CCP presents Dance On!

FILIPINO dancers and choreographers have responded to the changing times through Dance On!, the culminating performances of the Cultural Center of the Philippines (CCP) Professional Dance Support Program. Amid the challenging situation brought by the COVID-19 pandemic, the CCP initiated a special program to support the professional dance industry in the country. The program is under the mentorship of National Artist Alice Reyes, and dance masters Alden Lugnasin and Nonoy Froilan. Every week until Dec. 5, a series of dance performances will premiere live online on the CCP Facebook and YouTube Channel. The dance videos will remain posted on the CCP Online YouTube Channel after their live premieres. Premiering on Oct. 31 is the dance Light, at the end of, by choreographer Patrick John Rebullida, which explores what it means to value each part of the life cycle in equanimity. With music by Jose Buencamino, dancers John Ababon, Luigie Barrera, Justine Orande, Erl Sorilla, Sarah Alejandro, Stephanie Santiago, Jessa Tangalin, Regine Magbitang, and Nicole Barroso show through movement that all the pain, suffering, and death are but part of an evolution. Upcoming performances are: Nov. 7, Inlababo and In the Midst of Overcoming, featuring the music of Eddie Peregrina and choreography by John Ababon, and Nov. 14, Headspace, by choreographer-dancer Roneldon Yadao; Nov. 21, Re-FORM by choreographer Biag Gaongen; Nov. 28, Now by choreographer Lester Reguindin; and, Dec. 5, I Wanna Say Something by Choreographer JM Cabling. For more information, follow the official CCP social media accounts on Facebook, Twitter and Instagram, and visit the CCP website www.culturalcenter.gov.ph.

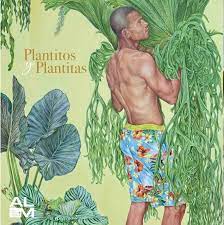

Art Lounge Manila presents ‘Plantitos y Plantitas’

ART Lounge Manila opens the exhibition “Plantitos y Plantitas” with partner plant atelier Arid and Aroids. “Plantitos y Plantitas” is an art-and-plant exhibition where the gallery is also an indoor landscaped garden inside the Podium Mall. It runs until Oct. 30. Presenting their works are painter-sculptor Tet Ureta Aligaen, botanical painter Dindon Cordova, painters Inka Madera, Julie Gil, Anna de Leon, Kristine Lim, Carlo Magno, Christian Mirang, Francis Nacion, Lisa Villasenor and mixed media artist Melissa Yeung Yap. For inquiries, call 0977-839-8971 or 0998-993-7963, or e-mail info@artloungemanila.com. For updates on upcoming shows, visit https://artloungemanila.com.

Consignments accepted for auction

SALCEDO Auctions is accepting consignments until the end of the month for the Under the Tree: The Wish List Gavel&Block Holiday auctions. The auction will be held live and online on Nov. 27. For more details on consignments, visit https://salcedoauctions.com/getting-started/sell. For inquiries, e-mail info@salcedoauctions.com, or contact 8823-0956 or 0917-107-5581.

Intramuros to open venues for exercise

AS INTRAMUROS reopens its sites, museums, and indoor attractions, to provide the public with alternative and safer venues for leisurely activity, the Intramuros Administration (IA) will soon open its open-air sites as venues for morning exercises exclusively for the vulnerable population starting Oct. 30. The vulnerable population, namely the senior citizens, persons with disability (PWD), pregnant women, and persons with health risks will be allotted two hours every Saturday from 8 to 10 a.m., to do their morning exercises at Fort Santiago and Baluarte de San Diego. Through an advance ticket reservation system, vulnerable individuals who are fully vaccinated can avail of this exclusive arrangement. The program for the fully vaccinated vulnerable population is open every Saturday, beginning Oct. 30, and can be booked through the following link: bit.ly/3ilptmu. For more information, the public can visit the social media accounts of Intramuros Administration on Facebook, Twitter, and Instagram. Inquiries may also be directed to tourism@intramuros.gov.ph.

