Shang’s The Marketplace holds farmers market

IT is all set to be a “Dealightful” month as Shangri-La Plaza’s The Marketplace is bringing back its popular Farm to Table market at the Grand Atrium on Aug. 4-7 to continue its support of local farmers. The farmers’ market features a wide range of locally grown organic products, as well as some carefully curated imported selections. It also introduces a number of new experiences for mall guests this year, including the Dizon Salad Bar that lets shoppers create their own salads using fresh ingredients on the spot. For P999, mall guests can join the Fresh Harvest All-You-Can, where they can fill their baskets with as much produce as they can in 60 seconds. This will be held on Aug. 6 from 3-9 p.m. The Marketplace is also supporting the Make-A-Wish Foundation — every purchase at Farm to Table helps fill care boxes with fruits and vegetables for children who are battling critical illnesses. For updates and inquiries, follow Shangri-La Plaza on Facebook at www.facebook.com/shangrilaplazaofficial and on Instagram @shangrilaplazaofficial.

Mimi & Bros marks International Beer Day

MIMI & BROS at BGC will celebrate International Beer Day on Aug. 5, Friday. From Aug. 5-7 (while supplies last) customers will get a free bottle of beer for every purchase of chicken wings. The signature Mimi & Bros Chicken Wings come in four variations: Bobby’s Honey Lime Wings, Eddie’s Buffalo Wings, Mimi’s Truffle Honey Butter Wings, and Fish Sauce Caramel Wings. Make a table reservation by sending Mimi & Bros a Viber message at 0945-798-5176.

Mid-Autumn Treasures at Marco Polo Ortigas Manila

MARCO Polo Ortigas Manila marks the Mid-Autumn season with Lung Hin’s premium mooncakes. This year’s featured flavors are: Red bean with double egg yolks, Red lotus seed with double egg yolks, White lotus seed with double egg yolks, and Black sesame with double egg yolks. Customers may order individual boxes at P918, boxes of four mooncakes at P3,258, or boxes of six mooncakes at P4,388. Limited-edition Treasure Chests are also available. The custom-made treasure chests of four and six mooncakes are available at P3,538 and P4,638, respectively. Limited-time savings of 20% are applicable on orders of at least 10 boxes of four or 10 boxes of six, for orders placed until Aug. 31. Lung Hin’s mooncakes will be available starting Sept. 1. Lung Hin is located at Level 44 of Marco Polo Ortigas Manila. To know more about the hotel, visit www.marcopolohotels.com.

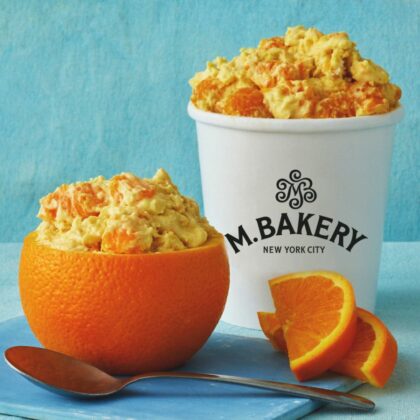

4 new desserts mark M Bakery’s 4th year

M BAKERY has provided freshly baked classic American desserts to Filipino foodies for the last four years, opening two branches — BGC and Rockwell Powerplant Mall — and continuing to expand its dessert menu. To mark its 4th anniversary this month, M Bakery introduces four new desserts: two new featured pudding flavors as M Bakery’s Flavors of the Month, and two other desserts. The new pudding flavors are Orange Cream Soda Pudding which combines orange juice, vanilla wafers, and mandarin oranges with vanilla pudding (small P165, medium P315, large P505; and a small party bowl serving eight for P2,200 and a large party bowl serving 20 for P3,250), and S’mores Banana Pudding, which is chocolate pudding layered with graham crackers, marshmallow fluff, marshmallows, bananas, and chocolate chips (small P155, medium P305, large P395, small party bowl P2,200, and large party bowl P 3,250.) The other two desserts are Banana Pudding Cookie, packed with white chocolate chips, vanilla wafers, and Banana Pudding mix (P120 apiece) and Fully Loaded Icebox Pie with a chocolatey double fudge brownie crust is layered with cream cheese filling, fudge icing, and topped with whipped cream, caramel drizzle, mini chocolate chips, chopped Kit Kat bars, and chunks of Milky Way bars. Place an advance order for the nine-inch pie (P2,200) or avail of the bar (P395). There will also be a promo: visit M Bakery’s social media pages on Aug. 21, then four lucky winners from Instagram and Facebook will be selected on Sept. 22 and will win P4,000 gift cards and limited-edition M Bakery scented candles.

SaladStop! brings back Cauli-fornia Dreamin’

SALADSTOP! has added a classic seasonal favorite to join the Daily Bowls line-up of exclusive salads for subscribers. Previously available in 2019 and 2021 as a seasonal salad, the Cauli-fornia Dreamin’ salad is a mix of romaine, red and white cabbage, cauliflower cheese patty, broccoli, cherry tomatoes, baked mushrooms, carrots, mandarin oranges, dried cranberries, and pumpkin seeds, tossed in a creamy Basil Pesto dressing. Unique to this vegetarian salad is the Cauliflower Cheese Patty, which is made from scratch using three different types of cheeses: feta, parmesan, and cheddar. The Cauli-fornia Dreamin’ salad or wrap is now available as a Daily Bowls Exclusive. As a special treat to launch this new exclusive on the Daily Bowls menu, subscribers can enjoy 15% off on all Daily Bowls subscriptions when they sign-up until Aug. 6 at saladstop.pickup.ph. (Delivery of subscriptions start on Aug. 8.) The Daily Bowls Exclusives menu is a lineup of never-before-released salads, wraps, and warm proteins that can only be ordered with a three-day or five-day plan. Daily Bowls Exclusives are available for delivery on Fridays with every subscription plan.

