Medilines Distributors: Growing, aging population drives healthcare growth

MEDICAL equipment distributor Medilines Distributors, Inc. is gearing up to grow as healthcare spending is expected to continue its upward trend, the company’s chairman said.

“We believe that there will always be demand for medical products, in as much as there will always be a patient needing care,” Medilines Distributors Chairman Virgilio B. Villar said in an e-mailed statement on Friday.

In a report by Ken Research, healthcare spending went up by a CAGR (compound annual growth rate) of 10.9% to P911.4 billion in 2020 from P489.1 billion in 2014. It is projected to grow by 11.2% to P1.5 trillion in 2025.

This takes into account the overall spending by the government as well as private healthcare units and household expenses.

“The growth of the healthcare sector is driven by a growing and aging population,” Medilines Distributors said, adding that the increase in incidences with non-communicable diseases and respiratory diseases in the country is also a factor.

Medillines Distributor is a distributor of medical equipment to private and public healthcare facilities across the country, offering products from brands such as Germany-based Siemens Healthineers for diagnostic imaging and B. Braun for dialysis equipment, as well as US-based Varian for cancer therapy equipment.

“Because of the alarming increase in Filipinos with serious diseases, there has been a huge demand for medical devices, particularly for the diagnosis and treatment of patients, thereby showcasing the promising growth prospects for the medical device industry in the Philippines,” the company said.

Medilines Distributors is preparing to go public with a P2-billion offer, selling as much as 825 million common shares for up to P2.45 apiece.

The company will offer up to 550 million common shares. The majority, or P743.1 million, of the proceeds will be used to repay debt, while the P541.5 million will be used for product procurement and to fund its plans to enter the medical consumables segment.

Medilines Distributors’ Mr. Villar will be offering as much as 275 million common shares, the proceeds of which will not be received by the company.

The company aims to conduct its offer period from Nov. 22 to Nov. 26, with a tentative listing date of Dec. 7 on the Philippine Stock Exchange. It will list under the ticker symbol “MEDIC.”

PSE President and Chief Executive Officer Ramon S. Monzon said previously the PSE is “pleased to see a company in this space tap the stock market for capital raising” after the healthcare industry was put at the forefront due to the pandemic.

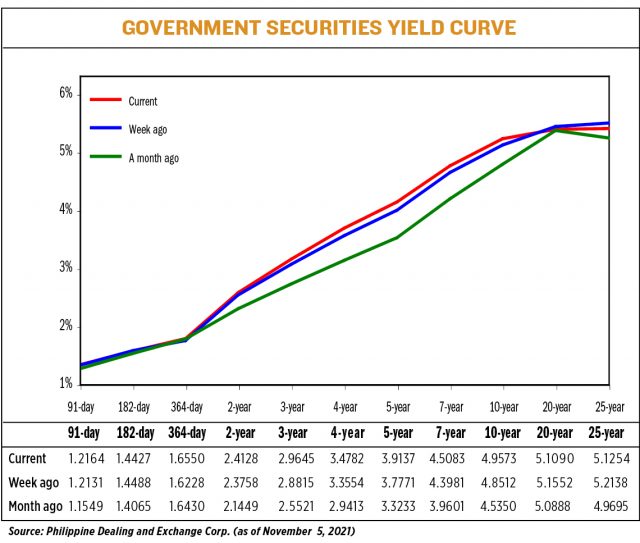

As the year ends, market sentiment is boosted by the reopening of the economy amid lower coronavirus cases as well as improved economic data.

First Metro Investment Corp. (FMIC) Head of Research Cristina S. Ulang said they expect the benchmark Philippine Stock Exchange index (PSEi) to finish the year within the 7,400 to 7,800 range.

“We think there is a chance of the market overshooting above 7,400. That’s due to looser quarantine restrictions we earlier anticipated based on the vaccination drive which is on the way to the targeted 70% of the population,” Ms. Ulang said in a Viber message on Saturday.

The index is near FMIC’s initial 7,400 year-end forecast, as market sentiment is boosted by optimism on economic reopening and a “tamed virus.” On Friday, the PSEi climbed 137.05 points or 1.90% to close at 7,340.77.

Rizal Commercial Banking Corp. (RCBC) Chief Economist Michael L. Ricafort said the PSEi’s gains in the past week were supported by lower inflation data and the improvement in the country’s exports and imports. — Keren Concepcion G. Valmonte