Vitarich posts P89.4-M net income on higher sales

VITARICH CORP. announced on Monday that its net income last year grew to P89.4 million from P9.3 million in 2020, driven by higher sales from all its business segments.

“2021 not only delivered new revenue records across segments, but also pointed to higher long-term volume growth. Our strategy to expand our capabilities has been validated by market trends toward rising consumption of meat products and convenience food,” Vitarich President and Chief Executive Ricardo Manuel M. Sarmiento said in a statement.

“This formed the basis of our recent capital investments in the business, and as a result, we have good revenue visibility going into 2022,” he added.

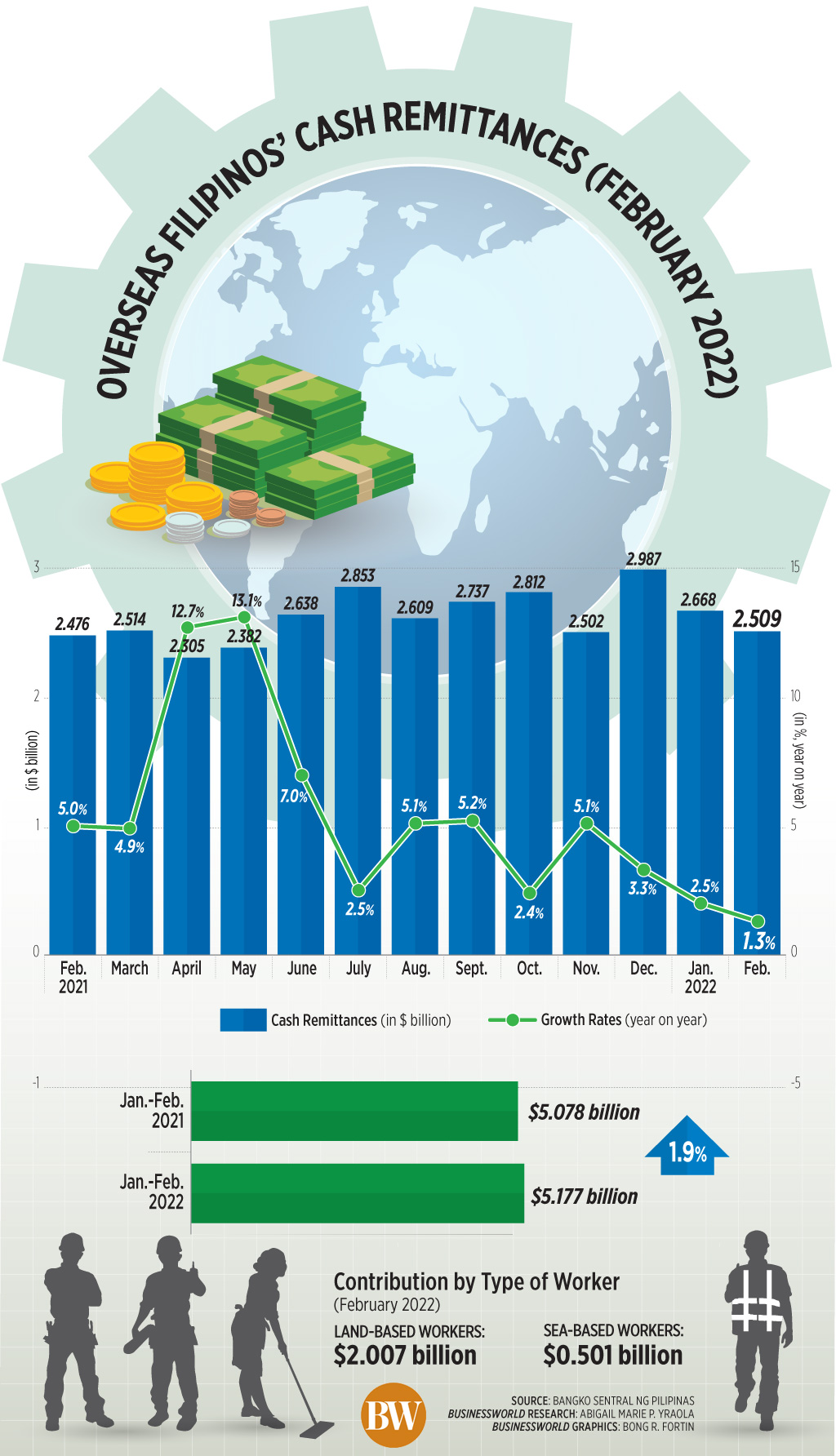

The company’s revenues were up 23% to P9.7 billion year on year, driven by growth in all three business segments, while operating income more than doubled to P184 million from P79 million.

Among its segments, revenues from the feeds segment went up 14% to P4.7 billion, which accounted for 48% of total sales.

The feeds segment produces and markets animal feeds, health and nutritional products, and supplements to various distributors, dealers, and end users nationwide.

Vitarich said that the volumes reached the highest levels ever for tie-up and commercial customers, such as distributors and direct farms.

Sales volume climbed 12% while average selling prices inched up by 3%.

In the fourth quarter of 2021, the company launched Vitarich Poultry Advantage to address the needs of backyard and general poultry farmers.

The company’s annual feed mill capacity increased 3% to 300,200 metric tons (MT) in 2021 from 290,800 MT in 2020, while production grew 8% to 226,900 MT from 209,700 MT.

Meanwhile, revenues from the foods segment, which accounted for 44% of the total, grew by 36% to P4.2 billion on the back of a 21% increase in sales volume and 12% increase in average selling prices.

The foods segment sells chicken broilers, either as live or dressed, to HRI customers, supermarkets, and wet markets.