Jollibee introduces new Chicken a la King Pie

JOLLIBEE is now serving Chicken a la King Pie, a new and uniquely crispy twist on a creamy classic. It features a creamy chicken-based filling in Jollibee’s signature crispy golden pie crust. Jollibee’s Chicken a la King Pie is now available in all stores nationwide for P59 (Solo), P99 (Value Meal with drink), P140 (Super Value Meal with fries and drink), and P175 (Trio). It can be delivered via the Jollibee Delivery App, JollibeeDelivery.com, #87000, GrabFood, and foodpanda. It is also available in-store, drive-through, and for take-out.

Burger King is temporarily renamed Chicken King

WITH the arrival of its newest chicken sandwich player, Chicken King, Burger King has seen it taking over BK stores. In photos launched on Burger King Philippines’ Facebook page, the restaurant’s facade, menu board, and dining area, is now all about the Chicken King. The chicken sandwich contains a generous chicken thigh muscle patty (marinated in herbs and spices and cooked to a golden brown) which is tucked between buttery potato buns with fresh tomatoes and lettuce, and topped with mayonnaise. The addition of Chicken King to BK’s menu is the restaurant’s latest move to expand its kingdom in the chicken sandwich territory. Chicken King is now available at select stores in Mega Manila, Pampanga, Rizal, Cavite, Laguna, and Bulacan, and can be ordered via BKdelivery.com.ph, and partner delivery services like Grabfood and Foodpanda.

7-Eleven now has Korean snacks

THE HALLYU or Korean wave continues as 7-Eleven brings the Korean trend to its stores. The convenience store giant has launched 7-Fresh K-Style Snacks, a Seoul-inspired line from its 7-Fresh Asian series. The series, which started with Japanese rice snacks and kani salad, now adds Korean snacks: The K-Style Plant-based Chicken Burger (P95) made with UnMEAT patties, a buttery brioche bun, and authentic Korean glaze; K-Style Garlic Cream Cheese Bun (P49), made with a soft buttery bun and a special cream cheese garlic filling; and K-Style Egg Drop Sandwich (P85) with a buttery brioche, sweet and savory egg drop dressing, and Aguila Gourmet Meats ham. The 7-Fresh K-Style Snacks are now available in select 7-Eleven branches. The K-Style Egg Drop Sandwich is available in Rizal, Parañaque, Manila, Makati, Mandaluyong, Pasig, and Quezon City only. The K-Style Garlic Cream Cheese Bun and K-Style Plant-Based Chicken Burger are available in Rizal, Parañaque, Manila, Makati, Mandaluyong, Pasig, Quezon City, Muntinlupa, Cavite, Batangas, Laguna, and Quezon only.

Sofitel hosts a Viking party

EXPERIENCE Nordic heritage, cuisine, and culture all in one night at the SKÅL: Viking Party Manila on Sept. 24, at the Harbor Garden Tent, Sofitel Manila. There will be a buffet of Nordic delicatessen, accompanied by free-flowing drinks including aquavit, schnapps, and vodka. There will also be non-stop entertainment on stage, with hits from the 1970s, ’80s, and the iconic Swedish band, ABBA. There will also be a grand raffle with exclusive resort stays, worldwide air tickets, and other exclusive prizes from sponsors up for grab. Proceeds from this event will be donated to the Chosen Children Village Foundation, a home for mentally handicapped and orphaned children. This event is organized by the Nordic Chamber of Commerce of the Philippines in partnership with Sofitel Philippine Plaza Manila.

New drinks at Starbucks

TO CAP off the summer season, Starbucks is introducing new drinks and bringing back classic flavors. Two new Starbucks Refreshers beverages are now available: The Strawberry Açaí with Lemonade Starbucks Refreshers and the Pink Drink with Strawberry Açaí Starbucks Refreshers (both contain caffeine). Starbucks is also bringing back the Oatmilk Cocoa Series: Oatmilk Cocoa Macchiato Signature, espresso blended with smooth oatmilk and vanilla syrup, topped with cocoa sauce; Oatmilk Cocoa Frappuccino, a blend of oatmilk, espresso, and ice, topped with plant-based whipped cream, cocoa drizzle, and cocoa powder. The beverages are available in stores and via GrabFood and foodpanda. New on the menu are Chocolate Cherrific Cake, Strawberry Lemonade Cheesecake, Chunky Monkey Chocolate Cookie, Chocochip Brownie, Meatless and eggless breakfast sandwich on plant-based brioche bread, Banana Chocolate Cream Pudding, and Fusilli Meatless Bolognese. Returning to the menu are Kouign Amann and Blueberry Cheese Pocket. New Starbucks merchandise is also available Including Color Wave Cold Cups and the coffee company’s first Back-to-School collection. There is also an Eco-Camping line of tumblers and mugs made with stainless steel and compostable PLA. The merchandise is available in all Starbucks stores and on the Official Starbucks Flagship store on Lazada and Shopee while supplies last.