The global rice market is going through a price crisis, which, in my view, is still beginning relative to that in 2008. It is concerning because we have had the Rice Tariffication Law (RTL) since 2019, which allowed private sector instead of National Food Authority (NFA) to import rice for us. In a way we are assessing how well advised our legislators were in passing the RTL law.

Those who disagreed with RTL see in this crisis a confirmation of what they had been saying all along: that the RTL risks our food security situation. If the global rice market is in disarray like now, the private sector could not import. Since we are presently grossly behind rice self-sufficiency at world price levels, there is great risk that we may not have enough rice to eat.

This has prompted the government to impose a rice price cap. This measure does not truly solve the problem, and usually makes the shortage worse. We are just wasting public funds in subsidizing rice retailers to enforce it. We don’t have enough funds to cover the losses of rice retailers. We only end up destroying our local rice trading. Rice queues may not be far behind if we continue with this measure. Thus, in a few weeks, I bet the government would give up rice price control.

This proposed solution is worrisome. Opponents of RTL are calling now for a review of that law. They argue that if we rely on the global market for our food, and it is not able to supply us with rice at affordable levels for whatever reason, then this law is breeding food insecurity in our country. They call for a reversal of it and to go back to the days of the NFA, or at least some features of PD 4, the charter of the NFA.

HOW BAD IS THE GLOBAL RICE CRISIS NOW?

