By Brönte H. Lacsamana, Reporter

AJ DIMARUCOT, 46, is one of a slew of Filipinos who use so-called non-fungible tokens (NFTs) to collect and sell digital art on the internet.

The Philippines ranked first out of 20 countries in terms of ownership of NFTs, which represent real-world objects such as art, music, in-game items and videos that are traded online, usually with cryptocurrency.

About a third of Filipino internet users claim to own these tokens, according to a December online survey by Australian information service provider Finder.

“Whether you’re a small or big artist, you immediately have a way to monetize your efforts and work using NFTs,” he said via Zoom.

Mr. Dimarucot sees a future when people, instead of providing free content to companies such as Facebook and Instagram in exchange for likes and followers, can monetize their creativity by getting their audience to pay $.001 or a peso for every like.

One in three NFTs have ended up as a dead collection, with little or no trading activity after minting, blockchain analytics firm Nansen said in a March 26 report.

Another third of the tokens were trading below the price it cost issuers to mint the tokens, according to the firm, which analyzed 8,400 collections made up of more than 19 million NFTs on the Ethereum blockchain.

“Our analysis revealed that NFT minters’ behavior could be taken as a signal for the short-term market trend, just as how we observe miners’ behavior as a proxy for Bitcoin’s price,” Nansen said.

As failed projects pile up, long-time crypto observers are having flashbacks to the initial coin offering bust of 2018, when thousands of digital tokens quickly became worthless after regulators warned they’re probably unregistered securities, Bloomberg reported.

Gary Vaynerchuk, the entrepreneur and chief executive at VaynerMedia, has predicted that 98% of NFT projects will fail after the gold rush fades, according to CNBC.

Mr. Dimarucot’s son is also involved in NFTs through Axie Infinity, an online video game where one can collect and mint NFTs that represent creatures known as Axies.

“It’s probably through gaming that we onboard more people into the space, and they might not necessarily know what an NFT is,” Mr. Dimarucot, an artist and graphic designer, said.

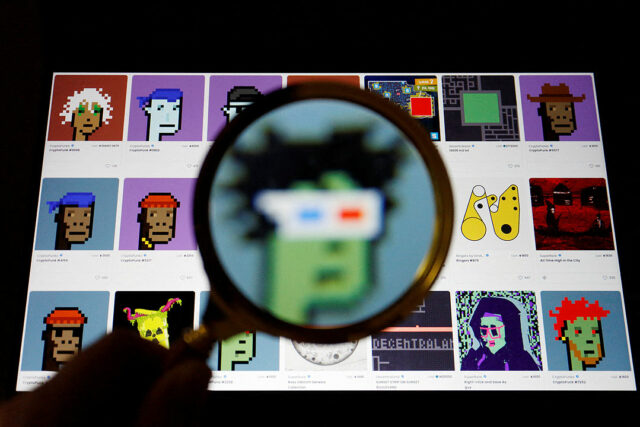

Unlike cryptocurrency, non-fungible tokens are unique and can’t be exchanged for one another. While one Bitcoin is always equal to another Bitcoin, NFTs have a digital signature that makes it impossible to exchange them for another NFT (hence, non-fungible).

By trading art via blockchain technology, such items become “non-fungible,” or unique due to authentication by digital certificates that also track each asset’s movements.

In 2020, non-fungible tokens took the Philippines by storm, with many home-bound Filipinos playing games to earn amid a coronavirus pandemic.

Axie Infinity, the most popular of these games, allowed Filipino players to buy in-game pets called Axies to win battles and reap rewards. These were then traded or sold for the cryptocurrency Ethereum. (Related story, “Hackers steal about $600 million in one of the biggest crypto heists”)

“I learned about Axie Infinity in July from a friend who was earning lots of money from it,” an anonymous collector who goes by the name Vector said via Discord. “He told me how to apply for a scholarship with Axie University.”

While he still doesn’t completely understand what NFTs are, he’s keen on improving his game to earn more.

Play-to-earn gamers like Vector spurred the rising popularity of the NFT gaming scene in early 2021, which led to an increase in the prices of in-game assets.

Yield Guild Games (YGG), which invests in blockchain games and NFT assets, loans out Axies to “scholars” who want to play and earn. Vector is one of these scholars.

