Manufacturing Purchasing Managers’ Index (PMI) of select ASEAN economies, May 2022

FACTORY ACTIVITY in the Philippines dipped in May, as the growth in production and new orders slightly eased, S&P Global said on Wednesday. Read the full story.

FACTORY ACTIVITY in the Philippines dipped in May, as the growth in production and new orders slightly eased, S&P Global said on Wednesday. Read the full story.

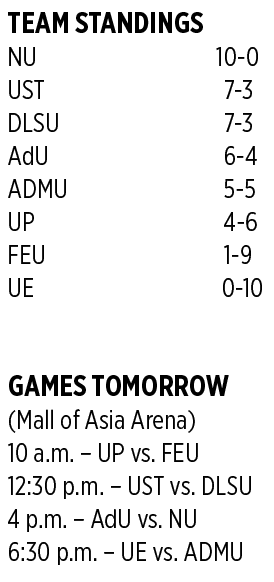

SANTO Tomas and La Salle lock horns in a crucial duel to dispute the solo second spot and bolster their respective Final Fourth aspirations in the UAAP Season 84 women’s volleyball tournament at the Mall of Asia Arena in Pasay City.

Currently at joint No. 2, the Golden Tigresses (7-3) and the Lady Spikers (7-3) meet at 12:30 p.m. with the winner also gaining ground to stay on the coattails of unbeaten pacer and Final Four-bound National University (NU).

NU, still immaculate at 10-0, will try to inch closer to the next big goal of clinching an outright finals berth via sweep against fourth-running Adamson (6-4) at 4 p.m.

NU, still immaculate at 10-0, will try to inch closer to the next big goal of clinching an outright finals berth via sweep against fourth-running Adamson (6-4) at 4 p.m.

At 10 a.m., No. 6 University of the Philippines (UP) (4-6) seeks to revive playoff drive against eliminated Far Eastern University (FEU) (1-9) while reigning champion Ateneo (5-5) eyes to stay in the race against also-ran University of the East (UE) (0-10) at 6:30 p.m.

University of Santo Tomas (UST) in the first round escaped with a thrilling 26-24, 22-25, 25-27, 25-23, 15-12 comeback win over La Salle that is raring to return the favor this time.

“Definitely, babawi ang Lady Spikers against UST. Hopefully, we can come out on top this time round,” said La Salle deputy mentor Benson Bocboc after running out of steam in their first duel.

But the Golden Tigresses are ready to fend off the Lady Spikers’ strong resistance especially after being tamed in a 20-25, 20-25, 20-25 loss to Ateneo the other day that snapped their four-game spree. — John Bryan Ulanday

Philippine Business Bank, Inc (PBB) booked a 24.4% increase in its net income in 2021, backed by the stronger performance of its core businesses as economic recovery continued.

PBB’s net profit stood at P1.16 billion last year versus the P938.88 million it booked in 2020.

“The bank’s full-year net income was driven by an improving economy and slower build-up of loan loss reserves following the bank’s accelerated provisioning strategy in 2020,” it said in a disclosure to the stock exchange on Tuesday.

This translated to a return on average equity of 8.24%, higher than the 7.02% it posted in 2020. Return on average assets also went up to 0.93% in 2021 from 0.80% a year prior.

“The bank has invested in a new core banking system in 2021 to strategically position PBB towards the digital banking era. We expect to continue to improve our products and services as a result of investments we seek to make in expanding our technological capabilities,” PBB Chief Executive Officer Roland Avante said in a press release on Tuesday.

“For 2022, we are seeing the resumption of commercial activities resulting in increased loan demand. We are optimistic that the economic recovery will continue to drive positive results. The bank’s processes and procedures evolve as we identify emerging opportunities to improve the way we serve our customers,” PBB said.

PBB’s net interest income dipped by 2.3% to P5.49 billion in 2021 from P5.62 billion in 2020. The lender attributed this muted decline to better management of funder costs and lower interest rates due to the central bank’s easy policy amid the coronavirus pandemic.

The bank’s net loans and other receivables increased by 2.68% to P91.7 billion in 2021 from P89.3 billion a year prior.

PBB set aside P747.4 million in provisions for loan losses. Total loan loss reserves as of end 2021 amounted to P4.2 billion, covering 105.9% of its non-performing loans.

Meanwhile, trading and other investment securities declined by 14.1% to P15.4 billion from P17.9 billion a year earlier due to the P9.6-billion decrease in trading securities, the bank said.

