AC Energy investors take profit after sustained increase

MARKET players cashed in last week on AC Energy Corp. after sustained uptrend seen the previous weeks.

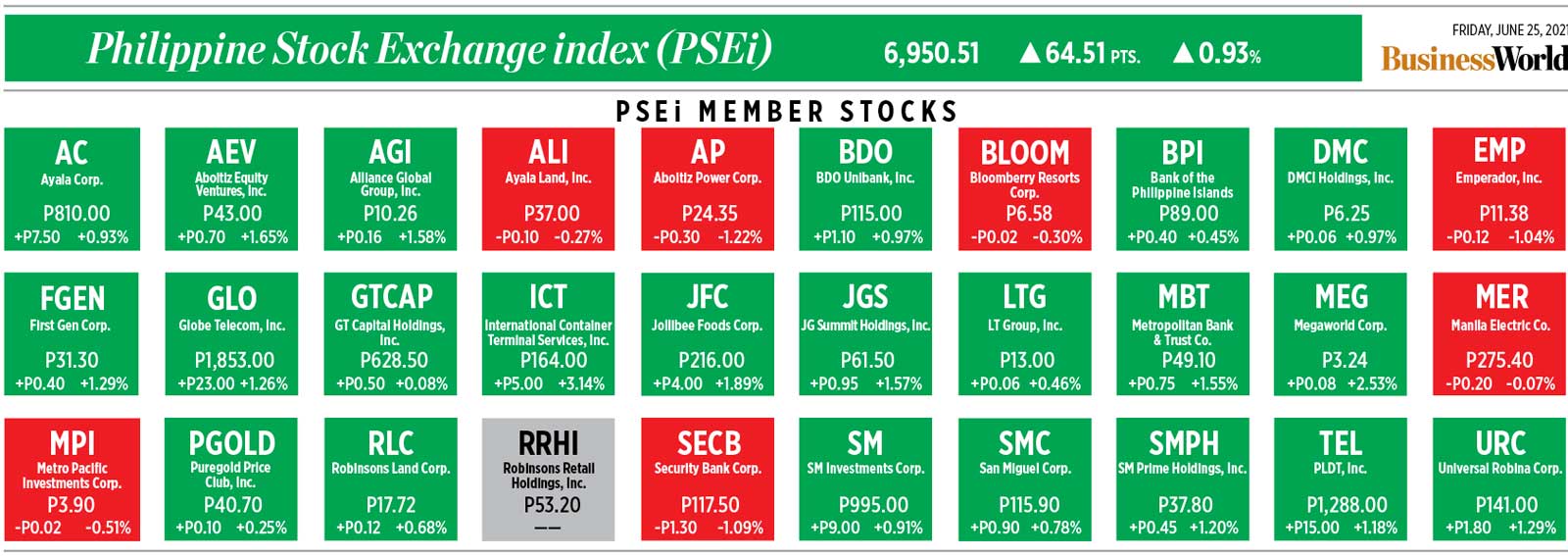

A total of 144.49-million AC Energy shares worth P1.21 billion exchanged hands from June 21 to 25, data from the Philippine Stock Exchange (PSE) showed, making the firm the third most actively traded issue last week in the local bourse.

On a weekly basis, the share price of Ayala Corp.’s energy platform dropped by 3.8% to P8.18 per share last Friday from its June 18 closing price of P8.50 apiece. Since the first trading of the year, the stock has fallen by nearly a fifth.

“This week’s movement is likely a minor correction to three weeks of uptrend, due to the issue being slightly overbought and some participants locking in gains, though for the medium term we see the uptrend continuing,” First Resources Management and Securities Corp. equity analyst Kyle L. Maamo said in an e-mail interview.

“AC Energy was able to maintain its uptrend previously because fundamentally it is a healthy growth company in the integrated power sector and investors were recognizing its value especially as it is on track to meet its renewables capacity goal of 5,000 megawatts (MW) by 2025, with 50% already realized,” he added.

In a separate e-mail, Philstocks Financial, Inc. Senior Research Analyst Japhet Louis O. Tantiangco attributed the stock’s downward movement last week to profit taking.

Last Tuesday, AC Energy announced that “GigaSol Alaminos” — a 120-MW solar farm in Alaminos, Laguna — went online and started supplying renewable energy to the grid.

AC Energy is a unit of AC Energy and Infrastructure Corp. (ACEIC), the holding company of the Ayala group’s energy and infrastructure businesses.

The energy firm aspires to become the largest listed renewables platform in the Southeast Asia, targeting a net attributable capacity of 5,000 MW by 2025.

So far, AC Energy’s power assets has a net attributable capacity of about 1,200 MW, more than half of which or about 670 MW come from renewable resources.

Mr. Maamo said investors are likely to treat the latest solar project as an overall good sign and an added revenue stream for AC Energy, proving the company’s commitment to renewable energy.

“As we enter the rainy season, the solar farm will give investors an idea of what to expect as to the potential seasonality of solar power, and how it affects ACEN’s output and earnings,” he said, referring to the firm’s ticker symbol.

Mr. Tantiangco shared the same sentiment, saying that any plans, developments, or acquisitions that would bring AC Energy closer to its goal may spur investor optimism.

“Investors may also be waiting for the completion of the planned infusion of ACEIC’s international assets to ACEN which would give the latter an additional 1,400 MW capacity,” he added.

Earlier this month, the Securities and Exchange Commission has greenlit AC Energy’s capital hike to P48.40 billion from P24.40 billion previously. This would pave the way for the asset-for-share swap with ACEIC for the latter’s international assets.

AC Energy’s attributable net income jumped by more than half to P829.32 million during the first three months of the year as electricity sales increased by a fourth to P5.69 billion.

“We expect [ACEN’s] double-digit growth of around 15%-25% for top and bottom lines [this year], though costs of the sale of electricity will also rise due to fuel prices and overall increased demand,” Mr. Maamo said.

“The improving state of the economic reopening will only pressure electricity demand further, although the relatively low-cost nature of wind farms will likely offset or at least lessen this burden on ACEN,” he added.

Given the recent developments in the energy and the expected economic recovery in the second half of the year, AC Energy’s growth momentum may continue, Mr. Tantiangco said.

“For this quarter, we saw a relatively strong electricity demand and tight power supply which even led to power disruptions in Luzon. The situation may have given a boost to ACEN’s top line and consequently, bottom line,” he said.

Currently, AC Energy is testing its 10-day exponential moving average, which serves as its initial support, Mr. Tantiangco said.

“If ACEN gives up its position above the said moving average, traders may wait and see first if its next support at the P8.00 level would hold before buying the share [this week],” he said.

He gave the stock’s resistance this week at P9.42.

Meanwhile, Mr. Maamo placed the stock’s support between P8.10 and P8.15, while its resistance level at P8.60.

“A short-term consolidation with declining volume may see ACEN trading between that range next week, although if we see a retest of P8.60 and a successful breakout, we will most likely further see a sustained uptrend with minimal barriers as ACEN draws closer to its 52-week high,” he said. — A.M.P. Yraola