Japanese woodblocks inspire new artworks

Modernismé, an exhibit featuring Tesa Celdran’s first collection of mixed media/collage paintings, opens on Sept. 26, at the Secret Fresh Gallery. Modernismé takes the traditional subject matter of ukiyoe — Japanese woodblock prints from the late 19th century – and combined these with the modern techniques of mixed media/collage. Celdran’s first mixed media/collage pieces were part of the Manila Biennale art auction in 2018. In 2020, she did the same for La Collina’s artisan market. Her first exhibit was The Chair Project, a show of Seating Furniture at Pineapple Lab, Makati in 2017. The Secret Fresh Gallery is located at the Ronac Art Center, 424 Ortigas Avenue, Greenhills, San Juan City. Contact the gallery for viewing, following COVID-19 health restrictions, via e-mail at secretfreshinfo@gmail.com.

Picture book-making webinar opens to the public

Award-winning Filipino artist and children’s book illustrator Aldy Aguirre will conduct “Illustrating Unheard Stories,” a two-part webinar which delves into the creation of picture books, on Sept. 29 and Oct. 6. The first session walks the participants through the artistic process, from conceptualizing characters, worldbuilding, creating storyboards to seamlessly incorporating texts and sketches. An interactive exercise will guide the students how to flesh out their cast, tapping the diverse personality traits provided by the class. The second part focuses on the art. Aguirre will discuss different mediums used in picture books, as well as the various points to consider in color selection. He will design a new cover from scratch, inspired by non-existent children’s book titles provided by attendees. Both sessions will conclude with a question-and-answer portion. Aguirre likewise tackles the making of two books he illustrated: Ya Pagkatu-Ang Na Banwa (The Creation of the World), a Tagakolu tale published by DO62 Indigenous People Education Partnership Initiative of De La Salle Philippines; and Si Kian, the story of Kian Delos Santos, one of the victims of extrajudicial killings during the war on drugs. Si Kian was published by Philippine Center for Investigative Journalism and Adarna House. Aguirre’s artworks, which range from colored pencils to watercolor and gouache, have graced a number of children’s books from various publishers and independent writers here and abroad. Hosted by the Arts and Culture Cluster of De La Salle-College of Saint Benilde, the webinar-demo is free and open to the public. It will be held via Zoom on Sept. 29 and Oct. 6, from 2 to 4 p.m. Interested participants may register through https://forms.gle/pFjMtbepchYG4FvP8.

CCP marks 52 years with spotlight on resident artists

TO celebrate its 52nd anniversary, Cultural Center of the Philippines (CCP) presents an online video streaming showcase focusing on the resident companies who have once tread its halls. Titled Mula Sa Tanghalan Naming Tahanan, the CCP Anniversary Feature brings together the resident companies of the CCP through a selection of their various online performances, put together into a video production. Throughout the rest of the month, the CCP will be featuring daily on the CCP Facebook Page, YouTube Channel, and Vimeo Showcase the works of Ballet Philippines, the Philippine Ballet Theater, Tanghalang Pilipino, the Ramon Obusan Folkloric Group, the Bayanihan Philippine National Folk Dance Company, the Philippine Philharmonic Orchestra, the UST Symphony Orchestra, the Philippine Madrigal Singers, and the National Music Competition for Young Artists Foundation. The Mula Sa Tanghalan Naming Tahanan showcase runs at http://bit.ly/CCP52Showcase until Oct. 6 on the CCP YouTube and Vimeo Channels.

Artist group holds first online exhibit

GROUNDED present “States of Cadence,” its first-ever online group exhibition which explores the works of grassroots and emerging artists from the Grounded Artist Network. The first exhibit of this two-part series opens on Sept. 23 at www.groundedph.com. Grounded, co-founded by Marika Manglapus-Ledesma, Bianca Yuzon-Henares, and Carina Alejandrino-Arenas, is a lifestyle brand and consultancy. For “States of Cadence: Exhibit 1,” the collection of artworks range from mixed media and paintings to prints and photographs, influenced by the challenges and triumphs from the different seasons of the artists’ lives. All the works are priced between P5,000 and P25,000. A portion of sales will be allocated for projects of Oceanus Conservation, a Philippine non-profit that conserves and restores blue carbon habitats such as coral reefs and mangroves. “States of Cadence” will also present short films from the @globestudios’ Independent Film Festival (.GIFF). There will also be a virtual wellness space to accompany this exhibit as part of Grounded’s mission to bring a more holistic approach to arts and culture. “States of Cadence: Exhibit 1” will run until Nov. 15. The second part of the series will be launched in December and will run until March, with plans of a physical show during the first quarter of next year. For details, visit www.groundedph.com.