On the funding side, deposit liabilities reached P112.4 billion as of end-2021, up from P100.4 billion in 2020 amid a 41.7% increase in current account, saving account deposits.

PBB’s capital adequacy ratio was at 11.82% as of December. The bank’s common equity Tier 1 ratio stood at 11.08%.

Its total resources as of December 2021 reached P132 billion.

The bank’s shares closed unchanged at P7 apiece on Wednesday. — KBT

SN ABOITIZ Power-Benguet, Inc. and an electric cooperative based in Ifugao province have jointly sought regulatory approval of their agreement for the supply of 7.5 megawatts (MW) of baseload power.

In their joint filing with the Energy Regulatory Commission (ERC), SN Aboitiz Power (SNAP) and Ifugao Electric Cooperative, Inc. (Ifelco) are seeking approval of their power supply agreement (PSA) that calls for a contracted demand of 7,500 kilowatts (kW) per hour or a minimum annual energy of 32.5 million kilowatt-hours (kWh).

For the first year, the charge is about P1,844 per kWh as capacity fee or the cost that covers the operations and maintenance of the power generation facility. The charge is subject to an annual escalation.

SNAP owns, operates, and maintains the 104.55-MW Ambuklao hydroelectric power plant located in Bokod, Benguet province and the 140.08-MW Binga hydroelectric power plant in Brgy. Tinongdan, Itogon, also in the same province.

Ifelco is a rural electric cooperative formed to supply, promote and encourage the use of electric service to its members. Its principal office is in Ifugao’s Lagawe town.

The PSA will commence on an agreed effective date, which is the next immediate 26th day of the month following the completion of condition precedents to supply and after ERC’s approval of the deal.

Under the agreement, any provisional authority granted by the ERC will be considered as approval for purposes of determining the effectivity date. The agreement will then remain in full force and effect for a period of nine years or 108 months from its effective date.

SNAP has the right to source replacement energy from its own backup facilities or any third party, as long as the alternate source uses renewable energy technology.

The agreement follows the holding of a competitive selection process in which SNAP’s bid was declared as the lowest.

The contracting parties said, “a provisional authority is needed to prevent a delay in the implementation of the PSA,” so that Ifelco would have sufficient electricity with which to supply its consumers as well as to avoid power interruptions in its franchise area. — VVS

LONDON — Oscar-winning actor Kevin Spacey has said he will voluntarily appear in Britain “as soon as can be arranged” to face sex crime charges, Good Morning America reported on Tuesday.

Last week, Britain’s Crown Prosecution Service (CPS) said it had authorized charges to be brought against Mr. Spacey, 62, on four counts of sexual assault against three men, and a further charge of causing a person to engage in penetrative sexual activity without consent.

Police said the alleged assaults had taken place between March 2005 and April 2013 — four in the capital and one in Gloucestershire. They involved one man who is now in his 40s and two men now in their 30s.

Mr. Spacey will be charged if he is arrested in England or Wales, a CPS spokesperson said.

“I very much appreciate the Crown Prosecution Service’s statement in which they carefully reminded the media and the public that I am entitled to a fair trial, and innocent until proven otherwise,” Good Morning America quoted a statement from the actor as saying.

“While I am disappointed with their decision to move forward, I will voluntarily appear in the UK as soon as can be arranged and defend myself against these charges, which I am confident will prove my innocence.” — Reuters

PRICE GROWTH of wholesale general goods for April was 8.3%, the highest level in almost 11 years amid robust demand and election spending, according to preliminary data from the Philippine Statistics Authority (PSA). Read the full story.

STOCKS continued to decline on Wednesday as the Philippine central bank said inflation may breach 5% in May and amid expectations of aggressive tightening by the US Federal Reserve.

The benchmark Philippine Stock Exchange index (PSEi) fell by 62.47 points or 0.92% to close at 6,712.21 on Wednesday, while the broader all shares index dropped by 17.13 points or 0.47% to 3,589.78.

“Philippine shares closed the session in the red, underscoring fears that high inflation is weighing on economic growth,” Regina Capital Development Corp. Head of Sales Luis A. Limlingan said in a Viber message.

“The local market extended its decline this Wednesday as the BSP’s (Bangko Sentral ng Pilipinas) projection of a faster inflation in May dampened sentiment,” Philstocks Financial, Inc. Senior Research Analyst Japhet Louis O. Tantiangco added in a Viber message.

