TOKYO — Japan’s central bank has stumbled into a rare public relations storm that has dragged debate about its ultra-low interest rates out of sterile boardrooms and into tabloid and social media, amid surging household ire over rising living costs.

Bank of Japan (BOJ) Governor Haruhiko Kuroda issued an unprecedented public apology and retraction earlier this month after comments that households were more “accepting” of retail price hikes triggered a flurry of angry tweets.

Once regarded for its masterful communication of complicated monetary policy to the world’s largest and shrewdest investors, Mr. Kuroda’s recent fumble shows the BOJ much less skilled at managing the wider public’s price expectations.

That could force the BOJ to rethink the way it communicates policy intentions to a population active on social media and unaccustomed to rising prices after decades of deflation or subdued price growth, three people familiar with the bank’s thinking say.

“The fact the governor had to take back his comment shouldn’t be taken lightly,” one of the sources told Reuters. “It’s become harder now to speak about changing public perceptions.”

Those concerns come amid broader questions about the credibility of central banks globally, which have drawn public fire recently for underestimating the inflationary hit to consumers and businesses from supply chain disruptions and the Ukraine war.

Public anger has been particularly strident in Japan where tabloids and television programmes criticized the 77-year-old Mr. Kuroda as someone earning a fat salary and out of touch with the pain households are facing from rising costs.

“What’s heightening is not households’ tolerance of price rises, but frustration over Kuroda’s BOJ,” Japanese tabloid Shukan Post wrote in its recent edition.

“He’s an elite celebrity who bought a luxury condominium with cash,” wrote a weekly magazine catering to housewives, taking aim at Mr. Kuroda’s salary which, at roughly 35 million yen ($258,608), is more than eight times the average Japanese households earned last year.

The BOJ told Reuters it would not comment on media reports about the governor’s private affairs.

Online, web searches made in Japanese for Mr. Kuroda’s name spiked this month to more than double the historical peak hit of April 2013, according to Google Trends, bringing unwanted public attention to the central banker whose term as governor ends next year.

“He should look at the people shopping. No one is willingly paying higher prices. They’re doing so to survive, while sighing of discontent,” wrote one Twitter user.

“Needless to say, we have no choice but to buy food and daily necessities even if their prices soar. People are absolutely not accepting price hikes,” wrote another tweet.

HECKLED, NOT HAILED

After almost a decade leading efforts to shock Japan out of deflation with a wall of money, Mr. Kuroda has finally accomplished his mission: he has stopped an economically debilitating rise in the yen and propped up inflation to his 2% target.

However, instead of being praised, he has been pilloried.

That’s because inflation is rising for the wrong reasons.