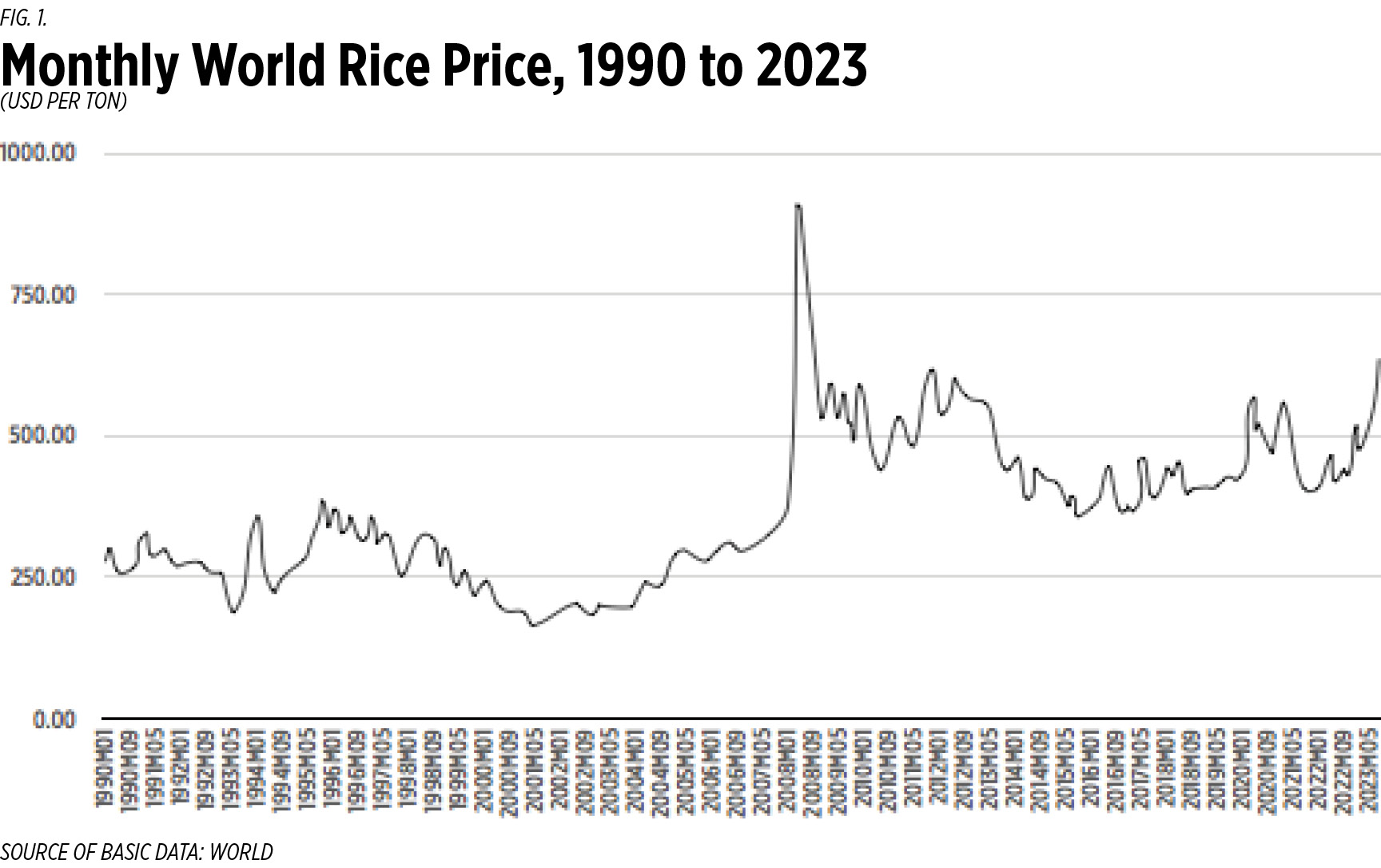

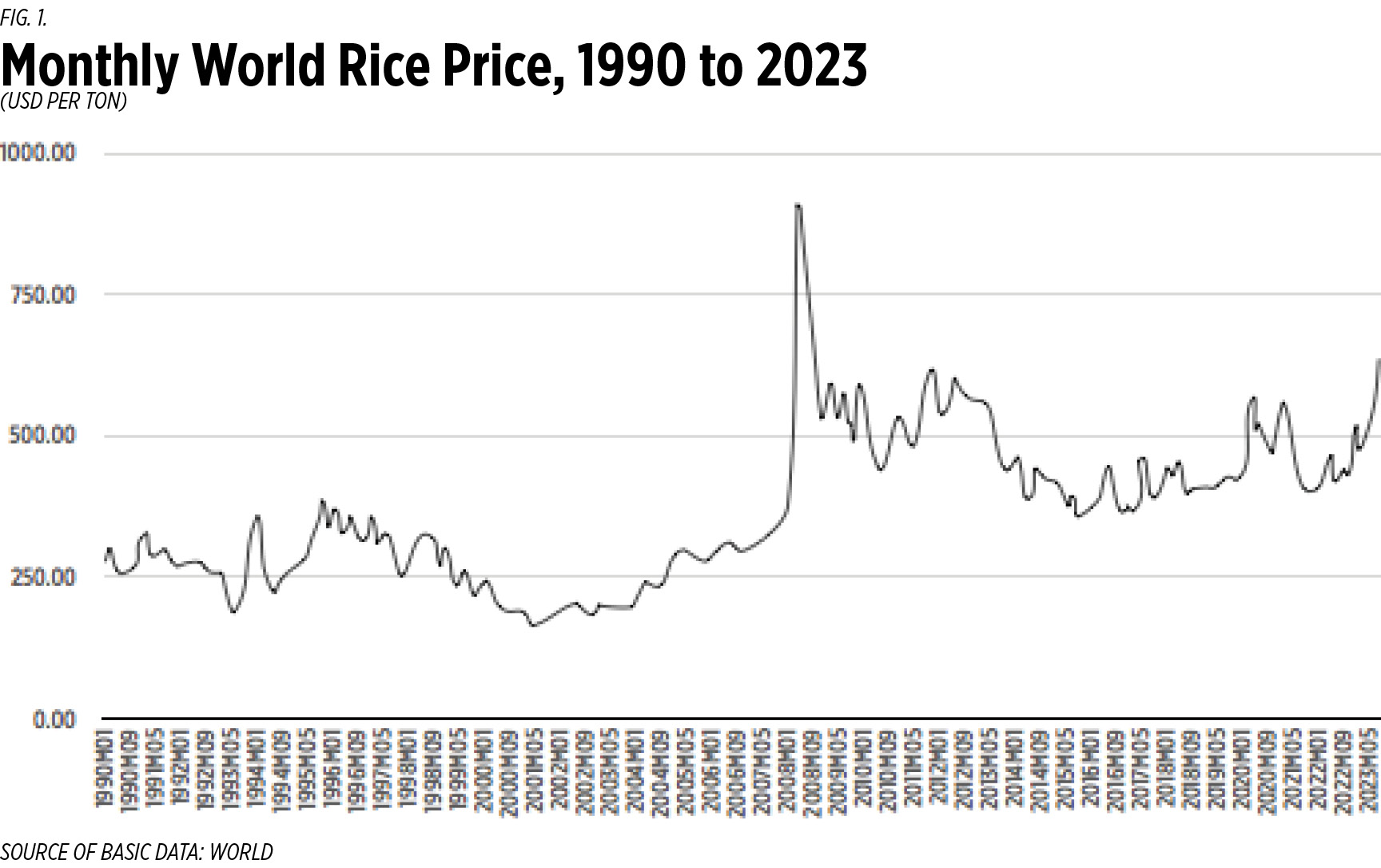

I examined the behavior of the Thai rice price, which is taken to be the global rice price. The data is obtained from the World Bank.