May inflation may have reached between 5% and 5.8%, BSP Governor Benjamin E. Diokno said on Tuesday. This is well above the 2-4% target of the central bank for this year.

The consumer price index last hit the 5% level in December 2018 and stood at 5.2% that month.

May inflation data will be released by the Philippine Statistics Authority on June 7. Headline inflation was at 4.9% in April, the highest in more than three years.

Regina Capital’s Mr. Limlingan said that June also marks the start of the Fed’s plan to reduce its balance sheet.

“Supply pressure might prevail, as sentiment glides to Wall Street’s weakness, given a Fed official’s comment on how the Fed should consider raising interest rates,” online brokerage 2TradeAsia.com said in a report.

The Fed begins shrinking asset holdings built up during the pandemic on Wednesday. Traders expect it will raise rates by 50 basis points at meetings this month to make a dent in an inflation rate running more than three times its goal, Reuters reported.

Fed Governor Christopher Waller on Monday said he is advocating to keep 50-bp rate hikes on the table until substantial reductions are seen in inflation, winding back expectations that the Fed might pause for breath after hikes in June and July.

Back home, majority of the sectoral indices ended in losses, except for mining and oil, which climbed 113.64 points or 0.95% to 12,033.86, and property, which gained by 6.04 points or 0.19% to 3,055.66.

Meanwhile, financials declined by 25.04 points to 1.51% to 1,633.58; industrials gave up by 137.81 points or 1.47% to end at 9,213.78; services dropped by 20 points or 1.06% to 1,850.55; and holding firms went down 37.40 points or 0.59% to 6,253.76.

Decliners outnumbered advancers, 108 versus 76, while 46 names ended unchanged.

Value turnover went down to P5.98 billion with 659.26 million shares changing hands from the P35.71 billion with 2.17 billion issues seen the previous trading day.

Net foreign selling increased to P552.88 million on Wednesday from P232.01 million on Tuesday. — Luisa Maria Jacinta C. Jocson with Reuters

THE PESO dropped further against the dollar on Wednesday due to inflationary concerns as the Bangko Sentral ng Pilipinas (BSP) expects the headline figure to have reached at least 5% in May and the European Union’s (EU) Russian oil embargo.

The local unit closed at P52.48 per dollar on Wednesday, losing 11 centavos from its P52.37 finish on Tuesday, based on Bankers Association of the Philippines data.

The peso opened Wednesday’s session at P52.43 versus the dollar. Its weakest showing was at P52.49, while its intraday best was at P52.42 against the greenback.

Dollars exchanged declined to $724.22 million on Wednesday from $925.62 million on Tuesday.

The local unit weakened due to the BSP’s high estimate for May inflation, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

Headline inflation likely quickened and breached 5% in May due to higher pump and food prices and a weaker peso, the BSP chief said on Tuesday.

May inflation may have reached between 5% and 5.8%, BSP Governor Benjamin E. Diokno said. This is well above the 2-4% target of the central bank for this year.

The consumer price index last hit the 5% level in December 2018 and stood at 5.2% that month.

May inflation data will be released by the Philippine Statistics Authority on June 7. Headline inflation was at 4.9% in April, the highest in more than three years.

Inflationary concerns are also growing after the EU approved a partial ban on Russian oil imports, a trader said.

“Peso also weaker as global crude oil prices remained volatile to among the highest in 2-2.5 months, as this could increase the country’s oil import bill,” Mr. Ricafort added.

EU leaders handed Hungary concessions to agree an oil embargo on Russia over its invasion of Ukraine, sealing a deal in the wee hours on Tuesday that aims to cut 90% of Russia’s crude imports into the bloc by the end of the year, Reuters reported.

The embargo — once legally imposed in the coming days — will hit seaborne shipments of Russian oil and encompass most imports from Russia once Poland and Germany stop buying it by the end of 2022, which diplomats and officials from both countries said was now government policy.

Oil prices extended gains on Tuesday after the EU agreed to slash oil imports from Russia, fueling worries of a tighter market already strained for supply amid rising demand ahead of peak US and European summer driving season.

US West Texas Intermediate crude was trading at $119.12 a barrel up $4.05 or 3.5% from Friday’s close. There was no settlement on Monday due to a US public holiday. Both benchmarks have posted daily gains since Wednesday.

For Thursday, the trader said the peso may weaken and test the P52.50-per-dollar level due to likely upbeat US job openings data that could give the US central bank an impetus to continue hiking rates aggressively.

