VATICAN CITY — Presidents, royalty and simple mourners bade farewell to Pope Francis on Saturday at a solemn funeral ceremony, where a cardinal appealed for the pontiff’s legacy of caring for migrants, the downtrodden and the environment to be kept alive.

US President Donald Trump, who had clashed with the pope on those issues, sat with the rows of foreign dignitaries on one side of Francis’ coffin in the vast St. Peter’s Square.

On the other side sat cardinals who will pick Francis’ successor at a conclave next month, deciding if the new pope should continue with the late pontiff’s push for a more open Church or cede to conservatives who want to return to a more traditional papacy.

The Argentine pope, who reigned for 12 years, died at the age of 88 on Monday after suffering a stroke.

“Rich in human warmth and deeply sensitive to today’s challenges, Pope Francis truly shared the anxieties, sufferings and hopes of this time,” said Italian Cardinal Giovanni Battista Re, who presided over the funeral Mass.

In spiritual language, the 91-year-old Re gave a simple message: there was no going back. The first pontiff from Latin America had been “attentive to the signs of the times and what the Holy Spirit was awakening in the Church,” he said.

Francis repeatedly called for an end to conflict during his papacy. His funeral provided an opportunity for Trump, who is pushing for a deal to end Russia’s war with Ukraine, to meet Ukrainian President Volodymyr Zelenskiy inside St. Peter’s Basilica.

Applause rang out as Francis’ coffin, inlaid with a large cross, was brought out of the basilica and into the sun-filled square by 14 white-gloved pallbearers at the start of the Mass.

The Vatican estimated more than 250,000 people attended the ceremony, cramming the square and the roads around.

The crowds clapped loudly again at the end of the service when the ushers picked up the casket and tilted it slightly so more people could see.

Aerial views of the Vatican showed a patchwork of colours – black from the dark garb of the world’s leaders, red from the vestments of some 250 cardinals, the purple worn by some of the 400 bishops and the white worn by 4,000 attending priests.

After the funeral, as the great bells of St. Peter’s pealed in mourning, the coffin was placed on an open-topped popemobile and driven through the heart of Rome to St. Mary Major Basilica.

Francis, who shunned much of the pomp and privilege of the papacy, had asked to be buried there rather than in St. Peter’s — the first time a pope had been laid to rest outside the Vatican in more than a century.

The burial itself was conducted in private.

The popemobile left the Vatican from the Perugino Gate, a side entrance just yards away from the Santa Marta guesthouse where Francis had chosen to live, instead of the ornate Renaissance apartments in the papal palace.

Crowds estimated by police as numbering some 150,000 lined the 5.5-km (3.4-mile) route to St. Mary Major. The scene resembled many popemobile rides Francis took in his 47 trips to all corners of the world.

Some in the crowd waved signs and others threw flowers towards the casket. They shouted “viva il papa” (long live the pope) and “ciao, Francesco” (goodbye, Francis) as the procession made its way around Rome’s ancient monuments, including the Colosseum.

TRUMP MEETS ZELENSKIY

The last time Trump had met Zelenskiy was in the White House in late February, when he gave him a public dressing down, but Saturday’s encounter appeared more cordial.

In one photograph released by Zelenskiy’s office, the two men were sitting close together on red-backed chairs, leaning towards each other as they talked in the marble-floored church.

A White House official said they had a “very productive discussion” and Zelenskiy called it a “good meeting”.

Among the other heads of state who attended the funeral were the presidents of Argentina, France, Gabon, Germany, the Philippines and Poland, together with the prime ministers of Britain and New Zealand, and many royals, including the king and queen of Spain.

Francis’ death ushered in a meticulously planned period of transition, marked by ancient ritual, pomp and mourning. Over the past three days, around 250,000 people filed past his open coffin, laid out before the altar of the cavernous basilica.

Choirs at the funeral sang Latin hymns and prayers were recited in various languages, including Italian, Spanish, Chinese, Portuguese and Arabic, reflecting the global reach of the 1.4-billion-member Roman Catholic Church.

Many of the faithful camped out overnight to try to secure spots at the front of the crowd, while others hurried there in the early morning.

“When I arrived at the square, tears of sadness and also joy came over me. I think I truly realised that Pope Francis had left us, and at the same time, there is joy for all he has done for the Church,” said a French pilgrim, Aurelie Andre.