During the year, the segment enhanced its Cook’s Premium Chicken products for hotels, restaurants, institutional clients.

Annual dressing plant capacity increased 5% to 79,000 MT from 75,500 MT, while production expanded 21% to 35,700 MT from 29,500 MT.

Lastly, revenues from the farms segment, which accounted for the remaining 8% of the total, increased by 19% to P778 million. Fair value adjustments on biological assets amounting to P55.1 million was recognized as part of revenues and P78 million as cost of goods.

The segment is involved in the production of day-old chicks and pullets.

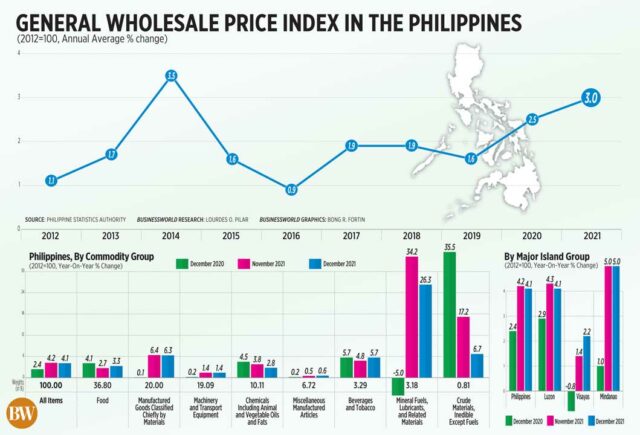

Vitarich said the cost of goods increased 21% to P8.9 billion due to higher sales volume and increased prices of raw materials such as wheat, soybean, and corn, which rose by an average of 12% compared to the prior year.

“The cost inflation was due to several factors, including logistics challenges due to COVID-19 (coronavirus disease 2019), reimposed series of quarantine measures in the third quarter, as well as supply disruptions for soybeans in the fourth quarter due to high demand from China, increasing domestic use in the US, and lower output from Brazil and Argentina,” it said.

Capital expenditures totaled P117.7 million due to the construction of a new warehouse in Davao and for additional machinery and equipment in Bulacan, Iloilo, and Davao to upgrade bagging lines for automation.

“We continue to execute on the factors we can control, including new products, improved customer satisfaction scores, enhanced processes, and engaged stakeholder relationships. Looking ahead, we expect revenues to stay robust, but the ongoing challenges will temper the full impact of sales growth on our earnings,” Mr. Sarmiento said.

“Supply chain headwinds will persist and pressure our costs in raw materials and transportation. In view of these elevated input costs, we will continuously reconfigure our purchasing approach and explore new grain and protein sources to reduce dependency on corn, wheat, and soybean meal. We are positive that higher volumes, cost efficiency, and responsible price increases will help us meet our performance objectives while ensuring that our products remain affordable,” he added.

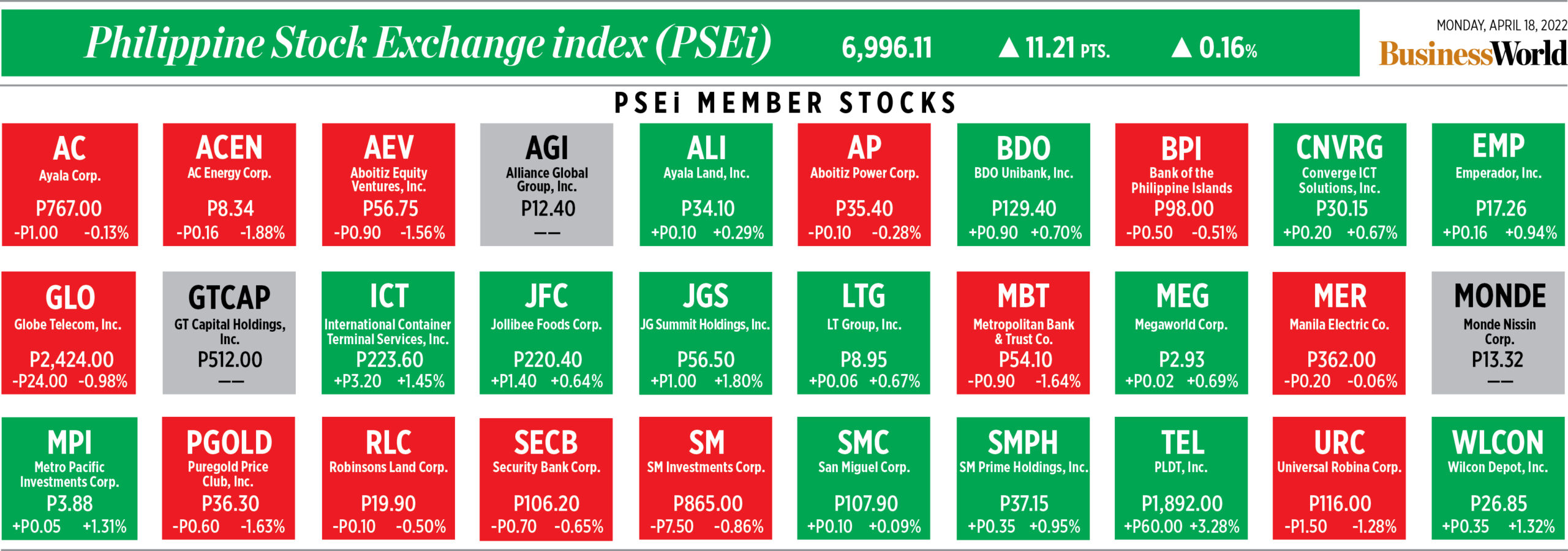

Vitarich shares went up by four centavos or 6.45% to finish at P0.66 each on Monday. — Luisa Maria Jacinta C. Jocson