Bootleg Beatles shows in Davao, Cebu canceled

CONCERT Republic has announced that The Bootleg Beatles concerts scheduled for the SMX Convention Center, Davao, on Oct. 27, and Waterfront City Hotel & Casino, Cebu, on Oct. 29 have been canceled. Their Manila show, scheduled on Oct. 30 at the Philippine International Convention Center, will proceed as scheduled. “Regrettably we have to cancel our forthcoming concerts in Davao and Cebu due to unforeseen production logistics,” said the Bootleg Beatles in a statement. “We apologize for any inconvenience caused and look forward to seeing you all in Manila!” the statement continued. Tickets for the Davao and Cebu concerts will be refunded at point of purchase, said a statement by Concert Republic.

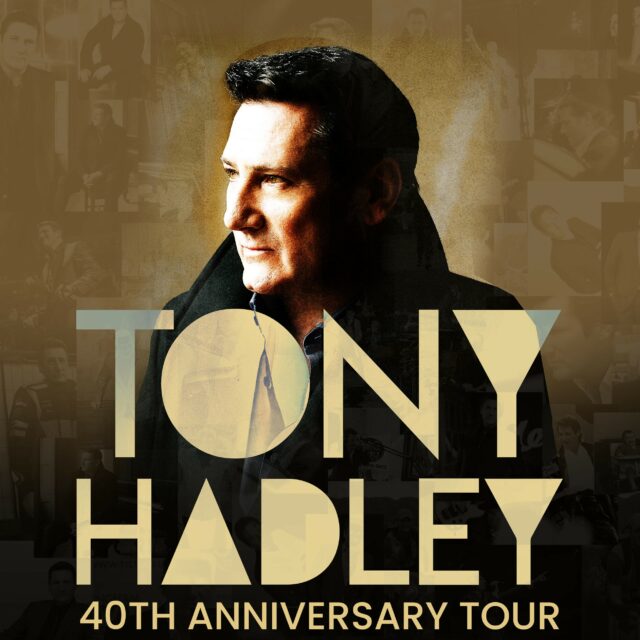

Spandau Ballet’s Tony Hadley performing in Manila

FORMER Spandau Ballet frontman Tony Hadley is 40 years in the music industry with a tour performing his most memorable tunes. Mr. Hadley will perform at the Newport World Resorts’ Newport Performing Arts Theater on Sept. 28, 8 p.m. Mr. Hadley rose to prominence during the New Romantics era of the 1980s with his former band, performing iconic hits “True,” “Gold,” “Lifeline,” “Round and Round” and “Through the Barricades.” In the 1990s, Mr. Hadley pursued a solo career and found his new sound — Euro House music. Tickets to the Newport Performing Arts Theater show are now available at all TicketWorld and SM Tickets outlets. Ticket prices range from P2,500 to P10,500. For inquiries, contact the Newport World Resorts National Sales Team at 0917-823-9602, 0917-807-9387, and 0917-658-9378, or call Ticketworld at (02) 8891-9999, or SM Tickets at (02) 8470-2222.

Delikado plays to a full house at Cinemalaya 2022

DELIKADO, the gut-wrenching documentary on Palawan’s threatened natural resources and valiant environmental defenders brought an emotional audience to their feet multiple times during its screening on Aug. 13 as the closing film of the Cinemalaya 2022 film festival. Delikado, a documentary on illegal logging in Palawan, drew the biggest crowd for Cinemalaya 2022, observed festival director Chris Millado. Directed by Agence France Presse’s Deputy Editor-in-Chief for Asia Pacific Karl Malakunas, the 96-minute environmental thriller documentary zeroes in on critical socio-environmental issues haunting Palawan, the Philippine’s last frontier. The documentary tackles mostly illegal logging, touches on illegal fishing, and mining, which, as the film uncovered, are largely instituted by big developers and politicians. Mr. Malakunas takes a jab at these issues through the lens of three grassroots champions: Palawan NGO Network, Inc. (PNNI) executive director Roberto “Bobby” Chan, former El Nido Mayor Nieves Rosento, and PNNI para-enforcer and land defender Efren “Tata” Balladares. “The power and energy in the room was just incredible. It is beyond my dreams to see how the film resonates with Filipinos and how it connects emotionally,” the film’s director said. The event ended on an emotional note as Tata Balladares’ daughter took the mic to express her deep appreciation for her father’s work. Speaking in the vernacular, she shared how she was unaware of the occupational hazards of being a para-enforcer prior to seeing the film. “Before, my father would say not to tell anyone he was my father because it is delikado (dangerous). But I stand before you now to say that even if it’s dangerous, I am proud to call you my father.” The documentary had a sold-out screening at the recently concluded Melbourne International Film Festival. It was awarded the Sustainable Future Award and Audience Award at the Sydney Film Festival 2022, the Special Jury Prize for Best Documentary Feature from the Los Angeles Asian Pacific Film Festival, and Special Mention for Best International Feature at Doc Edge, New Zealand. Mr. Malakunas hopes to bring the film to a wider audience, particularly among the youth and students, through nationwide screenings in the Philippines. For those interested in hosting a block screening, e-mail screenings@activevista.ph or call 0917-800-4409. To learn more about the film, visit delikadofilm.com or https://www.facebook.com/DelikadoFilm.

