Rates of T-bills, bonds to drop

THE RATES of government securities on offer this week may continue to go down on easing inflation concerns and as they track the decline in yields on US Treasuries.

The Bureau of the Treasury (BTr) wants to borrow P15 billion via the Treasury bills (T-bills) on Monday, broken down into P5 billion each via the 91-, 182-, and 364-day papers.

On Tuesday, the BTr will offer P35 billion in reissued 10-year Treasury bonds (T-bonds) with a remaining life of nine years and 24 days.

Two bond traders interviewed on Friday said they expect the rates of the T-bills to decline by 5 to 10 basis points (bps) this week.

Meanwhile, for the reissued 10-year bonds, the first trader sees the tenor’s rate ranging from 3.75% to 3.875% while the second trader gave a lower forecast range of 3.6% to 3.8%.

The first trader said yield movements at this week’s auctions will reflect easing concerns over inflation as well as declining US Treasury rates.

The second trader echoed this, adding that markets are also awaiting the results of the upcoming Federal Open Market Committee (FOMC) policy meeting of the US central bank.

“Despite US inflation figures rising, US Treasury yields fell. That might just mean that both local and foreign traders view inflation levels as temporary and are expecting the Fed to set a tone which is accommodative regarding the setting of interest rates and tapering,” the trader said via Viber.

Headline inflation was steady for the third straight month at 4.5% in May and fell within the 4-4.8% estimate of the Bangko Sentral ng Pilipinas (BSP).

Year to date, inflation averaged at 4.4%, higher than the 2-4% target of the BSP and its revised forecast of 3.9% for the year. May was the fifth month in a row that inflation went beyond target.

Meanwhile, the yield on the benchmark 10-year US Treasuries fell to 1.47% on Friday from 1.56% a week ago, and further down from its peak at 1.73% in early April.

The US Federal Reserve’s policy-setting body is set to meet on Tuesday and Wednesday and while it is widely expected to keep borrowing costs steady, it may discuss tapering its massive asset purchases.

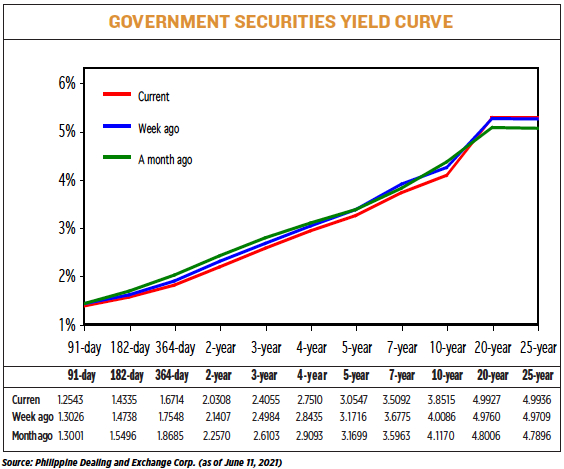

At the secondary market on Friday, the 91-, 182- and 364-day T-bills were quoted at 1.254%, 1.434% and 1.671%, respectively, while the 10-year tenor was at 3.852%, based on PHL Bloomberg Valuation Reference Rates published on the Philippine Dealing System’s website.

The BTr upsized the volume of T-bills it awarded last week to P21 billion from the initial plan of P15 billion as rates dropped across the board. Total bids stood at P92.52 billion.

Broken down, it raised P7 billion from the 91-day papers, up from the P5-billion program, from P26.359 billion in tenders. The tenor’s average rate fell to 1.176% from the 1.235% fetched in the previous auction.

The Treasury also upsized the 182-day T-bills it awarded to P7 billion from P5 billion at an average rate of 1.422%, down from 1.472% previously.

Lastly, the Treasury borrowed P7 billion via the 364-day securities, higher than the planned P5 billion. The one-year papers yielded 1.649%, down from 1.723%.

Meanwhile, the reissued 10-year T-bonds on offer on Tuesday were first issued in July 2020 and carry a coupon rate of 2.875%.

The last time the BTr offered this bond series was on March 23, where it raised P30 billion as planned from P53.92 billion in bids. The notes fetched an average rate of 4.614%, a sharp increase from the 3.066% seen in the previous auction of the same bonds on Feb. 2.

The Treasury wants to raise P215 billion from the local debt market this month: P75 billion via weekly offers of T-bills and P140 billion from weekly auctions of T-bonds.

The government is looking to borrow P3 trillion from domestic and external sources this year to help fund a budget deficit seen to hit 9.4% of gross domestic product. — Beatrice M. Laforga