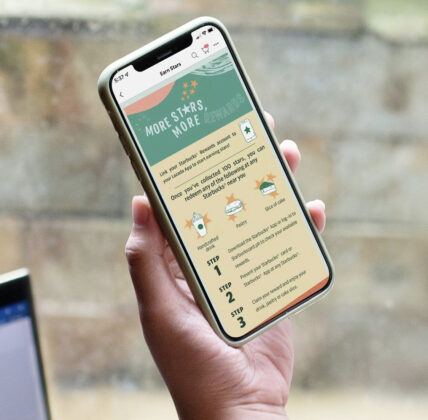

Starbucks offers new digital services

STARBUCKS Philippines recently launched three new services that bridge both physical and digital experiences. With customer convenience and safety in mind, Starbucks Philippines makes ordering easy, contactless and rewarding. Partnering with e-wallet platform, GCash, the first of these services include gifting of digital Starbucks gift certificates through GLife. In addition, the company now allows Starbucks Rewards members to collect Stars with purchases from the official Starbucks LazMall Flagship Store on Lazada, and expanded their Mobile Order & Pay features with new pickup options. Customers can now order and send Starbucks eGifts starting at P300 through GLife on GCash. Customers can choose to share Starbucks eGifts through messaging apps and redeem by showing the eGift QR code to pay for drinks, food or merchandise in any Starbucks store in the Philippines. For more information, visit https://starbuckscard.ph/sbcard/egift or through https://gcashapp.page.link/Starbucks via mobile. Meanwhile, Starbucks Rewards members who link their accounts to Lazada will earn one Star for every P25 spent on purchases from the Starbucks LazMall Flagship Store. To link a Starbucks Rewards account, customers can simply click the “Member” tab found in the Starbucks LazMall Flagship Store, and sign-in using a registered Starbucks Rewards e-mail and password. For more information, visit https://starbuckscard.ph/sbcard/faq. Finally, Mobile Order & Pay allows Starbucks Rewards members to place orders ahead of their visit and pick it up at their chosen Starbucks store, all within the Starbucks app. The app estimates wait time. When the order is ready, the customer can get their order from the handoff. For more information, visit https://starbuckscard.ph/sbcard/orderandpay.

Tatatito opens in Makati

A NEW restaurant in the heart of Makati City, Tatatito serves classic Filipino dishes done the Tatatito way. Crispy Pata, fried chicken, Sarsaparilla BBQ pork liempo, Sizzling bulalo steak, and Crispy binusog na pusit which are just some of the chef’s recommendations. Located in the OPL Building, 100 Don Carlos Palanca St., Legazpi Village, Makati City, Tatatito occupies two stories with a full seating capacity of 72 persons. There is space for safe distancing in these times. Its spacious, modern, and relaxed interiors feature geometric motifs and curves on the walls that derive from bamboo and banana leaves. Custom-made tables and solihiya-accented chairs stand on muted-tone and Machuca-tile flooring, well-lit by funnel-shaped lamps. Reagan Tan, CEO of The Mc Wilson Restaurant Group, says “Tatatito has full trust in the standard of Filipino recipes and delivers from the rich anchor of Filipino culture. We want to showcase Filipino food in the global setting.” Tatatito had its soft opening on Feb. 22. Tatatito also offers delivery. To order, call 0991-300-5000.

Heart health with the Philips Essential Airfryer XL

SINCE the signing of Proclamation No. 1096 on Jan. 9, 1973, the month of February in the Philippines has been designated as Philippine Heart Month. The proclamation aims to promote awareness of heart disease as a serious health concern among Filipinos. To achieve better heart health, there are many practical steps Filipinos can take. One of these is adopting a healthier diet. As more Filipinos are becoming increasingly health-conscious, there exists a need to create home environments that allow for people to easily practice and sustain healthier eating. Philips Domestic Appliances has devised a kitchen innovation that allows for the creation of delicious fried foods made with up to 90% less oil — Philips Essential Airfryer XL. The Rapid Air Technology used in the appliance makes it possible to cook food using only heated air. Through its unique “starfish” design that quickly and precisely circulates hot air, anyone can create delicious meals that are both crispy on the outside and tender on the inside. The airfryer allows home cooks to fry, bake, grill, roast, and even reheat, all while sparing homes from the odors that come with traditional deep-frying. It cooks food using up to 90% less fat. Designed with families in mind, the Philips Essential Airfryer XL has a 1.2 kg capacity basket and a 6.2 liter pan to easily cook up to five meal portions in one go. The QuickClean basket is treated with a non-stick coating for easy cleaning, and 100% of all removable parts of the appliance are dishwasher safe. The Philips Essential Airfryer XL is available on Lazada and Shopee.