Photo club holds exhibit-sale for kid’s education foundation

THE ZONE Five Camera Club (ZVCC or Zone V) is holding an online exhibit and charity sale at www.zonev.org from Oct. 23 to 31. Called “Images of H.O.P.E. (HELPING OTHERS PROSPER & EXCEL)”, the week-long event will showcase some of the best still camera work by Zone V. Proceeds from the sale will benefit the Assumption Development Foundation, a non-profit organization dedicated to the learning development of select youths of Sapang Palay, Bulacan. Featured will be color and black & white prints from its 50 members, including the club’s Ambassadors of Zone Five, a group composed of Jay Camus, Manny Inumerable, Cha Pagdilao, James Singlador, Danny Yu, and Ruben Castor Ranin, who was himself a recipient of an ADF scholarship.

Ateneo Art Gallery holds INK exhibit

ANG ILUSTRADOR ng Kabataan (Ang INK), the country’s first and only organization of illustrators for children, presents a fresh collection of artwork sharing personal experiences of members in response to the prompt: “What is your INK story?” Currently, Ang INK has more than 70 active members who are illustrators, graphic designers, painters, writers, teachers working in educational institutions, publishing companies, and design and advertising agencies. The exhibit, “INK Story: 30 Years of Ang Ilustrador ng Kabataan,” is ongoing at the Wilson L Sy Prints and Drawing Gallery of Ateneo Art Gallery (AAG). While the AAG remains closed to the public until further notice, Ang INK and AAG will release an online walkthrough of the exhibition through their respective social media accounts and websites. Inquiries about the exhibit and AAG’s reopening may be sent via e-mail at aag@ateneo.edu.

Ateneo lecture tackles gender violence in pop culture

TO CELEBRATE Time’s Up Ateneo’s (TUA) second anniversary, is will hold “Confronting GBV in Pop Culture,” featuring two short lectures, which will focus on care, community, and how to forward anti-gender-based violence in everyday physical and discursive spaces. The lectures will be followed by breakout sessions where audience members can have a discussion with the speakers. The event will be held on Oct. 30, from 8 to 9:30 p.m. via Zoom. Register via this link: https://tinyurl.com/TUAOct30. Links will be sent to registrants a few days before the event. The first lecture is entitled “The Look of Lust: On the violence of the gaze” by Dr. Ninotchka Mumtaj “Taz” Albano, who draws attention to gender-based violence implied by the objectifying gaze in pop-culture (fashion, movies, media) where spectators take part in objectification, sexualization and oppression. The second lecture is “Cancel Your Darlings: Towards a shared reckoning with fraught art” by Bee Leung. Her lecture imagines the possibilities of transformative community readership beyond the poles of cancel culture and separating the art from the artist. If we do not want to deny the harm texts and their creators may cause, then we need the right vocabularies and venues to explore what, if anything, there is to be reclaimed.

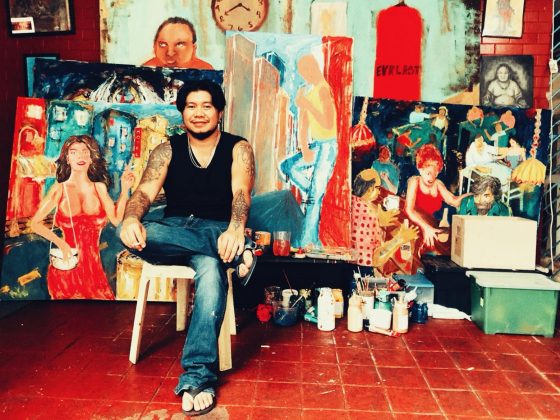

Crimson Boracay announces first artist-in-residence

IN LINE with its thrust towards becoming a center for arts and culture in the heart of Boracay, Crimson Resort and Spa Boracay has announced the appointment of its first-ever artist-in-residence, Eric Egualada. This creative residency will run for four months and include a number of activities. Mr. Egualada will be handling on-site painting classes and art-related workshops for guests, local residents, and staff members, as a way of encouraging them to become more creative and expressive. As artist-in-residence, Mr. Egualada will be involved in Crimson’s ARTS in Youth initiative wherein Crimson will sponsor several young students in their artistic education. Other creative pursuits currently in the pipeline for Crimson include a series of art exhibitions and workshops, art and food events, as well as a series of demonstrations by some of the country’s best visual artists. Mr. Egualada, a native of Angono, Rizal, has been painting for over 35 years and is an alumnus of the Jose Rizal University in Mandaluyong. An educator as well as an artist, he taught at the Angono National High School. Likewise, he trained for four years with the Department of Education, the Cultural Center of the Philippines, and the special arts program of the Dalubhasaan sa Edukasyon, Sining, at Kultura. Visit www.crimsonhotel.com or follow @CrimsonBoracay on Facebook and Instagram for more information.