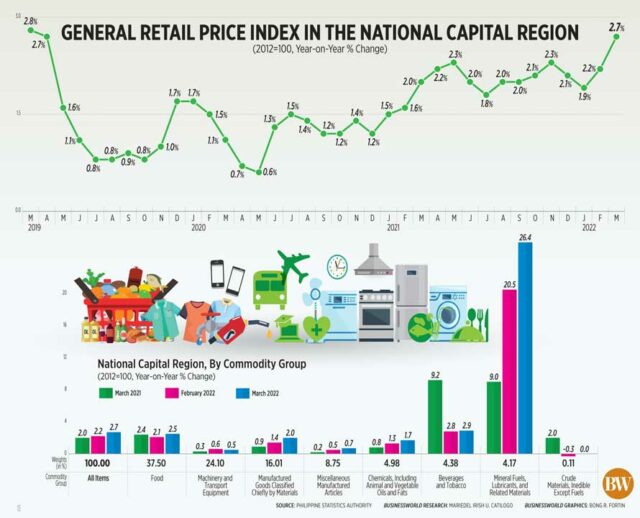

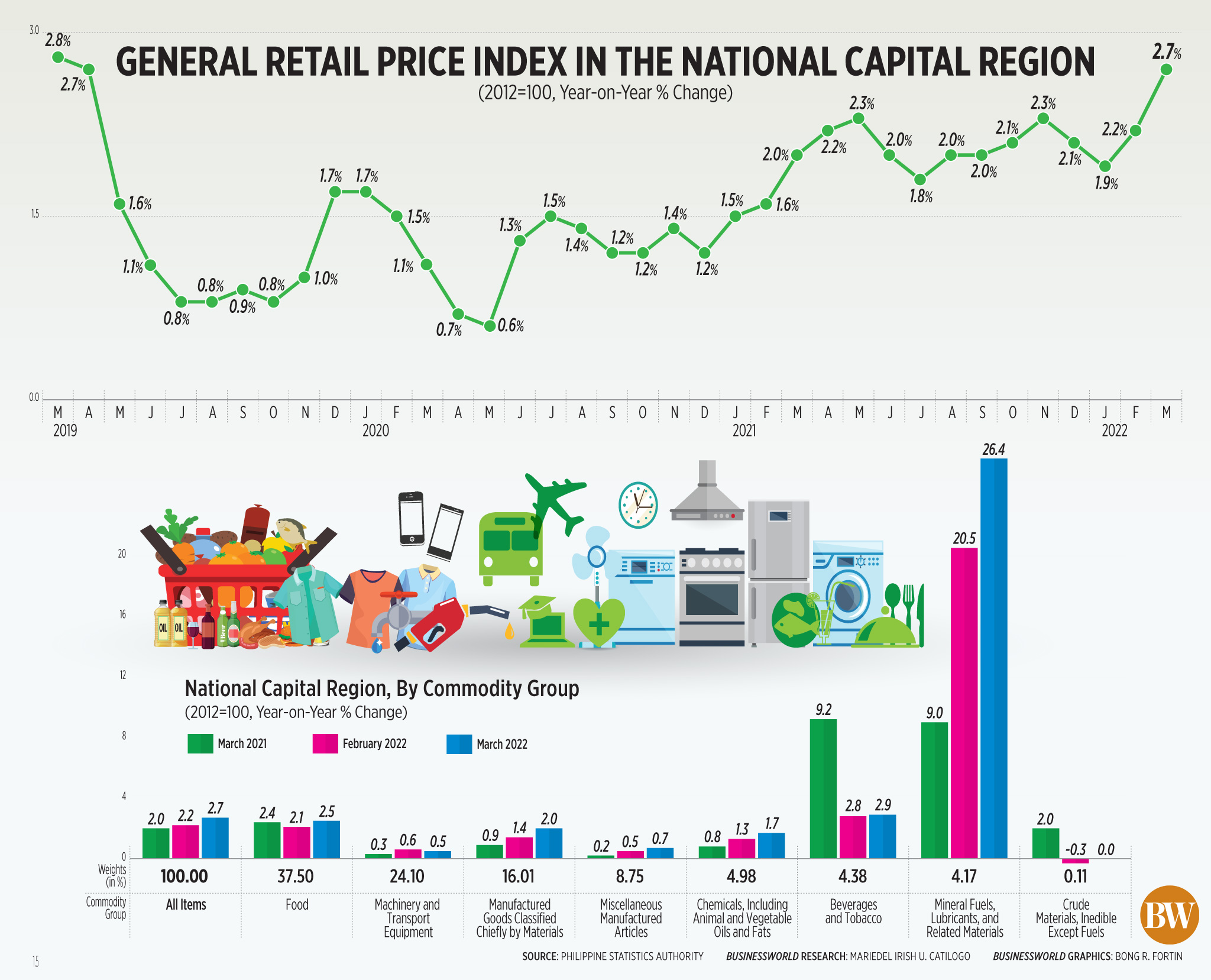

Consumer inflation exceeded the BOJ’s target for two straight months in May, but mostly due to the soaring cost of fuel and raw material imports rather than strong demand.