FAREWELL, ‘FRANCISCUS’

Francis, the first non-European pope for almost 13 centuries, battled to reshape the Church, siding with the poor and marginalised, while challenging wealthy nations to help migrants and reverse climate change.

“Francis left everyone a wonderful testimony of humanity, of a holy life and of universal fatherhood,” said a formal summary of his papacy, written in Latin, and placed next to his body.

Traditionalists pushed back at his efforts to make the Church more transparent, while his pleas for an end to conflict, divisions and rampant capitalism often fell on deaf ears.

The pope carried his desire for greater simplicity into his funeral, having rewritten the elaborate, book-long funeral rites used previously.

He also opted to forego a papal tradition of three interlocking caskets made of cypress, lead and oak. Instead, he was placed in a single, zinc-lined wooden coffin.

His tomb has just “Franciscus”, his name in Latin, inscribed on the top. A reproduction of the simple, iron-plated cross he used to wear around his neck hangs above the marble slab.

Attention will now switch to who might succeed him.

The secretive conclave is unlikely to begin before May 6, and might not start for several days after that, giving cardinals time to hold regular meetings beforehand to sum each other up and assess the state of the Church, beset by financial problems and ideological divisions. — Reuters

For aspiring business owners, the Master Siomai brand offers two distinct franchise models: the flagship concept and the more budget-friendly Siomai on the Go (SIOGO) option. These two models cater to different market needs, giving entrepreneurs options that align with their financial goals and business plans.

For aspiring business owners, the Master Siomai brand offers two distinct franchise models: the flagship concept and the more budget-friendly Siomai on the Go (SIOGO) option. These two models cater to different market needs, giving entrepreneurs options that align with their financial goals and business plans. SIOGO, on the other hand, provides a more affordable entry point into the food business. Designed around a

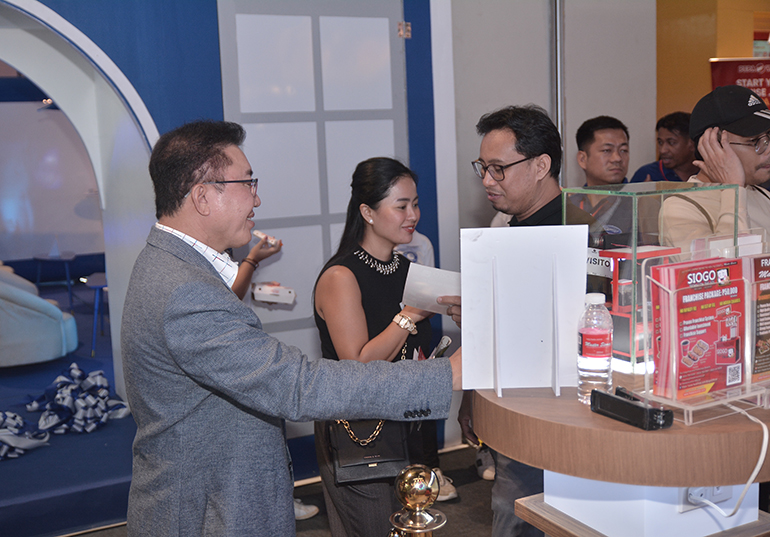

SIOGO, on the other hand, provides a more affordable entry point into the food business. Designed around a  During the expo, company representatives will be present to explain the business model in full. Attendees can speak directly with franchise consultants to understand the steps involved in applying, the requirements, and what kind of support they can expect after signing on.

During the expo, company representatives will be present to explain the business model in full. Attendees can speak directly with franchise consultants to understand the steps involved in applying, the requirements, and what kind of support they can expect after signing on.  As more people look for low-maintenance food businesses, Master Siomai’s booth is expected to draw a crowd. Its low start-up cost and easy-to-operate format gives people the option to build at their own pace while having access to an established system. The franchise model allows new owners to begin small and scale operations depending on performance and available resources; and it also allows those with long-term plans to expand without requiring major upfront commitments.

As more people look for low-maintenance food businesses, Master Siomai’s booth is expected to draw a crowd. Its low start-up cost and easy-to-operate format gives people the option to build at their own pace while having access to an established system. The franchise model allows new owners to begin small and scale operations depending on performance and available resources; and it also allows those with long-term plans to expand without requiring major upfront commitments.