London’s Blitz shelter tunnels to become a new tourist attraction

LONDON — Tunnels built to shelter Londoners during World War TII bombing by Germany are set to be transformed into the British capital’s biggest new tourist attraction for years, according to the company that has bought the sprawling network of passages.

The tunnels, which are a mile (1.6 km) long and tall enough in parts to fit a double-decker bus, lie under Holborn in central London. They were dug by hand starting in late 1940, when German planes were bombing the city almost every day and night in what was known as the Blitz.

During the bombing raids, Londoners headed into underground train stations for safety. By 1942, when the purpose-built tunnels were finished, the Blitz had ceased so they were never used for shelter.

“It’s real. It’s emotional,” said Angus Murray, chief executive of The London Tunnels, standing in an arched steel cavern as London Underground trains rumbled overhead.

Mr. Murray, a former investment banker, hopes to turn the tunnels into a memorial to the Blitz, which he says will be part museum, part exhibition and part entertainment space.

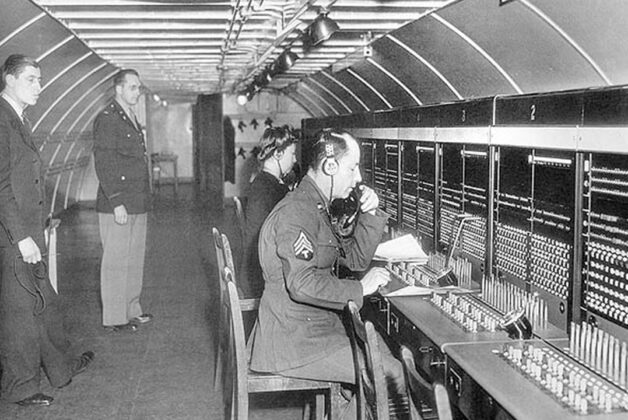

The tunnels housed spy headquarters in 1944, when James Bond author Ian Fleming worked in them for naval intelligence. The location is believed to have inspired Q Branch, where Bond goes to get his specialist equipment.

Thirty meters (100 feet) down, the underground citadel is a maze of old generators, pipes and rusty bolts. Bundles of wires dangle from the walls, which are dotted with dials, switches, and levers.

There are also the remains of a staff bar and canteen for the 200 people who worked in the tunnels in the 1950s and ’60s when it served as a telephone exchange.

Since the 1970s, the tunnel network has mostly stood empty.

Mr. Murray estimates the plan to create a tourist attraction, which was approved by the authorities last year, will cost around £120 million ($149 million). His company hopes up to 3 million people a year will pay over £30 ($37) to visit the space.

He likened its expected impact on tourism to the London Eye observation wheel, which opened 25 years ago and attracts more than 3 million visitors annually.

The tunnels will be ready for the public by late 2027 or early 2028, Mr. Murray said, adding they would be operated by an entertainment company familiar with running visitor attractions.

“In London, if one thing works, it’s tourism,” he said. — Reuters