Unlike in Western economies, rising inflation has yet to spark strong wage growth as the economy’s delay in recovering from the pandemic discourages firms from raising pay.

In fact, wages remained flat in Japan in the decade to 2020, contrary to a 13% rise in the United States, Organisation for Economic Co-operation and Development (OECD) data showed.

“Japan is inherently a country less tolerant of price hikes, so even a small rise in inflation triggers a big public response,” said Izuru Kato, chief economist at Totan Research.

“People want prices to go down, while the BOJ wants to push it up. That gap will make the BOJ’s communication with the public extremely difficult,” said Mr. Kato, a veteran BOJ watcher.

‘UNFIT FOR JOB’

Mr. Kuroda’s remarks on June 6 were not just an off-the-cuff gaffe, but part of a speech carefully prepared by BOJ staff.

Speaking before business executives and market players at a seminar, Kuroda said households’ tolerance for price rises had increased, allowing firms to charge more for goods.

“This can be regarded as an important change from the perspective of achieving sustained inflation,” the governor said.

BOJ officials say the speech was intended to explain the need for wages to rise more to ensure households can keep paying more. That message was lost when newspaper headlines focused on his comments about households accepting price rises, rather than his arguments for pay hikes.

Mr. Kuroda was forced to retract his comment and apologize for any misunderstanding, marking an extremely rare reversal for the head of an institution proud of its independence from political meddling.

Many in the BOJ, including those at the board, were caught off guard by the reaction and initially struggled to understand why it drew fire on social media, the three sources who spoke to Reuters said.

“The BOJ has been saying similar things in the past. But the reaction was big this time partly because inflation was actually perking up and hurting households,” one of the sources said.

The BOJ lacks a playbook on how to deal with such cases beyond apologizing to politicians and clarifying its intentions at Kuroda’s public appearances, they said.

At the BOJ, public relations is handled by staff who rotate positions once every few years, rather than by professionals with experience dealing with media.

“I don’t think they thought about the comprehensive impact of the message on the entire audience universe, including how the media would react,” David Wagner, a media specialist with experience with Japanese organizations for two decades, said of Mr. Kuroda’s comments.

“They have to make sure that their messages are really strategically considered before they release them,” he said. “Not complicated, not rocket science — it’s pretty simple.”

A MESSAGING MESS

That communication challenge could become even more critical as the central bank increasingly communicates its view on future price moves and an eventual exit from ultra-loose policy.

Public discontent over Mr. Kuroda also risks undermining the BOJ’s credibility and leaves it vulnerable to political attack.

Opposition parties jumped on Mr. Kuroda’s remark as a perfect opportunity to attack the government’s stimulus policies.

“It’s a comment insensitive to what people are going through,” Kenta Izumi, head of Japan’s leading opposition, said on Kuroda’s remark, urging the BOJ to end its zero interest-rate policy to stem yen falls that were pushing up import costs.

A survey by Kyodo news agency, taken on June 11–13, showed 77.3% of respondents thought Kuroda’s comment was inappropriate, and 58.5% thought he was unfit for the job. Over 70% said they will take into account soaring prices in voting at the election.

So far, Prime Minister Fumio Kishida is defending Kuroda and his ultra-loose monetary policy, saying repeatedly that there was no need to change the BOJ’s stimulus policy.

But some ruling party lawmakers have not hidden their discomfort over Mr. Kuroda’s remark, which came weeks ahead of an upper house election slated for July 10.

While a weak opposition means Kishida’s Liberal Democratic Party is expected to stay in power, Kuroda’s remark and public concern over rising inflation may affect the premier’s popularity. That, in turn, could affect Kishida’s choice of next BOJ governor when Kuroda’s term ends in April next year.

“Frankly, it doesn’t help for Kuroda to talk about households accepting price rises,” said ruling party lawmaker Shoji Nishida. “It’s particularly so as we’re facing an election.” — Leika Kihara and Kantaro Komiya/Reuters