The trader expects the peso to move between P52.40 and P52.55 versus the dollar, while Mr. Ricafort gave a forecast range of P52.35 to P52.50. — K.B. Ta-asan with Reuters

PRESIDENT-ELECT Ferdinand R. Marcos, Jr. has asked the Supreme Court to reject a lawsuit seeking to void his landslide win and protect the vote of 31 million Filipinos.

In a 45-page petition, the son and namesake of the late dictator said the Presidential Electoral Tribunal, not the High Court, has the power to pass on his eligibility to run for president.

“The petition must be dismissed for lack of jurisdiction,” he said through lawyer Estelito P. Mendoza. “At this point, it is only the Presidential Electoral Tribunal (PET) which may inquire into [my] eligibility”.

A group of taxpayers on May 16 asked the high tribunal to stop the count and void Mr. Marcos’ candidacy since he is allegedly unfit to become president after he was convicted of tax evasion in the 1990s.

The plaintiffs seek to overturn a Commission on Elections (Comelec) ruling allowing Mr. Marcos, better known as Bongbong, to run for president on May 9, accusing him of lying about his qualifications.

They said the election body had gravely abused its authority by failing to disqualify Mr. Marcos despite his conviction.

They also argued that Comelec should have barred his candidacy because criminals are perpetually disqualified from running for public office.

Congress proclaimed Mr. Marcos the winner of the presidential race on May 25 in the absence of a restraining order from the High Court.

The tribunal earlier ordered him, the Senate, House of Representatives and Comelec to comment on the lawsuit.

In his pleading, Mr. Marcos argued that the 1987 Constitution only requires the president to be a natural-born Filipino citizen, a registered voter, can read and write, at least 40 years old and has lived in the Philippines for at least 10 years.

The plaintiffs have accused Mr. Marcos of lying about his qualifications for president, adding that his conviction for tax evasion involved moral turpitude.

Martial Law victims of Mr. Marcos’ father, the late dictator Ferdinand E. Marcos, have filed a similar lawsuit.

The Comelec full court earlier affirmed a Second Division ruling that said Mr. Marcos did not mislead the public when he said in his certificate of candidacy that he was eligible to run for president. It also threw out several appeals that sought to disqualify the leading presidential bet due to his conviction.

“In view of respondent Marcos Jr.’s material misrepresentations in his certificate of candidacy (CoC), this court must cancel or deny due course to his CoC, declaring the same void ab initio,” the plaintiffs said earlier.

“Respondent Marcos Jr. must be deemed to have never been a candidate from the very beginning, his candidacy invalidated, and the votes attributed to him considered stray,” they added.

The en banc earlier affirmed a ruling by Commissioner Aimee P. Ferolino, who in February said there is no law punishing one’s failure to file income tax returns.

Retired Election Commissioner Maria Rowena V. Guanzon had accused her of delaying the case so her vote for disqualification would not count. She also said a senator from Davao was meddling in the case.

Mr. Marcos won the May 9 election by a landslide to clinch a remarkable comeback for his family, which is still facing court cases involving ill-gotten wealth and unpaid taxes.

He is the first candidate to win a majority in a Philippine presidential election since his father’s two-decade rule.

Mr. Marcos fled into exile in Hawaii with his family during a February 1986 “people power” street uprising that ended his father’s autocratic 20-year rule. He served as a congressman and senator after his return to the Philippines in 1991.

Political analysts earlier said the possibility of incoming Vice-President Sara Duterte-Carpio copying the path of a nine-year presidency forged by ex-President Gloria Macapagal Arroyo would be hard to ignore.

Ms. Arroyo as vice-president succeeded then President Joseph E. Estrada after his ouster by a popular street uprising in January 2001, three years short of the single six-year term of a Philippine president. She served six more years as president after winning in 2004 amid allegations of cheating. — Kyle Aristophere T. Atienza

THE DEPARTMENT of the Interior and Local Government (DILG) on Wednesday asked Meta Platforms, Inc., Facebook’s parent company, to delete or suspend pages that promote online cockfighting after it shut down seven illegal online cockfighting websites last week.

“We wish to remind Meta Platforms, Inc. that as a business entity operating in the Philippines, they are subject to Philippine laws, rules and regulations and must comply with them at all times, “Interior Undersecretary Jonathan E. Malaya said in a statement.

