In a Manila Times article published on Jan. 24, entitled “Did Ninoy torpedo the Marcos economy to sink it?,” columnist Rigoberto Tiglao argued that Ninoy Aquino’s return to the Philippines and assassination in 1983 sank the Philippine economy, causing its foreign debt default in October of that same year. According to Tiglao, Aquino made the Marcos era the “darkest years of the country.”

This article will explain why this claim is false. But don’t take it from me, take it from Tiglao’s own arguments and data, as found in his earlier pieces dating all the way back to 1988.

In a 2016 Manila Times article, Tiglao wrote: “Ninoy Aquino’s assassination in August 1983 merely hastened, but was not really the reason, for the debt default.” It is thus baffling that in the span of a few years, Tiglao went from acknowledging that Ninoy’s assassination was only a trigger for our economy’s nosedive to blaming the economic collapse on him.

The Philippines defaulted on its foreign loans a few months after Ninoy Aquino’s assassination in 1983, and experienced a deep recession in 1984 and 1985. However, by that time, a political and economic crisis, an “economic perfect storm,” had long been brewing.

The crisis was a result of a buildup of both internal factors (mismanagement of resources, corrupted crony projects, inefficient spending, massive and unpredictable corruption) and external factors (the global debt crisis of the 1980s). While Tiglao’s 2022 column elaborated on the effect of the global debt crisis on our own economic collapse, he failed to mention the huge role played by the regime’s bad economic policy, which he wrote articulately about in his previous works.

To further defend the dictatorship’s economic policy and pin the blame on Ninoy, Tiglao claimed that the regime’s economic performance needs to be understood in two parts: the first being a period of growth and prosperity from 1972 to 1980, and the second, the era of economic collapse afterwards.

He claimed that during the “golden years” of martial law from 1972 to 1980, the economy experienced robust growth, which is why there was much support for martial law and Marcos at the time. Indeed, for the elite, the early years of martial law were prosperous and the business environment favored them.

However, in a chapter Tiglao wrote in the 1988 book Dictatorship and Revolution: Roots of People’s Power, he wrote that this was only a semblance of prosperity. He noted that “the regime started to build up its foreign debt at this time partly to finance the infrastructure projects that would provide artificial stimulus to the economy, and partly to finance the growth of a faction of the Philippine ruling elite that accorded [Marcos] absolute loyalty: the ‘cronies.’”

This facade of prosperity brought about by massive spending on infrastructure (financed by foreign debt) lulled the elite into embracing martial law. Economic power was concentrated in the hands of very few, and crony capitalism, defined as an economic system characterized by close, mutually advantageous relationships between government officials and business leaders, thrived.

In 1988, Tiglao also noted that this massive infrastructure development policy would later become one of the factors that brought about the 1983 debt crisis, and that it was the “debt-driven growth path that led to the worst Philippine recession and contributed eventually to the regime’s downfall.” This contradicts Tiglao’s later writings — in 2018, in his book Debunked, Tiglao defended the debt-driven growth path by citing that Latin American and Asian countries also took on loans from US banks in the 1970s.

The Philippines’ debt-driven growth strategy failed because during the Marcos dictatorship, corruption was massive, uncontrolled, and unpredictable, and the spending of economic resources was unproductive and inefficient. In Debunked, Tiglao described the Filipino elite as “rapacious, in stark contrast to their counterparts in Southeast Asia.” He cited a study that during the Marcos era, the “elite from 1970 to 1981 brought out in a massive capital flight $3.1 billion.” (That was about a third of the increase in the country’s foreign debt.)

Moreover, business may have been booming for the middle and upper classes, but as 1988 Tiglao elaborated in Dictatorship and Revolution, poverty and inequality worsened, resulting in massive social unrest. He used the following data to illustrate the poor distributional outcomes during martial law:

• Due to the Green Revolution, poverty worsened in rural areas. The Masagana 99 program, which used high yielding rice varieties dependent on fertilizer and pesticides, did not equally benefit all farmers. The poorer farmers were at a disadvantage because of high capital costs. The sector was now vulnerable to the volatile influence of the international market economy. Because fertilizers and pesticides were petroleum based, when the oil price shocks hit in 1979, the government could no longer subsidize these inputs. Due to their lack of capital, farmers were swindled into more inequitable sharing arrangements with landlords or traders. Many had to sell their land and massive impoverishment ensued.

• Wage rates also substantially declined. From 1972 to 1978, the real wages of skilled urban laborers declined by 24%, while those of unskilled workers fell by 32%. The regime actually issued a decree ordering the Central Bank to halt the surveys that determined these wages.

• In Central Luzon and Southern Mindanao, more than 80% of the rural population lived below the poverty line. Over 40% of the rural population was below the poverty line in the mid-1970s, and a majority of them were dependent on rice and corn farming.

• Sugarcane workers and coconut farmers, under the Benedicto sugar monopoly and Cojuangco coconut conglomerate, were impoverished. When the Benedictos mechanized the sugar industry in the 1980s to reduce the cost of production, thousands of sugar workers lost their jobs. Meanwhile, capital was extracted from coconut farmers through the coconut levy, and by the end of the commodity boom in 1974, there was mass impoverishment in coconut areas.

Tiglao’s own arguments from his 1988 piece show that martial law was certainly no Golden Age, especially for the rural poor.