Figure 1 shows the plot of monthly rice prices since 1990. At the very end of this price plot, we see monthly rice prices surging. In August, it was $635 per ton. But there were similar episodes of rice price surges in the past.

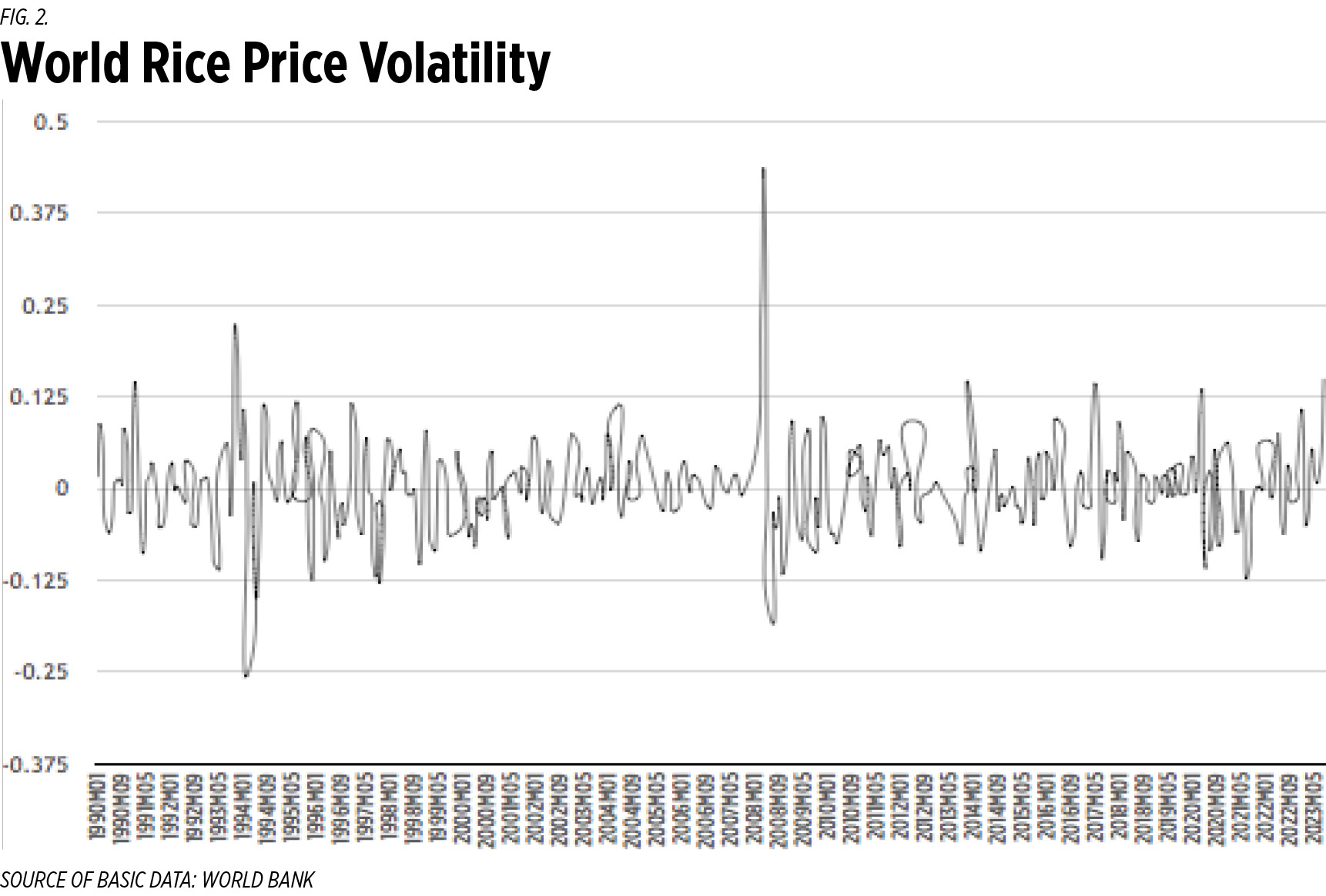

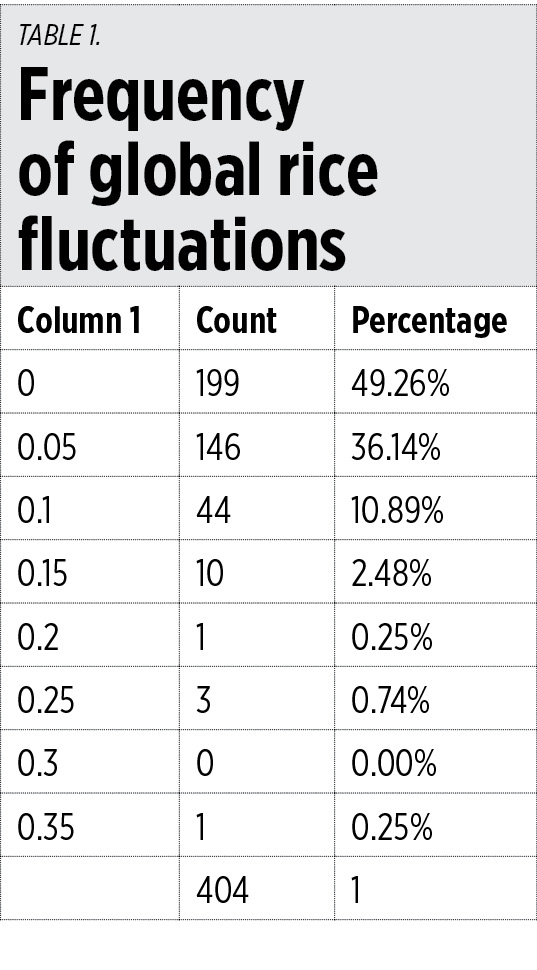

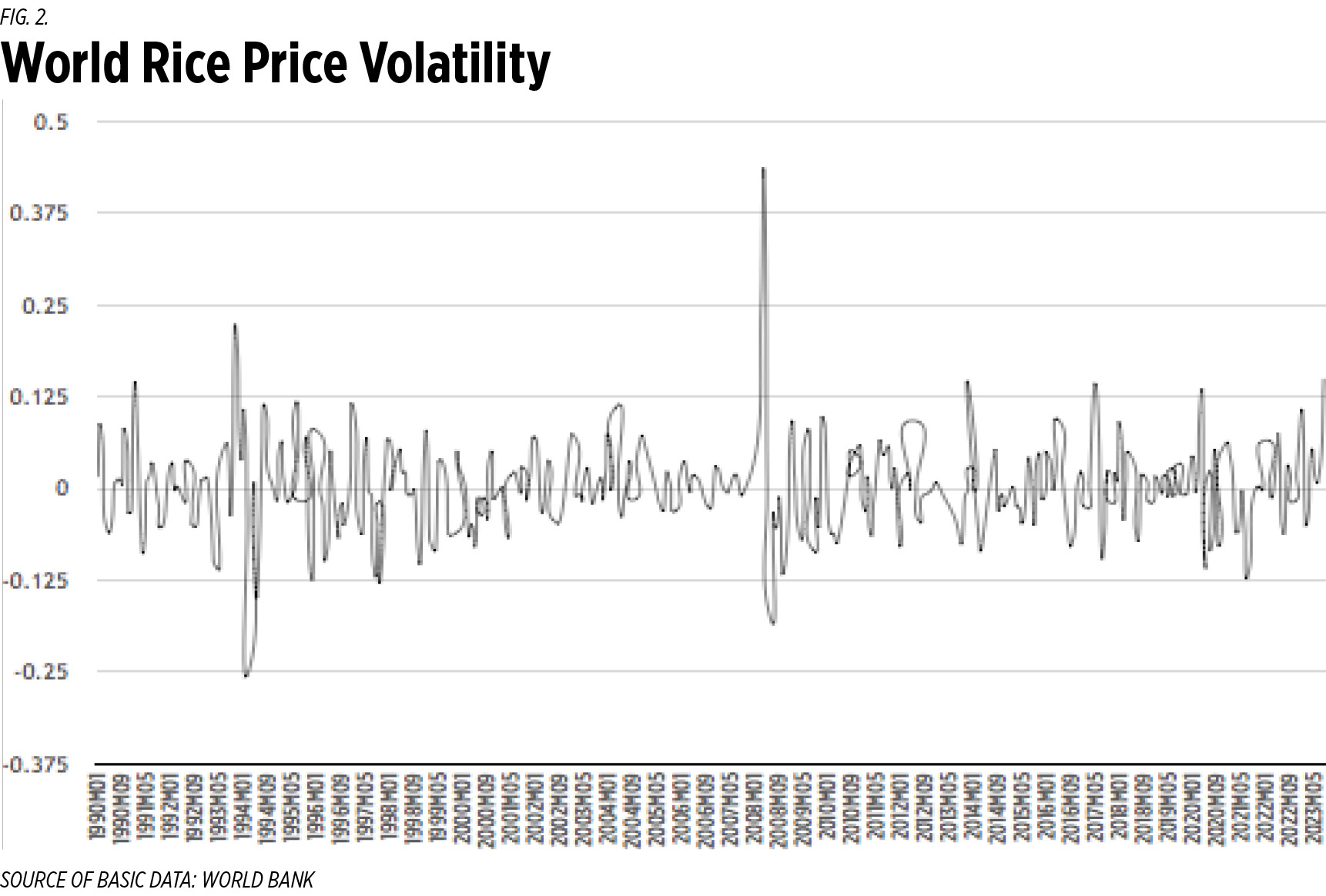

I used two indicators to check on how bad the current rice price surge is: extreme rice volatility and the level of rice prices. Price volatility is defined as the proportionate surge of monthly rice prices. Figure 2 shows the plot of global rice price volatility since 1990. The majority of fluctuations are 10% or below. Any volatility higher than 10% is extreme.

