By Bernadette Therese M. Gadon, Researcher

AROUND 2.3 million Filipinos have been plunged into poverty between 2018 and 2021, as the coronavirus pandemic left lasting scars on the Philippine economy, according to the Philippine Statistics Authority (PSA).

Preliminary results of the 2021 Official Poverty Statistics estimated poverty incidence among individuals — the proportion of Filipinos whose incomes fell below the per capita poverty threshold from the total population — rose to 18.1%, from the 16.7% recorded in 2018.

However, the figure fell short of the government’s goal to bring down poverty incidence to 15.5-17.5% in 2021.

The PSA said the number of Filipinos living in poverty rose by 2.322 million to 19.992 million in 2021, from 17.670 million in 2018.

Socioeconomic Planning Secretary Arsenio M. Balisacan attributed the rise in poverty incidence to the strict lockdowns implemented to contain the spread of the coronavirus disease 2019 (COVID-19).

“The effects of the COVID-19 pandemic, including income and employment losses, caused the poverty incidence to rise. Restrictions on mobility and low earning capacity of poor households due to limited access to regular and productive jobs made the lives of Filipinos difficult,” Mr. Balisacan said at a press briefing on Monday.

Despite this, Mr. Balisacan is optimistic the Marcos administration will be able to achieve its goal of bringing down the poverty rate to single digit or 9% by 2028.

“We can say that given the greater opening up of the economy in 2022, more reduction in the unemployment numbers and underemployment numbers in 2022, it’s likely that the poverty incidence would be lower, despite the uptick in inflation,” he said.

The poverty data were derived from the Family Income and Expenditure Survey (FIES), which was conducted in July 2021 and January 2022. It covered 165,029 families for both rounds of the survey.

The PSA said it will now conduct the FIES every two years, with the next survey in 2023.

SUBSISTENCE INDICENCE

SUBSISTENCE INDICENCE

Meanwhile, PSA data showed the subsistence incidence among Filipinos — the share of those individuals with per capita income below the per capita food threshold to the total population — also increased to 5.9% in 2021, higher than 5.2% in 2018.

In absolute numbers, this translated to 6.545 million Filipinos falling below the monthly food threshold in 2021, 1.005 million more than 5.541 million in 2018.

Also, poverty incidence among families with five members jumped to 13.2% in 2021, from 12.1% in 2018.

This meant around 492,000 families were plunged into poverty in 2021, bringing the total to 3.496 million from 3.005 million in 2018.

Subsistence incidence among families — the share of Filipino families in extreme poverty — also went up to 3.9% from 3.4% in 2018.

This was equivalent to 1.039 million families whose income fell below the food threshold, about 200,000 more than the 840,000 families in 2018.

The poverty threshold or poverty line is the minimum income required for an individual or a family of five to meet the basic food and non-food needs.

An average Filipino needed at least P2,406 per month to meet his or her basic needs in 2021 compared with P2,151 a month in 2018.

For a family of five, they would need around P12,030 a month from P10,756 per month in 2018.

Food threshold is the minimum income required for an individual or a family to meet the basic food needs, which satisfy the nutritional requirements for economically necessary and socially desirable physical activities.

The PSA estimated the food threshold at around P1,676 a month for an average Filipino from P1,511 in 2018.

For a family of five, it was estimated at around P8,379 a month, higher than P7,553 previously.

The income gap, which measures the average amount of income required by the poor to get out of poverty line, was estimated at 22.6% in 2021 from 21.7% in 2018.

This meant that incomes of poor families fell by 22.6% short of the poverty threshold. In other words, a family with five members needed an additional monthly income of about P2,719 to emerge from poverty in 2021.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said that while the pandemic was mainly the reason, inequality may also be a factor as to why poor Filipinos remained poor or became poor over the years.

“Even if growth in the Philippines was relatively strong, not all were benefiting from the gains and thus certain segments still struggled to get themselves out of poverty and or certain segments slipped more quickly back into poverty due to the lockdowns,” he said via e-mail.

“Higher inflation and lack of access to credit may have also been a key as vulnerable households may not find lifelines to get through to the next paycheck,” he added.

Analysts said that the new administration will have to come up with ways to provide support and to create more quality jobs to bring down poverty levels.

“More subsidies can really help. But its sustainability should be firmly supported by higher and efficient revenue collections by government… The challenge is increasing and propping up real investment that create real sources of incomes for Filipinos,” UnionBank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said.