GMA’s Gozon-Valdes elected Senior Vice-President

GMA NETWORK, INC.’s Executive Committee elected Annette Gozon-Valdes on Aug. 17 as its new Senior Vice-President effective Sept. 1. In this role she will oversee the Talent Management and Development, Program Management, Human Resources, and Legal departments, and also the Worldwide Division and some subsidiaries in the Kapuso Network. Ms. Gozon-Valdes has been a director of GMA since 2000. She set up GMA New Media, the network’s digital media and technology arm and future-proofing agent, she led the team that distributed GMA’s shows to territories in Asia, North America, Middle East, and Africa, and was also instrumental in pushing for new partnerships with new global platforms and in bringing some of the best foreign shows to the Philippines such as Full House, Stairway to Heaven, and Jewel in the Palace. She was recently appointed as Consultant of Sparkle, GMA’s talent management arm and serves as President of GMA Films, Inc. She is also the Corporate Secretary of GMA Network, director of GMA Ventures, Inc. and Philippine Entertainment Portal, Inc. (PEP), Treasurer of Citynet Network Marketing & Productions, Inc., and a Trustee of the GMA Kapuso Foundation.

Complex to launch in PHL via KROMA

KROMA Entertainment, Inc. is bringing global youth culture brand Complex to the Philippines, launching Complex PH. “We are very proud to collaborate with Complex in a partnership that will expand their unique voice, content and other movements to the Philippines through the KROMA ecosystem of platforms,” Ian Monsod, CEO of Kroma Entertainment, Inc. said in a statement. “KROMA is all about elevating Filipino talent and content on the world stage and giving Filipino audiences new ways to access world-class entertainment. Working with a leading global youth brand like Complex, under media and entertainment giant BuzzFeed, is aligned with this goal.” The partnership with Complex was sealed with KROMA Publishing, the digital publishing network under Kroma Entertainment, Inc. Its portfolio features titles like Wonder.ph and FreebieMNL, as well as partner communities and creators LunchboxerPH, PinoyGamer, and TNC PRO ML. Complex is part of Complex Networks, which was recently acquired by BuzzFeed, Inc., and features a portfolio of brands and intellectual properties in key categories: fashion, food, music, and pop culture. The collaboration is expected to deliver new content available across different channels and media.

Ben&Ben to release new single this week

CRYPTIC billboards and posters alluding to a new Ben&Ben release have recently appeared in strategic locations all over Metro Manila. The material, which contains discarded film photos with texts exposing some personal thoughts, is said to be part of the lyrics of an upcoming Ben&Ben song to be released this week. The nine-piece Filipino collective tweeted what looks like a snippet of a lyric offering an intimate take on the painstaking process of letting go. Ben&Ben also dropped a performance video of “Stand By You,” featuring Indonesian artist Pamungkas. The collaborative visuals, recorded earlier this month at SoundCheck Studio, has racked up more than 220,000 views as of press time. Set for their North American tour, the band will be performing in nine cities in the US and Canada. Their send-off concert will be on Sept. 3 at the CCP Open Grounds.

Mcoy Fundales releases latest single

GMA NETWORK-affliated singer-songwriter and the original vocalist of Orange and Lemons, Mcoy Fundales releases a new single, “Ang Forever Ko’y Ikaw,” under AltG Records, a sublabel of GMA Music. The song was composed by Mr. Funadeles as a theme song for GMA’s romantic comedy series Ang Forever Ko’y Ikaw in 2018. Back then, the song was made up of only one stanza and chorus. He recently found the opportunity to finish it. “I want to put another stanza, arrange and record it properly,” Mr. Fundales said in a statement. The track which is produced by Kedy Sanchez, A&R Manager of GMA Music, is about the serendipity of falling in love and instantly knowing that the person is meant for you. Mr. Fundales is also planning to release an album. At present, he is one of the writers of the TV shows Pepito Manaloto, Bubble Gang, and All-Out Sundays. “Ang Forever Ko’y Ikaw” is available on all digital streaming platforms worldwide.

JINBO and Tala Gil release collaboration

TAIWANESE R&B singer-songwriter JINBO has shared the track “Over the Sea,” his collaboration with Universal Records Philippines artist Tala Gil. The song paints a picture of what it’s like to be in a long-distance relationship. The two artists’ connection formally began in September 2020 when JINBO messaged Tala Gil after discovering her music on Spotify. They hope that the indie-pop/R&B vibe of “Over the Sea” can give listeners comfort and delight. “Over the Sea” is available on all digital streaming platforms.