 collateral and amortized over 10-15 years, renewable.

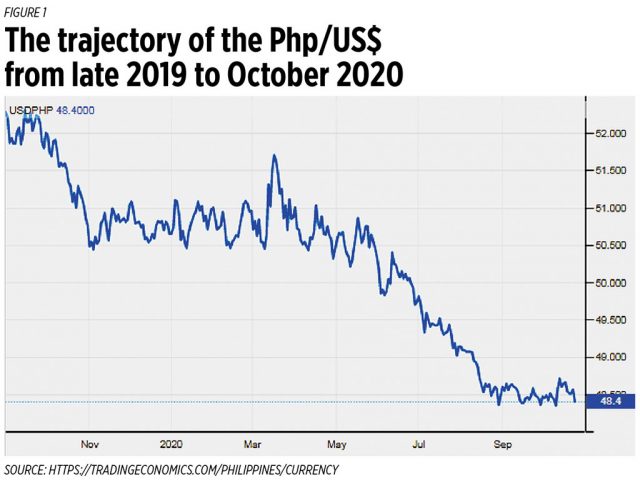

Deposit rates have stooped to below 1% p.a. (to 1.3% for time) while lending rates stood firm even as the BSP dropped the key reference rate to 2.25%, the lowest in history, “to support the economy amid the ill effects of the COVID-19 crisis.” Government securities plunged to measly rates and yields of 1.0+%, not quite covering estimated inflation of 2.3%, which has been held down by lower world crude prices and a stronger peso.

The economy is officially in a recession following a steep 16.5% contraction in the second quarter that followed a 0.7% slide in the first three months of 2020, officials reiterated in October. “The Duterte administration expects to return to its old growth path of above 6% in 2021, but banks and development institutions are not as optimistic. The World Bank pointed out that the rebound will depend largely on the government’s ability to contain local COVID-19 infections,” a CNN Philippines news-analysis concluded (Oct. 1).

Banks are not as optimistic, it is said. Noblesse oblige it was, for the banks and financial institutions to accede to the 60-day loan moratorium orders of the BSP under Bayanihan II, for how could they have said no to the challenge to help out in the pandemonic coronavirus crisis? Good that the mandated moratorium was shortened from the original one-year that House representatives so magnanimously first proposed, so presumptively in their behalf. In August, before HB 6953 was decided, even Diokno was one with the Bankers’ Association of the Philippines (BAP) and the Management Association of the Philippines (MAP) that the then-proposed 365-day loan moratorium “will pose serious risks to the soundness of banks and financial stability in general” and will deter economic recovery.

MAP Chief Francis Lim noted that “based on available figures, at least P11 trillion, or roughly 78% of the total P14-trillion deposits have been loaned to the public. Around 70% of the depositors are nonborrowers.” In May, banks already worried about possible increase in the number of non-performing loans (NPLs — loans past due for 90 days) as businesses reel from the effects of the COVID-19 pandemic. Diokno said then that “banks’ NPL is just 2.1% of their total loan portfolio, and 5% will still be manageable… Our banking system remains adequately capitalized and stable and has adequate buffers to withstand the impact of the COVID-19 situation,” he said (ABS-CBN, May 7).

Comparatively, China’s pre-COVID NPL ratio was 1.8%; Hong Kong’s 0.6%; and Singapore’s 1.3%, according to the International Monetary Fund. The NPL ratio in India, the third-largest economy in the region behind China and Japan, was 8.9% at the end of last year’s first quarter, and in the United States, it was 0.9% before COVID. But way back in February, the South China Morning Post quoted credit ratings agency Moody’s Investor Service that NPLs will increase in the coronavirus pandemic, and banks will have to set higher provisions for higher risks of default.

Borrowers may not have “buffers” or relief, even with a 60-day loan moratorium. They will have to pay their debts and accrued interests anyway and anyhow on Dec. 19, just before the lost Christmas in the time of the coronavirus.

Amelia H. C. Ylagan is a Doctor of Business Administration from the University of the Philippines.

ahcylagan@yahoo.com