Mr. Mapa said the Philippine economy faces a “triple threat of higher prices, rising interest rates, and a fiscal handicap that may limit the ability of the government to provide support.”

“What the administration does in the next few months and during the remainder of the young [six] years will determine where FIES will be in [three] years. Government officials must look to address the key issue of inflation and job creation at the soonest as this would pave the way for faster and more equitable growth,” he added.

AVERAGE INCOME SLIPS

Preliminary results of the FIES also showed the average income of Filipino households declined by 2% year on year to P307,190 in 2021 from P313,350 in 2018.

Average spending of Filipino families likewise dropped by 4.1% to P228,800 in 2021 from P238,640 in 2018.

Adjusted for inflation, Filipino families’ income averaged P282,080 in 2021, down from P313,350 in 2018.

Similarly, an average Filipino family spending amounted to P210,100 under 2018 prices, lower than P238,640 in 2018.

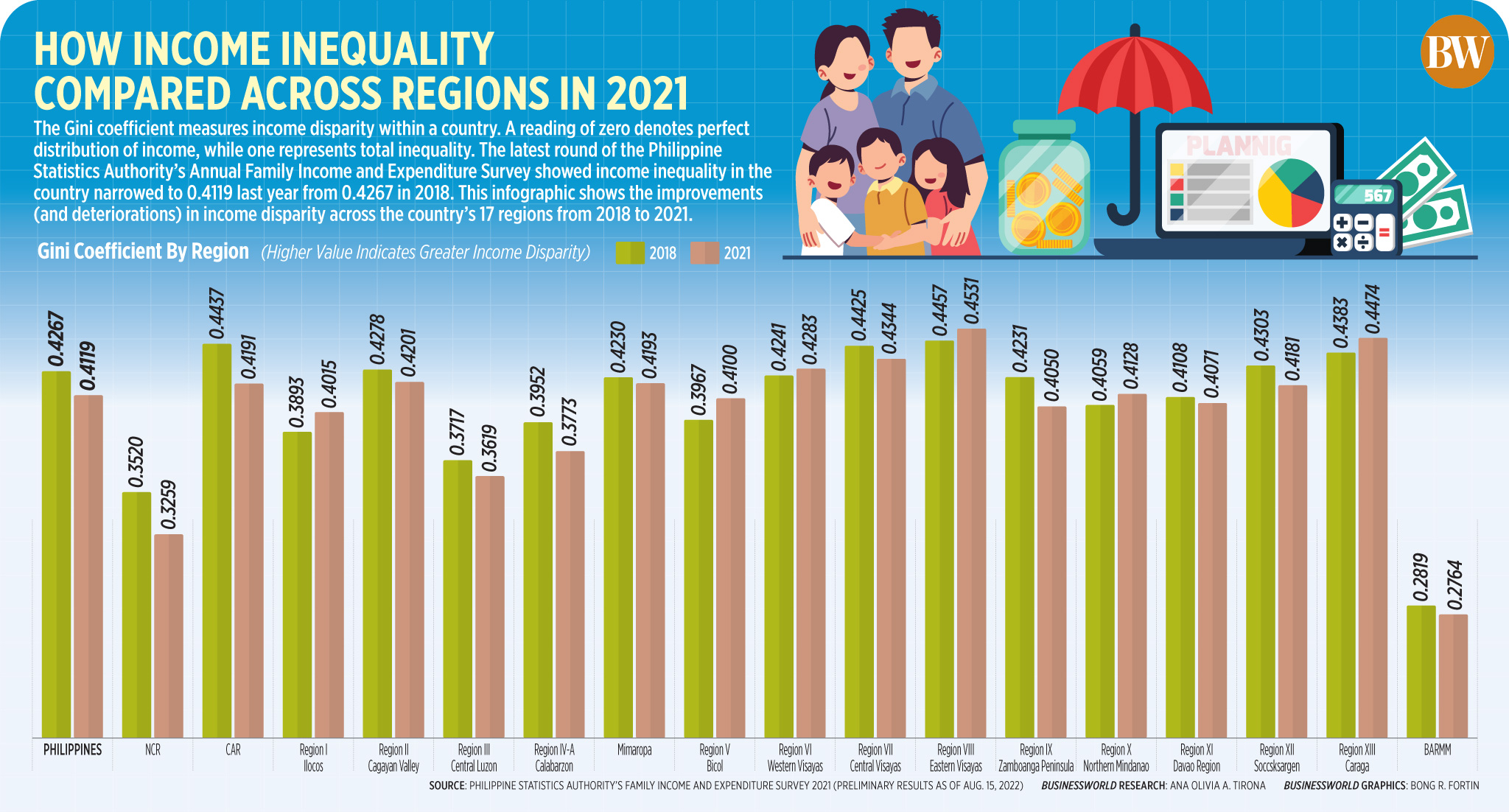

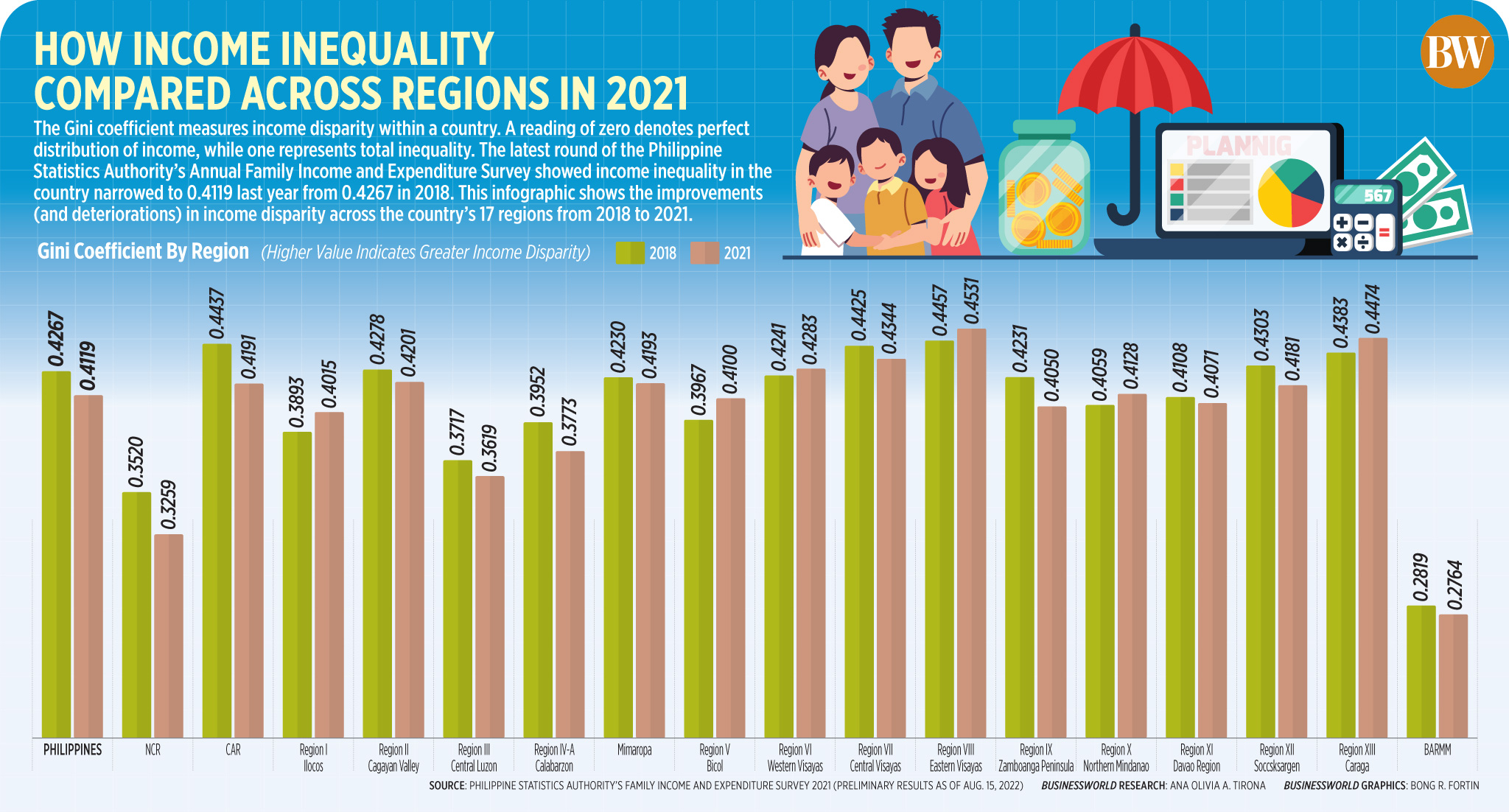

The Gini coefficient, which measures income inequality, dipped to 0.4119 in 2021 from 0.4267 in 2018. A Gini coefficient reading of 0 represents perfect equality, while 1 denotes perfect inequality.