West Gallery holds group show

WEST Gallery presents a group show, “Working Animals: Westbound,” until Oct. 16. The Working Animals artist collective opens a joint exhibition showcasing the group’s diverse talents, visual styles, and thematic trajectories. Continuing the series of shows which commenced in 2019 referencing movement and embarking on a journey (Northbound and Seabound), the artists now head to West Gallery for Westbound. The participating artists are Aiya Balingit, Keb Cerda, Ronson Culibrina, Dale Erispe, Lui Manaig, John Marin, and Pow Marin. The show is curated by Ryan Francis Reyes. Visitors are welcome by appointment only. To make an appointment, call 3411-0336 (landline) or 0915-175-3792 (mobile).

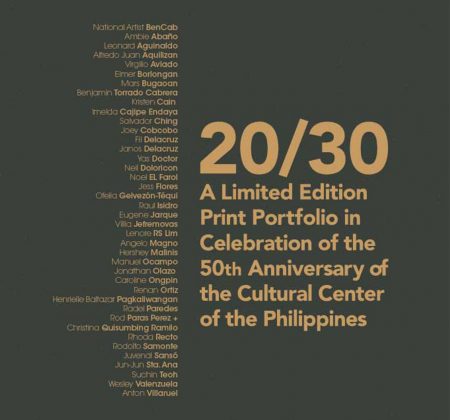

CCP, AP release limited-edition print portfolio

THE CULTURAL Center of the Philippines (CCP) and the Association of Pinoyprintmakers (AP) present a special limited-edition print portfolio, 20/30: A Limited Edition Print Portfolio in celebration of the 50th Anniversary of the Cultural Center of the Philippines. This is a collection of fine prints using traditional printmaking techniques by practitioners who have contributed to the development of Philippine contemporary printmaking and who represent a wide range of generations in Philippine art. The artists featured in this portfolio are or were affiliated in one way or another with AP. This project is the second commemorative print folio project of the CCP in partnership with AP. The first, produced in 2014, was called 25@45, and was made in celebration of CCP’s 45th anniversary. The proceeds of the 20/30: A Limited-Edition Print Portfolio will go to fundraising programs of the CCP and the AP.

Galerie Francesca presents Chinese painting exhibit

MANY critics consider the landscape as the highest form of Chinese painting. The exhibit “Silver Mountains, Sparkling Waters” featuring works by Fred Chin Tan harkens to the tradition of Chinese landscape painting. It focuses on life-sustaining and overflowing abundance aspects of nature. The exhibit is on view at Galerie Francesca until Sept. 30. Galerie Francesca is located at the 4L, Bldg. A, SM Megamall, EDSA, Mandaluyong City. For inquiries, call 0935-551-1305, or e-mail info@galeriefrancesca.com.

Louvre masterpieces now available for the home

SAMSUNG Electronics Co., Ltd. has a new exclusive artwork partnership with the Musée du Louvre in Paris, to develop the Art Store on Samsung’s lifestyle TV, The Frame. With new artworks from the Louvre joining the collection, The Frame now boasts a catalog of over 1,500 works of art from 42 different countries that consumers can enjoy in 4K picture quality from museums and galleries around the world, including the Prado Museum in Madrid, the Albertina Museum in Vienna, the Tate Modern in London, the Van Gogh Museum in Amsterdam, the Hermitage State Museum in Saint Petersburg, and LUMAS. By entering into a partnership with the Louvre, Samsung offers all The Frame owners a chance to explore the most visited museum in the world through 40 pieces of artwork and photographs. This selection includes the Mona Lisa and The Wedding Feast at Cana, as well as photos of the Louvre galleries, its architecture, and museum grounds. A short description of each work gives users a glimpse into their background and history. Samsung and the Louvre also plan to unveil other exclusive content for The Frame users later this year. The Frame is designed as a TV when on and art when off, serving as an innovative digital canvas. For more information on Samsung’s lifestyle TV products, visit www.samsung.com/ph.

The Met holds art dialogue series

THE SECOND installment of the Metropolitan Museum of Manila’s Art and Community — a series of dialogues that examine and explore the ecology of relationships within the Philippine arts and culture sector and its ties to society — will be held on Sept. 26, 10 a.m., over Zoom and Facebook Live. The dialogue, “Creative cultural hubs on collaboration & participation,” will look into how to grow arts and cultural spaces that are more socially-responsive, ecologically conscious, and people-centered environments. The event will draw on the experiences of the participatory and community-based models of KANTINA (Roxas City, Capiz), CASA San Miguel (San Antonio, Zambales), and Emerging Islands (San Juan, La Union), and will discuss the different modes of collaboration and participation in the broader context of cultural work and empowerment. For registration details, visit the Metropolitan Museum of Manila’s Facebook page.

