By Abigail Marie P. Yraola, Deputy Research Head

YIELDS on government securities (GS) traded in the secondary market were mixed last week amid the decline in US Treasuries and as weak data and tariff issues raised concerns about the outlook for the world’s largest economy.

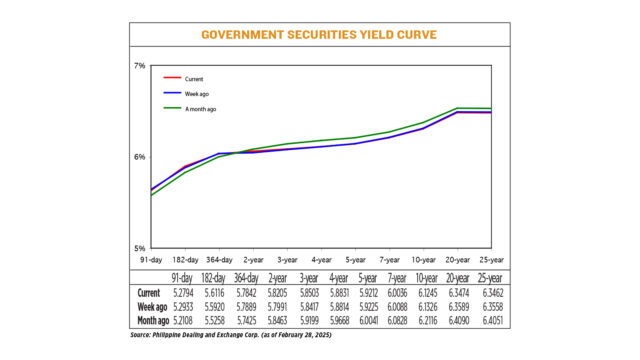

GS yields, which move opposite to prices, inched down by an average of 0.03 basis point (bp) week on week, according to the PHP Bloomberg Valuation Service (BVAL) Reference Rates as of Feb. 28 published on the Philippine Dealing System’s website.

Rates at the short end of the curve were mixed, with the 91- and 364-day Treasury bills (T-bills) declining by 1.39 bps (to 5.2794%), and 0.47 bp (5.7842%) week on week, respectively. Meanwhile, the 182-day T-bill went up 1.96 bps to fetch 5.6116%.

At the belly, the two-, three-, four-year Treasury bonds (T-bonds) saw their rates increase by 2.14 bps (to 5.8205%), 0.86 bp (5.8503%), and 0.17 bp (5.8831%), respectively. On the other hand, the five- and seven-year bonds inched down 0.13 bp (to 5.9212%) and 0.52 bp (6.0036%), respectively.

At the long end of the curve, yields fell across all tenors. The rates of the 10-, 20- and 25-year T-bonds went down by 0.81 bp, 1.15 bps and 0.96 bp to 6.1245%, 6.3474% and 6.3462%, respectively.

GS volume traded amounted to P24.79 billion on Friday, lower than the P39.83 billion recorded a week earlier.

“BVAL yields broadly tracked the movement in US Treasury yields, which dropped significantly over the week after a series of disappointing economic data on consumer sentiment and inflation expectations raised market fears of a likely wavering US economic performance from anticipated untoward effects of tariffs on consumption and future business prospects,” a bond trader said in an e-mail.

“Market participants have shifted their focus on the future viability of the United States to remain the trailblazer of global economic growth. Meanwhile, other developed economies have started strategizing their economic blueprints farther away from any trade policy pronouncements by US President Donald J. Trump,” the trader said.

ATRAM Trust Corp. Vice-President and Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said the lack of local catalysts led market participants to look to the US for drivers.

“For the week, local bond yields were slightly higher by 4-8 basis points across the curve. The yield curve saw a steepening move as investors positioned ahead of key economic data releases,” Mr. Ulpo said in a Viber message.

“Offshore, news regarding PMI (purchasing managers’ index) data, consumer sentiment, and tariff concerns affected US Treasury yields to dive lower. In particular, US President Donald J. Trump’s proposed tariffs introduced fresh uncertainties in the global trade outlook, causing a risk-off sentiment. This forced global investors to flee to safe haven assets as economic concerns continue to grow.”

Mr. Ulpo added that overseas uncertainties have affected interest in bonds.

“Domestic jitters from US policy uncertainties have likewise driven local demand strongly towards bond issuances as investors seek to secure relatively stable returns while waiting for greater clarity on future market opportunities,” the trader also said.

“Market participants have turned cautious in their approach to the bond market this year, primarily due to marked volatility in a rather less-risky market than equities.”

On Friday, the yield on benchmark US 10-year notes fell 6 bps to 4.227% from 4.287% late on Thursday, Reuters reported.

The 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, fell 8.9 bps to 3.991% from 4.08% on Thursday.

The prospect of higher US tariffs sent jitters through markets and revived concerns about an escalating global trade war.

Mr. Trump said on Thursday that 25% duties on imports from Canada and Mexico will come into effect on March 4 — not April 2 as he had suggested a day earlier — and said goods from China will be subject to an additional 10% duty. Last week, he also floated 25% tariffs on shipments from the European Union.

For this week, GS yield movements could be driven by the release of February Philippine consumer price index (CPI) data, which could affect the Bangko Sentral ng Pilipinas’ (BSP) policy easing path, Mr. Ulpo said.

The government will release CPI data on March 5 (Wednesday). The BSP said February headline inflation may have settled within 2.3%–3.0%.

“A reading at the lower end of this range could further reinforce expectations of a rate cut, potentially driving demand for government securities,” Mr. Ulpo said.

He added that the market will continue to monitor global developments, including the Trump administration’s trade policy and the movements of major central banks.

“On the global front, US labor market data will be a key factor in shaping expectations for the Federal Reserve’s next policy move, adding another layer of policy cue to market sentiment.”

“Domestic yields are seen to continue broadly declining next week from the compounded effect of lingering BSP policy rate cuts, anticipation ahead of the lower reserve requirement by end-March and brewing concerns on the global economic growth likely to exert downward pressures across the different portions of the yield curve,” the bond trader added.

The result of the Bureau of the Treasury’s bond auction this week could also affect GS yield movements, Mr. Ulpo said.

“The Bureau of the Treasury is set to offer a five-year bond at the primary auction, with yields expected to clear within the 5.95%–6.05% range. Market participants will closely watch the auction results to gauge demand for mid-tenor bonds ahead of the BSP’s anticipated rate cut in April.” — with Reuters