Carrying the mark of leadership

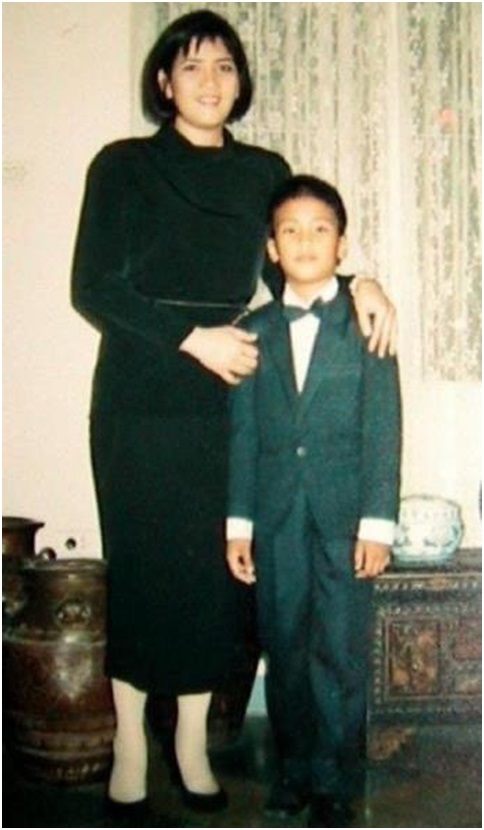

Much is expected of leaders, especially during times of crises. Cocolife President and CEO Atty. Jose Martin A. Loon had held his title for about a year before the pandemic hit, being the youngest to hold the position in the company’s history.

He had done much to get this far, of course. He had graduated from the University of the Philippines College of Law and passed the bar examinations in 2014. He earned his Master of Laws in National Security from Georgetown University the following year, and then accepted a slew of public and private leadership roles before becoming appointed as Cocolife’s chief.

When the COVID-19 pandemic broke out, Martin, along with all the other leaders of the world, had to bring all this skill and experience to bear. Dubbed as the biggest global challenge since World War II, COVID-19 has decimated parts of society all over the world, killing millions and putting so much more out of work. Many businesses crumbled under the weight of the pandemic, and being in the health and insurance sector did not help ease the pressure off of his shoulders.

“From the very start, the priority has always been the safety, financial security, and peace of mind of our people in these uncertain times. We have made huge strides as a company to ensure that our clients and stakeholders will continue to have timely access to our services at a time when they need us the most,” Martin said in an interview.

Fortunately, before the crisis, Cocolife had already begun the streamlining and digitalization of its internal processes to enable its entire workforce to continue working efficiently from home. In fact, in response to the call of government to reduce the processing time of all COVID-19 related claims, the company had successfully ensured that its hotlines remain accessible 24/7 to approve requests for medical procedures and hospital admissions.

Additionally, working closely with the company’s established network of hospitals across the country, Cocolife has ensured that they would have enough financial resources for the procurement of new medical equipment, PPEs, and support their expanded operations.

“Our various initiatives for our clients, employees, and the Filipino people through our donations to COVID relief efforts have enabled our company to live up to our ideals and to confidently claim that we have played our role well – that we have not shirked away from our commitment to our clients and to the Filipino people to be there for them in their time of need,” Martin said.

“We continue to believe in the resiliency and ability of the Filipino to bounce back from seemingly insurmountable odds, in the same way we know that the choices we have made as a company has already set us on the path to recovery.”

Even before this, Martin had been committed to enacting sweeping systemic changes to Cocolife. He spearheaded reforms within the company to institutionalize good corporate governance – emphasizing the importance of integrity, transparency, efficiency, and ethics to streamline internal processes and comply with external regulatory requirements. He also led efforts to transform the operations of the old and outdated company to be at par with global standards, recently receiving zero audit findings from its latest ISO Audit for the first time in its history.

Martin shifted the paradigm of the employees from a day-to-day work mindset into a value system centered on service, sacrifice, and people’s welfare, aiming to inspire their workforce to believe in their capacity to serve the people and be aware of their role in nation-building as providers of life insurance.

He had to conquer numerous challenges in his short time as Cocolife’s CEO, and this time he was facing his biggest challenge yet. Looking back, he recalls how he took inspiration from his mentors and from how his parents had raised seven children while juggling work “that made the country and its people part of their lives”.

“Being among the young CEOs in the corporate world, I find myself blessed to have mentors whose response to the pandemic has set a clear example of how the business and private sector can become a reliable partner of the government in crisis management and nation-building,” he said.

The training he had gained from Georgetown University was also extremely valuable in that it guided him in his approach with the crisis.

“I constantly found myself reverting to my training on ‘scenario building’ and led the management discussions to focus on analyzing and understanding the current trend in health and insurance claims, possible changes in direction of government policy, consumer behavior, and employee morale. This then enabled us to have a clear picture of possible future scenarios and to develop and identify possible pathways toward the direction and initiatives we wanted to take as a company,” he added.

Doing so allowed Cocolife to establish and maintain well-paced operations that is poised to deliver within their expected output for 2020, overcoming the setbacks and challenges of the pandemic. All while ensuring the continued employment of all Cocolife employees with “no one left behind”. Cocolife will also provide free COVID-19 vaccine for all its employees and their families once vaccine is already available.

The challenges are far from over. “I believe that in 2021 and perhaps even a few years after, we would feel the full impact of COVID-19 and eventually reap the consequences of the decisions that we have made to address the challenges brought about by the pandemic,” he said.

“Life will definitely not get any easier and we need to be ready for more complex challenges that we have to face head on. This year has shown that the best-laid plans and strategies can easily be thrown out the window by black swan events – or those that no one could predict or could fully comprehend the impact. Complacency does not have a place in our time. In approaching 2021 and the coming years, it would be important for me to deal with problems immediately, while being continuing to be flexible, innovative, and daring but always remaining grounded by my core values.”

Martin noted that he remains committed to transforming Cocolife for better in the years to come, intending to lead the company through whatever other crises looming on the horizon by sticking to their core values and helping more Filipinos.

“Cocolife plans to further strengthen its digital servicing even better by establishing efficient customer portals for its policyholders and potential clients. We have already initiated and worked on the needed updates in our core system and we’re looking at going full speed with the technological improvements by 2021,” he shared.

He added, “With our enhanced product development efforts, we also aim to launch more products and services that are responsive to the changing landscape and consumer needs.”

Visit The President’s Corner for more info on Atty. Jose Martin Loon.