Cautious trading seen ahead of GDP, labor data

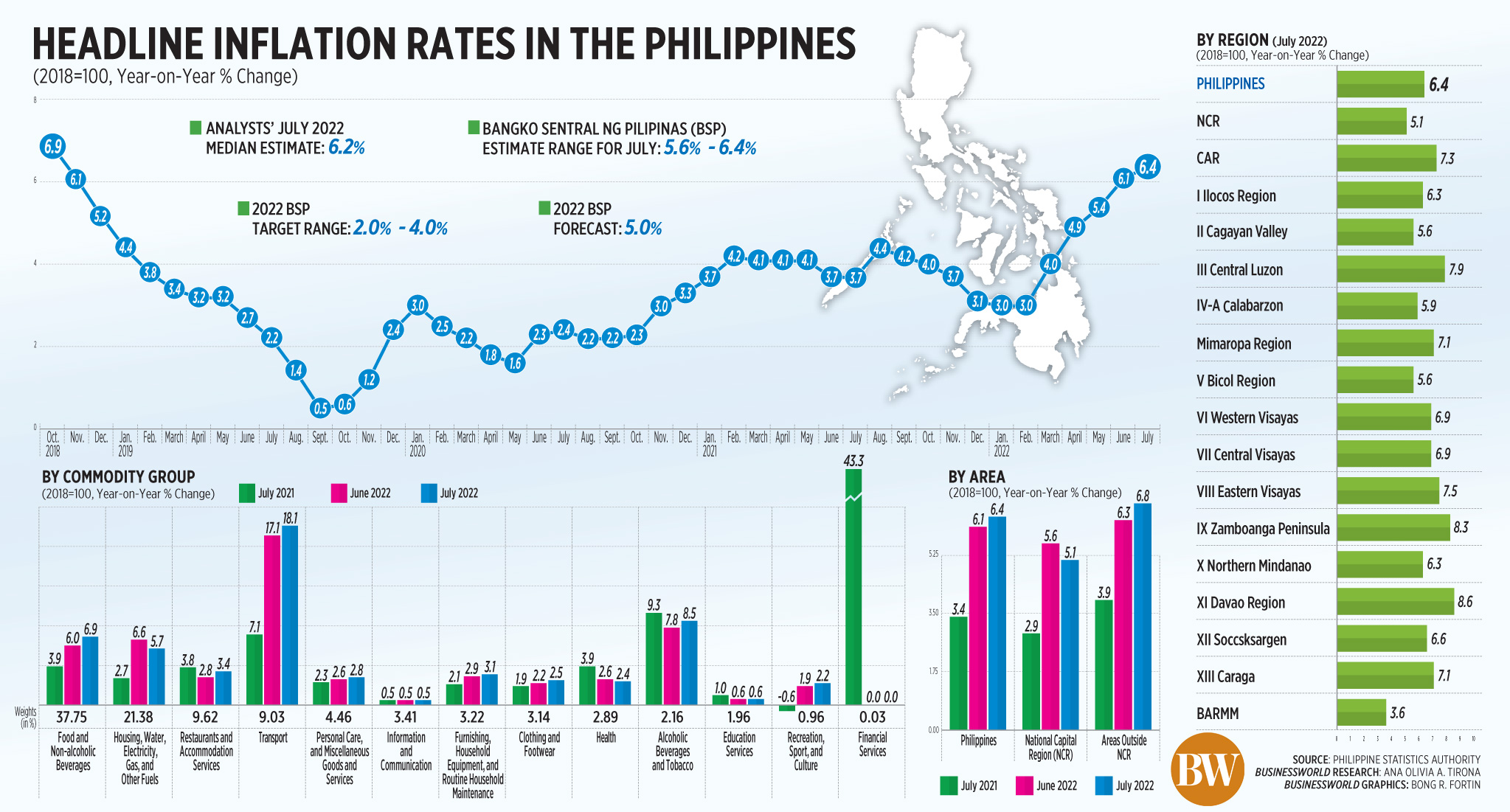

STOCKS may move sideways this week ahead of the release of latest Philippine gross domestic product (GDP) and labor data and expectations of an aggressive rate hike from the Bangko Sentral ng Pilipinas (BSP) next week after inflation hit another near four-year high in July.

The Philippine Stock Exchange index (PSEi) snapped its three-day rally on Friday, declining by 77.61 points or 1.19% to close at 6,405.50, while the broader all shares index went down by 29.70 points or 0.85% to 3,432.06.

Still, week on week, the PSEi went up by 89.57 points or 1.42% from its close of 6,315.93 on July 29.

“The index fell [on Friday] likely due to profit taking following three straight days of gains, as well as fund flows relating to the PSEi rebalancing,” China Bank Securities Corp. Research Director Rastine Mackie D. Mercado said in an e-mail.

“While investors appeared to have initially shrugged off the July inflation report, this may have eventually factored into investors’ reasons to secure some recent gains,” Mr. Mercado added.

For this week, he said that he expects continued market weakness due to the release of latest GDP and labor data on Tuesday.

“Reactive moves to those releases are expected, spurring volatility in the near term. However, we do note that recent momentum may be a product of investors’ bullishness on forward prospects despite prevailing risks — so there’s still a good chance of a continuation rally after these events,” Mr. Mercado said.

Philstocks Financial Senior Research Analyst Japhet Louis O. Tantiangco said the market is expected to remain cautious as investors continue to digest corporate results and ahead of the BSP’s policy meeting on Aug. 18.

“The robust Q2/1H corporate results may still give investors’ sentiment a boost. The market may deal with concerns over a possible aggressive policy action by the BSP in their meeting this August, however, following the July inflation print, which came in at 6.4%,” Mr. Tantiangco said in a Viber message.

“Investors are also expected to watch out for our second quarter GDP data and June labor data for clues on the health of our economy,” he said.

BSP Governor Felipe M. Medalla last week said the central bank still has room to hike borrowing costs without sacrificing the economy’s recovery as real interest rates remain negative. He said their planned hike of 25 basis points (bps) or 50 bps at their Aug. 18 meeting is still supportive of growth.

Meanwhile, a Businessworld poll of 18 economists and analysts last week yielded a median GDP growth estimate of 7.5% for the second quarter. This is lower than the 8.3% expansion in the first quarter and the 12.1% logged in the same period a year ago.

China Bank’s Mr. Mercado placed the PSEi’s immediate support between 6,380-6,400 range, and resistance at 6,600, while Philstocks Financial’s Mr. Tantiangco put immediate support at 6,400 and resistance at 6,600. — J.I.D. Tabile