Analysts remain bullish on banks as borrowing costs rise

THE LISTED BANKS were more resilient in the first quarter despite rising inflation environment worsened by the ongoing Russia’s invasion of Ukraine.

After the central bank hiked borrowing costs, these lenders could see a boost in profitability this year, analysts said.

The Philippine Stock Exchange index (PSEi) ended the first quarter at 7,203.47, increasing by 1.1% on a quarter-on-quarter basis from 7,122.63 in the last quarter of 2021.

The financial subindex, which included banks, rose by 5.5% to 1,694.89, lower than the 14.4% growth recorded in the fourth quarter.

The first quarter saw six out of 16 listed banks’ share prices increase on a quarter-on-quarter basis. BDO Unibank, Inc. led with 9.9% growth, followed by Bank of the Philippine Islands (BPI, 8.1%); China Banking Corp. (CHIB, 3.8%), Rizal Commercial Banking Corp. (RCBC, 2.5%), Metropolitan Bank & Trust Co. (MBT, 2.3%); and Asia United Bank (AUB, 1.3%).

Meanwhile, share price of Philippine Business Bank (PBB) dropped the most by 13.4%, followed by East West Banking Corp. (EW, -12.2%); Philippine Trust Co. (-8.5%); and Security Bank Corp. (-8.4%).

“In terms of stock price performance, BDO and BPI stood out as they returned 9.9% and 8.1%, respectively in the first quarter, which may be attributed to investors’ bullishness in the sector given that BPI and BDO are the heaviest weighted bank stocks in the PSEi and the financial subindex,” China Bank Securities Corp. Research Director Rastine Mackie D. Mercado said in an e-mail.

“This may also be reflective of investors’ continuing interest in the digital initiatives of these two banks, which continue to gain more visibility,” he said.

Mr. Mercado said BPI and Security Bank Corp. (SECB) stood out the most in terms attributable net income for the first three months of the year, growing by 60% and 66%, respectively.

“Despite the positive industry outlook for 2022, lingering pandemic-related obstacles, geopolitical tensions, US rate hikes and tapering, global inflation, and a new Philippine president by mid-year all weighed on the banking sector over [first-quarter] 2022,” Globalinks Securities and Stocks, Inc. Head of Sales Trading Toby Allan C. Arce said in an e-mail.

Philippine National Bank (PNB) Research Senior Equity Research Analyst Wendy Estacio said the market is uncertain in the first quarter on the impact of rising interest rates and high inflation environment worsened by the ongoing Russia-Ukraine war.

“While stock prices across the board were adversely affected by geopolitical and inflation concerns, bank stocks were notably more resilient,” China Bank’s Mr. Mercado said.