Digital protest for change through online exhibit

WRITERS, visual artists, designers, filmmakers, animators, photographers, content creators, and event consultants have utilized the digital medium in a virtual showcase entitled “To Differ, Digitally 2 (TDD2): Love and Dissent in the Time of Pandemic,” which features a series of protest artworks. “TDD2” is the second iteration of the exhibit, which explores the digital landscape as a platform to communicate constructive protest based on love and empathy. The show spotlights photos, graphic design, and illustrations, 2D and 3D models and rigs, animation and live action films, texts, audio, applications and software. The line-up of creators is comprised of writer Jag Garcia, motion graphics artist and designer Yolec Homecillo, multimedia designer Hannah Sison, 3D artist Volty Garcia, visual communicator Vanessa Puente, visual artist Emily Mones, designer, writer and artist Brian Bringas, graphic designers Dino Brucelas and Rafael Liao, writer and designer Ericka Garalde, filmmaker, writer and content producer Seymour Sanchez, multidisciplinary artist Teta Tulay, event consultant Mito Tubilleja, writer and content developer Penny Angeles-Tan, animator Benjie Marasigan and photographer Jay Javier. “TDD2” is produced by the Center for Campus Art (CCA) of the DLS-CSB and curated by CCA Director Architect Gerry Torres and artist Karen Ocampo Flores. To view the exhibit, visit the official Facebook page of Benilde CCA at https://www.facebook.com/BenildeCampusArt.

Climate Art Contest launched

THE ASIA Pacific Regional Ozone2Climate Art Contest has been launched to promote the linkage of the ozone layer and climate protection under the Montreal Protocol. Over 30 countries in the Asia Pacific region are participating in this contest, with each country organizing its own national competition, the winners of which will be entered into a regional-level contest. The overall initiative is being jointly organized by the United Nations Environment Program (UNEP) and the United Nations Educational, Scientific and Cultural Organization (UNESCO), and supported by Mahidol University. The art contest has three categories — photography, drawing, and graphic design — and it aims to raise the awareness of people in the region about ozone layer depletion and its link with climate change. “The Montreal Protocol under Substances that Deplete the Ozone Layer is one of the most successful multilateral environmental agreements in history, which not only enabled the recovery of the ozone layer, but also made significant contributions to climate change mitigation,” said Megumi Seki, Executive Secretary of UNEP’s Ozone Secretariat. She further added, “with full implementation of the Kigali Amendment, the Montreal Protocol could avoid a 0.4-degree Celsius global temperature increase by the end of the century. Further, the Montreal Protocol will also inspire the global fight against climate change.” Out of 38 developing countries in the Asia Pacific region, 33 including the Philippines have already confirmed their participation in the Asia Pacific Regional Ozone2Climate Art Contest, and more countries are expected to confirm their participation soon. Entries will be accepted until March 31, 2022. For more information about the contest, visit www.ozone2climate.org.

Cine Europa on-demand screenings

THE 2021 CINE Europa film festival presents 17 critically acclaimed European films online via www.cineeuropaph.com. One can register and secure virtual seats to the on-demand screenings until Sept. 29. All registered audience members will be able to see all films in the virtual theater portal. Cine Europa is an initiative of the EU Delegation and the EU Member States Embassies together with Goethe Institut Manila, the Philippine-Italian Association and Instituto Cervantes de Manila.

Shell Art tilt calls for entries

PILIPINAS Shell Petroleum Corp.’s Shell National Students Art Competition (NSAC) — the tilt is one of the longest-running student art competitions in the country — takes on a relevant theme this year, “restART,” which encourages young artists to come up with art works that inspire and contribute to a stronger and better country. The 54th edition of Shell NSAC will have the following categories: Oil/Acrylic, Watercolor, Sculpture, and Digital Fine Arts. This year’s 1st Prize winners will receive P60,000, a limited Shell NSAC shirt and jacket, a gold medal, and a plaque; 2nd Prize winners will get P40,000 cash, a limited Shell NSAC shirt and jacket, a silver medal, and a plaque; and 3rd Prize winners will get P30,000 cash, a limited Shell NSAC shirt and jacket, a bronze medal, and a plaque. The deadline for entries is on Oct. 1, 2021. Winners will be announced through a virtual awarding ceremony via Zoom on Nov. 24. For more details, visit https://www.shell.com.ph/energy-and-innovation/make-the-future/national-students-art-competition-juan-art-nation.html