Debt yields end higher as US data back Fed bets

YIELDS on government securities (GS) ended mostly higher last week following the release of US economic data that fueled bets on the Federal Reserve’s next move, which could also affect the Bangko Sentral ng Pilipinas’ (BSP) policy path.

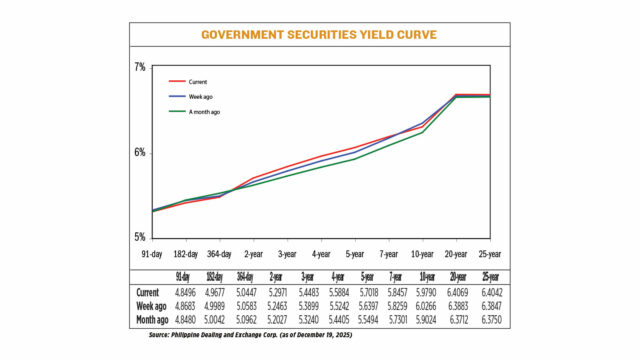

Debt yields, which move opposite to prices, rose by an average of 1.66 basis points (bps) week on week at the secondary market, based on the PHP Bloomberg Valuation Service Reference Rates as of Dec. 15 to 19 published on the Philippine Dealing System’s website.

At the short end of the curve, rates fell across the board. The 91-, 182-, and 364-day Treasury bills (T-bills) saw their yields drop by 1.87 bps (4.8496%), 3.12 bps (4.9677%), and 1.36 bps (5.0447%), respectively.

Meanwhile, at the belly, yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) rose by 5.08 bps (5.2971%), 5.84 bps (5.4483%), 6.42 bps (5.5884%), 6.21 bps (5.7018%), and 1.98 bps (5.8457%), respectively.

At the long end of the curve, the 20- and 25-year papers went up by 1.86 bps and 1.95 bps to yield 6.4069% and 6.4042%, respectively. Meanwhile, the 10-year T-bonds fell by 4.76 bps to fetch 5.9790%.

GS volume traded decreased to P44.87 billion last week from P89.79 billion previously.

The release of delayed US economic data on inflation and jobs mainly drove trading at the fixed-income market last week as the numbers supported US Federal Reserve rate cut expectations, the first trader said in an e-mail.

“This wiggle room still opens the possibility for the BSP to cut interest rates next year, pulling short-term yields lower. However, medium- to long-term yields moved up amid expectations of a potential acceleration in domestic inflation next year,” the first trader said.

“Market activity overall was weaker this week as Christmas Eve and the year-end approaches rapidly. Subsequently, this is also the reason for the sideways yield movement at the start of the week… On the global side, the lower-leaning US jobs data contributed to the fall in yields midweek on Wednesday and Thursday. The lower-than-expected US CPI (consumer price index) data incited a sell-off that caused yields to increase, which was also aided by traders looking to lessen their position,” the second trader said in a Viber message.

The number of Americans filing new applications for unemployment benefits fell a week ago, reversing the prior week’s surge and suggesting labor market conditions remained stable in December, Reuters reported.

Initial claims for state unemployment benefits dropped 13,000 to a seasonally adjusted 224,000 for the week ended Dec. 13, the Labor department said on Thursday. Economists polled by Reuters had forecast 225,000 claims for the latest week.

The claims data covered the period during which the government surveyed businesses for the nonfarm payrolls component of December’s employment report. Nonfarm payrolls increased by 64,000 jobs in November, the Bureau of Labor Statistics (BLS) said on Tuesday. December’s employment report will be released on schedule in January.

Though the unemployment rate was at 4.6% in November, the highest since September 2021, it was distorted by technical factors related to the 43-day government shutdown, which caused the BLS not to publish the jobless rate for October. The longest shutdown in history prevented the collection of data from households needed to calculate October’s unemployment rate.

Policymakers at the Federal Reserve this month cut the US central bank’s benchmark overnight interest rate by another 25 basis points to the 3.50% to 3.75% range. But they signaled a pause to further rate cuts while seeking clearer signals about the direction of the job market and inflation.

Meanwhile, US consumer prices rose less than expected in the year to November, but households still faced affordability challenges as the costs of basic goods and services like beef and electricity soared, posing a political problem for President Donald J. Trump.

The CPI increased 2.7% on a year-over-year basis in November after advancing 3.0% in the 12 months through September. Economists polled by Reuters had forecast the CPI would rise 3.1%. The CPI gained 0.2% over the two months ending in November. The BLS said it “cannot provide specific guidance to data users for navigating the missing October observations.”

Meanwhile, the BSP on Dec. 11 delivered a fifth straight 25-bp cut to bring the policy rate to an over three-year low of 4.5%. It has so far slashed benchmark rates by 200 bps since August 2024.

The central bank expects inflation to average 1.6% this year, below its 2-4% annual target. This could pick up to 3.2% next year and ease to 3% in 2027.

BSP Governor Eli M. Remolona, Jr. has left the door open to one final cut next year as manageable inflation gives them room to support the economy if needed.

For this week, GS yields could mostly move sideways, the second trader said.

“The relatively low market activity will continue. On the topic of yield movement though, I presume it will be a similar sideways movement, or back and forth day on day given that there is a similar lack of local news, while some relevant US data will be released, including annualized gross domestic product (GDP), durable goods orders, core personal consumption expenditures, and new home sales data,” the trader said.

“This week, expect sideways action in rates, while the long end could see buying if global risk appetite holds. Watch US GDP, US Fed commentary, and local inflation — any surprise there can quickly shift the curve,” Jonathan L. Ravelas, senior adviser at professional service firm Reyes Tacandong & Co., said in a Viber message.

The first bond trader said the yield curve could continue to steepen in line with US Treasuries as “a potential downward revision in the US GDP report could solidify expectations for US rate cuts next year.” — Lourdes O. Pilar with Reuters