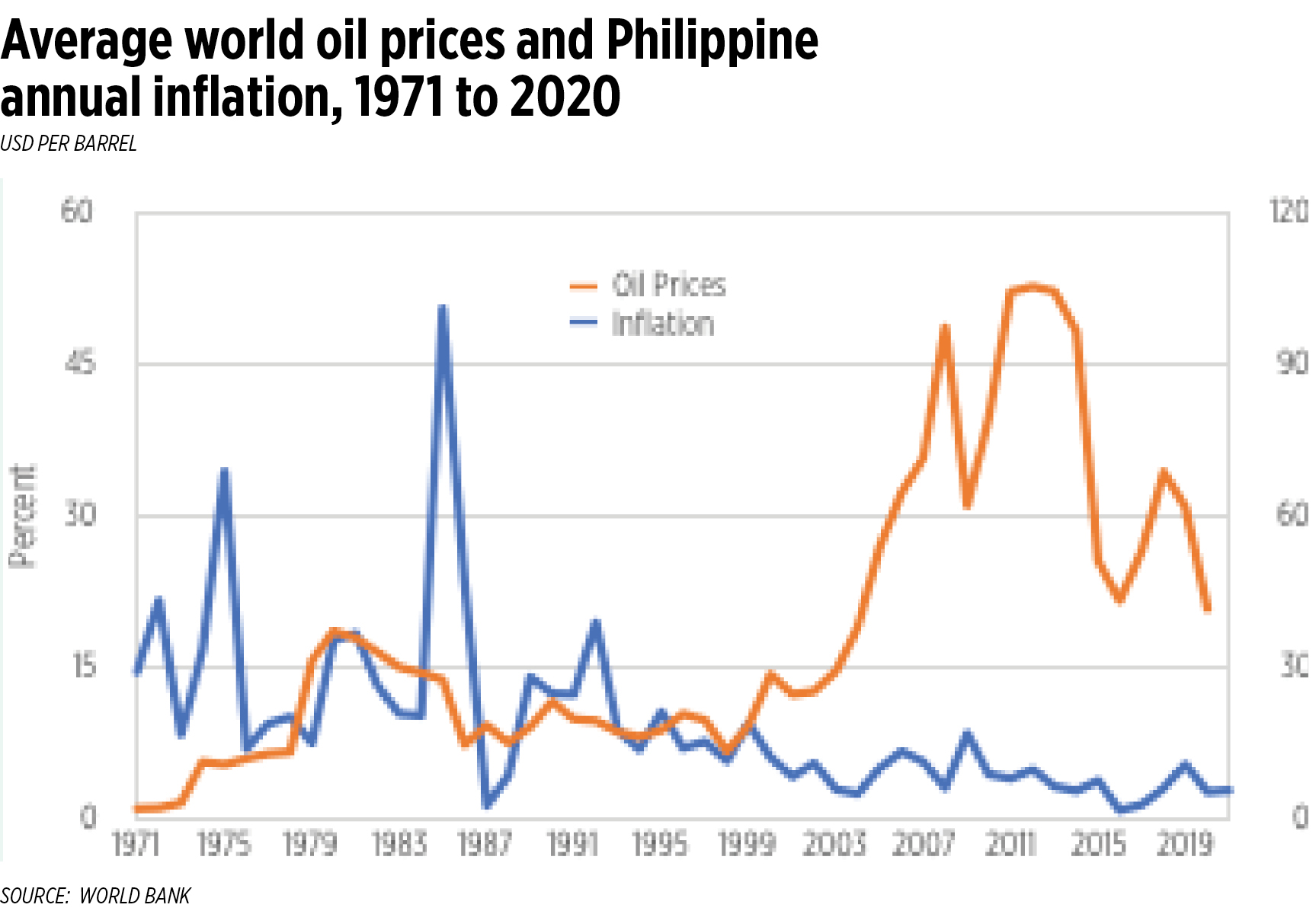

By 1981, the economy stalled. Tiglao’s 2022 column blamed this not on mismanagement by the government, but on external factors: the “Volcker shock” in late 1979 when the US Federal Reserve raised steep interest rates and the soaring of oil prices in 1980 due to the Iraq-Iran war. By 1982, Mexico defaulted on its foreign loans.

In 1983, Ninoy returned from his three-year exile in the United States. At this point, the country was already facing a huge economic crisis and Marcos’ health was ailing. In 2022, Tiglao, again pinning the blame on Ninoy, said that Ninoy went home to replace Marcos, and that if he had not been assassinated, a coup d’etat would have ensued, which would have also led to an economic crisis.

After Ninoy’s assassination, the political situation was volatile and business confidence dropped. The Central Bank had been bankrupted and at one point, we didn’t even have enough money for our basic imports. Fifty-four days after Ninoy’s assassination, the Philippines defaulted on its foreign loans by declaring a moratorium on its debt repayments. By 1984, we plunged into what was then the worst post-war recession the country had ever experienced.

Ultimately, the Philippines’ economic meltdown was caused by a confluence of numerous factors, and, as Tiglao mentioned in 1988, Marcos’ economic policy led to this catastrophe. Weak institutions, inefficient spending (both by the government and the Marcos family using government accounts), uncontrollable corruption, and crony capitalism embedded in traditional sectors under Marcos had already taken a huge toll on the country by the time Ninoy was killed.

“It was the last straw that broke the camel’s back of our foreign debt quagmire,” Tiglao wrote on the Aquino assassination in 2020, acknowledging that the Philippines was already in trouble when it came to our foreign debt by August 1983.

In 1988, Tiglao cited the Marcos regime’s economic policy decisions as contributing factors behind the 1983 debt crisis, and he even recently claimed that Ninoy’s assassination was not really the reason behind our meltdown. His 2022 claim that “Ninoy torpedoed the economy,” therefore, is a complete about face and distortion of the narrative.

If we need to put the blame on someone for the “darkest years of the country,” it should rightfully be Marcos. As Tiglao said in Debunked: “Of course, the buck stopped with Marcos, and he had command responsibility.”

Pia Rodrigo is the strategic communication officer of Action for Economic Reforms.