He said they have submitted a list of Facebook pages, groups and accounts that promote the multibillion cockfighting industry, but Meta had yet to respond.

The agency shut down seven websites amid a state crackdown on the practice. It said police and the Department of Information and Communications Technology have been closely watching cyber-space for illegal gambling operations.

The police’s Anti-CyberCrime Group was monitoring 12 other websites and eight social media platforms that were operating illegally.

“Their continued inaction on the request of this department, the Philippine National Police and other government agencies to take down pages, accounts, and other links encouraging people to patronize these operations is tantamount to tolerating illegal activity,” Mr. Malaya said of Meta.

This was also a violation of its own community standards, he added.

Six of 10 Filipinos wanted online cockfighting operations to be outlawed, DILG said, citing a poll.

President Rodrigo R. Duterte has ordered the closure of online cockfighting operations in the country, citing the ill effects of gambling.

Experts have said that Mr. Duterte’s decision to stop these operations might force operators to go underground.

The Philippine Amusement and Gaming Corp. estimated revenues from online cockfighting averaged P400 million monthly last year and P640 million a month since January.

“We also ask the public to support the ban on all forms of these operations on social media so that we can finally put a stop to this social menace that has destroyed the lives of so many of our countrymen,” Mr. Malaya said.

Online cockfighting gained popularity during the coronavirus pandemic, as Filipinos only needed to place bets using their mobile phones.

The Senate earlier launched an investigation for the suspension of the operations after reports of the disappearance of 30 people allegedly involved in online cockfighting. — John Victor D. Ordoñez

LAWMAKERS on Wednesday bypassed five officials appointed by President Rodrigo R. Duterte for lack of quorum.

Only five members of the Commission on Appointments physically attended the confirmation hearing, while three were online.

“There being no quorum, the meeting of the committee on constitutional commissions and offices is hereby adjourned,” said Senator Cynthia A. Villar, who headed the session.

The body was supposed to hear the appointments of Election Chairman Saidamen B. Pangarungan, Election Commissioners George Erwin M. Garcia and Aimee S. Torrefranca-Neri, Commission on Audit (CoA) Chairman Rizalina Noval Justol and Civil Service Commission Chairman Karlo Alexei B. Nograles.

Congress is set to adjourn on June 3, which means incoming President Ferdinand R. Marcos, Jr. will have to appoint a new set of officials.

“We cannot please everybody,” Senator Juan Miguel “Migz” F. Zubiri said in a statement. “This is a political body. We know there is a request from the new administration to give that courtesy.”

Senator Christopher Lawrence T. Go, a known Duterte ally, said he would have voted for the appointees.

“The independence of these constitutional commissions is one of the major pillars of our robust democracy,” he said. “It is necessary that we safeguard such independence at all times.”

Senator Ana Theresia “Risa” N. Hontiveros-Baraquel said senators agree that the next government should be the one to appoint these officials.

“There is a proper time that can be set aside to sift through the appointments on the part of Congress,” she told a news briefing. “There is no need to hurry.”

Mr. Zubiri on Tuesday said the Commission on Appointments should wait for Mr. Marcos’ own appointments instead of confirming the heads of the several independent bodies.

He noted that once they approve their appointments, Mr. Marcos could no longer appoint his own set of officials because they have a seven-year term.

“I’m just comforted by the fact that the four commissioners left behind are capable individuals,” Election Commissioner George Erwin M. Garcia, one of those who got bypassed, told a separate news briefing.

Meanwhile, a public think tank urged Mr. Marcos to declare a vacancy in more than 1,000 last-minute appointments made by his predecessor.

In a statement, InfraWatch PH said commissioners with fixed terms and civil service officers appointed close to the appointment ban during the election period “effectively ties the hand of the new administration from determining its policy agenda in various departments and commissions.”

“With the new government rejecting tax proposals from the outgoing economic team, it is clear that the new president seeks to undertake a clean sweep of current policy,” convenor Terry L. Ridon, a former congressman, said in a statement. “This requires a clean sweep of existing high-level personnel in various government agencies.”

The think tank noted that in March Mr. Duterte appointed more than 1,000 people to various executive agencies and government corporations.

These include appointments to constitutional offices, commissions with fixed terms and permanent appointments of civil service officials, it said.

InfraWatch PH said the new government should also look into the appointment of new civil service officials who joined the government during Mr. Duterte’s rule, which might have violated appointment rules. — Alyssa Nicole O. Tan and Kyle Aristophere T. Atienza