“It’s not easy to earn, though,” he said. “You have to work hard to play really well.”

Aside from YGG, many other outfits have popped up to fill the so-called NFT supply chain to support the growing community since the play-to-earn boom.

BreederDAO, a Philippine-based blockchain startup, has raised $10 million in series A funding through a token sale co-led by Andreessen Horowitz and Delphi Digital.

“If you look at the space right now, it’s still very raw,” Renz Carlo Chong, chief executive officer and one of the co-founders of BreederDAO, told BusinessWorld in a video interview. “Nobody has a full grasp of how play-to-earn really works.”

Axie Infinity is struggling and a number of games that followed are also barely keeping up, he pointed out. “It’s really interesting because nobody knows where the space will head towards.”

Axie Infinity has been losing about 50,000 players a month since January, based on data from activeplayer.io, due to supply-and-demand imbalance and volatile crypto assets, which developers at Sky Mavis have been trying to fix.

Mr. Chong is optimistic because of new blockchain startups and traditional gaming companies see value in the NFT space and are moving into it.

“You get to own these assets and you get to sell them in a decentralized marketplace, so you can see all of these projects — YGG, for example, tackling the player liquidity sides, bringing on the demand for all of these play-and-earn games,” he said.

BreederDAO seeks to tackle the asset liquidity side by bringing in the technology, human resources, and share in the market to increase their asset base and production capacity.

‘SCAMS’

As a digital artist with a son earning from Axie Infinity, Mr. Dimarucot thinks more Filipinos would probably join the NFT space due to both art and gaming. “More people will understand that there’s utility, there’s community and there’s a lot of opportunities in the space, so I’m excited.”

A staggering $174 million has been spent on NFTs since November 2017. Their sales surged to $25 billion globally in 2021 alone, fueled by the rising interest of celebrities and tech evangelists, according to market data tracker DappRadar. But some experts believe NFTs are a bubble that could eventually pop.

There are also concerns about the token minting process consuming a huge amount of energy and carbon footprint as well as accusations of the entire space being a Ponzi scheme.

“Please take the time to study NFTs,” said Marvin Germo, a financial consultant and author of the Stock Smarts book series, in a YouTube video discussing whether they’re a fad or the future. “Similar to cryptocurrencies and the metaverse, they’re technology. They’re disrupting the way we’re seeing things.”

There are scams and schemes everywhere and NFTs can harm people in the wrong hands, so it’s best to do your homework, he said via Zoom.

“No matter how much celebrities talk about it, you don’t invest in it or buy it just because other people are buying it,” Mr. Germo, who collects NFTs, said. “You should study anything that requires you to put your money in it.”

Mr. Chong said learning about non-fungible tokens is important, especially because it’s a new thing. “It’s really the same with a lot of new innovations.”

Because the blockchain is decentralized without banks to run the economy, there are also no operating expenses. The NFT community is instead governed by a code of trust that gives value back to users.

This makes it prone to all sorts of exploits, scams and hacks, something all innovations have to go through and address as they mature, Mr. Chong said.

Platforms like YouTube have been looking into features for video creators to capitalize on NFTs. Twitter now has a paid service where users can integrate NFT profile pictures by connecting their account to their Metamask wallet.

But artists looking to mint their works on the blockchain struggle with the newness of it all, Mr. Dimarucot said.

The urgent need to earn on the part of gamers becomes a driver to learn about the process.

“It was difficult at first, but the opportunities motivated me to research NFTs,” said Vector, the Axie Infinity scholar. “So far, it’s been worth it.”

The rewards trump both the hassle and the risks, as anyone already in the space would say, but Mr. Chong thinks there’s a vision to work towards.

Mr. Dimarucot claims the future of digital ownership will benefit those slaving away under the current Web 2.0 system, where people provide free content to companies such as Facebook and Instagram in exchange for likes and followers.

In the Web 3.0 metaverse — an idea for a new iteration of the World Wide Web based on blockchain technology — a small artist can monetize their efforts and everyone can supposedly give value to a digital creation.

“I think we’ll reach the point where you’re naturally doing NFTs without necessarily knowing it, like buying a ticket to a concert or a plane ticket or renewing a passport or license or getting a birth certificate,” Mr. Dimarucot said.

“Everything will be NFTs and tokenized on the blockchain.”