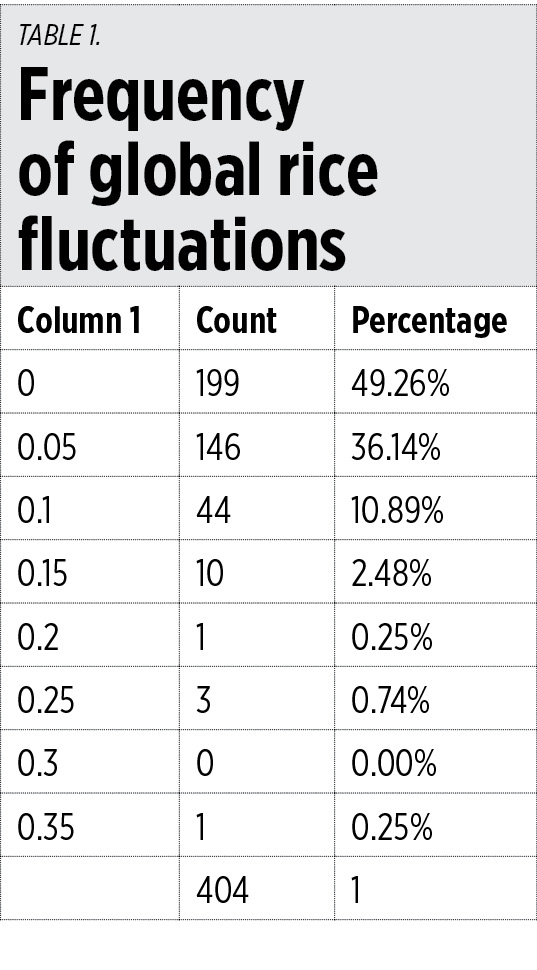

Table 1 shows the distribution of global monthly rice price fluctuations from 1990. Discounting rice price declines, nearly half of the price increases were at 10% or below. Extreme price volatility accounted for 2.7% of the data.

The current rice price fluctuation is just getting to be extreme. In August 2023, its volatility measured 14%.

I go back to the plot of the monthly prices and identify the episodes of rising world rice prices since 1991. An episode may be defined as the number of months when rice prices are increasing to their peak. Peak monthly prices are those followed by falling monthly prices.

Following these definitions, six price surge episodes may be identified from the chart of monthly world prices of rice (Figure 1). These were in February 1990, February 1991, July 1991, January 1994, October 1995, July 1995, May 2008, May 2012, and April 2020. The current monthly price for August 2023 is on a rising price surge, but we have yet to know if that would continue to increase.

The steepest price surge occurred in 2008. This was when Vietnam and India bent politically to their respective constituencies and banned rice exports. A third country contributed to that crisis by importing an unprecedentedly large amount of rice in just a period of four months. That was us during the administration of former President Gloria Macapagal Arroyo.