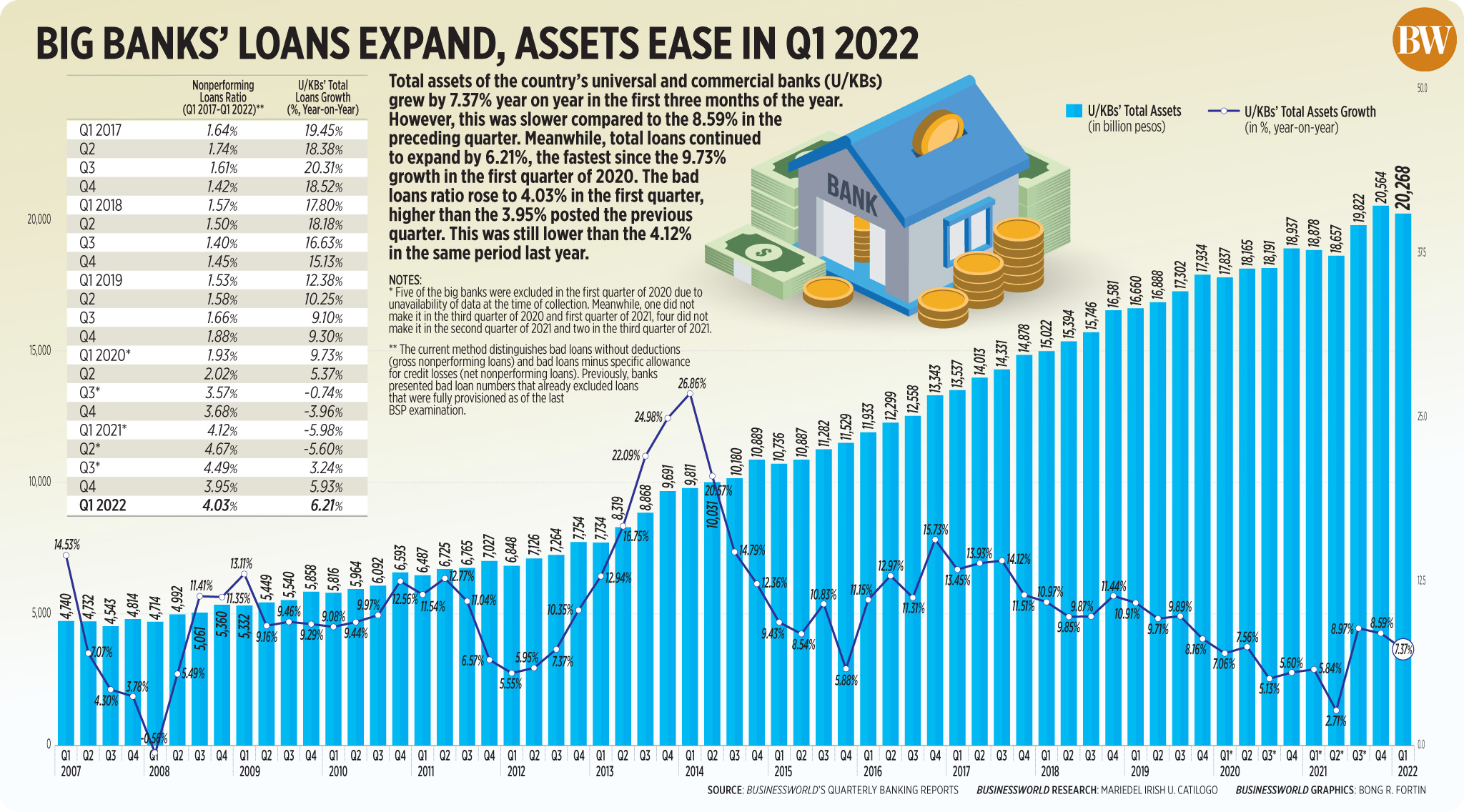

Central bank data showed total net income of the big banks increased by 26.7% year on year to P61.38 billion in the first quarter.

Meanwhile, provision for credit losses by universal and commercial banks fell by 8.8% as of end-March to P18.79 billion from P20.61 billion in 2021, the BSP data showed.

Total loan portfolio of the big lenders went up 8.6% as of March to P10.20 trillion from P9.39 trillion last year.

Gross nonperforming loans ratio of universal and commercial banks improved to 3.73% as of March from 3.87% in February.

After the Philippine gross domestic product rose 8.3% in the first quarter, the central bank hiked interest rates by 25 basis points (bps) last May to contain fast-rising inflation.

However, analysts see the rate hike as a “benefit” for banks as their profitability would also increase but also warned the risks on other aspects of the economy.

“In theory, it would buoy the bank’s profitability this year. However, since the pandemic still lingers, the timing of rate hikes is crucial, as lenders would gauge how fast they can pass through the hike to their clients,” Regina Capital Development Corp. Head of Sales Luis A. Limlingan said in an e-mail.

“If improperly timed, borrowers might be pushed on the verge of default. Hence, we see that the banks would be able to absorb a marginal climb in the rates, albeit with a slight lag,” he said.

“The liftoff by the central bank may likely dent demand and employment recovery, especially in the absence of fiscal support to cushion the economy from higher borrowing costs,” Mr. Arce said.

“Inflation is tilting the outlook towards the downside as higher prices for food and fuel challenge the central bank’s accommodative monetary policy settings, and there is increasing pressure to arrest inflation pressures by hiking interest rates as early as this month. Households are likely to face stronger headwinds as softer property price growth and higher living costs add pressure to household budgets,” he added.

Ms. Estacio said that the rate hikes could improve the banks’ net interest margins (NIMs) this year, adding that they are looking at 10-20 bps addition in NIMs if the central bank hikes by 50 bps.

Latest data by the BSP showed net interest margin — the ratio that measure banks’ efficiency in investing their funds by dividing annualized net interest income to average earning asset — slightly increased to 3.23% as of end-March from 3.21% in end-December. However, this was lower than the 3.49% recorded in end-March last year.

OUTLOOK

For the rest of the year, analysts see a favorable time for banks and investing in bank stocks as the country continues to lower down the quarantine levels, and the economy slowly picking up again after the bumps in the first quarter.

“Philippine banks are seen getting back its pre-pandemic profitability levels this year with a recovering economy and imminent resumption of business activity,” Mr. Arce said.

“The industry’s comfortable capitalization and stable funding profiles will underpin banks’ credit profiles. Overall credit conditions are expected to provide ample support to economic activity. Bank lending appears to have turned the corner in recent months. Lending activity continues to gain traction amid businesses’ optimistic outlook due to the continued rollout of vaccines and easing restrictions,” he added.

Both PNB’s Ms. Estacio and China Bank’s Mr. Mercado estimate growths in loans and NIMs as the central bank started to raise borrowing costs.

Ms. Estacio expects an average loan growth of 8% this year for banks under their coverage, and their NIMs to increase by 15 bps. She also see banks’ earnings to rise by an average of 17% year on year on lower loan loss provisions.

“For 2022, investors should factor in a recovery in loan portfolios as banks start to become less conservative in lending attributable to better economic growth. Wider margins from the possible policy rate hikes could also improve banks’ profitability,” Ms. Estacio said.

“Investors should look into a possible rise in operating expenses of banks given the initiatives to improve their digital operations,” she added.

However, Mr. Arce also reminded risks that could affect the glowing outlook for the year, such as another COVID-19 resurgence, and rapid rise of interest rates that could affect the credit demand and put pressure on small and medium enterprises (SMEs) who are still recovering from the pandemic.

“While we continue to be generally bullish on bank stocks, we think investors will continue to pay attention to banks: (1) that continue to post stronger [year-on-year] bottom line performance, (2) that have made larger strides in expanding their loan books, (3) that continue to improve their asset qualities (as evidenced by declining non-performing loan ratios) and book more normalized loan loss provisions, and; (4) that continue to invest and provide better visibility to digital initiatives. It is also worthy to note that [Philippine] banks remain well-capitalized and have ample buffers to weather any further shocks,” Mr. Mercado said. — Bernadette Therese M. Gadon