Panda Express opens a new store in downtown Manila

AMERICAN Chinese dining concept Panda Express rang in the Lunar New Year with a new store at Level 1, Pedro Gil Wing, Robinsons Place in Ermita, Manila. The new store is the sixth Panda Express in the whole Metro Manila area, since opening its first location at SM Megamall in Ortigas, Pasig City in late 2019. “The continuous expansion of Panda Express is a response to the clamor and cravings of Filipinos for delicious American Chinese cuisine,” said a company statement, pointing in particular to its entrée, The Original Orange Chicken, a crispy chicken dish wok-tossed in a sweet and tangy sauce, and the Honey Walnut Shrimp, an entrée made with crispy shrimp wok-tossed in a honey sauce and topped with glazed walnuts. Other dishes on the menu include Panda’s Wok Smart entrees — dishes with at least eight grams of protein and 300 or less calories, such as Black Pepper Chicken, a stir-fry with marinated chicken, celery and onion, coated in a bold black pepper sauce, Kung Pao Chicken, a Sichuan-inspired dish made with chicken, fresh vegetables, peanuts and dried chilis, and the classic Broccoli Beef, a beef entrée with fresh broccoli wok-tossed in a savory ginger soy sauce. Panda Express also offers plant-based options on its menu including Eggplant Tofu, featuring lightly browned tender tofu that is crispy on the outside, simmered in a sweet and spicy sauce with eggplant and red bell peppers. Panda Express Robinsons Place Manila is open for dine-in, take-out and delivery through order.pandaexpress.com.ph, GrabFood, and foodpanda. Delivery locations include select areas in Manila, Pasay and Makati City. To get more information on Panda Express, visit www.facebook.com/PandaExpressPH/ and @PandaExpressPH (Instagram).

Finding Margaritas for Margarita Day

INTERNATIONAL Margarita Day fell on Feb. 22, but that does not mean you can no longer celebrate it. And a true Margarita is made with Cointreau — a premium orange-flavored, triple-sec liqueur used in over 500 cocktails and considered a staple among bartenders. As the story goes, back in 1948, socialite Margaret “Margarita” Sames hosted an extravagant soiree for her friends and concocted a special drink where she mixed two of her favorite spirits, Cointreau and Tequila which gave birth to the classic Margarita. This month, Cointreau pays homage to Margaret Sames by creating the Perfect Margarita drink in collaboration with Patron using Patron Silver tequila. Both Cointreau and Patron will take over bars in the Metro to celebrate the Perfect Margarita with their own concoctions. The bars are: Alamat (Poblacion, Makati), which serves Juanderlast, made with Cointreau, tequila, mezcal, camias/orange, vanilla pandan, citrus, and salt, available for P300 from Feb. 22 until 27 (details on their Facebook or Instagram or call 0906-407-8466); Southbank Café + Lounge (Alabang, Muntinlupa), which created the Fresh Daisy, made with Cointreau, Patron Silver, Ancho Reyes Verde (citrus cloud foam), simple syrup, and egg white, which is available for P300 from Feb. 21 to 27 (for details visit their website or Instagram to know more or call 8296-0706; Baccarat Room & Bar (Solaire Resort and Casino, Parañaque) which serves a Mezcla de Baya Margarita or Mixed Berry Margarita inspired by Fresas con Crem’, a traditional no-bake dessert from Mexico mostly consumed during summer (for details visit their Instagram, or call 8888-8888 loc. 60388); HQ Poblacion (Poblacion, Makati City) whose Notorious Margarita is made with Cointreau, Patrón Reposado (Silver), spicy mango syrup, fresh lime juice, and garnishes with salt, sugar, lemon powder, cayenne, and basil (check out their Instagram for more information); The Hotel Bar at Pinks (Ground Floor, Shangri-La at the Fort, Taguig) which serves Petty Cash Margarita, sold at P420 per glass from 5 to 8 p.m. (check out this speakeasy through Facebook or call 2772-1147); and, OTO (Enriquez, Makati), whose Peachy Keen is a twisted classic margarita cocktail with a spicy finish, available for P420 (learn more through their Facebook and Instagram, or call 0966-708-0051. Meanwhile, Cointreau has again come up with a limited-edition reinterpretation of its iconic four-sided bottle. This year, the company collaborates with Parisian artist Florian Viel through The Tropicool Company on a hyper-colorful design with subtle references to both the orange liqueur and the cocktail to which this limited-edition bottle pays homage. For more information, visit https://www.cointreau.com/int/en .