I checked if these episodes of rising prices were what we referred to in the past as rice price crisis. The episodes that elicited concern were in years where they occurred with extreme price volatility. I averaged the price volatility by year, and I came up with the following years — 1993, 1995, 2007, 2008, and 2020 — as displaying extreme price volatility of at least 10%. Combining these with the years where there were episodes of rising rice prices, I selected three years when the global rice market displayed rice price crises. They were 1995, 2008, and 2020. The years 1993, 2004, and 2007 exhibited extreme price fluctuations, but the rice prices did not surge to high levels.

The rice price crisis of 2008 was particularly concerning. It involved the highest price volatility and the steepest price surge. The other concerning years, 1995 and 2020, had relatively flatter price surges. Perhaps the volatility in 2020 may be explained by the global recovery from the global economic depression caused by COVID-19.

The average duration of the three rice price crises was just less than a year. The world was able to recover and rice prices were brought back to their stable and affordable levels.

When rice prices peaked in May 2008, the Japanese government offered to use their World Trade Organization rice buffer to alleviate the price surge. Just the mere announcement by the Japanese on selling rice to the Philippines brought global rice prices down sharply.

The current rice price surge in the global market may continue, but in my view, it is very unlikely that it could worsen into a 2008-like rice price crisis. It may be like the 1995 global rice price crisis. And locally we likewise had a crisis then. And that was because the NFA was late in importing rice. The late Agriculture Secretary Bobot Sebastian had to resign because of that problem.

WHAT MAY WE DO THEN?

In my view it is a big mistake to reverse the RTL because of this crisis. Like other commodities, rice prices fluctuate. Currently rice is displaying extreme price volatility and is showing rising prices. But if we look back, this may just be for a few months. The world has learned from 2008 that one important measure to strengthen the situation during a global rice price crisis is to coordinate with one another. The ADB promoted an ASEAN Rice Forum during 2008 where rice suppliers and buyers met regularly to assess the rice market situation.

Bringing the NFA back to what it was is over-insuring ourselves for food insecurity. Some improvements may be made to RTL, particularly on the use of the Rice Competitiveness Enhancement Program (RCEP), but it’s ending the NFA rice monopoly is its soundest feature for food security. The NFA invoiced taxpayers with P250 billion in corporate debt if I am not mistaken. This is just a high insurance premium for food security.

Some advisers to the government have not learned that price controls do not work. They are not enforceable, and they make the situation worse. Public funds are not enough to pay for the retailers’ losses, which prompts them to hide rice in the hope that price controls may be lifted in the next few weeks. That worsens the shortage.

The government can be more helpful if they convert the subsidy to a consumption subsidy targeted for the poor, and not disturb the market. The middle-income consumers would still bear the losses, but if this crisis only lasts less than a year based on what we observed in the past, that may be a better option than imposing price controls.

But there is always this question. The RTL enabled the private sector to import rice. But except for a few large traders, they may not import any if global rice prices continue to rise. These few large traders can manipulate the market, increasing rice prices further. Without the other smaller rice importers going into the global rice market, this risk is likely.

If this crisis develops into something like 2008, the government should be ready to import — but not through the NFA. That takes a long time because we must reverse the RTL for that solution. This would just be an ad hoc importation to serve as a counterweight to the few traders who may manipulate rice prices. The imported rice may be distributed through the Kadiwa program.

FOCUS ON INCREASING RICE PRODUCTIVITY

The RTL is not a perfect law. In my view, the RCEP part of it can be improved. The RCEP money could be used to promote rice productivity, but not in the way RTL has prescribed. For example, CP Foods has a good business model in modern swine farming involving clusters of backyard farmers in contract growing arrangements. Relatively large agribusiness companies can develop a similar arrangement in the rice industry. Capital investments of farmers can be lent to farm clusters supported by agreements between these farmers and these companies using RCEP.

Farmers could themselves likewise do farming all the way. We see successful cooperatives like the Soro Ibaba Development Cooperative in Batangas City. That is our largest agricultural cooperative, and they are managing their business relatively well.

I am not promoting the agencies of the Department of Agriculture distributing the RCEP money. That would not increase productivity and we would just be wasting money. Government agencies can support technology developments, provide public goods, and regulate to ensure fair trade between the cluster of small farmers and the large private agribusiness companies.

Ramon L. Clarete is a professor at the University of the Philippines School of Economics.