Filmmaker Richard Somes holds first solo exhibit

FILM and TV director Richard Somes is holding his first solo exhibit in a move he calls is a fulfillment of his childhood dream and a way for him to cope with the pandemic. Mr. Somes, known for films such as Yanggaw, We Will Not Die Tonight (2018) and Historiographika Errata (2017), taught himself how to paint which eventually led him to sideline as a tattoo artist. He became a production designer and a film director with 24 directorial credits to his name. When the pandemic struck in 2020 and the entertainment industry locked down, Mr. Somes took up painting to cope with anxiety and depression. His first solo exhibit, is ongoing at the Secret Fresh Gallery at the Ronac Art Center in San Juan City. It features 10 of his works. The exhibit’s titled Inside the Mind of Richard V. Somes.

Cebu Design Week to hold Art Fair

CEBU Design Week, in collaboration with the National Commission for Culture and the Arts (NCCA), is presenting the Visayas Art Fair: Connecting the Islands Through Art on Nov. 25-28, at Montebello Villa Hotel, Cebu City. The Visayas Art Fair is part of NCCA’s celebration of Museums and Galleries Month in the month of October. Dates were moved to November because of the COVID-19 pandemic. The Visayas Art Fair 2021 is a historical undertaking to unite three regions (Regions 6, 7, and 8) of the Visayas to present their Visayan identity, arts and culture to the world. Simultaneous with the visual arts exhibition will be art demonstrations, art talks, musical performances, among others, showcasing Visayan creativity.

Ayala Land unveils underpass ceiling mural

AYALA Land unveiled a vibrant mural featuring various flora and fauna from various regions of the Philippines at the Legazpi Underpass in Makati. According to the mural’s lead artists Janica Rina and Jerson Samson, “It also tells the story of how humans and nature can harmoniously thrive together and also reminds us to value the natural treasures in our homeland.” They were assisted by displaced artists in completing this mural. The Legazpi Underpass stands parallel to Ayala Avenue at the heart of the MCBD and it connects the Ayala Triangle Gardens and Ayala Center. Other underpasses in Makati that have ceiling murals are the Salcedo Underpass and the Ayala Avenue Underpass. To watch the official unveiling of the Legazpi Underpass mural, visit the Make It Makati Facebook page: https://fb.watch/8JTZf-hCrl/.

Globe’s new sculpture lights up

GLOBE took part in the 2021 National Mental Health Week celebration by lighting up its blue lobby glass sculpture at its headquarters, The Globe Tower, on Oct. 8. The glass sculpture, called The Flow, is a Bohemian hand-blown glass designed by Libor Sostak and developed by Lasvit exclusively for Globe. It is inspired by “The flow of data in virtual and infinite space that are spreading to all directions over the globe.” “Light Up Blue for Mental Health” is an initiative by the Philippine Mental Health Association (PMHA) and several other partners to put the spotlight on mental wellness and its importance, especially during the pandemic. The color blue as a symbol of serenity, peace and calmness provided a beacon of hope during this time of health crisis. It was the second time for the annual activity to be held locally. Establishments and institutions that supported the campaign include the Philippine International Convention Center, National Museum, Quezon City Government, Lourdes School of Mandaluyong, DepEd Tayo Kapangan National High School, Ambangeg National High School, Philippine National Police Cordillera, Adamson University, UP College of Public Health, and the Ifugao United Action Force: among others. As an advocate of mental health for almost a decade now, Globe has programs such as HOPELINE, a round-the-clock suicide prevention and crisis support desk created in 2012 with Globe providing the necessary technology for its operations. HOPELINE can be accessed using the HealthNow app’s Urgent Help button on the welcome page. Another initiative is HopeChat, a mental health consultation platform developed with Australia-based Virtual Psychologist for employees. It was piloted to over 8,000 employees back in July 2020 to help them deal with the psychological impact of COVID-19. Globe also partnered with Bantay Bata 163, a child welfare program of ABS-CBN Lingkod Kapamilya Foundation, Inc., which protects disadvantaged and at-risk children through a nationwide network of social services. Bantay Bata #163 and the HOPELINE 2919 are toll-free for all Globe and TM customers.